This note shows that around the world, older generations are less likely to use digital payments and financial technology (fintech) than younger generations. The digital divide by age declines with higher income and education, implying that age disparities are particularly stark within groups who are disadvantaged in other dimensions. Survey evidence suggests that the digital divide by age results from attitudes towards new financial technology (limited perceived benefits) and not from differences in privacy concerns (higher perceived risks). To ensure that people of all ages have access to financial services even as the financial sector digitises, policymakers can enhance financial education, ensure inclusive design and offers, and maintain access to offline payments, including cash.

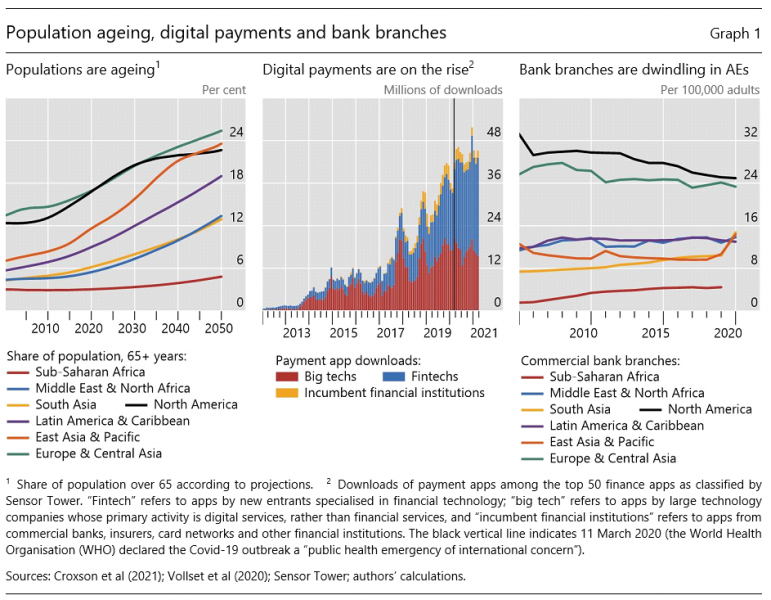

Around the world, populations are ageing. The share of the world’s population aged 60 and above is expected to rise from around 12% today to over 20% by 2050 (Graph 1, left-hand panel; Vollset et al, 2020). This development is occurring in both advanced economies (AEs) and emerging market and developing economies (EMDEs). In large part, it reflects greater life expectancy and a decline in birth rates. Yet the unprecedented increase in the share of older citizens will affect economies and financial systems in the decades to come, for example by affecting the supply of savings, investment opportunities and ultimately growth.2

Beyond direct economic effects, policy makers are discussing the consequences of population ageing for access to financial services and financial inclusion (Yi, 2020). The financial sector is becoming increasingly digital, spearheaded by the emergence of digital products and services offered by fintechs, big techs and incumbent financial institutions (centre panel). Ongoing projects on central bank digital currencies (CBDCs) could foster the digitalisation of money. In parallel, the number of physical bank branches is stagnating or even declining in many countries, particularly in AEs (right-hand panel). These developments could leave segments of the population that are less tech-savvy and mostly rely on cash or offline financial transactions – most notably older individuals – without access to financial services. It could lead to a “digital divide” across generations (UN, 2020; WEF, 2021).

This policy brief documents the digital divide in the use of financial technology by age across different regions and how it correlates with individual characteristics, for example the level of income or education. It then uses survey data to investigate possible reasons for the digital divide by age. The note concludes by highlighting policy approaches to close this gap and ensure that digital financial services are more inclusive going forward.

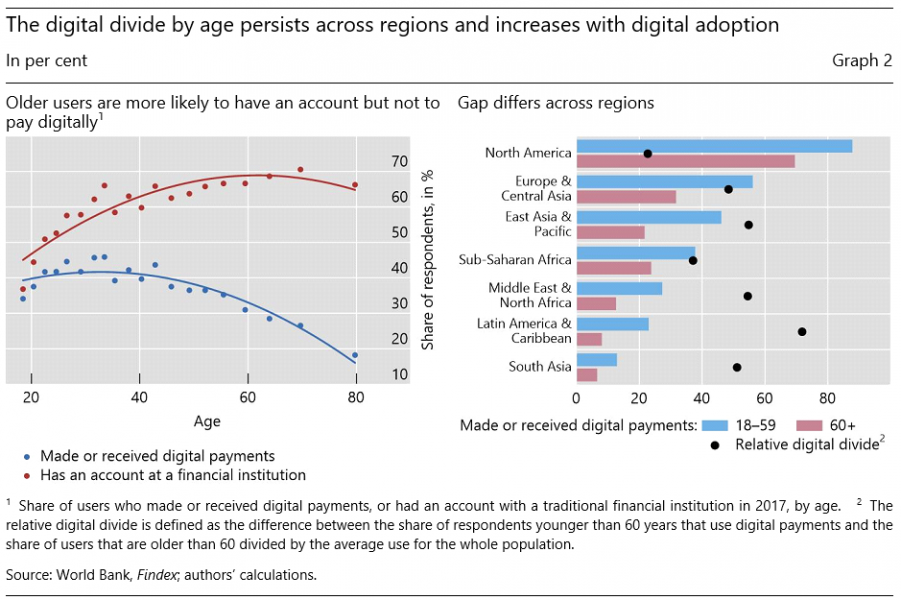

The use of financial technology (fintech) declines with age. Data from World Bank Findex for 136 countries show that on average, over 40% of those younger than 40 use digital payments, but less than 25% of those of age 60 and above do (Graph 2, left-hand panel). In contrast, the likelihood of having an account with a traditional financial institution increases with age.3 The general use of digital payments also varies across regions (right-hand panel). Use is particularly high in North America, followed by Europe and Central Asia, and East Asia and the Pacific. South Asia, and Latin America and the Caribbean report lower numbers.

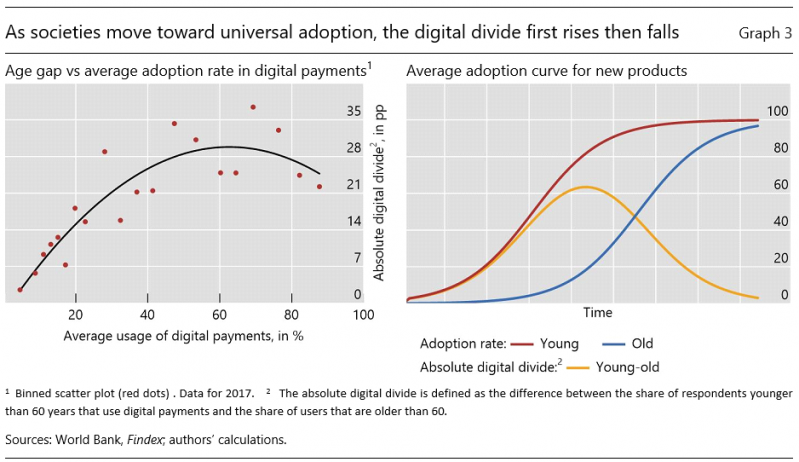

The digital divide appears to be higher in absolute values in countries with higher average digital adoption rates (Graph 3, left-hand panel). In particular, the relationship between overall adoption rates and the digital divide by age (defined as the share of respondents younger than 60 years that use digital payments minus the share of users that are older than 60) follows an inverse U-shaped relationship. In other words, as digital payments become more widely adopted, the digital divide initially increases. Once adoption of new technology is relatively widespread, the gap narrows again.

This pattern is in line with adoption patterns observed for other products. Population subgroups, for example younger versus older cohorts, may differ in the initial speed of adoption (right-hand panel). In the initial stages, pronounced use among early adopters means that gaps in the use of new technology emerge. As late adopters catch up, the gap eventually closes again. The inverse U-shaped relationship thus suggests, on the one hand, that even if financial technology becomes more widespread, it does not automatically translate into higher adoption among all subgroups of the population by age. On the other hand, it illustrates that a widespread adoption can eventually overcome initial gaps in adoption rates.

Given the incidence of the average use of digital payments on the digital divide, in what follows we also focus on the relative digital divide, defined as the absolute digital divide (share of respondents younger than 60 years that use digital payments minus the share of users that are older than 60) over the overall adoption rate. The relative digital divide is reported for the different regions with black dots in the right-hand panel of Graph 2. It ranges from a low of 23% in North America to a high of 72% in Latin America and the Caribbean.

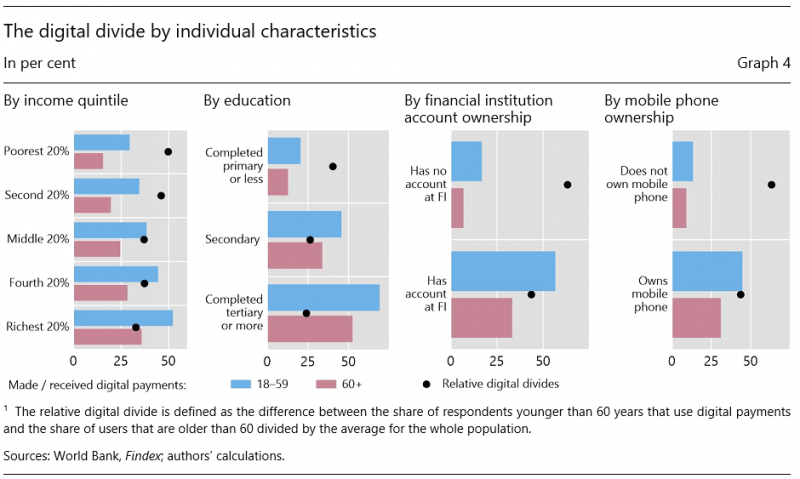

Graph 4 shows that both the absolute digital divide (represented by the difference between the histograms) and the relative digital divide (represented by the black dots) are more pronounced among subgroups who are disadvantaged in other dimensions. The left-hand panel indicates that both measures fall with respondents’ income. For example, the relative divide averages 50% in the lowest income quintile, and 33% in the highest quintile. It is also lower for respondents with a higher educational attainment (centre-left panel) and with an account at traditional financial institutions (centre-right panel). Finally, the divide is present both for respondents with a mobile phone and those without, but it is relatively larger for the latter (right-hand panel).4 Higher overall adoption rates imply that age disparities narrow as households become richer and more educated and as they gain access to an account at a traditional financial institution. The latter pattern could reflect that in general, the use of fintech services is higher among those that also use traditional financial institutions (Chen et al, 2021).

Different factors could help explain the digital divide by age. On one hand, older users may be less familiar or less inclined to adopt new (financial) technology, even if it would offer better or more tailored products and services at potentially more attractive prices. They may simply prefer analogue transactions or cash payments, and not perceive high benefits from digital payments. On the other hand, worries and concerns about data privacy or misuse of data could prevent widespread adoption. They may thus perceive higher risks or costs of using new technologies.

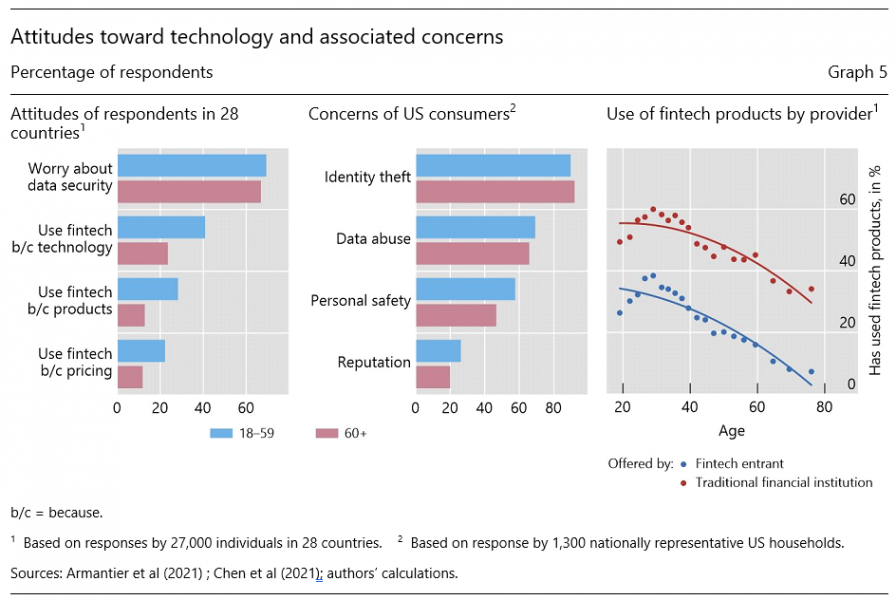

Cross-country survey data show that younger cohorts report more than older cohorts that they worry about their security when dealing with companies online (Graph 5, left-hand panel). While both groups indicate a high level of concern, those of age 18–59 report a level of concern that is 3 percentage points higher than that of those of age 60. Similar results are present among a representative sample of US consumers (centre panel). Concerns about the abuse of personal data for unintended purposes (in the news or media, eg for political agenda or targeted ads) or about implications of data-sharing for their personal safety are systematically lower among older cohorts (Armantier et al 2021). Thus, concerns about data privacy do not seem to be a primary driver of the gap.

By contrast, older citizens report being significantly less willing to adopt new financial technology in general, for example digital banks. They are also less willing to use a fintech entrant or share their personal data for cheaper offers; or use a fintech even if it offers better products or products that are better suited to the respondent’s lifestyle. Thus, the perceptions of the benefits of using fintech services may be lower and the costs of getting used to new technology higher. These may be the relevant driver of the gap, rather than perceptions of costs if personal data are disclosed.5

The literature finds that agents trust traditional financial institutions more than fintechs to handle their data, but there is a similar pattern for the use of fintech products by age (Graph 5, right-hand panel). If differences in trust or concerns about data would explain the digital divide, adoption rates should decline by less with age for fintech products offered by traditional financial institutions. The fact that this is not the case suggests that attitudes towards new technology explain the gap in the use of fintech by age.

Central banks oversee payment systems, and some central banks have an explicit mandate for financial inclusion. Ensuring that digital payments are accessible to all is important in normal times – and perhaps even more so in times of crisis like the Covid-19 pandemic. Going forward, as the acceptance of cash declines and bank branches close, there is a risk that older users may have less access to financial services than they do currently.

What can central banks and other public authorities do to close the digital divide?

First, authorities can work to support awareness of digital technologies and ensure access to high-speed internet and mobile phones. In the United States, for instance, the Federal Reserve System has promoted the teaching of digital skills, and advocated greater rural access to broadband internet (Hegle and Wilding, 2019). These measures may be valuable in their own right but could also have an impact on access to digital payments.

Second, authorities can encourage the private sector to consider the needs of older users in designing digital financial services. This may involve further efforts to make such services more attractive to older users who are more comfortable with cash and in-person interactions. It may extend to work on user interfaces for CBDCs. These need to cater to a wide range of groups in society and must hence be intuitive and easy to use. While data privacy is not a matter specific to older users (indeed, younger users have higher concerns), this too is a relevant dimension to consider.6

Third, authorities can ensure that “offline” payments remain. Many central banks are taking efforts to support the ongoing use of cash, and adequate geographic coverage of bank branches and automated teller machines (ATMs). The ability of CBDCs to function offline is also high on policy makers’ agendas. These initiatives may become more important over time. While some of the digital divide may decline on its own as currently young users (with high adoption) age, other disparities by eg income or education may persist.

Armantier, O, S Doerr, J Frost, A Fuster and K Shue (2021): “Whom do consumers trust with their data? US survey evidence”, BIS Bulletin, no 42, May.

Auclert, A, H Malmberg, F Martenet and M Rognlie (2021): “Demographics, wealth, and global imbalances in the twenty-first century”, NBER Working Papers, no 29161.

Bank for International Settlements (2019): “Big tech in finance: opportunities and risks”, Annual Economic Report 2019, Chapter III.

Bank for International Settlements (2020): “Central banks and payments in the digital era”, Annual Economic Report 2020, Chapter III.

Bank for International Settlements (2021): “CBDCs: an opportunity for the monetary system”, Annual Economic Report 2021, Chapter III.

Carstens, A (2021): “Public policy toward big techs in finance”, speech at the Asia School of Business Conversations on Central Banking webinar “Finance as information”, 27 January.

Chen, S, S Doerr, J Frost, L Gambacorta and H S Shin (2021): “The fintech gender gap”, BIS Working Papers, no 931, March.

Doerr, S, G Kabas and S Ongena (2022): “Should Old Folk Really Smile All the Way to the Bank? How Population Aging Relaxes Bank Lending Standards”, Working Paper.

Yi, G (2020): Keynote speech at 2nd Chengfang Fintech Forum, part of the Annual Conference of the Financial Street Forum.

Hegle, J and J Wilding (2019), “Disconnected: Seven Lessons on Fixing the Digital Divide”, Federal Reserve Bank of Kansas City.

Vollset, S, E Goren, CW Yuan, J Cao, A Smith, T Hsiao, C Bisignano, G Azhar, E Castro, J Chalek, A Dolgert, T Frank, K Fukutaki, S Hay, R Lozano, A Mokdad, V Nandakumar, M Pierce, M Pletcher, T Robalik, K Steuben, HY Wunrow, B Zlavog and C Murray (2020): “Fertility, mortality, migration, and population scenarios for 195 countries and territories from 2017 to 2100: a forecasting analysis for the Global Burden of Disease Study”, The Lancet, vol 396, no 10258, pp 1285–306, October.

All authors are from the Bank for International Settlements (BIS). The views in this paper are those of the authors only and do not necessarily reflect those of the BIS.

For instance, recent studies have found that population ageing can lead to an increase in global savings, lower growth and an increase in bank risk-taking (Gagnon et al, 2016; Auclert et al, 2021; Doerr et al, 2022).

The negative (positive) correlation between respondents’ age and their use of digital payments (ownership of a financial account) remains even after accounting for respondents’ gender, education and income levels, employment status, whether they own a mobile phone as well as country-level characteristics.

Countries with higher GDP per capita usually also have higher school enrolment rates or more bank branches and mobile subscriptions. When we jointly investigate the impact of all four structural indicators, we find that GDP per capita, school enrolment and mobile subscriptions have a statistically significant effect.

It is possible that older users have concerns that are not captured in the questions. For instance, the survey does not ask about the worry of making a mistake in a transaction, or the reduced visibility of expenditures using digital payments. Anecdotally, these may be important factors for some users.

Chen et al (2021) find that women are more concerned about privacy and data security when dealing with companies online. If regulatory policies are successful in protecting privacy and increasing trust, this may thus help to address the gender gap in digital payments, even if does not directly address the age gap.