Global economic recessions like the Great Recession and the COVID-19 pandemic have been associated with spectacular hikes in financial uncertainty virtually everywhere around the globe, suggesting that there might a common global component driving these co-movements. Is financial uncertainty a driver of the business cycle at a global level? We address this question by constructing a novel measure of global financial uncertainty (GFU) and by quantifying its role as driver of the global business cycle. We find that unexpected spikes in global financial uncertainty trigger global economic downturns and deterioration in global financial conditions, a prominent example being the Great Recession. We find that the world output loss occurred during the 2008-2012 period would have been 13% lower in absence of GFU shocks. We also unveil the existence of a global finance uncertainty multiplier: large (small) deteriorations of the global financial cycle due to GFU shocks are correlated with large (small) world industrial production losses.

The COVID-19 pandemic has put under the spotlight the dramatic economic effects of large global shocks, as it happened also for the 2007-2009 Global Financial Crisis and the Great Recession that followed. The Great Recession was indeed global in nature, and it was characterized by a substantial amount of financial market uncertainty in most countries. To examine the effects of such large-scale shocks, in Caggiano and Castelnuovo (2021) we construct a novel measure of global uncertainty, which we term “global financial uncertainty” (GFU henceforth). We use a comprehensive dataset featuring over 38,000 observations related to 42 countries belonging to five continents, which account for 83% of the world output. To extract a measure of global financial uncertainty, we estimate a dynamic hierarchical factor model (DHFM) à la Moench, Ng, and Potter (2013), which is designed to separate the global component from the region/country-specific ones. The model is estimated on monthly volatility data on stock market returns, exchange rate returns, and 10-year government bond yields over the sample July 1992 – May 2020.

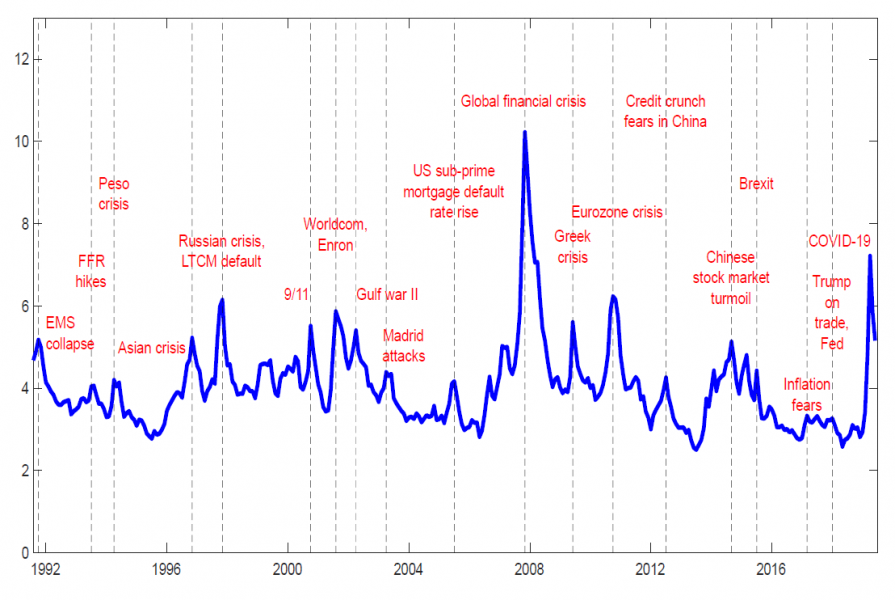

Figure 1 depicts our novel measure of GFU. Our index displays spikes in correspondence of well-known episodes of global financial market turmoil. Examples of such episodes include the collapse of the European Monetary System in 1992; the Asian and Russian crises in 1998; the 9/11 terrorist attacks in 2001; the second Gulf War in 2003; the Greek crisis in 2010; the Eurozone sovereign debt crisis in 2011; the Chinese stock market turmoil in 2015; the Brexit referendum in 2016; and the COVID-19 pandemic shock. Not surprisingly, the largest spike is associated with the collapse of Lehman Brothers and the acceleration of the Global Financial Crisis in 2008.

Figure 1: Global Financial Uncertainty as estimated by Caggiano and Castelnuovo (2021).

Sample: 1992M6-2021M5.

As documented in our working paper (Caggiano and Castelnuovo 2021), our GFU measure is highly correlated with regional uncertainty in North America and Europe as well as in countries like the US, the UK, and Germany. We interpret this evidence as supportive of the influence that “hegemons” such as these three countries have in their own regions in first place, but also at a global level. Interestingly, we find our GFU measure to be much less correlated with financial uncertainty in Asia and Latin America and in their respective countries, or in countries like China, Japan, Singapore, Italy and Greece. This is due to specific events that had a particularly strong effect at a local or regional level such as the economic reforms that generated uncertainty in China in the early 1990s, currency crisis (the Peso crisis in Argentina and Mexico and the exchange rate crisis in Italy in the early 1990s; the Asian crisis triggered by the collapse of the collapse of the Thai baht in 1997), and debt crisis (Greece at the beginning of the 2010s). While these events are found to be relevant also at a global level (according to our GFU measure), our factor model points to a relatively stronger impact at a regional and country-specific level.

After having documented the existence of a global component in financial uncertainty, the next question we address is whether sudden increases in global financial uncertainty have played a major role in driving the global business cycle. To this end, we estimate a vector autoregressive (VAR) model We include our GFU index as proxy of financial uncertainty, and the world industrial production index (WIP) estimated by Baumeister and Hamilton (2019) as a proxy of global output. To keep into account the role played by the financial cycle, and to separate shocks in global financial activity from shocks in global financial uncertainty, we include the global financial cycle measure proposed by Rey (2018) and Miranda-Agrippino and Rey (2020) (GFC). We then use our estimated model to compute the proportion of the world output loss occurred during the Great Recession which can be attributed to GFU shocks. We identify exogenous variations in GFU via a novel combination of narrative, sign, ratio, and correlation restrictions. Our identification approach allows us to tackle the challenging task of identifying second-moment (uncertainty) shocks and separate them from first-moment financial shocks. It also allows us to account for the potential endogeneity of financial uncertainty: in our model, financial uncertainty shocks are allowed to trigger a downturn in real activity on impact, and also global output shocks can contemporaneously drive global uncertainty (details can be found in Caggiano and Castelnuovo 2021). Following the indications by Lenza and Primiceri (2020), we exclude COVID-19 observations from our analysis to avoid biasing our impulse responses, which would otherwise be heavily distorted by the few COVID-19-related outliers at the end of the sample.

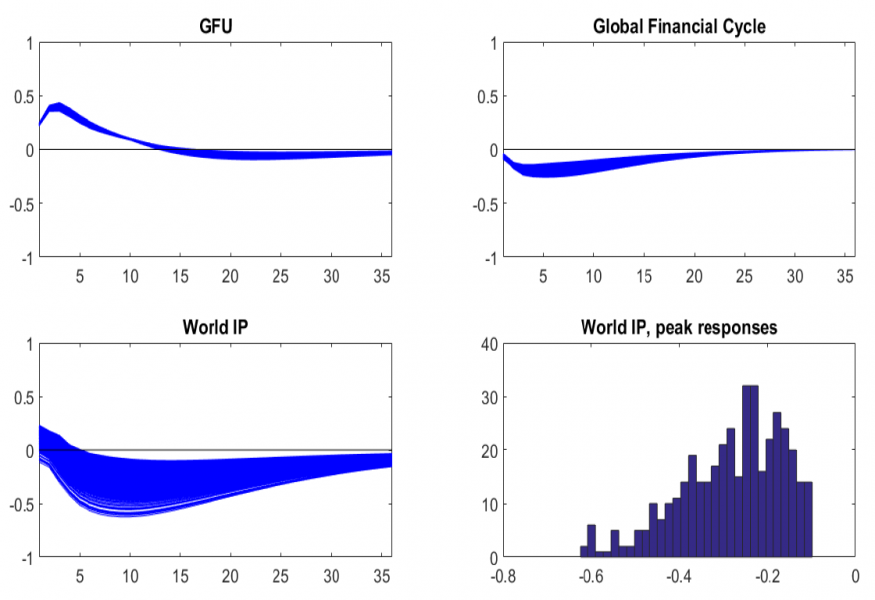

Figure 2 plots the dynamic impulse responses produced by our econometric analysis. Two main results arise. First, we find GFU shocks to have a negative impact on both the global financial cycle and global output. Second, a forecast error decomposition analysis (fully documented in Caggiano and Castelnuovo 2021) shows that the (median) contribution of GFU shocks to the volatility of the global financial cycle at business cycle frequency is about 30%, and to that of global output of about 9%.

Figure 2: Impulse Responses to a Global Financial Uncertainty Shock.

Sample: 1992M6-2019M4.

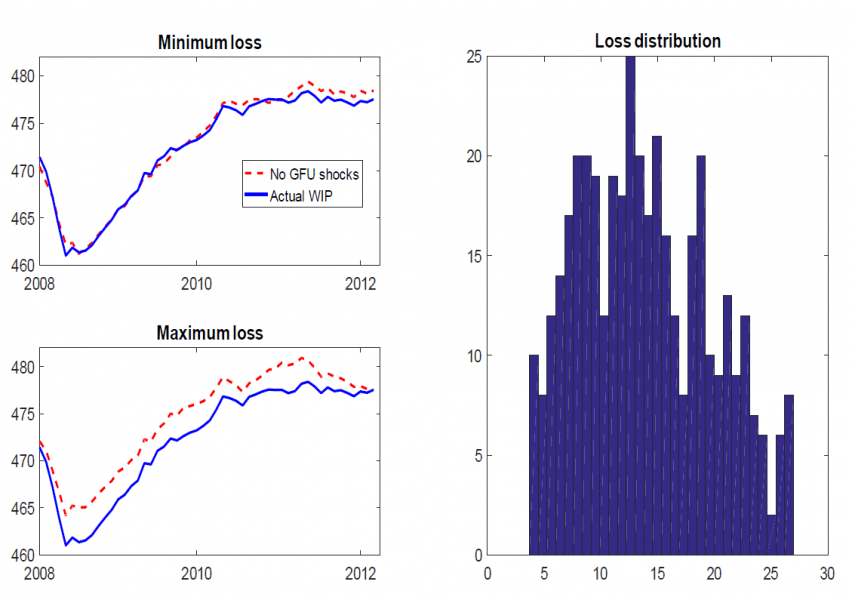

The major spike in global financial uncertainty is associated with the Great Recession. What can we say about the contribution of financial uncertainty to the Great Recession? We use our estimated model to compute the proportion of the cumulative world output loss realized during and in the aftermath of the Great Recession which can be attributed to global financial uncertainty shocks solely. Figure 3 plots the outcome of our investigation. According to our simulations, the loss in WIP during the 2008M9-2012M12 period would have been 13% lower had GFU shocks been absent. Since we adopt a set-identification approach, this estimate is the median value of a distribution of identified models, which are consistent with a minimum contribution of 4% and maximum of 27%.

Figure 3: Role of GFU shocks during the Great Recession: World Industrial Production, Counterfactual simulations. Sample: 2008M9-2012M12. Left panes: Blue solid lines: Actual series. Red dashed-lines: Counterfactual series simulated with our estimated structural VAR by shutting down GFU shocks. Models associated with the minimum (upper left panel) and maximum (lower left panel) WIP loss plotted in the figure. Right panel: Distribution of the WIP loss across all retained models.

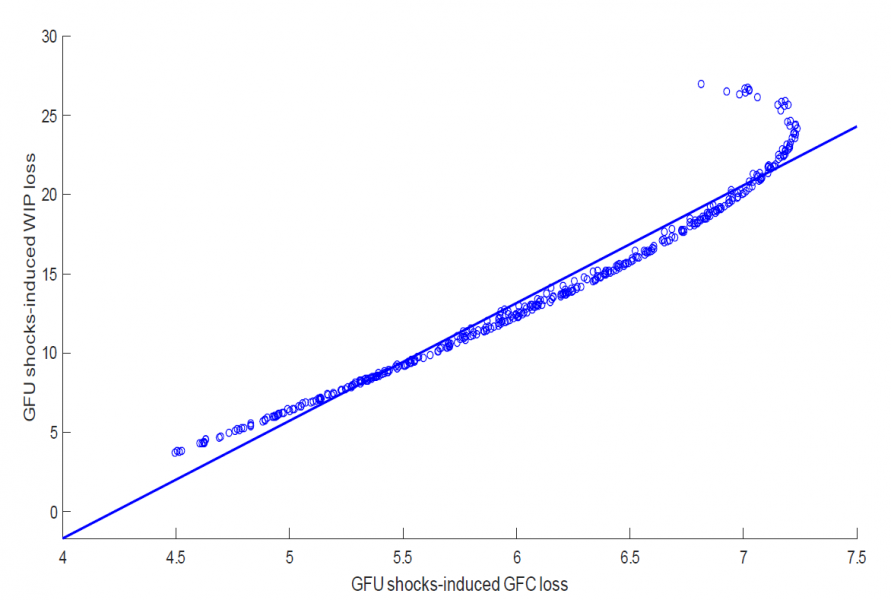

A by-product of our approach is that the heterogeneity of moments associated to the set of identified models can help us shed light on the channels that are responsible for the transmission of GFU shocks to the real side of the economy. According to our estimated VAR model, spikes in global financial uncertainty trigger both a contraction in real activity as well as a deterioration of financial conditions. How important is the response of financial conditions to an uncertainty shock in driving the contraction in real activity? The interest in this question is motivated by a recent paper by Alfaro, Bloom, and Lin (2021) on the role played by financial frictions in magnifying (“multiplying”) the real effects of uncertainty shocks. Their theoretical model points to existence of a finance-uncertainty multiplier: if financial conditions would not deteriorate after an uncertainty shock, the contractionary impact of heightened uncertainty would be substantially milder. We use our set of identified models to provide evidence on the existence of a global finance-uncertainty multiplier during the Great Recession as follows. For each identified model (which are all equally consistent with the data), we calculate the contraction in global financial conditions and in global output loss induced by a global financial uncertainty shock. We then look at the correlation between financial and output losses. Figure 4 documents the existence of a positive correlation between these two losses, i.e., conditional on a GFU shock, the larger the deterioration in global financial markets, the larger the world industrial production loss (and vice-versa). Our empirical evidence suggests that a finance-uncertainty multiplier may very well be at work at a global level.

Figure 4: Global Finance Uncertainty Multiplier.

Sample: 2008M9-2012M12. Scatter plot correlating the World Industrial Production loss and the deterioration of the Global Financial Cycle due to GFU shocks according to all our retained models.

Alfaro, I., N. Bloom, and X. Lin, 2021, The Finance Uncertainty Multiplier, available at https://nbloom.people.stanford.edu/research.

Baumeister, C., and J.D. Hamilton, 2019, Structural Interpretation of Vector Autoregressions with Incomplete Identification: Revisiting the Role of Oil Supply and Demand Shocks, American Economic Review, 109(5), 1873-1910.

Caggiano, G., and E. Castelnuovo, Global Uncertainty, Bank of Finland Research Discussion Paper No. 1/2021.

Lenza, M. and G. Primiceri, 2020, How to Estimate a VAR after March 2020, NBER Working Paper No. 27771.

Miranda-Agrippino, S. and H. Rey, 2020, U.S. Monetary Policy and the Global Financial Cycle, Review of Economic Studies, 87(6), 2754–2776.

Moench, E., S. Ng, and S. Potter, 2013, Dynamic Hierarchical Factor Model, Review of Economics and Statistics, 95(5), 1811-1817.