The views expressed in this policy note are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

Abstract

Rising trade policy tensions risk accelerating the fragmentation of global trade with potentially significant consequences for global growth and resilience. In the short term, persistent or expanding tariffs and other trade barriers reduce economic efficiency, raise price volatility, and increase the risk of a prolonged period of stagflation. Over the medium term, greater fragmentation could complicate efforts to address structural challenges such as population ageing, climate transition and rising fiscal pressures from defence spending.

The expansion of global trade has delivered large benefits. It has allowed countries to specialise based on their comparative advantages, boosted productivity, and lowered inflationary pressures. Consumers gained access to a wider array of affordable goods, while businesses tapped into global supply chains and new markets. Trade integration also played a significant role in poverty reduction across the worldtion could complicate efforts to address structural challenges such as population ageing, climate transition and rising fiscal pressures from defence spending.1

However, global trade growth has slowed since the Global Financial Crisis (GFC) and concerns about inequality, fairness, and resilience have gained greater prominence. Non-tariff barriers have also become more prevalent along with calls for reshoring. These recent trends have contributed to a more fragmented trading landscape, raising questions about the future of globalisation.2 In 2025, a new wave of trade tariffs introduced by major economies has further tested the multilateral trading system, amplifying uncertainty and reinforcing concerns about a shift towards more inward-looking and protectionist policies.

This policy note begins by examining the recent rise in trade tensions and protectionist measures. It then shows that many of the concerns behind these developments lack empirical support, and that tariffs are unlikely to rebalance trade or deliver lasting gains in economic growth. The note concludes by emphasizing the need for coordinated policy responses – domestic and global – to preserve the gains from openness and ensure fair outcomes amid shifting economic and geopolitical conditions.

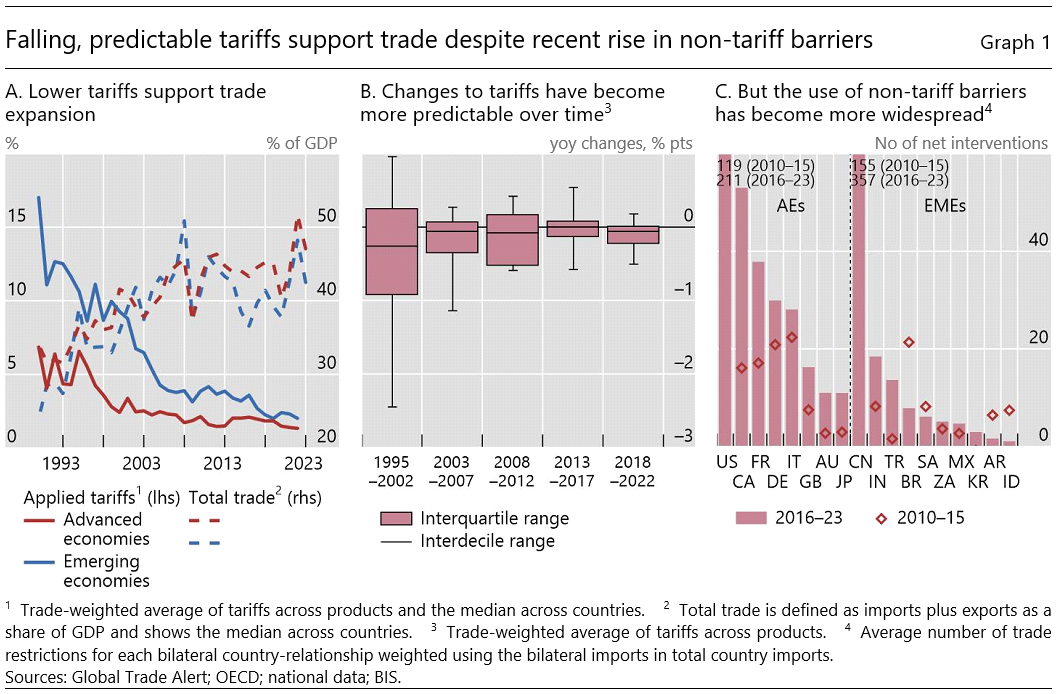

Historically, the expansion of international trade has been accompanied by stable or declining tariffs at the global level (Graph 1.A). In this regard, two key developments stand out. First, emerging market economies (EMEs), which have traditionally had higher tariffs than advanced economies (AEs), have cut the average tariff differential to about half of what it was in the late 1990s. Second, the strengthening of a global, rules-based trade framework – with predictable and commonly agreed rules – has played a crucial role in supporting trade integration. In recent years, tariff changes have become smaller and more gradual, often less than 0.5 percentage points, allowing firms to adjust their business plans across jurisdictions with greater certainty (Graph 1.B).

Global trade growth, however, began to slow after the GFC and has largely plateaued since the Covid‑19 pandemic. Part of this reflects natural limits to market integration and the expansion of global value chains. At the same time, non-tariff barriers (NTBs) have become more prevalent, particularly in advanced economies (Graph 1.C).3 Moreover, liberalising trade in agriculture and services has proved challenging, especially amid growing scepticism towards globalisation (see below). Supply chain disruptions during the pandemic have also exposed the fragilities of complex production networks, prompting firms and policymakers to shift the focus from efficiency to resilience, thereby shortening supply chains. Finally, geopolitical competition has intensified, driven in part by strategic rivalries over emerging sectors such as renewable energy, electric vehicles and strategic resources (e.g. rare earths).

The slowdown in trade and the growing importance of non-tariff barriers have occurred against a backdrop of greater scepticism about the benefits of trade integration. A key concern is that trade integration has contributed to rising inequality within countries. Indeed, trade can put pressure on jobs and wages, especially in the most exposed sectors like manufacturing, and need to be accompanied by adequate policies.4 In addition, even when beneficial from an aggregate perspective, trade is not always viewed as “fair”. For instance, the use of export subsidies by many countries can give domestic producers an unfair competitive edge.5 And the fall in manufacturing employment on the back of growing and persistent trade deficits only amplifies perceptions that international trade benefits certain countries at the expense of others.6

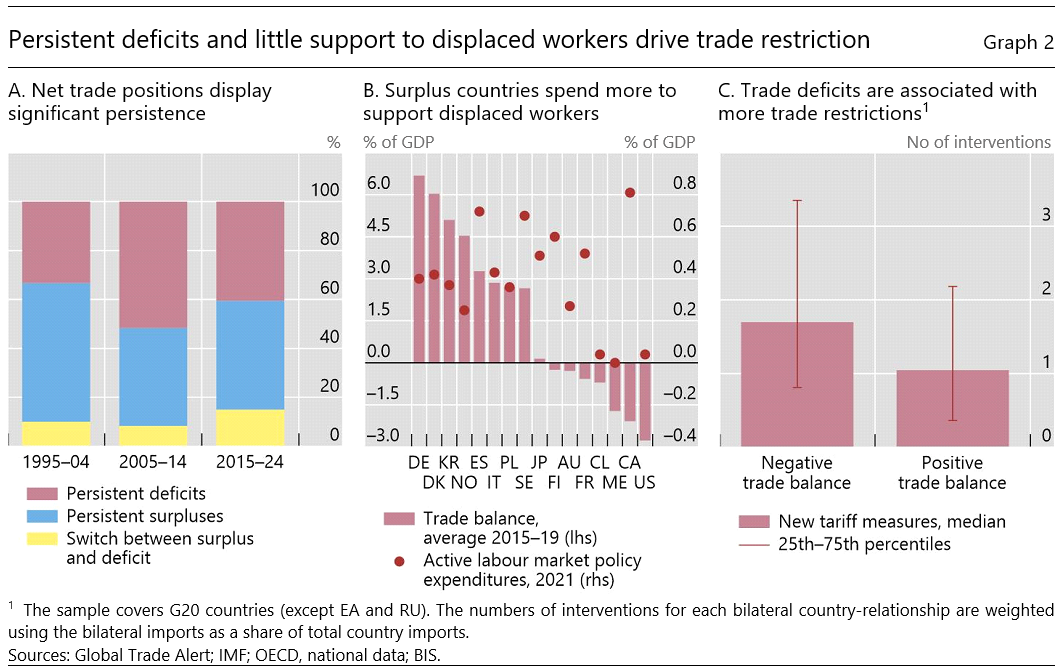

Perceptions of unfairness have been reinforced by persistent trade imbalances and, in some cases, inadequate support for displaced workers. Over the past 30 years, the trade balances of the twenty largest economies have shown remarkable stability, with less than 20% probability of switching between surpluses and deficits from one year to the next (Graph 2.A). Yet, this persistence is only part of the problem. Countries with sustained trade deficits, such as the United States, allocate few resources to support displaced workers (Graph 2.B), a situation exacerbated, particularly in the post Covid-19 period, by a tendency in some countries to scale back social safety nets. Unsurprisingly, these developments have contributed to the growing discontent against globalisation, reflected in a rising number of trade restrictions (Graph 2.C).7

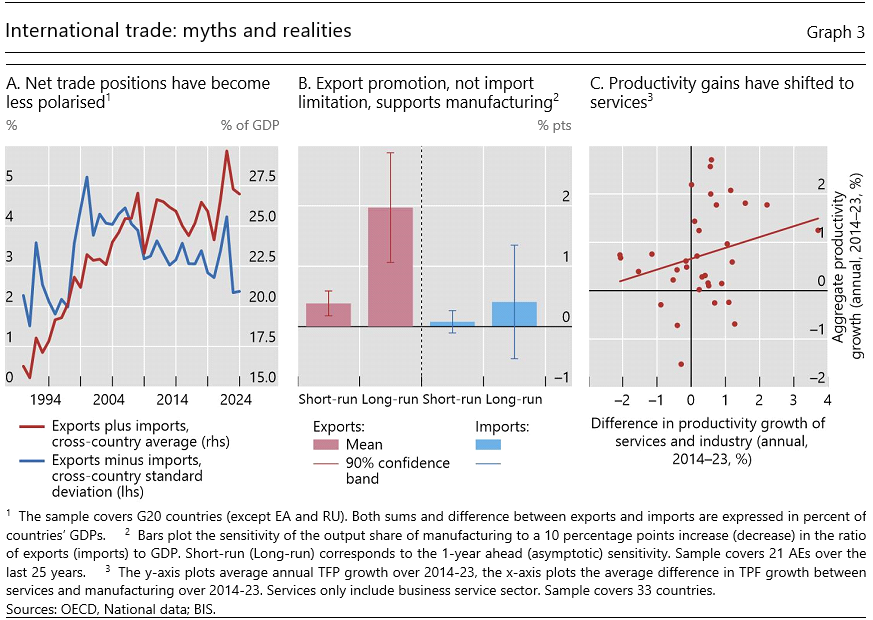

Several common concerns about trade integration are not supported by evidence. First, the view that global trade has expanded at the expense of some countries accumulating ever-larger deficits does not hold up to scrutiny. Since the early 2000s, the dispersion in net trade positions amongst the 20 major economies has actually declined (Graph 3.A). Second, in manufacturing – the focus of many trade-related criticisms – the frequently heard claim that higher import penetration leads to a smaller manufacturing sector lacks empirical support.8 Rather, the data suggest that manufacturing performance is primarily linked to the dynamism of the export sector (Graph 3.B). Promoting exports, rather than restricting imports, is therefore a more effective strategy for supporting the domestic industry.9 Moreover, the decline in manufacturing employment reflects increased automation, as evidenced by the fact that the share of manufacturing in GDP has fallen less than its share in overall employment. Finally, while manufacturing remains socially and politically important – particularly in terms of employment and regional equity – its role as the main driver of productivity growth has diminished. In several advanced economies, services have become the primary contributor to total factor productivity (TFP) growth (Graph 3.C). As such, policymakers should prioritise removing barriers that constrain growth in the service sector, while also considering targeted measures to support workers and communities affected by industrial decline.

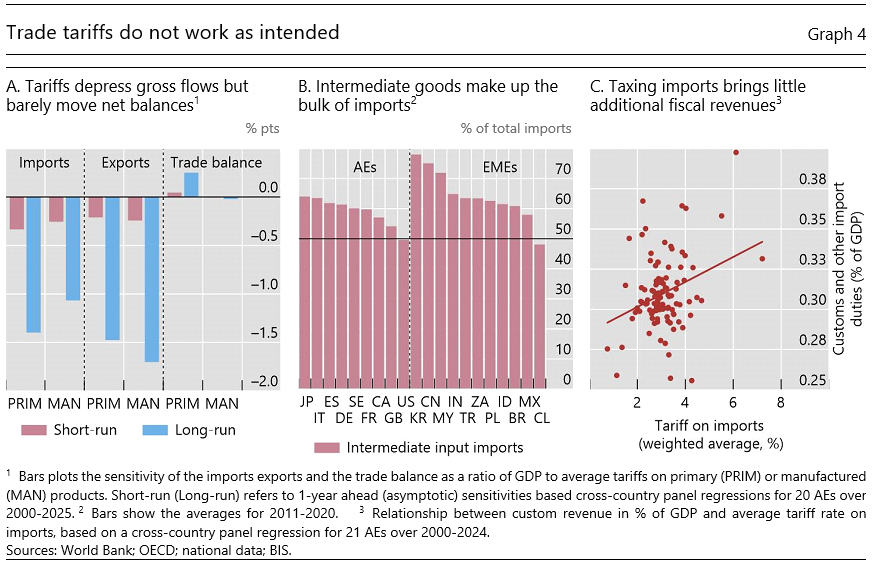

These factors suggest that broad-based tariffs are an inadequate tool for addressing structural trade imbalances. This is also confirmed by the empirical evidence. First, trade balances – unlike gross trade flows – tend to be unresponsive to the imposition of tariffs (Graph 4.A).10 This may reflect a range of offsetting mechanisms, including the reallocation of import across trading partners, exchange rate adjustments, and retaliatory measures that dampen exports.11 At a more fundamental level, tariffs are unlikely to have a lasting effect on the balance between saving and investment – the key determinant of current account imbalances. In addition, unless raised to prohibitive levels – with a high risk of provoking retaliation – tariffs are unlikely to alter the underlying economic forces that shape countries’ patterns of specialisation. As a result, tariffs typically leave trade balances broadly unchanged while raising import prices.12

Second, evidence that trade restrictions or import substitution policies effectively boost domestic output is scarce. On the contrary, tariffs often weigh on activity and impose substantial costs through higher prices. This is particularly relevant given that, in most economies, a large share of imports consists of intermediate goods and services along the production chain (Graph 4.B). Restrictions on upstream inputs – such as steel or aluminium – can raise production costs and reduce competitiveness across the value chain. As a result, measures intended to support domestic supply may instead end up undermine it.

If tariffs cannot alter trade balances or boost domestic output, their potential to serve as a substitute for domestic taxation is also limited. In AEs, estimates suggest that each percentage point increase in the average tariff rate is associated with customs revenues rising by 0.01 percentage points of GDP (Graph 4.C). This limited gain largely reflects behavioural responses. As noted, trade tends to adjust, with imports shifting away from higher-tariff goods, thereby eroding the revenue base. More generally, as with other forms of taxation, higher tariffs can dampen economic activity, further limiting revenue collection.

Addressing current account imbalances requires tools beyond trade policy. Demand management policies, e.g. fiscal consolidation, can play a key role by influencing the balance between national saving and investment. This is especially true as imports tend to move more than one-for-one with GDP, so that, when fiscal tightening slows domestic output, a disproportionate share of the adjustment occurs through reduced imports. Empirically, a one percentage point cut in the fiscal deficit can narrow the trade deficit by up to 0.3–0.4 percentage points of GDP.13

Surplus countries also have a role to play. Persistently large current account surpluses often reflect excess domestic savings. Stimulating domestic demand – particularly through public investment or targeted consumption policies – can help reduce these imbalances. For example, shifting fiscal policy from surplus to a more neutral stance can support domestic absorption without undermining fiscal sustainability. More structurally, reforms aimed at reducing precautionary saving – e.g. by introducing or expanding social safety nets – or removing distortions that discourage private consumption or investment (e.g. regulated energy prices, credit market frictions) can also help. By supporting domestic demand, these measures reduce dependence on external markets and contribute to a more balanced trade globally.

There is also scope for improving aspects of the global trading system. The current framework – largely shaped in the late 1980s and 1990s when AEs dominated global output – has not fully kept pace with shifts in the global economic landscape. To be successful, reform efforts should consider a broader array of issues than simply tariffs. One central concern is market access, raised by both EMEs seeking better access to AE markets, and by AEs aiming to open EME markets. In addition, the growing use of export controls, export subsidies and industrial policies that provide unfair competitive advantages has brought new challenges to the trading system. These measures, which have taken a central role in several national trade strategies, require a comprehensive and coordinated policy. While global reform is inherently complex, a multilateral approach – grounded in dialogue among the world’s largest trading blocs – offers the most promising path forward, to preserve the gains from trade while addressing legitimate concerns on all sides.

Abbas, A. Bouhga-Hagbe J., Fatás A., Mauro P., and Velloso R. (2011): “Fiscal Policy and the Current Account,” IMF Economic Review, (59), 603–629.

Autor, D. H., Dorn, D. and Hanson, G. H. (2013): “The China syndrome: Local labour market effects of import competition in the United States,” American Economic Review, 103(6), 2121–2168.

Autor, D. H., Dorn, D. and Hanson, G. H. (2016): “The China shock: Learning from labour‐market adjustment to large changes in trade,” Annual Review of Economics, 8, 205–240.

Bornert, X. and Musolino, D. (2024): “The manufacturing reshoring phenomenon: A policy‑oriented analysis of factors driving the location decision,” Economies, 12(5), 100.

Bown, C. P. and Crowley, M. A. (2013): “Import protection, business cycles, and exchange rates: Evidence from the Great Recession,” Journal of International Economics, 90(1), 50–64.

Cavallo, A., Gopinath, G., Neiman, B. & Tang, J. (2021): “Tariff pass-through at the border and at the store: Evidence from US trade policy,” American Economic Review: Insights, 3(1), 19–34.

Dollar, D. and Kraay, A. (2001): “Growth Is Good for the Poor,” Journal of Economic Growth, 7(3), 195–225.

Fabry, E. and Veskoukis, A. (2021): “Strategic autonomy in post‑Covid trade policy: How far should we politicise supply chains?” IAI Papers, 21, July.

Fajgelbaum, P. D., Goldberg, P. K., Kennedy, P. J. and Khandelwal, A. K. (2020): “The Return to Protectionism,” Quarterly Journal of Economics, 135(1), 1–55.

Feenstra, R. C. (1989): “Symmetric pass-through of tariffs and exchange rates under imperfect competition: an empirical test,” Journal of International Economics, 27(1–2), 25–45.

Flaaen, A. and Pierce, J. R. (2024): “Disentangling the Effects of the 2018–2019 Tariffs on a Globally Connected U.S. Manufacturing Sector,” Review of Economics and Statistics, September, 1-45.

Furceri, D., Hannan, S. A., Ostry, J. D. and Rose, A. K. (2019): “Macroeconomic consequences of tariffs,” IMF Working Paper 2019/009.

Goldberg, P. K. and Reed, R. C. (2023): “Growing threats to global trade,” Finance & Development, June.

Kassa W. (2025): “Regionalization of Global Trade: A New Order in the Making,” Global Policy, forthcoming.

Pettis M., A. Tooze and A. Elrod (2024): “Trade and the Manufacturing Share,” https://www.phenomenalworld.org/analysis/trade-and-the-manufacturing-share/

Rodrik, D. (2018): “Straight talk on trade: Ideas for a sane world economy”, Princeton University Press.

Sachs, J. D. and Warner, A. M. (1995): “Economic reform and the process of global integration,” Brookings Papers on Economic Activity, 26(1), 1–118.

Timmer, M. P., Los, B., Stehrer, R. and de Vries, G. J. (2021): “Supply chain fragmentation and the global trade elasticity: A new accounting framework,” IMF Economic Review, 69(4), 656–680.

UNCTAD (2024): “The GTAP 11 satellite Data Base on Ad-Valorem Equivalents of Border Non-Tariff Measures”. https://unctad.org/system/files/information-document/AVE_GTAP_README_rev1.pdf

Wacziarg, R. and Welch, K. H. (2008): “Trade liberalization and growth: New evidence,” World Bank Economic Review, 22(2), 187–231.

Van Heuvelen E. (2023), “Subsidy wars”, Finance and Development, IMF, June.

World Trade Organization (WTO) (2025). Anti-dumping, subsidies, safeguards: contingencies, etc. Retrieved July 7, 2025, from WTO website.

See Sachs and Werner (1995) and Wacziarg and Welch (2008) on trade openness and growth, and Dollar and Kraay (2001) on the role of trade in global poverty reduction. Market integration has also raised supply elasticity (Timmer et al, 2021).

Goldberg and Reed (2023) document the slowdown of global trade after the GFC, while Fabry and Veskoukis (2021) and Bornert and Musolino (2024) provide evidence of recent policies to insulate key supply chains from external risks.

Estimates for AEs for the period 2016-2018 suggest that tariff-equivalents of non-tariff barriers are the same magnitude as trade tariffs (UNCTAD 2024). Increased reliance on non-tariff measures has also coincided with the development of trade regionalisation (Kassa, 2025).

See, for example, Autor et al (2013, 2016) for evidence from the United States on how import exposure has affected local labour markets, particularly in terms of employment and wage outcomes. These studies also emphasise that the adverse effects are concentrated in specific regions and sectors, and that the overall gains from trade can be substantial if accompanied by adequate policies to support adjustment and redistribute benefits more broadly.

According to the WTO, export subsidies are prohibited when they “distort international trade, and are therefore likely to hurt other countries’ trade” (WTO, 2025). Subsidy disputes and countervailing duty investigations at the WTO have increased steadily since 2010 (Van Helen, 2023).

See Furceri et al. (2019) for how trade imbalances contribute to political backlash. Rodrik (2018) provides a broader discussion of how persistent deficits and sectoral decline shape public perceptions of trade fairness.

Bown and Crowley (2013) find that countries were more likely to impose new temporary trade barriers when domestic unemployment was high or when trading partners’ output growth slowed, indicating a clear counter-cyclical pattern.

See Pettis et al (2024) for a discussion on the link between manufacturing activity and current account balances.

Consistently, Flaaen and Pierce (2024) show that employment gains from import protection following the 2018–19 U.S. tariff were more than offset by higher input costs and retaliatory measures.

Furceri et al (2019) find that the trade balance–to–GDP ratio is largely unresponsive to tariff changes over a five-year horizon. And while there may be some improvement in economic expansions, the effect is short-lived and dissipates within two years.

Fajgelbaum et al. (2020) find that U.S. imports of product varieties directly targeted by the 2018 tariffs declined by an average of 31.7%. In response, retaliatory tariffs led to a 9.9% drop in U.S. exports of the affected products.

Feenstra (1989) estimates the pass-through rate of tariffs on Japanese cars between 0.6 and 1. More recently, Cavallo et al. (2021) find near-complete pass-through of import tariffs at the border.

See Abbas et al. (2011) for a review of estimates across different econometric methods.