This policy brief is based on ECB Working Paper 3310. The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with.

Abstract

Fiscal policy announcements are commonly viewed as commitments to future government spending, expected to stimulate demand and support economic activity. At the same time, they may also convey information about policymakers’ assessment of the economy. Using a theoretical model of signaling and a newly built dataset of narratively identified fiscal announcements from Japan, we show that large fiscal packages that exceed private sector’s expectations and are announced under high uncertainty can signal that economic conditions are worse than previously thought. Markets may then respond more pessimistically, dampening or even offsetting the intended stimulative effect. Our results support the idea that signaling effects from fiscal policies considerably weaken policymakers’ ability to stabilize the economy in highly uncertain environments and, in extreme cases, can offset and even reverse the expansionary impact of an announced fiscal stimulus.

Fiscal policy is widely regarded as a key tool for stabilizing business cycles. During the COVID- 19 pandemic, for instance, many countries enacted substantial fiscal packages to support their economies amidst the widespread crisis. However, assessing the effectiveness of these stabilization policies is inherently difficult, as they are typically implemented in response to endogenous developments, such as a recession. Consequently, the size of these interventions likely reflects policymakers’ assessments of the economic outlook. This implies that the announcement of a large fiscal stimulus may be interpreted by the private sector as an indication that the government views the recession as particularly severe. Such an interpretation may worsen private sector expectations about the economic outlook, potentially weakening the stabilizing effects of the fiscal intervention. In Melosi et al. (2025) we investigate the potential signaling effects of fiscal policy and provide the first empirical quantification of these effects by using a newly constructed dataset of fiscal news in Japan.

We first develop a stylized model to illustrate the theoretical mechanism underlying the signaling effects of fiscal policy. This model provides critical insights that inform the design of our empirical analysis on the signaling role of fiscal policy and yields four central predictions. First, signaling effects emerge when there is asymmetric information between policymakers and the private sector, and when policy actions are interpreted as responses to evolving economic conditions. Second, the magnitude of signaling effects increases with the level of prior uncertainty held by the private sector. Third, signaling effects dampen (or magnify) the impact of a policy action if the private sector expected a smaller (or larger) intervention before the government reveals the size of the fiscal intervention. Fourth, signaling effects do not necessarily reverse the impact of economic policies. A fiscal expansion may still increase output, even if the signaling mechanism partially dampens its effect.

We construct a novel dataset that combines the daily Nikkei 225 stock index with narrative records from press releases about thirty-four supplementary fiscal packages announced by the Japanese government from 1992 to 2022. This fiscal news was introduced in response to events that threatened to worsen the economic outlook, such as the 2011 earthquake or the COVID- 19 pandemic. We use articles of the Nikkei newspaper – the major, real-time, economic and business outlet in Japan – to identify the timing of public announcements for each fiscal package.

We focus on Japan because of its orderly and predictable legislative process for spending bills, offering a unique setting to empirically assess the significance of signaling effects. A key institutional feature is that the size of a spending bill is disclosed at a specific stage in the legislative process and is not renegotiated thereafter. This characteristic enables us to precisely identify the moment when the size of fiscal packages is first made public. Establishing the exact timing of fiscal stimulus announcements allows us to assess whether the private sector revises its expectations about government spending in response to the news. This is essential for understanding whether the announcement comes as a surprise and is interpreted as a signal about the broader economic outlook. To this end, we examine changes in stock prices on the day the size of the fiscal package is revealed and control for revisions in the private sector’s expectations.

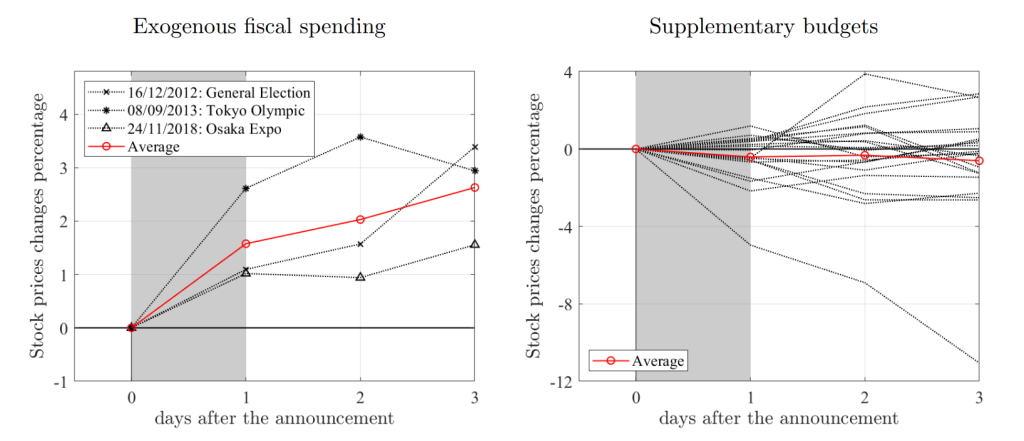

An important preliminary step is to establish how stock prices respond to fiscal news, absent signaling effects. We show that the stock market generally reacts positively to fiscal news in Japan when announcements of fiscal stimuli do not bring any information about the economic outlook. Bullish responses to fiscal news are not obvious, as these news might lead to expectations of future tax increases – such as taxes on dividends or capital gains – or heightened sovereign default risk. As shown by the left panel of Figure 1, though, we find that the stock market reacts positively to announcements of large fiscal spending, which are arguably unrelated to the business cycle and thus cannot convey any signal about the government’s view of the economic outlook. Instead, as shown by the right panel of Figure 1 we find that the response of stock prices is equally split between negative and positive values following announcements of fiscal stimuli to address looming recessions.

Figure 1. Effects of fiscal spending news on stock prices

Note: The figure shows the responses of stock prices to fiscal announcements of three large exogenous fiscal stimuli (left panel) and the supplementary fiscal packages (right panel). We normalize the response to zero on the day before the announcement. The shaded areas highlight the time of the announcement. The red-solid line with a circle marker shows the average value of responses.

The positive response of stock prices to fiscal news, absent signaling effects, implies that these effects might have a negative impact on the stock market. According to our stylized model, signaling effects tend to reduce the effectiveness of fiscal policy in stabilizing the business cycle, particularly when the private sector is more uncertain about the economic outlook. We find evidence supporting these predictions by analyzing changes in stock prices on days when news about the size of supplementary fiscal packages is released. Our results show that when uncertainty – captured by stock market volatility in the Nikkei 225 – is elevated, news about larger than expected fiscal stimulus package depresses stock prices. This pattern is consistent with the theory of signaling effects.

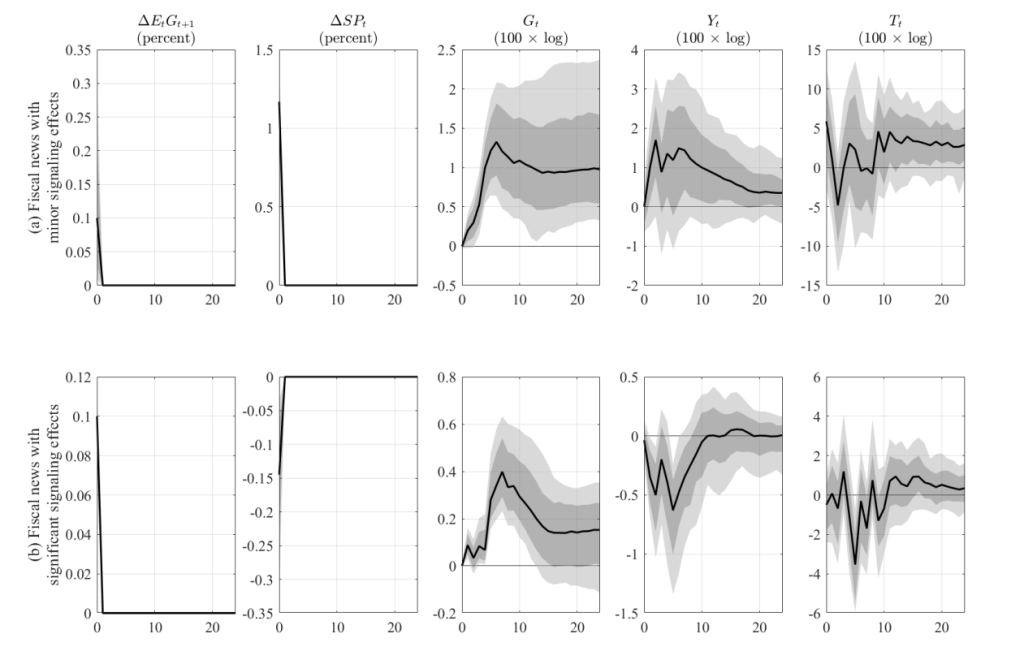

Consistently with our theory, which shows how uncertainty plays an important role in determining the strength of signaling, we estimate a threshold vector autoregression model where we use uncertainty as our threshold variable. As shown by Figure 2, under high uncertainty, output increases in response to fiscal news with minor signaling effects – characterized by positive co-movement between revisions in expectations about government expenditure and stock prices – and decreases in response to news with significant signaling effects, where this co-movement is negative.

Figure 2. Impulse response functions to fiscal news with minor or major signaling effects

Note: The black line shows the median impulse response. The dark- and light-shaded areas correspond to 68% and 90% confidence bands, respectively. The magnitude of the shock is normalized to yield a median impact of 10 basis points on the revision of expectations about future government spending. The x-axis shows months. Uncertainty is measured as the cross-sectional standard deviation in the responses of household expectations from the Consumer Confidence Survey, related to the question about livelihood over the next six months. High (low) uncertainty is a month in which the cross- sectional standard deviation is above (below) average. The variables ∆E_tG_(t+1) and ∆SP_t denote the revisions to expected government spending and stock prices, respectively, on the days when the Japanese government announces the size of supplementary fiscal packages. The variables G_t, Y_t, and T_t denote government expenditure, real GDP, and tax revenue, respectively.

The findings suggest that the effectiveness of fiscal policy depends not only on the size and composition of spending measures, but also on how announcements are interpreted by households and financial markets. In periods of elevated uncertainty, large fiscal packages may signal a more pessimistic economic outlook, thereby weakening their impact on output. Policymakers can mitigate such effects by carefully designing communication strategies that clarify the objectives of fiscal interventions and distinguish policy actions from assessments of economic conditions. Providing transparent and timely information about the macroeconomic outlook, coordinating messages across institutions, and avoiding unnecessary surprises in the scale of announcements may help anchor expectations and enhance the stabilising role of fiscal policy.