Since the global financial crisis (GFC) the non-bank financial sector has grown rapidly in the euro area and at global level. We currently observe a change in the structure of the financial landscape from a bank-based system to a system that relies more on market-based finance. The Capital Markets Union (CMU) will further foster this development and strengthen the cross-border dimension of investments. This should enhance the resilience of the euro area and can complement the banking union in providing for financial risk-sharing. At the same time, however, the process of financial integration and capital market development may be accompanied by the emergence of new financial stability risks. From a policy perspective, this structural change from a bank-based system to a system that relies increasingly on market-based finance underscores the need for developing a system-wide or macroprudential perspective for the non-bank financial sector to ensure financial stability.

Since the global financial crisis (GFC) the non-bank financial sector has grown rapidly in the euro area and at global level. This has led to a fundamental change in the structure of the financial landscape from a bank-based system to a system that relies increasingly on market-based finance. The Capital Markets Union (CMU) will further foster this development and strengthen the cross-border dimension of investments within the EU. As the CMU project is pursued, the non-bank financial sector will continue to play an important role in fostering capital market deepening in Europe and providing firms with alternative funding sources to bank credit.

At the same time, this structural change could harbour risks and vulnerabilities which might affect financial stability and the financing of the real economy more broadly. As a consequence, there is a need to develop a system-wide or macroprudential perspective to ensure that the non-bank financial sector remains a stable source of funding.

This article first provides an overview of the key developments in the euro area financial sector, for instance by highlighting the growing importance of non-bank financial intermediation for real economy financing. It also points to the benefits of more integrated capital markets alongside potential risks and vulnerabilities. The second part of the article hones in on the investment fund sector, exploring how and through which channels vulnerabilities in this sector could amplify risks in the wider financial system. Finally, the article explains why the growing role of market-based finance needs to be accompanied by developing a macroprudential or system-wide perspective on financial stability risks beyond the banking sector.

Growing non-bank financial sector in the euro area

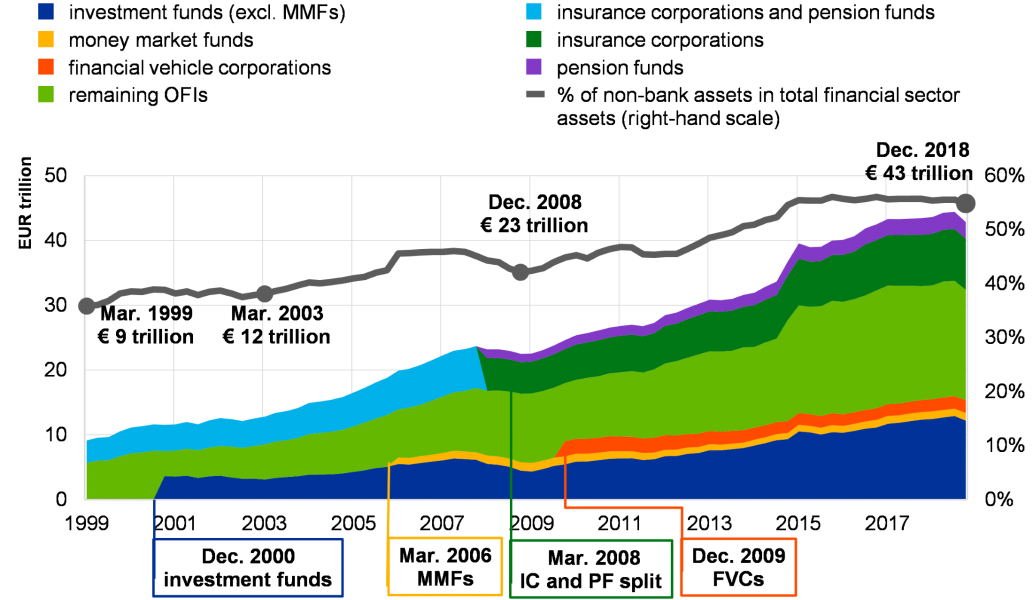

We are witnessing profound changes in the structure and functioning of euro area financial markets. Total euro area assets held by the non-bank financial sector have almost doubled over the last ten years, growing from €23 trillion in 2008 to €42 trillion in 2018 and representing 55% of total financial sector assets (see Figure 1 below). More specifically, the euro area investment fund sector has expanded rapidly since the GFC: its total assets grew from €4.5 trillion at the end of 2008 to €12.2 trillion at the end of 2018.

Figure 1: Growing assets of the non-bank financial sector in the euro area

Source: Author’s calculations based on ECB”s euro area accounts (EAA). Notes: Developments presented take into account net inflows as well as rising asset valuations. MMFs refer to money market funds, ICs to insurance companies, PF to pension funds, and FVCs to financial vehicle cooperations.

Growing importance of the non-bank financial sector in supporting the financing of the real economy and financial market integration

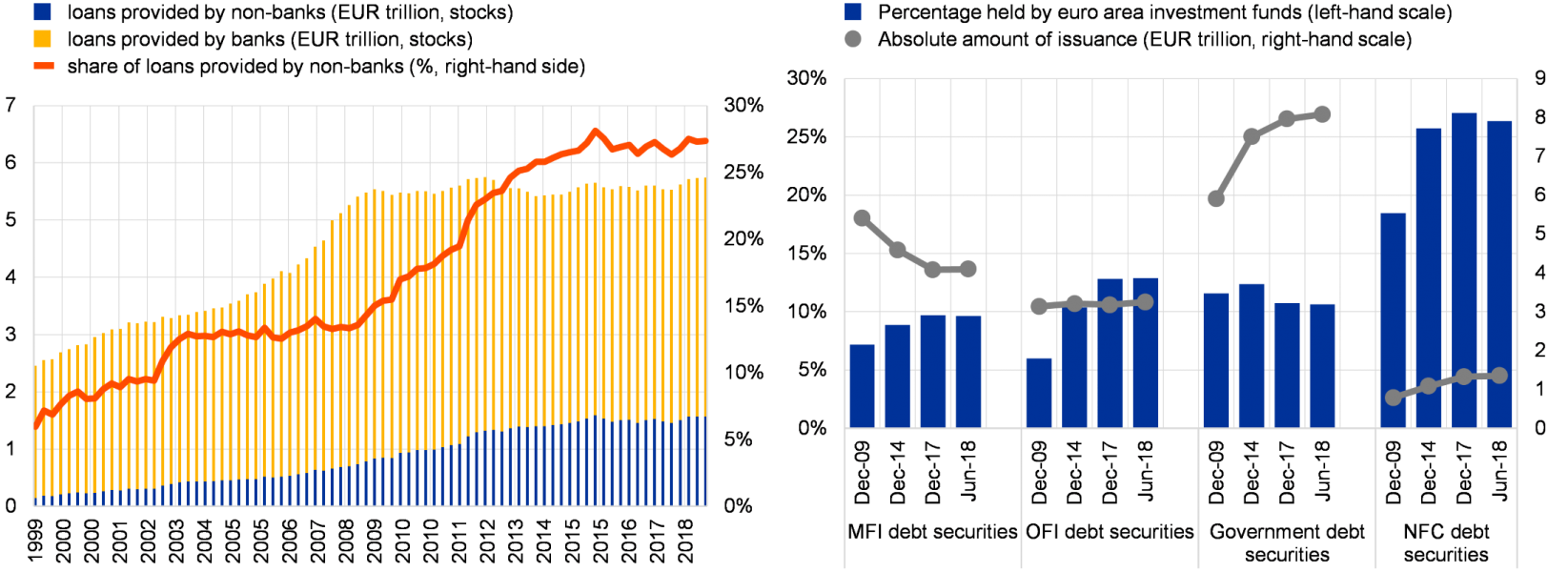

The fast growth in the size of euro area non-banks has been accompanied by their increasing role in financing the euro area economy. The share of loans to non-financial corporations (NFCs) from the euro area financial sector provided by non-banks reached 28%, double the figure ten years ago (see Figure 2a below). NFCs also increasingly finance themselves in the market through the issuance of debt securities, which are primarily held by non-bank financial institutions and investment funds in particular (see Figure 2b below). Since non-bank financial institutions provide ever more financing to NFCs, this helps NFCs to diversify their funding sources.

Figure 2: The increasing role of the euro area non-bank financial sector in debt financing of non-financial corporations (NFCs)

| 2a Loans provided to NFCs | 2b Euro area investment funds” holdings of euro area debt securities |

Source: Author’s calculations based on ECB’s euro area accounts (EAA) (left panel). European Central Bank (2018) (right panel). Notes: In the left panel, ‘non-banks’ refers to financial corporations other than MFIs and includes investment funds, financial vehicle corporations, insurance corporations, pension funds, and remaining OFIs resident in the euro area (i.e. loans provided by non-banks include securitised loans). ‘Banks’ refers to monetary financial institutions resident in the euro area. NFC refers to non-financial corporations resident in the euro area. In the right panel, debt securities issued by the monetary financial institution (MFI), government and non-financial corporate (NFC) sectors are measured as nominal amounts outstanding, while the holdings by funds are based on market value. The change in ratios over time thus partly reflects valuation effects.

Potential role in shock absorption

The share of non-bank financing is likely to increase further as we progress towards more integration and as the CMU project evolves. A key goal for a European CMU is to provide firms with additional funding sources as alternatives or complements to bank credit.

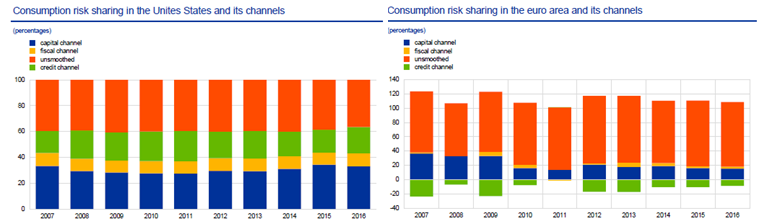

In addition, CMU will further strengthen the cross-border dimension of investments, which provides for additional private risk sharing possibilities and can ultimately help to make economies more resilient to local shocks through better international risk sharing.2 Recent analysis shows that, compared to other economies, there is large potential for improved risk sharing in Europe through better integrated capital markets (see Figure 3), in which the non-bank financial sector could continue to play an important role.3 The model underlying Figure 3 estimates what proportion of an economic shock in the euro area can be cushioned and through which economic channels, e.g. through cross-regional transfers in the fiscal space or adjustments of cross-border funding flows.4 The analysis estimates that only 20% of shocks to GDP growth are mitigated through such channels in the euro area, whereas in the US 60% of the shocks can be mitigated through cross-regional diversification effects. Risk sharing in the US takes place mainly via the capital market and credit channels5, with the capital market channel explaining the largest share of the overall smoothing of shocks across States. While in the US the credit channel accounts for about 20% of risk sharing, a negative contribution to risk-sharing in the euro area suggests that economies lend relatively more to other euro area countries in economic good times than in downturns. A negative contribution to risk sharing via the credit channel in the euro area may thus add to consumption volatility in a procyclical way. This, in turn, limits potential for countries to insure themselves against adverse events affecting their economies.

Figure 3: Risk sharing in the euro area compared to the US

Source: Cimadomo, J., Hauptmeier, S., Palazzo, A. A., and Popov, A. (2018). Notes: Bars display the proportion of a one-standard-deviation shock to domestic GDP growth that is absorbed by each risk sharing channel. Estimates are performed on windows of ten years, e.g. the bar for 2007 describes the average ten-year cumulative contribution of the capital channel, fiscal channel and credit channel during the period 1998-2007.

Potential risks and vulnerabilities

Alongside the benefits of the diversification of funding sources for the real economy and potential better risk sharing, the shift towards non-bank financial intermediation can create potential new vulnerabilities. The growing relevance of the non-bank financial sector and investment funds, in particular, can have implications for the ability of the financial system to absorb shocks and might entail new sources of risk as well as different transmission channels of financial instability. By zooming in on investment funds as the fastest growing sector among euro area non-banks, the following section sheds light on the different transmission channels, such as interconnectedness, procyclicality, leverage or liquidity mismatch, which can generate systemic risk through shock amplification.

Maturity and liquidity transformation in investment funds: run risks and fire sales

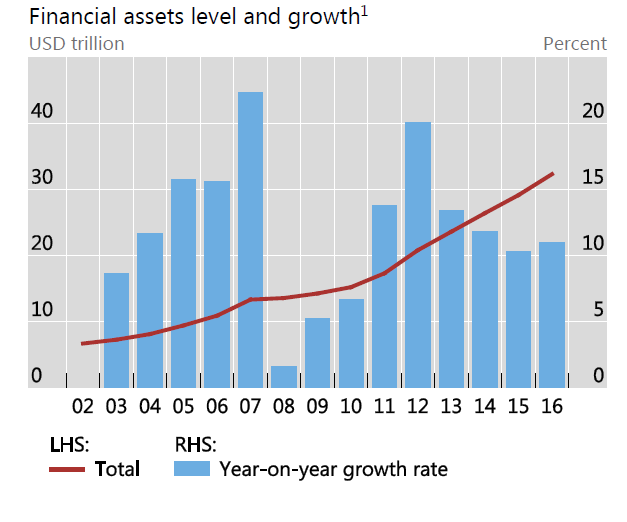

Investment funds offering daily redemptions can be subject to run risk, in particular if they invest in illiquid assets.6 Because investor withdrawals are costly for the future fund value, they impose a negative externality on the investors remaining in the fund.7 The expectation that some investors will withdraw their money can lead remaining investors to follow, resulting in first-mover advantages which can lead to investor runs.8 Runs are more likely the larger the negative externality from withdrawals. Studies show that run risks are particularly large for funds holding less liquid assets due to greater liquidation costs.9 Figures published by the Financial Stability Board (FSB) show that at the end of 2016 investment funds susceptible to run risk held assets equal to $32.3 trillion globally, representing a six-fold increase since 2002 (see Figure 4 below).10 This segment has contributed to the overall growth of the FSB “narrow measure”, which captures entities that may be engaged in credit intermediation that involves liquidity/maturity transformation and/or leverage.

Figure 4: Developments for run-sensitive investment funds

Source: FSB (2018). Notes: Economic Function 1 (EF1) relates to collective investment vehicles (CIVs) with features that make them susceptible to runs.

Even if the amount of assets under management in the FSB’s “narrow measure” is large, the possibility of a market-wide run on investment funds is subject to a number of conditions which mitigate such risks. First and foremost, investment fund shares are priced at a variable net asset value (NAV), which allows passing market risk on to the fund investors. In addition, investment funds usually maintain sufficient liquidity buffers and credit lines to accommodate outflows. Moreover, asset managers usually take a prudent approach in managing portfolio liquidity, in addition to in- and outflows, as well as variation margins in securities lending and derivatives transactions. Funds with less liquid assets and/or funds that experienced higher redemptions are found to hold more cash and liquid assets afterwards.11 And finally, investment funds in the EU are regulated under the UCITS12 Directive and AIFMD13 which provide disclosure requirements and guidance on liquidity management practices.

Nevertheless, there have been several instances, including very recent ones, where asset managers of bond and equity funds experienced severe liquidity issues as a consequence of large scale outflows. In June 2019, one of the most well-known UK equity investment funds (Woodford Equity Income Fund) had to suspend redemptions until further notice, being unable to fund these as it had already depleted its liquid assets pool. Similarly, bond funds held by H2O asset management experienced substantial outflows between June and July 2019, possibly triggered by a loss in confidence and uncertainty around liquidity of the underlying portfolios. In another well-known case from June 2018, GAM, one of the biggest Swiss asset managers, had to suspend redemptions in one of its flagship funds as investors’ withdrawals threatened the survival of the fund. The Financial Times14 reported that “Many laid the blame at GAM’s […] investments in illiquid bonds, which has made it difficult to satisfy investors demanding their money back”. Finally, immediately after the Brexit referendum in June 2016, several UK real estate funds had to suspend redemptions because of significant outflows.

These recent episodes generally happened in fairly benign macroeconomic and financial conditions, with ample liquidity in financial markets, all of which provided a supportive environment for investment funds needing to liquidate their assets. But such benign conditions cannot be taken for granted for every period in which funds might have to accommodate larger outflows.

In all of these cases there was substantial maturity and liquidity transformation performed by investment funds and it is via this element that additional systemic risk can be introduced by non-banks with respect to direct holdings of assets. If, instead, the end investors had held the underlying assets directly, there would have been less incentive to sell them when other investors were selling, due to reduced first-mover advantages. Furthermore, being aware of the underlying illiquidity of their asset holdings, investors would not have expected to be able to liquidate immediately had they been invested directly in the underlying assets. First-mover advantages and liquidity risk at the fund level can in this way increase liquidity risk at the system level.15

Regulators and risk overseers have identified liquidity risk in mutual funds as a potential vulnerability and developed recommendations to mitigate the risks. In its 2017 policy recommendations to address structural vulnerabilities from asset management activities, the FSB highlights the liquidity mismatch between fund investments and redemption terms for open-ended fund units as a key vulnerability that could present financial stability risks.16 The need to address liquidity risk in open-ended funds was also highlighted recently by Bank of England Governor Mark Carney.17 Carney emphasised that fund redemption terms should be better aligned with the actual liquidity of the underlying investments.

The magnifying effects of leverage in investment funds

The GFC showed that leverage interacts with liquidity risks to magnify the consequences of adverse macroeconomic shocks on financial instability.18 Often, the type of leverage associated with subsequent liquidity (and in extreme cases solvency) problems was synthetic (i.e. obtained through derivatives) and funded with short term debt.

Mutual funds substantially increased their exposure to credit derivatives in the run-up to the GFC. Between 2004 and 2008, the percentage of the 100 largest U.S. corporate bond funds selling credit default swaps (CDS) jumped from 20% to 60%. In the same period, their average CDS position grew from 2% to almost 14% of their NAV, with six funds reaching above 50% of their NAV.19 Funds predominantly used CDS to increase their exposure to credit risks – that is, they were net sellers of credit protection, not net buyers. When the GFC hit, such high synthetic leverage resulted in significant losses for some funds. For example, two fixed-income retail mutual funds20 lost roughly 80 percent and 36 percent of their NAV in 2008, respectively, due to their exposure to total return swaps. The funds’ adviser21 had to intervene to support one of the funds which was unable to cover the margin calls associated with the swaps.22 Exactly 10 years before, in 1998, the LTCM hedge fund had to be rescued by a consortium of creditors. Here too, leverage was a key ingredient in the fund’s demise. With $5bn in equity, LTCM managed to borrow $125bn (hence showing a 25x financial leverage ratio), with which it entered derivative positions reaching more than $1tn notional value ($1168bn at the start of 1998).23 While notional value is an imperfect measure of synthetic leverage, these numbers are extreme by any standard. Any adverse market move stood to jeopardise LTCM’s viability very quickly, and it ended up happening.

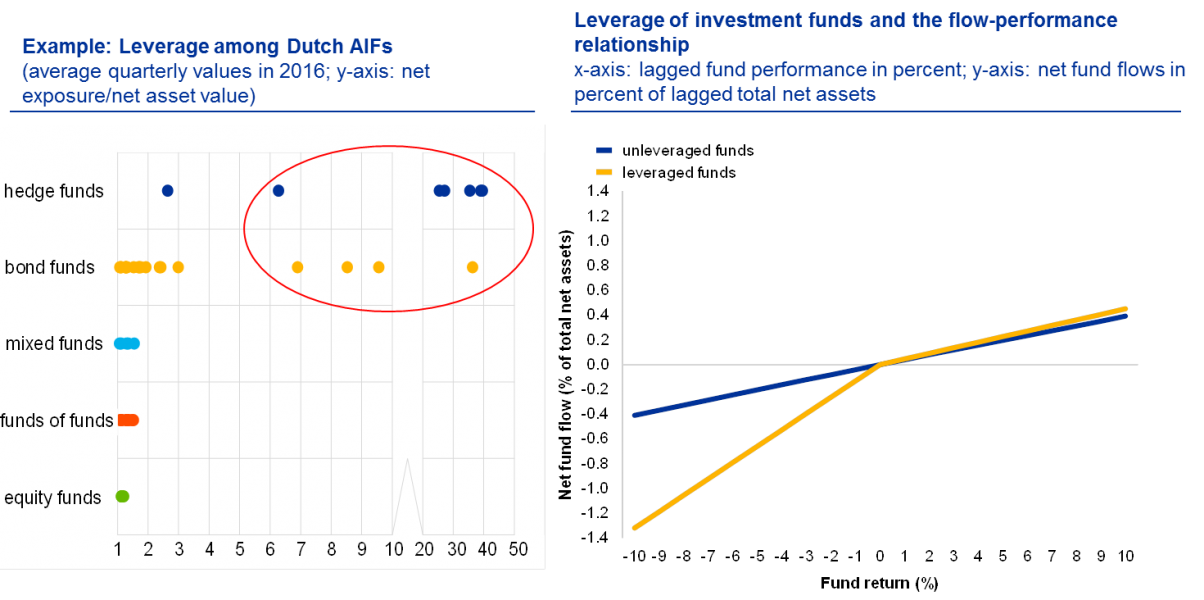

In the EU, leverage of mutual funds is restricted under the UCITS Directive, while there are no binding constraints on leverage for some types of alternative funds (AIFs). In principle, authorities in the EU can impose macroprudential leverage limits on AIFs, but these tools still need to be operationalised in line with the recommendation of the European Systemic Risk Board (ESRB).24 Evidence for alternative funds in the Netherlands suggests that leverage for these institutions is low on average, but there are pockets of very high leverage among some types of bond and hedge funds (see Figure 5a below).

Even when not excessive in itself, leverage can add to fund fragility if combined with short-term redemptions or more generally liquidity mismatches. ECB studies25 demonstrate how investors in leveraged funds react more sensitively to negative fund returns than investors in unleveraged funds (see Figure 5b below). Besides sales to accommodate redemption requests, leveraged funds may need to sell additional assets to keep leverage constant. Furthermore, leveraged funds need to delever proportionally more than unleveraged funds to cover margin calls and higher haircuts on leveraged positions during stressed periods. Therefore, to avoid internalising future costs from additional security sales during bad periods, first-mover advantages are likely to be larger for investors in leveraged funds than for investors in unleveraged funds.

Figure 5: Leverage and procyclicality of investment funds

| 5a Leverage among Dutch AIFs | 5b Leverage and the flow-performance relationship |

Source: van der Veer, K., Levels, A., Lambert, C., Molestina Vivar, L., Weistroffer, C., van Stralen, R.C., Sousa, R. de (2017). Notes: Data on net exposure and fund’s net asset value from the AIFMD reporting framework. Substantial leverage is defined under the AIFMD as net exposure exceeding three times a fund’s net asset value.

Interconnectedness and different channels of contagion

Interconnectedness has been shown to be able to amplify the consequences of distress in one or more non-banks, whereby interconnectedness can be created by several types of commonalities.26 The key interconnections in the system and thus potential contagion channels stem from (i) direct exposures, (ii) ownership links and (iii) indirect exposures through common asset holdings.

Starting with direct exposures, several cases can be cited when the distress of one entity triggered instability affecting the web of its counterparties: Lehman Brothers being the most obvious, but also AIG and the already quoted LTCM. In the case of AIG, ownership links also played an important role, whereby the significant losses in one subsidiary only (Financial Products subsidiary) affected the stability of the global insurance conglomerate.27 Furthermore, common creditors linking different counterparties can also become vectors of contagion between two unrelated markets.28

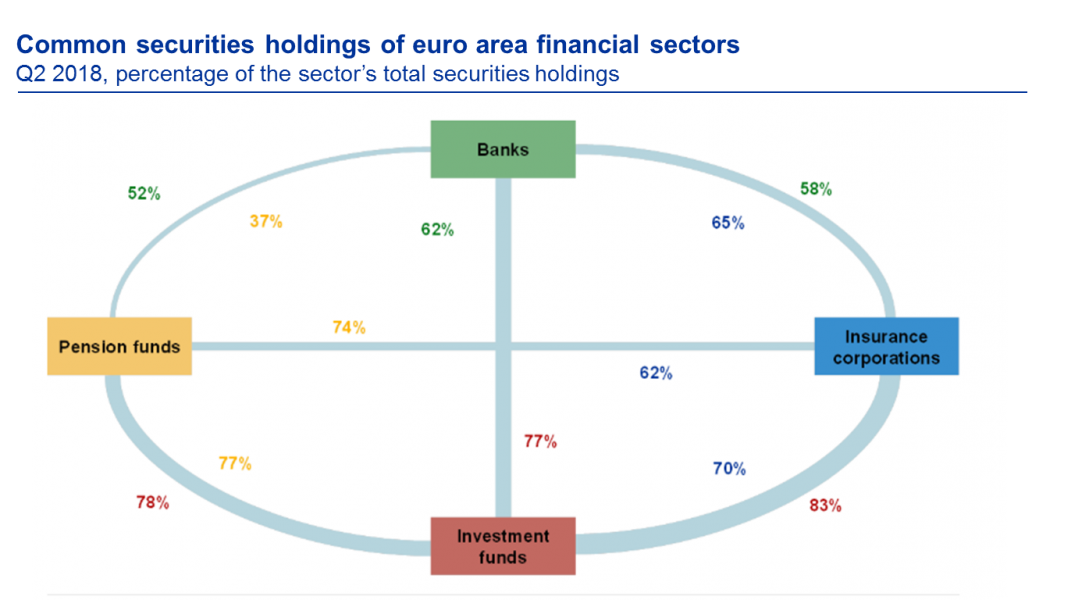

Regarding indirect exposures through common asset holdings, an ECB analysis illustrates that the non-bank financial sector is highly interconnected with other sectors through common exposures. For example, investment funds show the highest interconnectedness with pension funds and insurance companies: about 80% of their aggregate portfolios are securities also held by the other two sectors (see Figure 6). Therefore, if investment funds were to sell significant amounts of their securities (e.g. to meet redemptions), this could trigger price declines of these securities, which in turn could adversely affect the balance sheets of other sectors such as pension funds and insurance companies holdings these assets.

Figure 6: Potential contagion channel between bank and non-bank sectors

Source: European Central Bank (2018). Notes: Each node represents a financial sector. Green denotes banks, blue insurance corporations, red investment funds and orange pension funds. A link between a pair of nodes represents the sum of the common holdings of two euro area financial sectors (i.e. holdings of securities that are held by both sectors). Percentages denote the common holdings as a percentage of total holdings of the sector.

More specifically, in the face of redemptions, a fund is likely to sell its most liquid assets first. In this way, holders of the same liquid assets may be affected by the fund redemptions. When the riskiness of subprime securitisations became apparent, funds holding such instruments did not sell them but instead sold more liquid corporate bonds, propagating the GFC to much wider markets.29 Indirect exposures through common asset holdings can also represent an important channel of contagion within one sector. Studies30 show that in August 2007, as a consequence of their common investment strategies and models, most long/short hedge funds experienced unprecedented losses during days when the markets they were investing in (US equities) remained stable.

The degree of complexity in the interconnectedness sphere is further increased by the configuration of non-bank financial intermediation with some international financial centres acting as provider of services to an array of investors in source and destination countries.31

Summing up: market fragility beyond insolvency risk

Episodes of financial distress have been characterised by a build-up phase where leverage, liquidity and maturity transformation in non-banks increase in a self-reinforcing mechanism. Non-banks may contribute to a wider financial sector exuberance, which can render both the financial system and the real economy more vulnerable to shocks. If an adverse shock materialises, it can trigger a self-reinforcing opposite mechanism of deleveraging, liquidity evaporation and falling asset prices.32 Because of their business models (e.g. mutual funds not being ultimate bearers of risk), non-banks may be less affected by financial distress in terms of their own insolvency risk. Nonetheless, their contribution to self-reinforcing mechanisms in both the build-up and the distress phase may be substantial, with leverage, liquidity transformation and interconnectedness all potentially acting as key amplifiers.

Because the financial system tends to shift more towards market-based financial intermediation, the contribution of the non-bank sector to the interconnected structure and to cyclical dynamics of the financial system is likely to increase as well. If we are to avoid excessive cyclicality and interconnectedness that were important in previous financial cycles, we need to understand clearly how non-banks, with their specificities, collectively contribute to and are affected by these phenomena.

Ensuring the solidity of individual institutions is not sufficient to guarantee stability of the system as a whole: a macroprudential framework for non-bank financial institutions is needed to identify and address risks at the system level. In particular, further progress is needed in the following key areas: (1) improving reporting and risk monitoring, (2) enhancing understanding of how the system is interconnected and behaves namely through macroprudential or system-wide stress tests and (3) implementing a toolkit to be used by authorities should vulnerabilities turn into emerging systemic risks in the non-bank sector, including from procyclicality, leverage and liquidity transformation.

Improve reporting and enhance risk monitoring

In order to identify the build-up of risks it is paramount to have comprehensive and granular data of a good quality. While considerable progress has been made since the GFC33, data on various sectors of non-banks remain incomplete. For example, ECB data show that approximately 45% of the euro area non-bank assets falls under the “other financial institutions” category (see Figure 1), a residual category for which little information on identity and business models is available. Broader and more granular data in this space would certainly help shedding light on the structure and dynamics of euro area non-bank sectors. Another example is synthetic leverage which has been a key risk driver in previous episodes of market stress. Having a consistent set of leverage metrics (including synthetic) that capture risks and are comparable across jurisdictions is thus important. In this regard and in line with the 2017 FSB recommendations34, the ESRB35 has highlighted that an important step towards allowing authorities to better monitor leverage in the fund sector globally would be the consistent collection of leverage metrics by all jurisdictions.

More generally, standardised granular data infrastructure would enable mapping the microstructure of the euro area financial system and obtaining one integrated overview. A prerequisite for such an overview is the use of internationally agreed standards, which allow for the unique identification of entities and financial instruments such as the International Securities Identification Number (ISIN) and global Legal Entity Identifier (LEI). In this regard, further efforts to promote LEIs are needed to ensure wide and systematic use of these identifiers by industry and authorities across jurisdictions. Another important element is to overcome various obstacles which do not allow all relevant authorities to have a direct access to the (already existing) data and/or impede an (efficient) data sharing among relevant authorities.

Enhance understanding of liquidity, leverage and interconnectedness risks through macroprudential or system-wide stress tests

The growth of market-based finance underscores the need for models to assess its resilience and simulate how the financial system as a whole may function under stress, as also recently recommended by the Financial Stability Board.36 Ideally, such system-wide simulation exercises need to embed the full range of contagion channels and amplifiers discussed above. It is also important for them to take a broad perspective towards the non-bank financial system, including, for example, dealers, insurance companies, pension funds and central counterparties alongside investment funds. Initial attempts have been made in this direction37, though this line of work is still clearly at an early stage. A key challenge going forward for system-wide stress testing will be to manage the trade-off between the need for rich modelling of a range of different sectors, with all the assumptions that entails, and the need for robustness.

The ECB has also developed a granular model of interconnectedness, albeit with narrower sectoral focus.38 In this framework, a set of heterogeneous agents interact in asset, funding, and securities markets and face solvency and liquidity constraints on their behaviour. The model provides a framework to investigate a wide range of shocks coming either from the real economy or from market prices. The aim is to capture the endogenous nature of systemic risk caused by the interaction of institutions and markets in the financial system instead of only ensuring resilience of individual entities: a macroprudential perspective on both banks and non-banks. The model is able to disentangle different sources of systemic risk, like common exposures to the real economy or financial contagion through the interbank market, and identify key players in the financial system. It is thus a complementary element of the ECB’s internal work on system-wide stress testing, framing key capital market interactions among different entities and sectors.

Implement a toolkit to be used by authorities should vulnerabilities turn into emerging systemic risks in the non-bank sector

After the crisis considerable progress has been made in strengthening the EU regulatory and supervisory framework for non-banks. This represents a cornerstone to limit risks in the non-bank financial sector. At the same time, policy makers have expressed concerns about financial stability risks that may stem from a growing share of non-bank financial intermediation. The relevance of risks arising from leverage and liquidity transformation in the non-bank sphere has been long recognised at the global and European level, as testified by the work of the FSB, International Organization of Securities Commissions (IOSCO) and ESRB among many others.39

The FSB policy recommendations40 to address vulnerabilities arising from asset management activities foresee a potential macroprudential role for authorities in providing direction on the use of liquidity risk management tools by funds in extraordinary circumstances. It is especially important that in situations where measures available to asset managers alone are insufficient, authorities are equipped with relevant powers to be able to mitigate structural vulnerabilities arising from asset management activities. In a similar vein, it is crucial to implement and operationalise fully the ESRB recommendations on liquidity mismatches and leverage in investment funds. To achieve this, ESMA will develop guidance to support authorities in assessing leverage risks in the alternative investment funds (AIF) sector and design, calibrate and implement a macroprudential leverage limit. Importantly, ESRB recommendations also foresee a role for authorities in suspending fund redemptions in a stress scenario, also in line with the FSB recommendation on asset management vulnerabilities, making both the FSB and ESRB recommendations actual and important.

More generally, a macroprudential framework needs to enable authorities to identify new and emerging risks from non-bank financial intermediation and should provide authorities with intervention powers and instruments to prevent or mitigate systemic risks arising in the non-bank financial system. In this regard, developing further the macroprudential toolkit that authorities should have at their disposal is key.41 Complementing the powers that are currently envisaged for authorities with ex-ante tools targeting risks stemming from liquidity and maturity transformation at system level42 should be explored further with the aim of preventing the build-up of vulnerabilities before they become material.

We are witnessing a sea change in the EU financial sector. The traditional banking nature of financial intermediation in Europe is being transformed into a more diversified system, with non-bank intermediation providing an invaluable source of funding and becoming ever more sizeable and relevant to the real economy. This brings many benefits. These benefits are the raison d’etre of the CMU project, which the ECB very much continues to support. In order to reap these benefits fully, we should strive to ensure that non-bank intermediation develops in a sustainable and resilient manner. To this end, we need to provide the conditions under which capital markets can flourish, whilst at the same time making sure that regulatory and supervisory measures keep financial stability risks in check.

Non-banks are clearly different from banks, including the larger variety of types of entities and activities represented in the non-bank financial sector. Heterogeneity of business models poses a challenge for the identification of systemic risk in the non-bank space. In general, we are looking less at the risk-bearing capacity of the institution’s balance sheet and more at the potential for contagion and shock amplification through the system as well as amplification of the broader financial cycle. That is why key risks that we look at relate to procyclicality, liquidity, leverage and interconnectedness. A macroprudential framework for non-banks would need to be capable of identifying and addressing the key fragilities and externalities stemming from the non-bank financial sector, and provide for the appropriate tools that allow authorities to achieve this in an efficient and effective manner.

Such a framework should not hinder but support the beneficial role that non-banks play in financial intermediation – absorbing shocks, rather than amplifying exuberance and stresses. By ensuring that non-bank financing develops in a sustainable manner, it would help reap the full benefits of a deep and integrated European capital market that is particularly relevant in a monetary union.

Aikman, D., Chichkanov, P., Douglas, G., Georgiev, Y., Howat, J. and King, B. (2019). “System-wide stress simulation”. Mimeo, Bank of England.

Alogoskoufsy, S., di Iasio, G., King, B., Nicoletti, G., Takeyama, A. and Vause, N. (2019). A model for system-wide stress simulations. Mimeo, Bank of England and ECB.

Abad, J., D”Errico, M., Killeen, N., Luz, V., Peltonen, T., Portes, R., and Urbano, T. (2017). “Mapping the interconnectedness between EU banks and shadow banking entities”. National Bureau of Economic Research working paper 23280.

Adam, T. and Guettler, A. (2010). “The Use of Credit Default Swaps by U.S. Fixed-Income Mutual Funds.” Working Paper No. 2011-01, Washington, D.C.: FDIC Center for Financial Research, November 19, 2010.

Adrian, T., and Shin, H. S. (2010). “Liquidity and leverage”. Journal of Financial Intermediation, 19(3), 418-437.

Baranova, Y., Coen, J., Lowe, P., Noss, J. and Silvestri, L. (2017). “Simulating stress across the financial system: the resilience of corporate bond markets and the role of investment funds”, Bank of England Financial Stability Paper No. 42.

Blackrock (2017). “Macroprudential policies and asset management”. Blackrock Viewpoint, February 2017, retrieved at: https://www.blackrock.com/corporate/literature/whitepaper/viewpoint-macroprudential-policies-and-asset-management-february-2017.pdf

Bley, A. and J. P. Weber (2017). “Capital Markets Union: deepening the Single Market makes sense, but don’t expect too much”. Vierteljahrshefte zur Wirtschaftsforschung, DIW Berlin, Volume 86, 01.2017.

Borio, C. E. (2004). “Market distress and vanishing liquidity: anatomy and policy options”. BIS Working Papers N.158.

Branzoli, N., and Guazzarotti, G. (2017). “Liquidity transformation and financial stability: evidence from the cash management of open-end Italian mutual funds”. Bank of Italy Temi di Discussione (Working Paper) No, 1113.

Brunnermeier, M. K., and Pedersen, L. H. (2008). “Market liquidity and funding liquidity”. The Review of Financial Studies, 22(6), 2201-2238.

Chen, Q., Goldstein, I., and Jiang, W. (2010). “Payoff complementarities and financial fragility: Evidence from mutual fund outflows”. Journal of Financial Economics, 97(2), 239-262.

Cimadomo, J., Hauptmeier, S., Palazzo, A. A., and Popov, A. (2018). “Risk sharing in the euro area”. In: ECB Economic Bulletin, Issue3 / 2018, 85-98.

Cominetta, M., Lambert, C., Levels, A., Ryde n, A., and Weistroffer, C. (2018). “Macroprudential liquidity tools for investment funds – A preliminary discussion”. Macroprudential Bulletin.

Diamond, D. W. and Dybvig, P. H. (1983). “Bank runs, deposit insurance, and liquidity”. Journal of Political Economy, 91(3), 401-419.

Doyle, N., Hermans, L., Molitor, P., and Weistroffer, C. (2016). “Shadow banking in the euro area: risks and vulnerabilities in the investment fund sector”. ECB Occasional Paper Series, No. 174.

Downs, D. H., Sebastian, S., Weistroffer, C., and Woltering, R.-O. (2016). Real estate fund flows and the flow-performance relationship. The Journal of Real Estate Finance and Economics, 52(4), 347-382.

Edelen, R. M. (1999). Investor flows and the assessed performance of open-end mutual funds. Journal of Financial Economics, 53(3), 439-466.

Edward, F. R. (1999). “Hedge funds and the collapse of long-term capital management”. Journal of Economic Perspectives, 13(2), 189-210.

ESRB (2018). Public comment on IOSCO report: leverage.

ESRB (2017). “Recommendation of the European Systemic Risk Board of 7 December 2017 on liquidity and leverage risks in investment funds”. (ESRB/2017/6), published on 14 February 2018.

ESRB (2016). Macroprudential policy beyond banking: an ESRB strategy paper, July.

European Central Bank (2017). “Financial Integration in Europe 2017”.

European Central Bank (2018), Financial Stability Review, November 2018.

European Central Bank (2019), Financial Stability Review, May 2019.

Elliott, D. (2014). “Systemic Risk and the Asset Management Industry.” Economic Studies at Brookings, Brookings Institution, Washington.

Feroli, M., Kashyap, A. K., Schoenholtz, K. L., and Shin, H. S. (2014). “Market tantrums and monetary policy”. Chicago Booth Research Paper, (14-09).

Financial Times (2018). “‘Go anywhere’ bond funds spark debate around liquidity risk”. Financial Times November 19, 2018.

Financial Times (2019). “BoE governor Mark Carney calls for change to fund regulation”. 26 June 2019.

FSB (2018). “Global Shadow Banking Monitoring Report 2017”. March 2018.

FSB (2017). “Policy Recommendations to Address Structural Vulnerabilities from Asset Management Activities”. 12 January 2017.

Geanakoplos, J. (2010). “The leverage cycle”. NBER Macroeconomics Annual, 24(1), 1-66.

Goldstein, I. and Pauzner, A. (2005). “Demand –deposit contracts and the probability of bank runs”. The Journal of Finance, 60(3), 1293-1327.

Goldstein, I., Jiang, H., and Ng, D. T. (2017). “Investor flows and fragility in corporate bond funds”. Journal of Financial Economics, 126(3), 592-613.

Gorton, G., and Metrick, A. (2012). “Securitized banking and the run on repo”. Journal of Financial Economics, 104(3), 425-451.

Inhoffen, J. (2019). “Stability implications of financial interconnectedness under the Capital Markets Union”. DIW Roundup 129: Politik im Fokus.

International Monetary Fund (2015). “Global Financial Stability Report”, April 2015. Washington, DC: International Monetary Fund.

IOSCO (2018a). “Recommendations for Liquidity Risk Management for Collective Investment Schemes”, Final Report.

IOSCO (2018b). “IOSCO Report: Leverage”, Consultation Paper.

Jank, S. and Wedow, M. (2015). “Sturm und Drang in money market funds: When money market funds cease to be narrow”. Journal of Financial Stability, 16, 59-70.

Khandani, A. E., and Lo, A. W. (2011). “What happened to the quants in August 2007? Evidence from factors and transactions data”. Journal of Financial Markets, 14(1), 1-46.

Lane, P. (2018). “Remarks by Mr Philip R Lane, Governor of the Central Bank of Ireland, at the Bank of Spain-SUERF Conference “Financial Disintermediation and the Future of the Banking Sector”. Madrid, 30 October 2018.

Manconi, A., Massa, M., and Yasuda, A. (2012). “The role of institutional investors in propagating the crisis of 2007–2008”. Journal of Financial Economics, 104(3), 491-518.

McDonald, R. and Paulson, A. (2015). “AIG in Hindsight”. Journal of Economic Perspectives, Vol. 29, No 2, 2015, 81-106.

Molestina Vivar, L., Wedow, M., Weistroffer, C. (2019). “Burned by leverage? Procyclical flows and fragility in mutual bond funds”. Forthcoming.

Montagna, M., and Kok, C. (2016). “Multi-layered interbank model for assessing systemic risk.” ECB working paper series n. 1944.

Montagna, M., Covi, G., and Torri, M. (2019). “Economic shocks, financial contagion and systemic risk in the Euro Area” ECB working paper series, forthcoming.

Nanda, V., Narayanan, M., and Warther, V. A. (2000). Liquidity, investment ability, and mutual fund structure. Journal of Financial Economics, 57(3), 417-443.

Schularick, M., and Taylor, A. M. (2012). “Credit booms gone bust: Monetary policy, leverage cycles, and financial crises, 1870-2008”. American Economic Review, 102(2), 1029-61.

Stein, J. (2014). “Comments on “Market Tantrums and Monetary Policy”. Speech at the 2014 US monetary policy forum, New York, New York.

van der Veer, K., Levels, A., Lambert, C., Molestina Vivar, L., Weistroffer, C., Raymond, C., and de Sousa van Stralen, R. (2017). “Developing macroprudential policy for alternative investment funds”. ECB Occasional Paper Series.

Ziya Gorpe, M., Covi, G., and Kok, C. (2019). CoMap: Mapping Contagion in the Euro Area Banking Sector (No. 19/102). International Monetary Fund.

This note should not be reported as representing the views of the European Central Bank (ECB). The views expressed are those of the author and do not necessarily reflect those of the ECB. This article largely builds on a presentation held at the 9 May 2019 Vienna Conference on “Financial stability in 2030: Maintaining effectiveness while reducing complexity” organised by the Austrian National Central Bank (OeNB). With many thanks to Katharina Cera, Matteo Cominetta, Margherita Giuzio, Michael Grill, Claudia Lambert, Anouk Levels, Linda Fache Rousová, Anders Rydén, Luis Molestina Vivar, and Christian Weistroffer for their analytical support. The analysis in this paper is based on their work, some of which has been published in the ECB’s Financial Stability Review and in the Macroprudential Bulletin.

The concept of international risk sharing refers to the idea that countries or economic agents such as households and enterprises diversify risks to insure themselves against adverse events affecting their economies. More specifically economic agents, such as households and firms, attempt to insure their consumption against idiosyncratic fluctuations in output of their economy and thereby aim to “smooth out” changes in their consumption resulting from economic shocks. International risk sharing is thus estimated as the relationship between total economy consumption growth and output growth. To the extent that consumption growth is uncorrelated with output growth, this would point to effective risk sharing.

See Cimadomo et al. (2018).

Bars display the proportion of a one standard deviation shock to domestic GDP growth that is absorbed by each risk sharing channel.

Three channels can be distinguished: (1) the Fiscal channel, generally referred to as the public channel, relies on cross-regional fiscal transfers, such as transfers from the federal government at the state or regional level. Private mechanisms work through the other two channels: (2) the Credit channel operates via cross-border saving/borrowing, i.e. the public sector, households and firms may borrow internationally (or inter-jurisdictionally), and (3) the Capital market channel which operates via internationally/inter-jurisdictionally diversified private investment portfolios.

See Doyle et al. (2016).

See e.g. Edelen (1999) and Nanda et al. (2000).

See Diamond and Dybvig (1983), Goldstein and Pauzner (2005), Chen et al. (2010), Goldstein et al. (2017).

See Chen et al. (2010), Jank and Wedow (2015) and Downs et al. (2016).

See FSB (2018). Economic Function 1 comprises collective investment vehicles with features that make them susceptible to runs.

See IMF (2015) and Branzoli and Guazzarotti (2017).

Undertakings for Collective Investment in Transferable Securities.

Alternative Investment Fund Managers Directive.

See Financial Times (2018).

See Elliot (2014).

See FSB (2017). To note that IOSCO was requested to operationalise the FSB policy recommendations on liquidity and issued the Recommendations for Liquidity Risk Management for Collective Investment Schemes to this effect in February 2018.

See Financial Times (2019).

See Adrian and Shin (2010) and Brunnermeier and Pedersen (2008).

See Adam and Guettler (2010).

The Oppenheimer Champion Income Fund and the Oppenheimer Core Bond Fund.

OppenheimerFunds

See Adam and Guettler (2010).

See Edward (1999).

See ESRB (2017).

See Molestina Vivar et al. (2019) and van der Veer et al. (2017).

See Inhoffen (2019) and Abad et al. (2017).

See McDonald and Paulson (2015).

See IMF (2015).

See Manconi et al. (2012).

See Khandani and Lo (2011).

See Lane (2018).

See Borio (2004), Brunnermeier and Pedersen (2008), Geanakoplos (2010), Adrian and Shin (2010), Gorton and Metrick (2012), Schularick and Taylor (2012).

For example, the European Market Infrastructure Regulation data now covers all derivatives transactions in the EU; the Money Market Statistical Reporting database now covers repo markets as well as there has been progress related to the forthcoming reporting of Securities Financing Transactions.

See FSB (2017).

See ESRB (2018). To note that the ESRB has voiced these views in response to IOSCO’s efforts to facilitate a meaningful and consistent assessment of global leverage in investment funds, as part of operationalising the FSB’s recommendations.

See FSB (2017).

See Baranova et al. (2017), Aikman et al. (2019), Alogoskoufis et al. (2019).

See Montagna and Kok (2016), Montagna et al. (2019) and Ziya et al. (2019).

See ESRB (2016), ESRB (2017), FSB (2017), IOSCO (2018a,b).

See FSB (2017).

See speech by Luis de Guindos, Vice-President of the ECB, at the Opening Conference, 21st Euro Finance Week, Frankfurt am Main, 12 November 2018: Coming to the forefront: the rising role of the investment fund sector for financial stability in the euro area.

For a preliminary discussion of possible liquidity tools in the investment fund sector see Cominetta et al. (2018).