Shleifer, A. and Vishny, R. W. (1992). Liquidation values and debt capacity: A market equilibrium approach. Journal of Finance, 47(4):1343–1366.

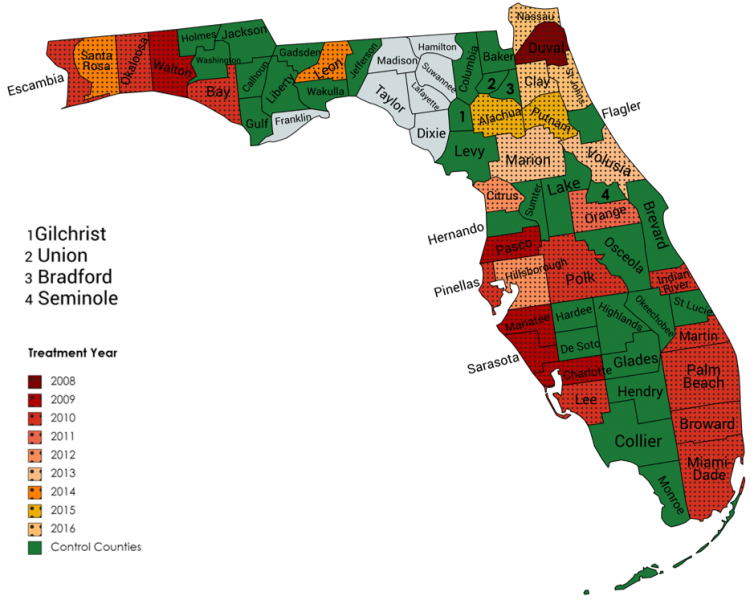

At the time of writing, Florida and Ohio are the only two states in the U.S. permitting county courts to conduct electronic foreclosure auctions as of yet. However, most counties in Ohio adopted the state policy (Bill 390) during the Covid-19 pandemic, making an empirical assessment of electronic auctions more difficult.

After no third parties buy at the foreclosure auction, the property becomes a Real Estate Owned (REO) asset in the balance sheet of the bank. REO expenses include maintenance and selling costs, and can total up to 15.95% of property value. See https://www.benefits.va.gov/homeloans/servicers_valeri.asp.

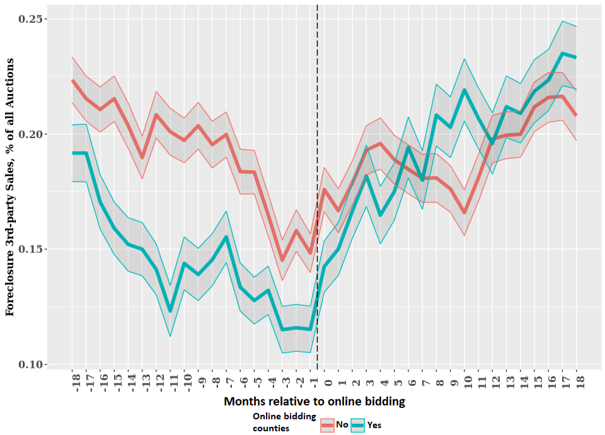

There are also indirect benefits the improved sale technology most likely brings: defaulting borrowers suffer smaller deficiency judgements, fire-sale spillovers are lower in neighborhoods and the community therein. These analyses are outside the scope of this paper.

Therefore, online bidding helps owner-occupants to acquire a home in a cost-effective way. The cost savings potential is found to be the primary motive for most U.S. consumers to acquire a foreclosed home at an action. This factor is particularly important among Millenials, who are also the ones more willing to participate with remote bidding (see https://www.svclnk.com/blog/more-than-three-in-five-us-consumers-would-consider-buying-a-home-at-auction-according-to-new-servicelink-survey/ ).

Though I cannot rule out that participation rates of more distant buyers increase (data about non-winning bids are observable only for affected counties post-treatment), another reason why electronic bidding reduces buyer-property distance may just be that monetary participation costs are lower than frictions associated with in-person participation (e.g., dealing with the lender’s representative, requesting days off at work, non-anonymity).