This Policy Brief is based on IMF working paper WP/24/118 “Aging Gracefully: Steering the Banking Sector through Demographic Shifts”

As the global population ages, the banking sector faces significant transformations, impacting balance sheets, risk profiles and stability. Our analysis spanning the years 2000-2022 across advanced economies reveals a nuanced impact of aging on banking systems. While traditional lending tapers and the importance of maturity transformation diminishes, leading to a potential reduction in average risk, banks’ pursuit of yield to compensate for the loss of their traditional business, through unfamiliar avenues, introduces potential tail risks. This Policy Brief explores these dynamics, emphasizing the need for proactive policy measures to navigate the challenges posed by aging populations in maintaining banking stability.

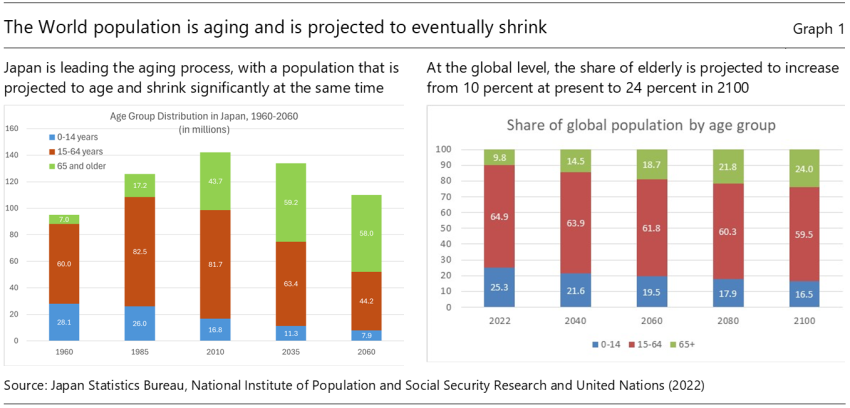

The global trend of aging populations, especially in advanced economies, has profound implications for the financial sector landscape. In the past two decades, advanced economies have witnessed a significant increase in their elderly populations, a trend projected to continue and intensify in the coming years. This demographic transition, characterized by lower fertility rates and longer life expectancies is gradually altering the macro-financial landscape. The population of some countries like Japan is even starting to shrink, with the world forecasted to follow in its footsteps (Graph 1). The implications are far-reaching, affecting consumption patterns, labor markets, and, critically, the financial sector.

While the ramifications of an aging population on life insurance and pension fund risk have garnered attention within the economic profession, the specific impact on banking systems necessitate further exploration. Our analysis extends the examination of the influence of ageing on banking stability beyond the national contexts towards a comparison across advanced economies.

Traditionally, banks have played a pivotal role in the economy through maturity transformation transformation—borrowing shortshort-term deposits to lend as long long-term loans. As expected from the life life-cycle hypothesis, however, as populations age, the demand for such traditional banking services diminishes. Elderly populations tend to be wealthier, requiring less borrowing, and more conservative with their financial choices, being less inclined towards risky investments. This shift poses a dual challenge for banks: a contraction in their core lending business and an excess of deposits seeking profitable investment avenues.

In response to these demographic pressures, banks are compelled to recalibrate their operational framework, with consequences both on their assets and liabilities. The expected reduction in loan offerings is compensated for by augmenting investments in government bonds and other securities, diversification into novel financial ventures and expanding internationally. While such adaptations may open new revenue streams, they also introduce new risks. These include market, liquidity, and operational risks, arising from unfamiliar territories and investment vehicles. Furthermore, banks’ forays into international markets to counterbalance domestic demographic challenges carry geopolitical and regulatory risks.

Employing a mix of descriptive and econometric analyses for banks in advanced economies during the period 2000-2022, the paper meticulously explores the relationship between aging demographics and changes in banks’ balance sheets, their propensity for risk-taking, and the aggregate stability of the banking system.

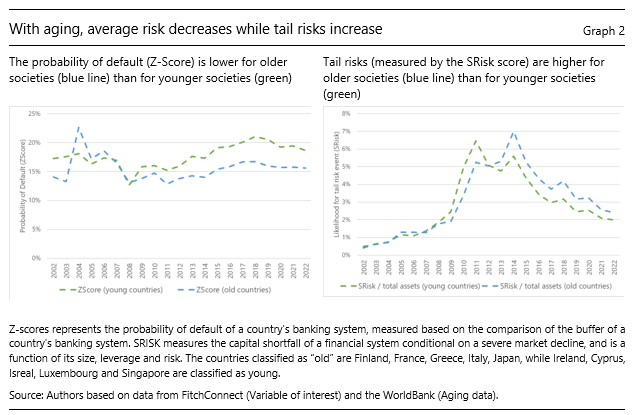

Our analysis indicates that banks in aging societies tend to reduce the risk profile of their assets, primarily due to decreased lending and reduced maturity transformation activities, supported by favorable funding conditions. Consequently, banking stability generally improves in aging societies, as illustrated in Graph 2 (left side). We measure bank solvency using country-level Z-scores, reflecting the probability of default based on capitalization and return volatility (Graph 2, left side).

However, the strategic shifts to manage excess deposits and seek yield introduce new tail risks—low-probability, high-impact events that could strain financial stability (Graph 2, right side). To measure tail risks, we use a market-based metrics of worst-case losses that considers interconnectedness risk (SRisk). Similar trends are also visible for banks’ Expected Default Frequency (EDFs) and banks’ price to book ratios, reinforcing our findings.

As the world navigates the uncharted waters of demographic aging, the banking sector stands at a critical juncture. The gradual yet significant demographic shift present both challenges and opportunities. The choices made today today—by banks, regulators, and policymakers policymakers—will shape the financial landscape of tomorrow. The anticipated response of the banking sector to aging populations is complex, entailing both risks and opportunities. The aim should not merely be to mitigate risks but to seize the opportunities presented by an aging society, ensuring a stable, inclusive, and dynamic financial sector.

This research underscores the necessity for banks in aging economies to proactively and sustainably adjust their business models away from traditional maturity transformation to mitigate risks effectively. Past crises, such as the Great Financial Crisis, illustrate the challenges of such transformations. For instance, foreign banks faced significant losses from US subprime debt exposures that supervisors had inadequately analyzed. Although aging was not a key factor in that instance, this episode underscores the importance of thorough risk assessment and adaptation in response to demographic changes. Similarly, although the risks posed by aging demographics may not be immediate, their gradual evolution through indirect channels is making them less visible compared to traditional factors influencing bank solvency. Larger banks with their global footprints, may possess the resilience to navigate these demographic shifts through strategically diversifying their activities and expanding geographically to mitigate emerging tail risks. However, smaller banking institutions, which are geographically more concentrated, may face considerably more hurdles in adapting to these demographic transformations.

Policymakers should support this transition by implementing rigorous supervisory analyses, encouraging innovation in financial products tailored to aging populations. Employing meaningful scenario analyses can guide bank strategies and public policies alike. Supervisory diligence is paramount, particularly in evaluating banks’ strategies to offset low structural profitability in home markets by venturing into riskier foreign markets or new products tailored to the needs of aging households. This scrutiny ensures that banks remain resilient and stable amidst their efforts to diversify and seek higher returns in unfamiliar territories. Additional prudential measures could be considered, but they must not further weaken banks´ solvency profiles. Therefore, other policy instruments to backstop banks, including fiscal ones, should not be ruled out. The future stability and dynamism of the financial sector depend on these adaptive measures.