This policy brief is based on BIS Working Papers No 1284. The views expressed here are those of the authors and do not necessarily represent the views of the IMF, its Executive Board, IMF management, or those of the Bank for International Settlements.

Abstract

How can poor countries catch up with rich ones? This brief documents the role of human and physical capital, and financial development in convergence in manufacturing labor productivity across countries and industries. It then examines the influence of economic structure and financial development at the aggregate level. Manufacturing industries exhibit strong unconditional convergence over time, but with some variation: Greater reliance on human capital in an industry is linked to faster convergence, whereas industries that depend more on physical capital need sufficiently high levels of financial development to converge. At the country level, convergence is faster as economies shift away from agriculture (which typically requires less human capital), and towards industrial production or services. Furthermore, poorer countries that initially have high shares of agriculture in their GDP have been shifting away from agriculture at a faster rate, likely contributing to the observed aggregate convergence. Greater financial development is also linked to faster convergence at the country level.

Economists have long sought to understand the underlying forces that can make poor countries grow and catch up with rich ones. One key prediction comes out of basic macro models: Poor, low capital countries have high returns to investment, and so if capital is allocated efficiently across countries, poor countries should grow faster than rich, capital abundant countries with low returns to capital (Solow 1956). This “unconditional convergence” has been under considerable debate thereafter. Evidence came in for and against, qualifications were made (i.e., conditional convergence), conclusions varied (Barro and Sala-i-Martin 1992, Mankiw et al. 1992, Pritchett 1997, Easterly and Levine 2001).

More recently, Rodrik (2013) documented evidence on unconditional convergence in manufacturing industries. He argues that the lack of convergence in other sectors suggests that convergence occurs in only the “modern” parts of the economy; and the small size of manufacturing and modest pace of labor reallocation toward manufacturing has weakened aggregate convergence in absolute terms. Nevertheless, evidence for aggregate convergence has picked up in recent decades (Kremer et al. 2021, Klein and Crafts 2023).

The resurgence of aggregate convergence suggests that the underlying factors that foster convergence might change over time. However, it is still not clear what drives convergence in the manufacturing sector, which ingredients spur the convergence process, and how these might contribute to aggregate convergence. Productivity is likely the key separator of growth rather than factor accumulation (Easterly and Levine 2001). Theoretical advancements further predict that financial development and accumulation of human capital are key inputs that greatly affect productivity and the path of economic growth (Mankiw et al. 1992, De Gregorio 1996, Aghion et al. 2005, Morales 2003). In a previous SUERF Policy Brief (Hardy and Sever 2023a), we highlight that patenting rates across countries and industries are converging, implying that research and knowledge accumulation can act as a driver of manufacturing productivity convergence (Hardy and Sever 2023b).

This brief argues that human capital and finance play a key role. Our recent paper (Hardy and Sever 2025) empirically examines the role of (physical and human) capital and financial development in the convergence process. It first focuses on labor productivity in manufacturing industries at the industry-country level. It then turns to aggregate (country-level) convergence of per capita GDP, focusing on the influence of the sectoral structure of the economy and financial development. Human capital-intensive industries converge faster, but financial development can boost convergence for physical capital-intensive industries and for the economy more broadly.

We start with the empirical framework proposed by Rodrik (2013) to investigate unconditional convergence of labor productivity (as an equivalent to GDP per capita at the aggregate level) across countries and 2-digit manufacturing industries over time. Data on 2-digit manufacturing industries (ISIC, Rev. 3, 15-36) is from the UNIDO covering 99 economies since 1980. We transform annual data into four 10-year non-overlapping periods, and examine the association between the beginning-of-period level of labor productivity and its average growth during the subsequent decade (i.e., β-convergence).

To test whether the convergence process is linked to industries’ reliance on physical and human capital, we extend the standard convergence framework by adopting an empirical strategy in the spirit of Rajan and Zingales (1998). This allows us to delve into differences in convergence by exploiting within-country variation in the reliance on human and physical capital across 2-digit manufacturing industries. The measures of human and physical capital intensity for each industry are based on data from a benchmark country with highly developed financial markets and a relatively frictionless labor market (the US). Hence, those industry-level measures of dependence on different types of capital likely reflect the differences in industries’ needs for production (rather than being shaped by some frictions). Human capital intensity (HCI) is the share of workers in each industry with at least a high school degree, while physical capital intensity (PCI) is the ratio of total real capital stock to value added, following Erman and Kaat (2019).

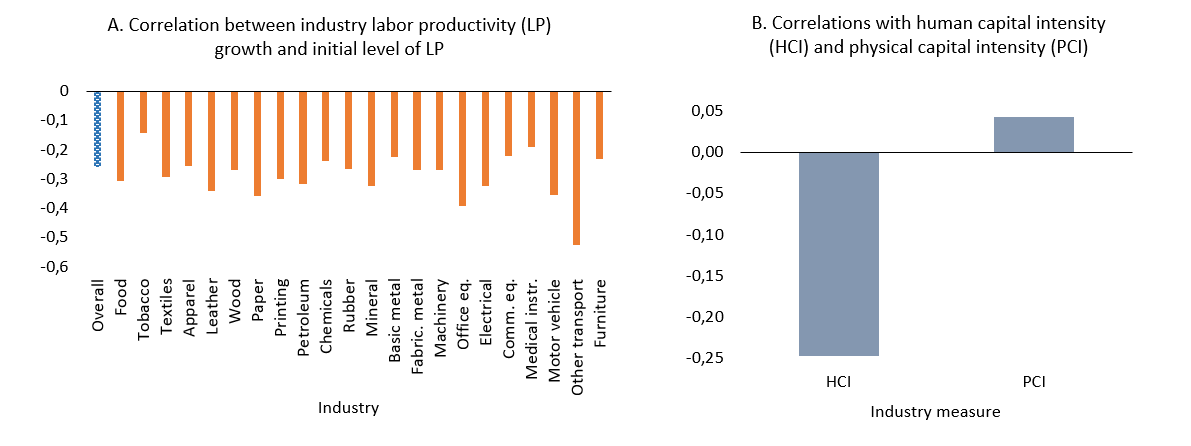

Unconditional convergence in manufacturing industries is apparent at first blush (Figure 1, Chart A). We calculate the correlation between the initial level of industry labor productivity and its growth rate—averaged over the subsequent decade—after isolating the variation arising from industry- and period-specific shocks. The negative association between the initial level and future growth in the overall sample (blue bar in Chart A) means that industries with initially lower labor productivity see higher growth, converging to the global frontier (i.e., 𝛽-convergence of labor productivity across countries and industries).

We also document this correlation for each 2-digit industries separately (orange bars in Chart A). Negative values for industries indicate that convergence is also prevalent within industries across countries: Each single industry converges to its own global frontier over time.

However, there seems to be some variation in this pattern across industries. Is this variation related to industries’ human and physical capital intensity? We report the correlations between those estimated industry-specific associations (shown by orange bars in Chart A) and our industry-specific measures (HCI and PCI) in Chart B. The correlation with HCI is negative, suggesting that human capital-intensive industries show stronger convergence (the first bar in Chart B in Figure 1), i.e., more negative associations between initial labor productivity and its subsequent growth when HCI is higher. PCI is not linked to faster convergence (the second bar in Chart B in Figure 1).

Figure 1. Industry labor productivity: Associations between initial level and subsequent growth

Notes: Chart A reports the correlations between the initial level of industry labor productivity and its growth rate—averaged over the subsequent 10-year period—for the overall sample (blue bar) and for each 2-digit manufacturing industry separately (orange bars). The analysis is based on non-overlapping 10-year periods. Industry growth rates are net of industry, period, and industry-year fixed effects. Chart B reports the correlations of the industry-specific associations (i.e., the correlations as shown by the industry-specific bars in Chart A) and industry-level measures of human (HCI) and physical capital intensity (PCI).

We then scrutinize these patterns using a regression setup. Our analysis first confirms these results: labor productivity across countries and 2-digit manufacturing industries shows unconditional convergence.

However, the pace of convergence depends on industries’ HCI, consistent with the pattern in Figure 1 (Chart B). As an example, we consider two industries: Machinery (a human capital-intensive industry, at the 75th percentile of HCI) and wood (an industry with low human capital intensity, at the 25th percentile of HCI). We estimate how much faster these industries grow (i.e., the convergence boost), when they initially have low labor productivity, relative to their own peers with initially high labor productivity. For this purpose, we compare country-industry observations which are initially at the 25th and 75th percentiles of the labor productivity distribution in the sample.

A machinery industry with initially low labor productivity exhibits a 2.7 percentage points additional growth per annum (on average, during the subsequent decade) coming from convergence, compared to a machinery industry with initially high labor productivity. A similarly estimated convergence boost is only 1.9 percentage points for the wood industry. Thus, the differential convergence boost to growth, based on the differences in HCI across these industries, is 0.8 percentage points. This is economically important considering that the average annual growth of labor productivity in the sample is 4 percent.1

In contrast, physical capital intensity is not associated with faster convergence. However, greater financial development can facilitate convergence for industries with higher PCI, deepening the link shown in Aghion et al. (2005) between financial development and aggregate convergence: Industries with greater PCI converge only when financial development in a country is sufficiently high.

We turn to country-level data to see whether these industry-level findings are reflected in overall macroeconomic convergence. We assume that more modern sectors (i.e., industry and services) rely more on human capital than traditional activities (i.e., agriculture). If this is the case, and if the industry-level patterns above hold at the macro-level, one can expect that per capita GDP convergence should be faster for countries with a higher share of non-agricultural activities in GDP.

The analysis of per capita GDP shows that unconditional convergence is faster when the economy is composed more of human capital-intensive sectors rather than agriculture. For instance, a poorer country (25th percentile of GDP per capita) with high industrial production (33 percent of GDP) sees annual growth that is 2.3 percentage points higher than a rich country (75th percentile of GDP per capita). If these countries have low industrial production (20 percent of GDP), this convergence boost becomes only 1.4 percentage points.

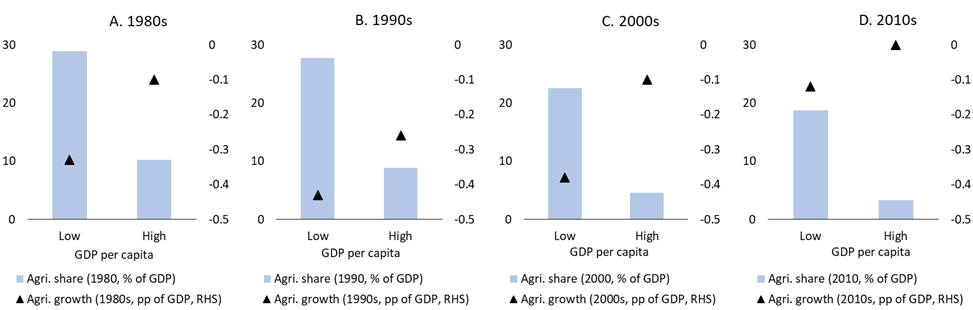

Given the evidence for faster convergence when the economy is tilted more towards non-agricultural activities, we explore whether poorer economies have been shifting from agriculture faster (i.e., structural transformation), which would have positive implications for per capita GDP convergence. Figure 2 shows suggestive evidence. In each decade, the charts report the initial share of agriculture in GDP and the average growth rate of this share (in percentage points of GDP) over the decade in two subsamples based on the median value of initial per capita GDP (dividing the sample into poorer and richer countries based on the beginning-of-period per capita GDP levels). We observe a clear pattern: Poorer countries have larger shares of agriculture in their GDP to start with, but they tend to shift away from it faster. This suggests that the shift to the sectors that tend to be more dependent on human capital (non-agriculture) has been faster in poorer economies, having a positive bearing on convergence at the aggregate level.

Figure 2. Shift from agriculture over time

Notes: The charts use aggregate data (for all countries with available data points in each decade) over the period 1980-2022, and report the beginning-of-period GDP share of agriculture value added and its growth rate in the subsequent decade (in percentage points of GDP) in two subsamples with low and high levels of the beginning-of-period values of real GDP per capita. Chart A divides the sample into 2 subsamples based on the median level of GDP per capita in 1980. It documents the mean share of agriculture value added (as percent of GDP) in each subsample in 1980 (shown by the bars). It also uses the average growth rate in agriculture value added share (in percentage points of GDP) over the 1980s (average of the growth rates in 1981, 1982, …, 1990), and reports the mean value of the growth rates across countries (shown by the black triangles, right-hand side axis). Charts B-D follow the same procedure for the remaining 10-year periods. pp= percentage points, agri.=agriculture, RHS= righthand-side.

Finally, we show that greater financial development is also linked to faster macro-level convergence (of GDP per capita) across countries over time, consistent with the industry-level findings.

The results have important implications for our understanding of economic growth and policy priorities in poorer economies:

Overall, financial development, accumulation of human capital, and fostering high human capital industries remain key elements to help growth in developing countries to facilitate converge faster towards their advanced economy peers going forward.

Aghion, Philippe, Peter Howitt, and David Mayer-Foulkes. “The effect of financial development on convergence: Theory and evidence.” The Quarterly Journal of Economics 120, no. 1 (2005): 173- 222.

Barro, Robert and Xavier Sala-i-Martin (1992): “Convergence”, Journal of Political Economy, vol 100(2), pp 223-251.

De Gregorio, José (1996): “Borrowing constraints, human capital accumulation, and growth”, Journal of Monetary Economics, vol 37(10), pp. 49-71.

Easterly, William, and Ross Levine (2001): “It’s Not Factor Accumulation: Stylized Facts and Growth Models”, World Bank Economic Review, vol 15(2), pp 177-219.

Erman, Lisardo, and Daniel Marcel te Kaat. “Inequality and growth: industry-level evidence.” Journal of Economic Growth 24 (2019): 283-308.

Hardy, Bryan, and Can Sever. What is Needed for Convergence? The Role of Capital and Finance. Bank for International Settlements, Monetary and Economic Department, Working Papers No 1284. 2025.

Hardy, Bryan, and Can Sever. Does Innovation Converge?. SUERF Policy Brief No 711, October, 2023a.

Hardy, Bryan, and Can Sever. Innovation convergence. Bank for International Settlements, Monetary and Economic Department, Working Papers No 1108, 2023b.

Klein, Alexander and Nicholas Crafts (2023): “Unconditional Convergence in Manufacturing Productivity across U.S. States: What the Long-Run Data Show”, Warwick Economics Research Papers, No 1458.

Kremer, Michael, Jack Willis and Yang You (2021): “Converging to Convergence”, NBER Macroeconomics Annual.

Mankiw, N. Gregory, David Romer and David Weil (1992): “A Contribution to the Empirics of Economic Growth”, The Quarterly Journal of Economics, vol 107(2), pp. 407–437.

Solow, Robert (1956): “A contribution to the theory of economic growth”, The Quarterly Journal of Economics, vol 70, pp 65-94.

Pritchett, Lant (1997): “Divergence, big time”, Journal of Economic Perspectives, vol 11(3), pp 3-17.

Rajan, Raghuram and Luigi Zingales (1998): “Financial dependence and growth”, American Economic Review, vol 88(3), pp. 559-586.

Rodrik, Dani. “Unconditional Convergence in Manufacturing.” The Quarterly Journal of Economics 128, no. 1 (2013): 165-204.

These patterns at the industry-level stay similar when we test convergence conditional on country-specific factors.