This brief examines convergence of innovation using patent data from two-digit manufacturing industries in 32 countries between 1976 and 2006. Patenting rates converge over time (patenting growth is faster when patents are initially lower), including within countries (across industries) and within industries (across countries). The quality (citations and citations per patent) and efficiency (patents per worker) of innovation also exhibit convergence. Convergence is widespread across all countries and industries, and in all time periods. Patent convergence is stronger where financial development, international financial integration, and institutional quality are higher, and under the policies supportive of financial liberalization. These factors contribute to both within country and within industry convergence. The results highlight the importance of financial and institutional environment for patenting, and ultimately for productivity and economic growth.

Many growth models predict that less developed countries should grow faster and catch up with more developed ones over time (i.e., economic convergence), and whether they actually do has been a major question in the empirical literature for decades (e.g., Barro, 1997 and 2003; Islam, 1995; Rodrik, 2013; Sala-i Martin, 1996; Solow, 1956). In both models and the data, innovation and productivity growth are key to sustained long-term growth. Thus, differences in innovation and progress across countries are crucial to understand the economic convergence process. Yet whether innovative outcomes exhibit convergence, and what contributes to it, has so far remained an overlooked empirical question.

This brief summarizes our recent work exploring convergence of innovative outcomes (Hardy and Sever, 2023). We empirically focus on patenting at the country-industry level and examine convergence in patenting rates both within and across countries and industries. Our data covers 20 two-digit (SIC codes) manufacturing industries from 32 advanced and emerging market economies over 1976-2006. We proxy innovative outcomes with patent data pulled from the NBER patent database, which covers patents filed in the United States (by applicants worldwide). We allocate patents (which are not grouped by sector) to two-digit manufacturing industries following the procedure in our earlier work (Hardy and Sever, 2021) which adopts the weighting scheme as proposed by Hsu et al. (2014).

Innovation convergence implies that country-industry pairs with initially low rates of patenting experience faster growth in patenting, thereby catching up with their higher-patenting peers. We complement our main measure for innovative outcomes – i.e., patenting rates – with others to get a more rounded view. For one, patent citations provide a measure of the quality of innovative output produced. For another, citations per patent captures the average quality of an individual patent. These two measures confirm that the observed patenting catch up does not capture “empty” patents that are marginal innovations only. A fourth measure is patents per worker, a measure of the efficiency of patent production. Convergence in this last measure indicates that the patenting convergence is not driven solely by “offshoring” of R&D work to cheaper labor markets, but rather an actual improvement in the productive process. We also explore the heterogeneity in patent convergence based on countries’ macro-financial and institutional environment, and also by focusing on the financial policies envisaging financial liberalization. Our approach with country-industry level data allows us to control for the shocks specific to a given country or industry at a given point in time.

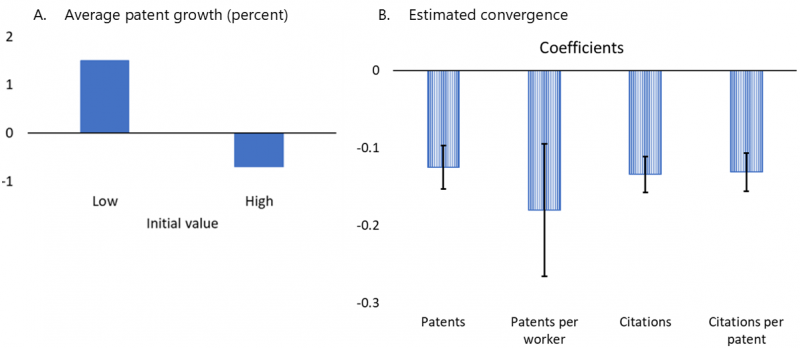

Patent convergence is apparent at first blush in the data. Comparing patent growth in low patenting country-industries (below the median) versus high patenting country-industries (above the median) shows that growth is indeed higher when patent levels are lower (Figure 1.A). The average growth rate of patenting at the country-industry level is 1.5% per annum for low patenting observations, whereas it is -0.7% for high patenting ones. Thus, the observed convergence is driven especially by low patenting country-industries growing quickly, but also in part by high patenting ones slowing down the rate of new patent production.

Figure 1: Convergence observed for different innovation proxies

Notes: The annual data is transformed into non-overlapping 5-year periods. In panel A, the sample is divided into two subsamples based on the median value of the beginning-of-period values of the number of patents. The average growth rate of patents (over each period) is reported for both subsamples where the initial number of patents is low versus high, based on the median value of the beginning-of-period patents. In panel B, average annual growth of patenting during a 5-year period is regressed on the initial level of patents in each period. Country-time, industry-time and country-industry fixed effects are included. The bars depict the coefficient estimates (convergence beta) for different industry-level regressions with the number of patents, the number of patents per worker, the number of citations and the number of citations per worker. The 90 percent confidence intervals are also illustrated.

Convergence in patenting holds up under a more robust analytical framework. Panel B of Figure 1 displays the convergence coefficients for different measures of innovative outcomes based on regression analyses. The estimates reveal a negative association between the initial number of patents and the subsequent rate of patenting in an industry, controlling for unusual shocks to patenting in a given country or a given industry with fixed effects. The convergence rate of about 12.5% (in the first bar) suggests that an industry with initially half the number of patents relative to a peer sees a convergence boost in patenting rates of 8.6 percentage points per annum for the subsequent 5-year period. The convergence pattern remains similar for the quantity of patents, patent citations (a measure of aggregate quality of innovation), citations per patent (a measure of the average patent quality), and patents per worker (a measure of efficiency of innovative production).

These results correspond to “conditional convergence” – meaning that patent rates slow for a given country-industry as its stock of patents rises, or the convergence is conditional on country-industry fixed effects (as well as country-time and industry-time fixed effects). The observed (and strong) convergence under the presence of the fixed effects means that each country-industry may be converging to a path dictated by its own specific context, but that does not necessarily mean it will converge to others in an absolute sense. However, we also document “unconditional convergence” in patenting rates – excluding all fixed effects. Unconditional convergence is smaller, but still implies a 1.9 percentage point boost to patent growth relative to a country-industry with twice as many patents. This is economically large, given that the median annual growth rate of patenting is about 0.8 percent in the sample.

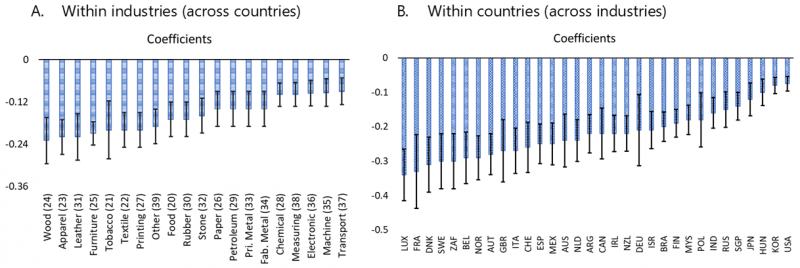

This convergence is broad based, cutting across all industries and all countries. Panel A of Figure 2 shows convergence across countries for each industry, while Panel B shows convergence across industries within a given country. Albeit measured with some imprecision, lower patenting industries such as wood, apparel and textile industries exhibit stronger convergence across countries, relative to some of their higher patenting peers (e.g., electronic, machinery, transportation industries). Within countries, low-patenting industries in Luxembourg, France and Denmark tended to converge faster, compared to convergence rates in some other countries (e.g., Hungary, Korea, USA). Notably, these within country convergence rates do not correlate strongly with patenting rates of the country itself.

Figure 2: Convergence within industries and countries

Notes: The annual data is transformed into non-overlapping 5-year periods. Average annual growth of patenting during a 5-year period is regressed on the initial level of patents in each period. In panel A, country and time fixed effects are included. The bars depict the coefficient estimates (convergence beta) for each industry for regressions with the number of patents. In panel B, industry and time fixed effects are included. The bars depict the coefficient estimates (convergence beta) for each country for regressions with the number of patents. For both panels, the 90 percent confidence intervals are also shown.

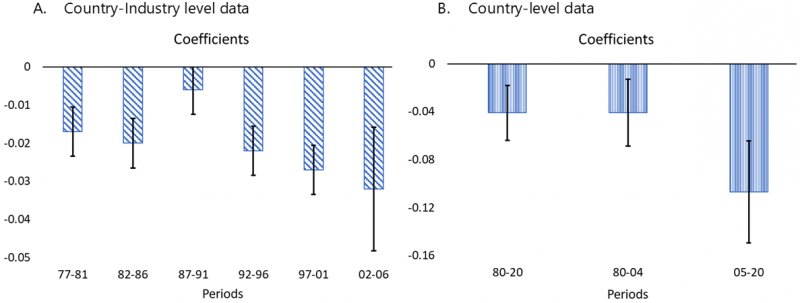

Convergence in patenting appears to be accelerating over time. In our country-industry data, convergence is observed in every subperiod, and our estimated convergence rate increased over time (with one exception) through 2006 (Figure 3.A). Utilizing more up to date country-level data pulled from the World Bank World Development Indicators, we show that this trend continued past 2006, as patent convergence in the past 15 years has been stronger than the previous 25 (Figure 3.B).

The heterogeneity in patenting convergence across countries, industries, and over time suggest that there are other important factors that can affect the speed of this convergence. We examine the role of various country-specific factors in patent convergence by focusing on three categories, namely financial and institutional development, international financial integration, and financial regulation. We find that higher levels of bank credit, market capitalization, and institutional quality are associated with faster convergence rates in patenting. Likewise, greater international financial integration, including through higher foreign direct investment, predicts a higher speed of convergence. Further, policies supportive of financial liberalization seem to be associated with stronger patent convergence. These effects are pronounced both across industries within countries and across countries within industries.

Figure 3: Patent convergence is increasing over time

Notes: The annual data is transformed into non-overlapping 5-year periods. Average annual growth of patenting during a 5-year period is regressed on the initial level of patents in each period. In panel A, country and industry fixed effects are included. The bars depict the coefficient estimates (convergence beta) for each period for regressions with the number of patents. The 90 percent confidence intervals are also illustrated. In panel B, country and time fixed effects are included. The bars depict the coefficient estimates (convergence beta) based on the macro-data for regressions with the number of patents. The 90 percent confidence intervals are also illustrated.

These results provide important and encouraging insights into the ongoing convergence process. Innovation convergence has been taking place within countries, industries previously not known for innovating are doing so at higher rates, and convergence seems to be accelerating. This process can be fostered further by developing institutions (such as secure property rights for intellectual property) and increasing financial development and integration. R&D efforts leading to innovation require long term investment which generally have to be financed externally (Hardy and Sever, 2021) and need to be supported by strong property rights to ensure a payoff. Many low patenting countries in the past decades (i.e., emerging market economies) have likely benefited from the progress in the institutional environment and the development of the domestic financial system.

Since patents are in principle unique, low patenting countries are increasingly adding to the global stock of knowledge. This does not appear to be just an offshoring of R&D labor to cheaper markets. The actual output of patents per worker is converging, and the article further notes that patenting is tied to persistently higher value added for the country-industry that produces the patent. That said, the declining patenting rates in high patenting countries and slower unconditional convergence rates warrant some caution. Nevertheless, innovative and productivity enhancing improvements in developing economies are gaining pace and can be an important force for economic growth and convergence, with real effects on the economic outcomes there.

Barro, R. (1997). Determinants of economic growth: A cross-country empirical study. MIT Press, Cambridge, MA.

Barro, R. (2003). Determinants of economic growth in a panel of countries. Annals of Economics and Finance, 4, 231-274.

Hardy, B., & Sever, C. (2021). Financial crises and innovation. European Economic Review, 138, 103856.

Hardy, B. & Sever, C. (2023). Innovation convergence (No. 1108). Bank for International Settlements.

Hsu, P., Tian, X., & Xu, Y. (2014). Financial development and innovation: cross-country evidence. Journal of Financial Economics, 112(1), 116–135.

Islam, N. (1995). Growth empirics: a panel data approach. The Quarterly Journal of Economics, 110(4), 1127-1170.

Rodrik, D. (2013). Unconditional convergence in manufacturing. The Quarterly Journal of Economics, 128(1), 165-204.

Sala-i Martin, X. (1996). The classical approach to convergence analysis. The Economic Journal, 1019-1036.

Solow, R. (1956). A contribution to the theory of economic growth. The Quarterly Journal of Economics, 70(1), 65-94.