This SUERF Policy Brief is based on the paper “Friends or Foes? Banks’ Deposits and Digitalization in a Monetary Tightening”, by Federica Ciocchetta, Raffaele Gallo, Silvia Magri, and Massimo Molinari, Banca d’Italia, Working Paper no.1490, July 2025. All opinions expressed in this policy brief are those of the authors and do not necessarily reflect those of Banca d’Italia.

Abstract

This policy brief analyzes whether the deposits of “high digital” banks, i.e. those whose customers mainly use online money transfers, are more sensitive to changes in interest rates following the monetary tightening in 2022. We show that there are no significant differences between high digital and other banks in the decline of sight deposits and in the dynamics of the associated interest rates. By contrast, household term deposits and the related interest rates increase more for high digital intermediaries compared to other banks. This larger increase in household term deposits is not correlated with the main indicators of bank vulnerabilities, while it is driven by ex-ante larger and more profitable high digital banks and by those with a lower initial share of household term deposits. Overall, the stronger sensitivity of deposits of high digital banks seems to be limited to household term deposits with no negative impact on their profitability.

Digital innovation in banking has primarily focused on deposit services: since the end of the last decade, in major jurisdictions, nearly all banks have offered the possibility to transfer money online. The digitalization of deposits is expected to affect both the speed of deposit flows and the bank responsiveness in adjusting deposit rates when market interest rates change.1 The extent of this impact varies across banks depending on the composition of their depositor base: some customers are far less sticky than others as they pay more attention and are more capable to compare investment options. Overall, they are more likely to switch from one bank to another or towards different investment opportunities outside the banking system (Xiao, 2020) and the use digital devices allows them to act more quickly.

The stickiness of deposits is key for banks. When the interest rates rise, they can benefit from a much lower increase in the cost of their funding thanks to the franchise value of their deposits.2 However, the effect of the increasing digitalization of deposits may be a possible reduction in their stickiness and therefore in their franchise value, with remarkable consequences for banks’ business models and for their financial stability, specifically during monetary restrictions (Drechsler et al., 2023, Koont et al., 2023).

To appraise this possible effect, we evaluate the deposit dynamics during a monetary tightening across banks by focusing on the different level of digitalization of their deposits. We rely on a comprehensive dataset based on supervisory banking reports, covering sight and term deposits of households and firms as well as on bank balance sheet items between January 2021 and December 2023; we also examine interest rates on deposits applied by a small representative sample of banks reporting them.

A crucial point of the analysis is to pinpoint a specific indicator of banks’ deposit digitalization. We focus on the intensity of online money transfers usage by customers, which is the cornerstone of the digital change that occurred on the bank deposit side in the past years. Specifically, we classify as ‘high digital’ banks those intermediaries operating in Italy that, during the four quarters preceding the monetary tightening in July 2022, had a share of online to total money transfers in the highest quintile of the distribution (i.e. higher than 89 per cent).3 Key to our analysis is the idea that the intensive use of digital devices to transfer money reflects bank customers’ rapidity to switch. Hence, our indicator based on digital money transfers allows us to capture this trait, which is otherwise very difficult to measure at the bank level. At the same time, the period considered provides us with the ideal empirical setting to test its relevance: we exploit the heterogeneity of this unique transition phase, where this technology is made available by all intermediaries and yet its use varies across customers. The depositors’ rapidity to switch directly speaks to the possible reduction in deposit stickiness, which is central to the current debate and what matters in the analysis, regardless of its underlying determinants.

Our final sample includes 60 high digital banks4 and 290 other intermediaries. As of June 2022, the group of selected high digital banks accounted for 28 per cent of total deposits and 32 per cent of term deposits.

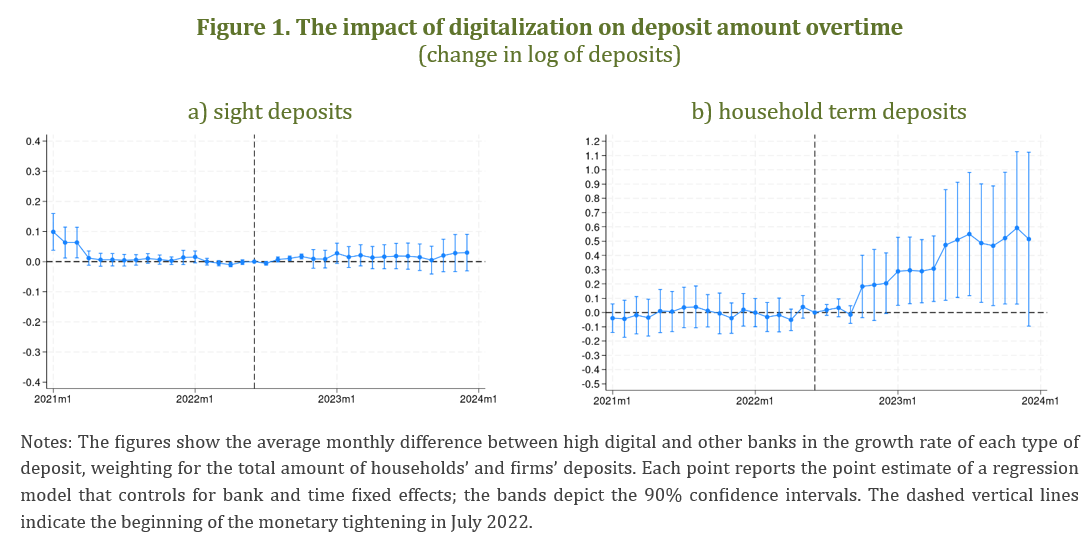

After the monetary restriction in 2022, we do not find any significant evidence of stronger deposit outflows for high digital compared to other banks: no difference arises between the two groups for sight deposits (Figure 1). By contrast, term deposits increase more for high digital banks and this trend is driven only by the household sector: after the tightening, the average growth rate of household term deposits (weighted for the total amount of household and firm deposits) was 33 p.p. higher for high digital banks than for the other ones (16 p.p. in the unweighted regression).

Furthermore, we analyze interest rate dynamics on the smaller sample of banks reporting this information.5 After the monetary tightening, we find no difference in the increase in rates on sight deposits between the two categories of banks, while high digital intermediaries raise more their interest rates on household term deposits (85 basis points in the weighted regression and 32 basis points in the unweighted one).

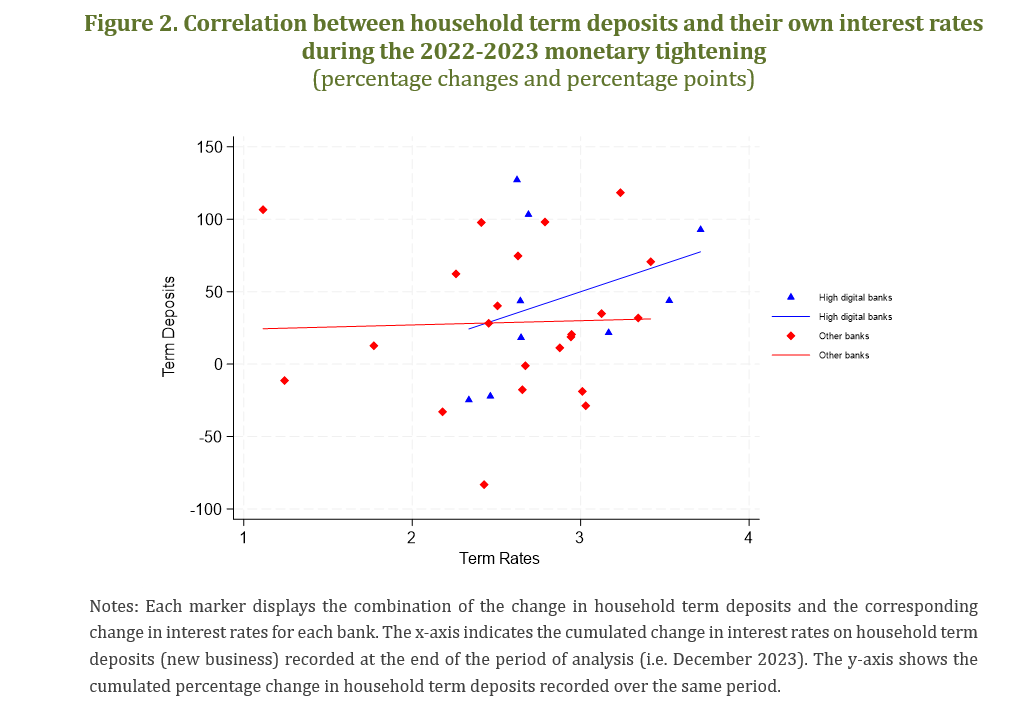

Finally, we find evidence of a greater increase in household term deposits for high digital banks when they change their interest rates (Figure 2). Although some other banks have increased interest rates in a similar way, they more frequently observe a weaker growth rate of household term deposits over time than high digital banks. This stronger growth observed for high digital banks is hence not only explained by the higher interest rates, but also to the greater rate-sensitivity of their customers.

Our analysis also evaluates the effects of the observed dynamics on selected outcomes of high digital banks after the monetary tightening. These banks increase more than other banks the proportion of household term deposits relative to total deposits and end up attracting a larger number of depositors. Interestingly, despite the higher increase in the interest rates of household term deposits, we do not find a negative effect on the profitability (ROA and ROE) of high digital banks, with respect to the other ones, over one year after the start of the monetary tightening. This could be partly due to the relatively low share of household term deposits on total deposits and since high digital banks tend to increase more the investments in assets with high and fixed rates, such as mortgages.

We finally focus on the group of high digital banks to single out some heterogeneities. First, we verify whether the increase in household term deposits is stronger for the most vulnerable high digital banks, which might have raised interest rates to avoid a possible reduction in their funding. However, we do not find evidence of different dynamics for high digital banks with a higher NPL ratio, worse liquidity risk indicators, or larger unrealized losses on the portfolio of Government bonds. This suggests that high digital banks do not appear to have reacted to some specific vulnerabilities. Secondly, the stronger increase in household term deposits is driven by high digital banks that, before the tightening, were larger and more profitable, as well as for those with a lower initial share of household term deposits. The latter group may be particularly interested in increasing their reliance on a more stable source of funding.

In the period following the monetary tightening in 2022, high digital banks exhibited an increased sensitivity of household term deposits to policy rates compared to other banks, while no difference arises for sight deposit dynamics. Although the increased sensitivity of household term deposits could suggest a possible decline in their deposits’ franchise value, it does not negatively impact these banks. Indeed, the observed dynamics have no negative effect on the profitability of high digital banks in the period analysed. Furthermore, the stronger rise in deposits does not reflect the dynamics of the most vulnerable high digital banks, rather it is driven by intermediaries that are ex-ante larger and more profitable and with an initial lower share of household term deposits.

An important remark is in order. Our results suggest that, for the time being, the digitalization of deposits does not pose a threat to the stability of the banking system in the event of a common shock such as a monetary tightening affecting all institutions simultaneously. This conclusion shall not be generalized: the interplay between deposit digitalization and specific idiosyncratic shocks, for example an abrupt reduction in the bank’s liquidity ratio, may be very different.

Drechsler, I., A. Savov, and P. Schnabl (2017). The Deposits Channel of Monetary Policy. The Quarterly Journal of Economics, Vol. 132 (4), 1819–1876.

Drechsler, I., A. Savov, P. Schnabl, and O. Wang (2023). Banking on Uninsured Deposits, NBER Working Paper, No. 31138.

Erel, I., Liebersohn, J., Yannelis, C., Earnest, S. (2023). Monetary policy transmission though online banks, NBER Working Paper No. 31380.

Liang, P., M. Sampaio, and S. Sarkisyan (2024). Digital Payments and Monetary Policy Transmission, Fisher College of Business Working Paper No. 2024-03-014 and Charles A. Dice Center Working Paper No. 2024-14.

Koont N., T. Santos, and L. Zingales (2023), Destabilizing digital “bank walks”, Chicago Booth, Stigler Center, New Working Paper Series.

Xiao, K. (2020). Monetary Transmission Through Shadow Banks. The Review of Financial Studies, Vol. 33 (6), 2379–2420.

First, digitalization reduces the search and comparison costs of different investment opportunities and, secondly, it shrinks the market power of banks in the deposit market as it makes frictionless to transfer funds (Drechsler et al., 2017; Liang et al., 2024).

Drechsler et al. (2023) refer to the difference between the book and market value of deposits as the deposit franchise value of the bank. Even when interest rates rise and the market value of assets falls below the level of liabilities, the value of the bank can still be positive, and the bank survives if this shortfall is lower than the deposit franchise value. This value is directly related to the sensitivity of deposit rates to other interest rates available to depositors.

With respect to previous analyses regarding the US that focused on the number of branches (Erel et al., 2023) or on the popularity of bank digital apps (Koont et al., 2023), the focus on the digitalization of banks’ customers allows us to adopt a more flexible definition that includes banks with no or few branches, which by design have a high share of online money transfers, as well as those that attracted more tech-savvy customers, which are more prone to use digital channels.

They include 20 cooperative banks, 21 small and medium size banks, 5 large banks and 14 are online banks, which offer banking services mainly through the digital channel as they have few or no branches.

The sample includes 69 banks at the end of 2023, representing 85 per cent of total deposits of households and firms.