This policy brief is based on Banque de France, Working Paper No. 977 “The New Keynesian Climate Model“. The views expressed are those of the authors and do not necessarily represent those of the Banque de France, the Eurosystem, or the Bank for International Settlements.

Abstract

Climate change is increasingly affecting economic developments through the physical damages it creates and the mitigation and adaptation policies it elicits. Central banks, focused on price stability and output smoothing, must navigate this new environment and its impact on price developments. Inflationary pressures emerge from rising costs and lower productivity due to the physical impact of climate change (so-called “climateflation”). Inflation may also rise due to carbon tax policies and green investment necessary to transit to a low-carbon economy (so-called “greenflation”). In Sahuc et al. (2025), we introduce a New Keynesian Climate (NKC) model to analyze these two phenomena. The model estimated on world data integrates long-run environmental changes in a tractable New Keynesian framework that can be used to study monetary policy. It shows the trade-offs central banks face in a world where inflation and growth are increasingly shaped by environmental constraints.

The NKC model was developed to fill a key gap in existing macroeconomic tools. Integrated Assessment Models (IAMs), widely used by climate economists, evaluate the long-term costs of global warming and the benefits of reducing emissions (Nordhaus, 1992, Fernández-Villaverde et al., 2025). However, they largely overlook inflation dynamics and the role of central banks. In contrast, Dynamic Stochastic General Equilibrium (DSGE) models, the foundation of modern central banking, are designed to analyze short-term fluctuations and policy responses (Smets and Wouters, 2007). When included at all, climate change is typically treated as a temporary and reversible phenomenon, rather than as a permanent force reshaping the structure of the economy.

The NKC model bridges these two frameworks. It incorporates the structural trends of IAMs, such as carbon accumulation, population growth, and technological progress, into a macroeconomic setting that captures inflation, output, interest rates, and the behavior of central banks. This new framework is deliberately designed to preserve the analytical clarity and tractability of traditional macroeconomic models, such as those developed by Woodford (2003) and Gali (2008), while incorporating key features to capture climate externalities and abatement costs. Its structure includes: (i) an IS curve that includes investment in emission-reducing technologies; (ii) a Phillips curve that factors in economic damages from carbon accumulation; (iii) a Taylor-type monetary policy rule that adjusts interest rates in response to inflation and output gaps; and (iv) a carbon accumulation equation that tracks the cumulative stock of CO₂ emissions, which negatively affect productivity. This synthesis allows for a coherent and realistic analysis of how climate change and climate policy affect macroeconomic outcomes, and how monetary policy can respond. This unified model is estimated using Bayesian techniques and global macroeconomic and emissions data from 1985Q1 to 2023Q3.

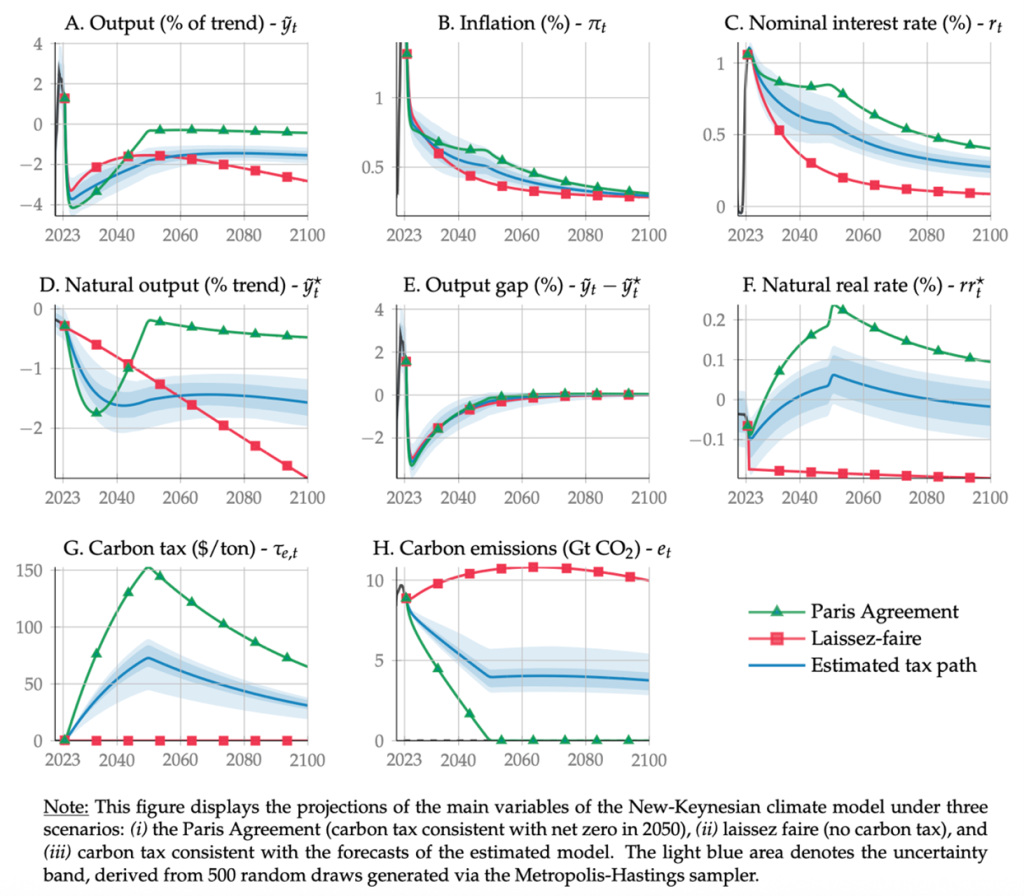

Figure 1. Model-implied projections based on alternative control rates of emissions

In the spirit of Barrage and Nordhaus (2004), we use the NKC model for quantitative purposes to explore three plausible global scenarios, each shaped by a different assumed carbon tax trajectory (see Figure 1).

The laissez-faire scenario: In this baseline, no carbon tax or climate policy is introduced. CO₂ emissions rise unchecked in line with production, accelerating climate damage. As productivity permanently declines due to rising temperatures and natural disasters, output falls below its long-run potential, and the natural interest rate drops. Interestingly, inflation does not surge in this scenario. Instead, economic stagnation dominates, as demand weakens in anticipation and inflation remains low.

The Paris Agreement scenario: This path reflects full implementation of climate commitments, specifically, raising the carbon tax gradually from 2024 to reach net-zero emissions by 2050. Initially, this leads to higher inflation, as carbon taxes drive up production costs. In response, green investment also pushes up demand. Over time, however, this investment pays off: emissions decline, productivity stabilizes, and the economy grows more resilient. Higher green investment puts upward pressure on the natural interest rate. While central banks must tighten policy to tame inflation, the long-run gains from climate mitigation remain preferable to inaction.

The estimated scenario: This data-driven middle ground reflects how economic agents form expectations, based on estimated beliefs about the likelihood of the Paris Agreement being realized. It corresponds to a trajectory that achieves approximately half of the targeted emissions reductions. Firms and households anticipate moderate climate policy, in between full Paris Agreement implementation and total inaction. The result is a delayed but smoother transition, with inflationary pressures and output effects falling between the two extremes.

Each scenario highlights a crucial insight: Climate policy choices shape inflation, growth, and interest rates not just in the long term, but immediately. Central banks need to prepare accordingly.

Five key insights for central banks emerges from the analysis:

1. Greenflation is real and persistent

Climate mitigation aligned with the Paris Agreement leads to higher inflation in the early phases of the transition. By contrast, a laissez-faire path may contain short-term inflation but eventually imposes severe costs on output and welfare as climate damage accumulates.

2. Nominal rigidities amplify effects

Nominal price stickiness plays a central role. It affects the pass-through of abatement costs to inflation and changes the timing and size of consumption responses. Ignoring these frictions, such as in current integrated assessment models, leads to overly aggressive carbon pricing and neglects transitional inflation.

3. Early action minimizes long-term damage

Delaying the green transition may reduce inflationary pressures in the short term, but it leads to far more severe consequences beyond 2050. The NKC model shows that postponing climate action amplifies economic volatility, deepens output gaps, and undermines long-run growth. The sooner central banks and governments act, the more orderly and manageable the transition becomes.

4. Monetary policy must account for a shifting natural interest rate

A key insight is that the natural rate of interest changes over the course of the transition. As green investment expands and productivity stabilizes through mitigation, the equilibrium interest rate increases. Monetary policy rules based on outdated assumptions about this rate risk over-accommodating and fuelling excess inflation. Central banks need flexible frameworks that respond to evolving fundamentals and account for climate-related structural shifts in the economy.

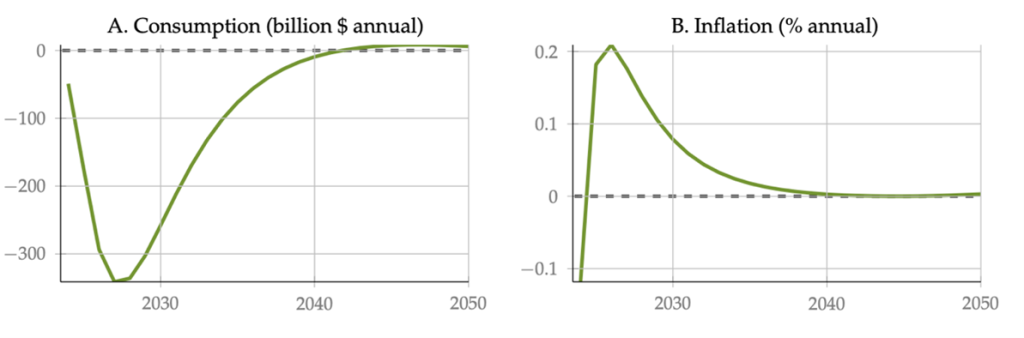

5. Mispricing carbon is costly

If carbon prices are set without accounting for nominal frictions, the result is higher inflation, reduced household consumption, and thus a possible diminished public support for climate policy (see Figure 2). To design realistic instruments, models must embed the nominal consequences of climate policy, since the associated welfare cost of inflation leads to a lower optimal carbon price.

Figure 2. Macroeconomic costs of mispricing the social cost of carbon

Our results indicate that monetary policy cannot be designed in isolation from climate policy. First, monetary policy must adapt. Central banks should account for the inflationary effects of decarbonization and the upward shift in the natural rate of interest. Static Taylor rules calibrated to pre-transition conditions are no longer optimal and may exacerbate inflationary pressures. Second, policy alignment is important. The joint design of carbon pricing and monetary policy responses can avoid destabilizing dynamics and ensure a smoother green transition. Third, integrated modeling is critical. Policy simulations and fiscal assessments must rely on models that incorporate nominal rigidities and dynamic macroeconomic responses, rather than focusing solely on long-run equilibrium outcomes.

While central banks are not responsible for climate policy, they cannot ignore the macroeconomic consequences of climate change and the transition to net zero. To remain effective, inflation-targeting regimes and monetary policy frameworks must evolve alongside these structural shifts. Our model shows how central banks can respond to the inflationary pressures of mitigation, recalibrate their policy tools, and safeguard economic stability in a climate-constrained world.

Barrage, L. and Nordhaus, W. (2024). Policies, projections, and the social cost of carbon: Results from the dice-2023 model. Proceedings of the National Academy of Sciences, 121:e2312030121.

Fernández-Villaverde, J., Gillingham, K., and Scheidegger, S. (2025). Climate change through the lens of macroeconomic modeling. Annual Review of Economics, Forthcoming.

Galí, J. (2008). Monetary policy, inflation, and the business cycle. Princeton University Press.

Nordhaus, W. (1992). The ‘DICE’ model: Background and structure of a dynamic integrated climate-economy model of the economics of global warming. Technical Report, Cowles Foundation for Research in Economics, Yale University.

Sahuc, J.-G., Smets, F., and Vermandel, G. (2025). The New Keynesian Climate Model, Latest version available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5035207

Smets, F. and Wouters, R. (2007). Shocks and frictions in US business cycles: A Bayesian DSGE approach. American Economic Review, 97:586–606.

Woodford, M. (2003). Interest and Prices: Foundations of a Theory of Monetary Policy. Princeton University Press.