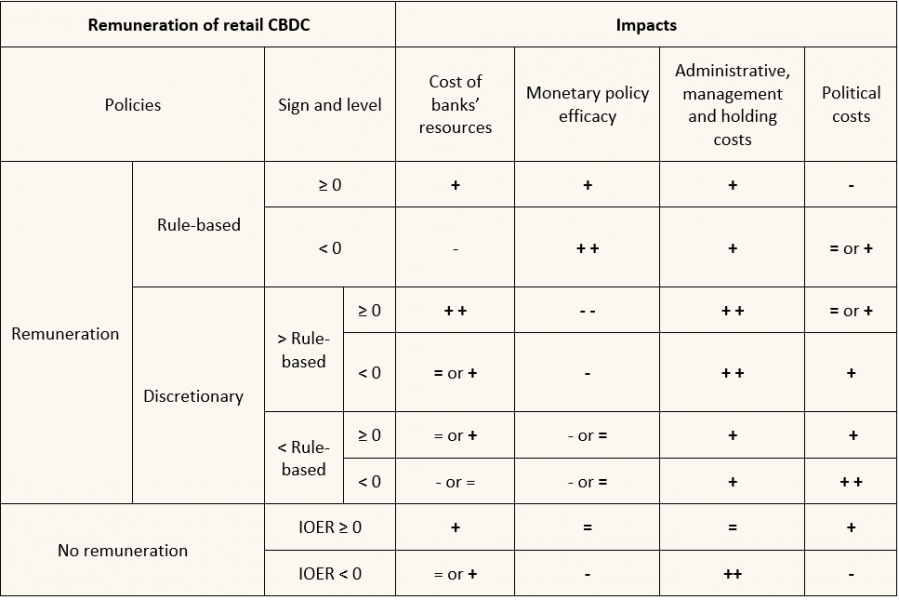

The author lists the main options central banks would be faced with when defining their policies regarding the remuneration of retail CBDC, as well as the main areas they would probably look at when making their choices. He assesses qualitatively the impacts of the choices made on the likely areas of interest for central banks, showing that whether the policy rate and/or the rate on CBDC is positive or null or strictly negative matters. Eventually, the two main policies that stand out are to issue a “banknote-like” CBDC, i.e. not to remunerate it, or to do so following a rule derived from the central bank’s interest rate policy for excess reserves.

More and more central banks are planning or considering the possibility of issuing a “general purpose” also said “retail” central bank digital currency (CBDC), that would be accessible to the public and the financial institutions (Boar et al., 2020), and have published reports on the subject (see e.g. BIS, 2020, Bank of Japan, 2020 and ECB, 2020)2. Although the issue of whether or not the CBDC should be interest bearing is usually discussed, the possibility that the interest rate could be negative is hardly mentioned. In fact, the discussion regarding a possible negative remuneration of retail CBDC focuses on the fact that issuing this new form of central bank money would not allow to decrease the so-called “effective lower bound” (ELB, i.e. the lowest interest rate level monetary policy can reach), since cash would continue to be available. This point is valid as long as cash itself is not interest bearing. However, referring to the ELB does not exhaust the discussion on a possible negative remuneration of CBDC.

This lack of an in-depth discussion on the sign of the interest rate on retail CBDC contrasts with the fact that many central banks in developed economies have implemented negative interest rate policies for several years, in Europe (euro area, Sweden, Switzerland) and in Asia (Japan). It contrasts also with the concern put forward in central banks’ communication not to compete with the banking sector when issuing a CBDC. A priori, setting a not-so attractive interest rate on CBDC, including a possibly negative one, would be a simple solution to limit such competition.

This paper instead aims at considering various possibilities. It starts by listing the main policy options central banks would be faced with when defining their policies regarding the remuneration of retail CBDC. It then looks at the areas which would likely be important when making these choices. In a third step, it assesses qualitatively the impacts of the policy choices on the likely areas of interest for central banks, showing that whether the policy rate and/or the rate on CBDC is positive or null or strictly negative matters. It concludes by discussing briefly the options the central banks could retain.

Table 1 below summarizes the approach and the main findings.

Table 1: Remuneration of CBDC and Impacts

In Table 1, “IOER” stands for “interest on excess reserves” (see below).

Discussions on CBDC remuneration usually distinguish two cases: the CBDC is interest bearing or it is not. In fact, not bearing an interest is a specific case of remuneration: the interest rate is fixed and set at zero. Besides, a classical distinction in monetary economics is that decision-making is either rule-based (i.e. before deciding on the level of the interest rate, the central bank decides on which criteria it is going to base its decision) or discretionary (the central bank decides on a purely case by case basis). In particular, it can be shown that, by increasing the credibility of the central bank and reducing uncertainty, a rule-based approach contributes to making monetary policy more efficient.3 As can be seen in the left part of Table 1, I retain both approaches, applying the distinction between rule-based and discretionary decision-makings to the case in which retail CBDC is interest bearing.

The reference rate for the rule-based decision-making (see upper middle left part of Table 1) is here the policy rate that puts a “floor” to the level of money market rates, since no one would accept to lend in the money market at an interest rate that is lower than the one paid by the central bank. In the Federal Reserve’s monetary policy framework, this rate is referred to as the interest rate on excess reserves (IOER), i.e. the reserves held by banks on top of required reserves. The interest rate on retail CBDC could not be set at a level higher than the IOER, unless individual limits are set on individual holdings, a possibility I will return to in the following. Otherwise, banks would prefer to hold CBDC rather than reserves and the “floor” to interest rates in the money market would be determined by the rate on retail CBDC, thus depriving the IOER of its role. Consequently, the rule I have in mind would be one in which the IEOR acts as a “ceiling” to the interest rate on CBDC, with the latter determined on the basis of the IOER minus a spread. On the one hand, a spread of a minimum size would be useful if the central bank wishes banks not to hold the retail CBDC. On the other hand, an upper limit for the size of the spread would avoid discouraging completely the use of retail CBDC. In terms of figures, the spread could for instance be anywhere between 25 and 150 basis points. Most of all, it would have to be set in advance.

Furthermore, when the interest on CBDC is set discretionarily (see lower middle left part of Table 1), I distinguish two cases: the interest rate can be either above or below the rule-based rate. That the latter is not determined precisely does not matter. What matters is rather that the central bank has not announced a rule. Consequently, the spread between the interest rate on retail CBDC and the IOER could vary randomly, with a change in the level of one interest rate not necessarily triggering one in the other, or not necessarily one of the same magnitude: there would be no certainty that the two interest rates would move in tandem. Why would a central bank choose to set the interest rate on retail CBDC in a discretionary manner? One may think of specific purposes or circumstances in which the central bank may wish not to ‘tie its hands’ in advance and thus make this interest rate a monetary policy or financial stability instrument of its own. For instance, the central bank may desire, in the wake of the launch of the CBDC, to ‘test the water’, keeping the faculty to reduce the interest rate on retail CBDC if substitution out of deposits was deemed too rapid, although a rule could include a transition clause. It may also wish, in case of a ‘run’ out of banks’ deposits into retail CBDC, to try to counter it in the same way. However, this might prove counter-productive, especially if the public is of the opinion that the central bank has privileged information on the situation of the banking system, e.g. because it is in charge of bank supervision.

In the case where the retail CBDC is not interest bearing (lower left part of Table 1), I refer directly to the sign of the IOER.

I identify four areas of interest for central banks when deciding which policies they would follow when setting the interest rate on retail CBDC (see left part of Table 1). Of course, other areas of interest, e.g. the impact on financial market rates, could also be mentioned.

The impacts are assessed in comparison with the present situation where no CBDC is issued. I analyse separately the impacts of the three basic policies: rule-based remuneration (upper middle right part of Table 1), discretionary remuneration (lower middle right part of Table 1) and no remuneration (lower right part of Table 1).

Whether the interest rate on retail CBDC is positive or null, or negative, the impacts on the cost of banks’ resources of a rule-based remuneration should be predictable, with changes in the IOER and thus in the interest rate on CBDC passed one for one into the banks’ deposits rates and eventually the cost of banks’ resources (Armelius et al., 2018). Regarding specifically the case of negative policy rates, it is currently difficult for banks to pass them through to depositors, since banknotes bear a zero interest rate. By showing the determination of the central bank to adopt a negative interest rate policy, a rule-based remuneration would make it easier for banks to price negative interest rates on deposits. Overall, monetary policy efficacy would be increased.

Furthermore, although setting a negative interest rate on retail CBDC could lead to political pressure, the central bank could point to the fact that a negative interest rate policy is implemented precisely with the view to returning to positive interest rates, which holders of retail CBDC would then benefit from. More generally, linking the interest rate on retail CBDC to a policy rate would reduce its policy content and make the level at which it is set less contentious, the questioning of the central bank being then more focused on the policy rate.

The retail CBDC interest rate could be set above or below the rule-based rate.

Setting the discretionary rate above the rule-based rate does not seem to make much sense since it would be conducive to higher cost of banks’ resources than in a rule-based setting, and to an unduly restrictive monetary policy stance, reducing monetary policy efficacy, especially when the interest rate CBDC is not strictly negative. However, in this case, political pressure on the central bank would be tamed, at least partly since some politicians and media could make the point that, as the rate on retail CBDC is set above the level resulting from a rule (e.g. above the IEOR), it could be set even higher (hence the “=” possibility in Table 1). If this rate were set discretionarily at an above rule-based level but still in negative territory, the impact on banks’ cost of resources would depend on whether the rate is set close to zero, in contradiction with an overtly expansionary monetary policy, or sufficiently negative. In the former case, the possibility of a positive impact on the cost of banks’ resources would be open. In any case, setting discretionarily the interest rate on retail CBDC above the rule-based rate but in negative territory would likely not be the option retained, both because it would negatively affect monetary policy efficacy and because it would anger politicians and the public.

In the case where the discretionary rate would be set below the rule-based rate, the impacts would be similar to the ones in which the rate on retail CBDC are set at an above rule-based level (see above), except that they would be diminished. Furthermore, there would be no need for individual limits on holdings. Neither would there be a need for a “tiered remuneration”, since the rate would be unattractive, especially when it is negative. However, politicians and the public could be angered because banks’ deposits (i.e. reserves) would be better remunerated than the central bank money held by the public, whereas paying interest is easier on digital money than on banknotes. They would be particularly displeased when the retail CBDC remuneration would be negative.

This policy would make the retail CBDC the more like a “digital banknote”, although it is possible to pay interest on banknotes (Pfister and Valla, 2018) and thus suppress any ELB.6 If the IOER is positive or null, the impacts would be similar to the ones when the CBDC remuneration is set discretionarily at a level that is below the rule-based one but still positive or null. Analogously, if the IEOR is strictly negative, the impacts would be similar to the ones in which the CBDC remuneration is set discretionarily at a level that is above the rule-based one and negative. Furthermore, when the IOER is strictly negative, politicians and the public would be satisfied because they would get a better treatment than the banks.

It has just been shown that the absence of remuneration was superior to two discretionary policies (above rule-based with a negative interest rate on retail CBDC and below rule-based with positive or null interest rate on retail CBDC). These two policies can thus be eliminated. It is also unlikely that central banks could retain either of the other discretionary policies: the above rule-based one with a positive or null interest rate on retail CBDC is inefficient in monetary policy and financial stability terms and has high administrative, management and holding costs, and the below rule-based one with a negative interest rate on retail CBDC has high political costs. Thus all discretionary policies can be eliminated, which leaves a choice between a rule-based policy and an absence of remuneration.

A central bank that puts the improvement of monetary policy efficacy high on its agenda for retail CBDC would likely prefer the rule-based approach. However, if the IOER is negative or could become so in a not so distant future, a central bank that does not want to incur political costs would likely prefer a non-remunerated CBDC, with the possibility to embrace a rule-based approach once policy rates have “normalized”. The insistence in central banks’ publications on presenting a possible retail CBDC as a “complement” to banknotes, in the sense of banknotes for the “digital era” (BIS, 2020, Bank of Japan, 2020, ECB, 2020), tends to show that they lean in favour of the second approach.

Pfister C., Valla N. (2018), ‘New Normal’ or ‘New Orthodoxy’? Elements of a Central Banking Framework for the After-Crisis, Working Paper 680, Banque de France, https://publications.banque-france.fr/sites/default/files/medias/documents/wp680.pdf.

The views expressed are the author’s and not those of Paris 1 Panthéon-Sorbonne or Sciences Po. I thank Françoise Drumetz, Jean-Michel Godeffroy, Anastasia Melachrinos and Nicolas de Sèze for their remarks and remain sole responsible for any error.

For a general introduction to CBDC, one can refer to Pfister (2020).

The classical reference is Barro and Gordon (1983).

A related concern is that, rather than raising interest rates on deposits, banks would become more dependent on central bank refinancing. However, in the present context where banks hold an historically extremely high level of excess reserves (for instance, in the euro area, at the end of August 2020, banks held in their accounts with the Eurosystem reserves representing more than one-third of the overnight deposits they collected), this can be seen as a quite remote prospect. Banks would deplete their excess reserves, which are a very little productive asset, before they have recourse to central bank refinancing.

The ECB recognizes this implicitly when it envisages that it could subsidize PSPs to distribute CBDC (European Central Bank, 2020).

Incidentally, this shows that the existence of an ELB, cash issuance and CBDC remuneration are three distinct subjects.