As the largest consumer credit market in the U.S., the residential mortgage market is central to monetary policy transmission. Shadow banks now account for more than 50% of this market. How shadow banks adjust their lending in response to interest rate changes is therefore of first-order importance when thinking about the effects of monetary policy on aggregate mortgage credit. We propose a new conceptual framework for the transmission of monetary policy that underscores the rising share of shadow banks in mortgage servicing and the hedging role of mortgage servicing in attenuating the negative effects of higher interest rates on shadow banks’ credit supply. Higher interest rates reduce prepayment risk, increasing the value of mortgage servicing assets and cash flow from servicing income. Both effects mitigate the contractionary effect of higher interest rates on shadow bank mortgage lending. Banks benefit less from the hedging role of mortgage servicing due to their reliance on deposit funding and the capital charge on mortgage servicing assets. Our results suggest that a rising shadow bank share in mortgage servicing dampens the pass-through of monetary policy to aggregate lending.

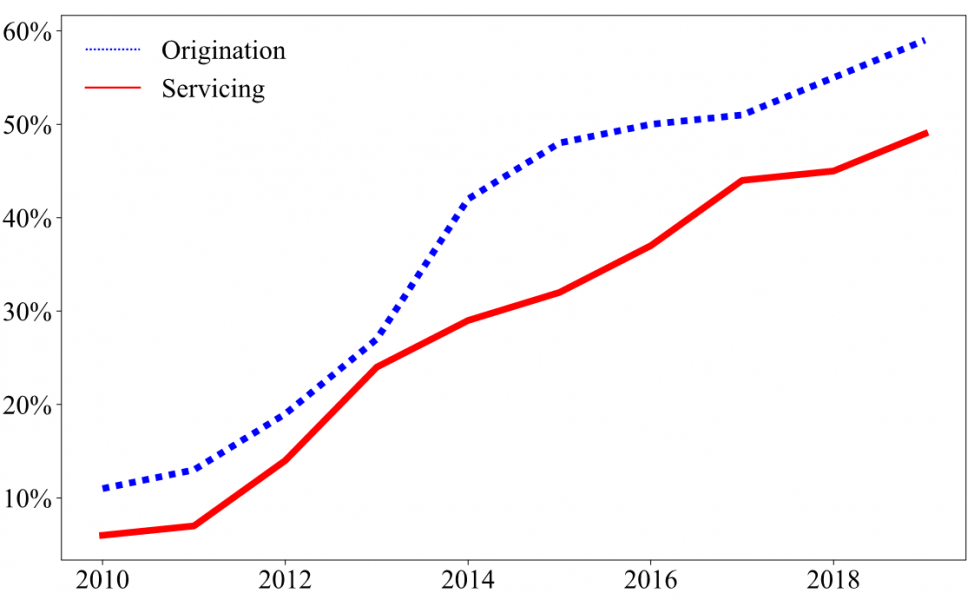

In the past decade, shadow banks (i.e., non-depository institutions) have become important players in the mortgage origination and servicing market, with a market share of more than 50% (Buchak et al., 2018; see Figure 1). Despite the central role played by the mortgage market in monetary policy transmission and the rising importance of shadow banks in this market, little is known about what shapes the transmission of monetary policy to shadow bank credit supply. We propose a new framework for understanding monetary policy transmission through shadow banks, which relies on shadow banks’ servicing business (Agarwal, Hu, Raluca, and Zheng, 2022).

Figure 1: Shadow bank market share in mortgage origination and servicing

Notes: This figure plots the market share of shadow banks in mortgage origination and servicing. The figure shows that shadow banks have accounted for a rising market share in both the origination and servicing markets in the past decade. Data source: Inside Mortgage Finance and the Urban Institute.

Mortgage servicing refers to the activity of collecting mortgage payments from borrowers and distributing them to the relevant investors. A financial institution that originates a mortgage could service the mortgage itself or sell the right to service the mortgage to another financial institution. The right to service a mortgage is a financial contract called a mortgage servicing right (MSR). An MSR is created when a mortgage is sold and securitized, which is the case for a vast majority of mortgages in the U.S. The owner of an MSR, i.e., the servicer, can earn a fee (mortgage servicing fee) by collecting principal, interest, tax and insurance payments from the borrower, and holding the money until it is due to relevant investors (Kim et al., 2018). When the interest rate increases, borrowers are less likely to pay off their mortgages via refinancing. The mortgage servicing right becomes more valuable because the expected duration over which the MSR holder collects the servicing fee rises and the interest on escrow money increases.

Mortgage servicing is an important source of external and internal financing for shadow banks, especially during contractionary monetary policy periods. By owning the claim to service a mortgage for its duration, a shadow bank holds an asset whose value is positively correlated with interest rates and that can be pledged as collateral for external funding (collateral effect). At the same time, servicing provides shadow banks with a relatively stable stream of fixed income that is typically unaffected by changes in interest rates (cashflow effect). Thus, for shadow banks, servicing acts as a natural hedge against interest rate shocks and attenuates the effects of monetary policy on their mortgage lending. We call this the mortgage servicing channel of monetary policy transmission.

We provide evidence on the mortgage servicing channel using shadow bank call reports, the confidential Home Mortgage Disclosure Act (HMDA) dataset, and unexpected monetary policy shocks from Gürkaynak et al. (2022) between 2012-2019. Our main finding is that shadow banks with more holdings of mortgage servicing rights decrease new lending by less after a contractionary monetary policy shock.

We further examine the two mechanisms, the collateral effect and the cash flow effect, that account for the role of mortgage servicing in hedging against interest rate shocks. We first show that, shadow banks with with a higher exposure to mortgage servicing draw down their credit lines more and pay a lower cost on external funding when interest rates rise. This effect is stronger for shadow banks that are more likely to face adverse selection frictions in the external financing market, i.e., those with low capital and liquidity ratios and with a risker borrower pool. Next, we show that shadow banks with higher ex-ante holdings of MSRs have relatively higher earnings and higher share of servicing income in gross income following contractionary monetary policy shocks. These results directly speak to the role of mortgage servicing in allowing shadow banks to access cheaper external funding and generating more stable internal funding after unexpected rises in interest rates.

An important question to ask is whether the mortgage servicing channel matters for monetary policy transmission to aggregate lending. This depends on both the relative strength of the mortgage servicing channel for banks and shadow banks and the composition of lenders in the servicing market. We first show that the mortgage servicing channel is weaker for banks compared to shadow banks. Conditional on having the same ex-ante exposure to servicing, shadow banks reduce mortgage origination by less compared to banks after a contractionary monetary policy shock. This is because banks mainly rely on deposit funding to originate mortgages and they carry a capital charge on holding mortgage servicing assets.

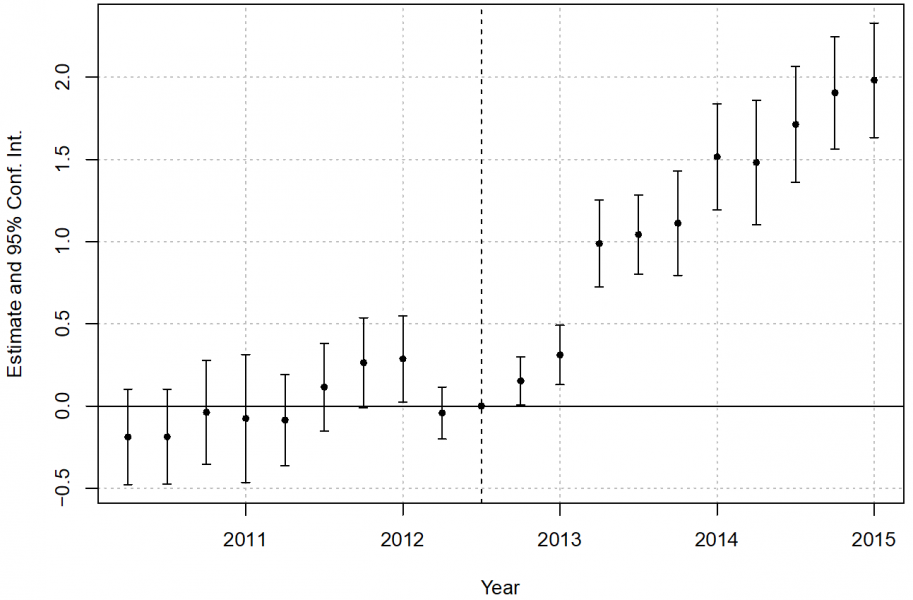

The heterogenous strength of the mortgage servicing channel for banks versus shadow banks indicates that mortgage servicer composition matters for the overall strength of the mortgage servicing channel and, in turn, affects the pass-through of monetary policy to aggregate lending. We utilize the U.S. implementation of Basel III capital requirements on banks’ holdings of mortgage servicing rights to generate plausibly exogenous variation in the nonbank share of servicing (Berrospide et al., 2016; Irani et al., 2021). The areas where banks’ aggregate capital deficiency was higher saw more entry of shadow banks into the local mortgage market (see Figure 2). It is exactly these areas that experience weaker pass-through of monetary policy shocks to aggregate lending. Our estimates suggest that, because of the Basel III-induced reallocation of mortgage servicing from banks to shadow banks, mortgage lending was 2.6% greater than it would have been in response to a 25bp contractionary monetary policy shock. In dollar terms, this translates into $7.4 billion of additional new mortgage lending in the quarter following the contractionary monetary policy shock.

Figure 2: Effect of Nonbank Servicing Share

Notes: The figure plots the coefficients of interest from estimating the impact of Basel III capital requirement on the MSA level servicing market share of shadow banks. Error bars represent 95 percent confidence intervals.

A crucial takeaway from our results is that the composition of lenders operating in the mortgage servicing market is relevant for the ability of monetary policy authorities to shape real outcomes. Just as Drechsler et al. (2022) show that higher interest rates between 2003–2006 had minimal impact on mortgage lending because the contraction in banks’ portfolio lending was offset by an increase in privately securitized mortgages, our findings suggest that the monetary tightening that began in 2022 may be less effective given the dominant role of shadow banks in the mortgage market. Because shadow banks typically serve a different clientele compared to traditional banks, monetary policy could also have unintended distributional consequences that depend on the composition of lenders operating within a given region.

Berrospide, J. and R. Edge (2016). The effects of bank capital requirements on bank lending: What can we learn from the post-crisis regulatory reforms. Working Paper, Federal Reserve Board.

Buchak, G., Matvos, G., Piskorski, T., & Seru, A. (2018). Fintech, regulatory arbitrage, and the rise of shadow banks. Journal of financial economics, 130(3), 453-483.

Drechsler, I., Savov, A., & Schnabl, P. (2022). How monetary policy shaped the housing boom. Journal of Financial Economics, 144(3), 992-1021.

Gürkaynak, R., Karasoy‐Can, H. G., & Lee, S. S. (2022). Stock market’s assessment of monetary policy transmission: The cash flow effect. The Journal of Finance, 77(4), 2375-2421.

Jiang, E.X., Financing Competitors: Shadow Banks’ Funding and Mortgage Market Competition, The Review of Financial Studies, 2023; https://doi.org/10.1093/rfs/hhad031.

Kim, Y. S., Laufer, S. M., Stanton, R., Wallace, N., & Pence, K. (2018). Liquidity crises in the mortgage market. Brookings Papers on Economic Activity, 2018(1), 347-428.

Irani, R. M., Iyer, R., Meisenzahl, R. R., & Peydro, J. L. (2021). The rise of shadow banking: Evidence from capital regulation. The Review of Financial Studies, 34(5), 2181-2235.