Introducing a general-purpose Central Bank Digital Currency (CBDC) carries the risk of bank disintermediation, potentially jeopardizing financial stability and monetary policy transmission through the bank lending channel. Nonetheless, a digital euro could be issued on a large scale without leading to bank disintermediation or a credit crunch, subject to two conditions. First, the central bank would require proper mechanisms to manage the volume and the user cost of CBDC in circulation. Second, the central bank should continue to facilitate access to its long-term lending facilities, to maintain a bank funding source alternative to retail deposits at an equivalent cost. Depending on its design, a digital euro could improve bank profitability by absorbing large amounts of idle (and expensive) excess reserves without penalizing lending. A digital euro could also strengthen banks’ competitive position relative to non-bank lenders and encourage bank digitalization.

In July 2021 the ECB Governing Council launched a two-year investigation phase of a digital euro project. A digital euro would be an electronic form of central bank money offered by the Eurosystem to citizens and firms for their retail transactions, complementing the existence of cash and central bank deposits. The Eurosystem has identified several reasons to supply a digital euro, such as providing a safe and trustworthy form of digital money (as opposed to risky cryptocurrencies and other similar private monies) or an alternative to foreign payment providers in Europe. A digital euro could also offer a contingency solution if physical cash declined significantly or non-EU digital money were to largely displace payments in euro (ECB, 2020).

However, like for other CBDCs, introducing a digital euro could lead to bank disintermediation, threatening financial stability and monetary policy transmission through the bank lending channel. If central banks allowed private individuals and firms to exchange a substantial share of their bank deposits for retail CBDC in real time, this might facilitate bank runs. Even in normal times, commercial banks could be deprived of an important source of cheap funding, inducing them to reduce their lending and shrink their balance sheets, with negative repercussions on economic activity and output.

A recent BcL Working Paper examines this issue by means of a realistic and comprehensive model exploring the impact on banks from the introduction of a digital euro (or €-CBDC)2. By adapting the analytical framework of Dutkowsky and VanHoose (2018, 2020) to the euro area to model the €-CBDC introduction as an exogenous shock affecting bank deposits, the BcL study clarifies two conditions that are required to avoid triggering bank disintermediation or a credit crunch.

First, the central bank would require proper mechanisms to manage the volume of digital euros in circulation. This would be crucial to limit future shocks on bank deposits. Moreover, this would allow the central bank to better calibrate its monetary policy stance: e.g., by reabsorbing a large fraction of excess reserves that, in the current juncture, may become unnecessary for the effectiveness of unconventional monetary policies. The theoretical analysis confirms that banks with sufficient excess reserves to cover client deposits shifting to €-CBDC could increase their profitability proportionately, without a negative impact on their lending. Since the overall volume of excess liquidity as of September 2021 totals 4.4 trillion euro, a conservative back-of-the-envelope estimation calibrated on pre-pandemic conditions suggests that slightly more than one trillion euros could be issued as €-CBDC. This amount would represent less than 25 percent of euro area banks’ excess liquidity, but roughly the same as the maximum market capitalization of Bitcoin until today (22/10/2021).

– Via hard limits and sweep accounts

In order to control the flows into €-CBDC, the simplest solution would be to impose some hard limits on the individual availability of the €-CBDC beyond a certain threshold. For example, the central bank could impose a ceiling on €-CBDC accounts3, either by refusing the settlement of any transaction that would trigger a violation of the limit, or by rerouting the same settlement towards a commercial bank account belonging to the same user.

Alternatively, if the objective of the central bank is just to prevent an excessive use of the digital euro as a store of value, but not as a medium of payment, €-CBDC accounts could function as sweep accounts, automatically transferring any exceeding amount only at the close of each business day. This method could allow for the settlement of any €-CBDC payment during the day, regardless of the amount, though without the possibility of stocking up on digital euros beyond the regulatory threshold.

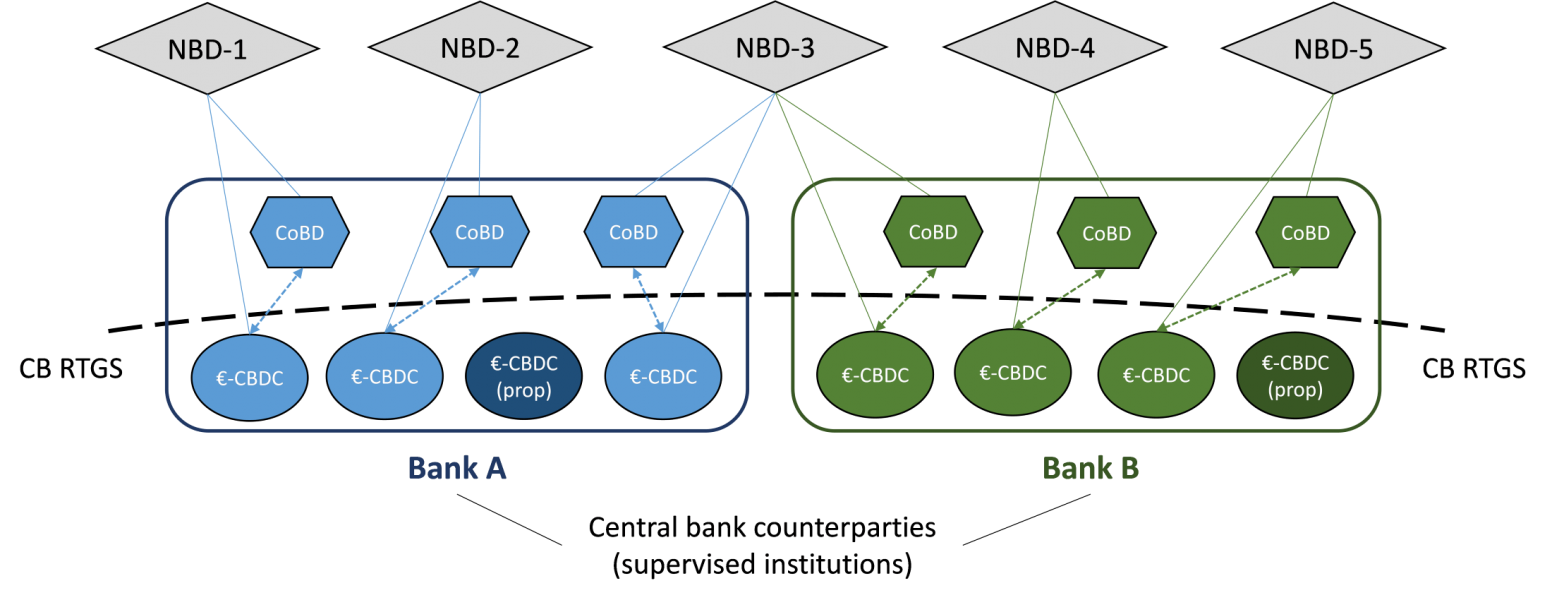

Assuming that a commercial bank would act as €-CBDC agent on behalf of its (non-bank) customers, the bank would have two types of accounts in the central bank RTGS system: i) proprietary accounts (analogous to current reserve accounts), to manage its own payment activities, and ii) third-party client accounts, to manage €-CBDC payment activities on behalf of its underlying customers4. Fig. 1 below presents a schematic view of this setup.

Figure 1. A possible solution to implement a digital euro by leveraging the current RTGS system

NBD: Non-bank depositor; CB RTGS: Central bank Real-time Gross Settlement; CoBD: Commercial bank deposits.

Notwithstanding its apparent simplicity, imposing a ceiling on €-CBDC accounts could present some uncertainties from an operational and especially from a legal point of view (if the digital euro had legal tender status, for instance). It might also generate arbitrage opportunities to elude the ceiling, and it could ultimately undermine public confidence in the use of the digital euro. Therefore, the central bank might require additional tools, which could be used either in parallel or as an alternative to the adoption of binding limits. Two natural candidates to this effect are: i) a direct instrument such as the €-CBDC’s overall rate of return (inclusive of charges and fees), and ii) an indirect mechanism based on reserve requirements on bank deposits.

– Via the €-CBDC’s overall rate of return

Regarding the first tool, Fegatelli (2019, 2021) show that, in order to avoid negative externalities such as a bank disintermediation or a substantial decline in cash usage, the overall rate of return for a CBDC should never exceed the lower between zero (the physical cash nominal rate of return) and the key policy rate (the theoretical risk-free rate). In the current juncture, this means that a slightly negative interest rate could be charged to €-CBDC holders, possibly in the form of a variable-rate deposit fee based on the outstanding amounts held in €-CBDC accounts. Notice that, from an economic point of view, this fee would be justified by the operational and maintenance costs borne by the central bank, either directly or indirectly (if €-CBDC accounts were operated by a third-party agent). Only the €-CBDC account fees would be anchored to the main policy rate(s), while the €-CBDC nominal interest rate would remain constant at zero (like for cash).

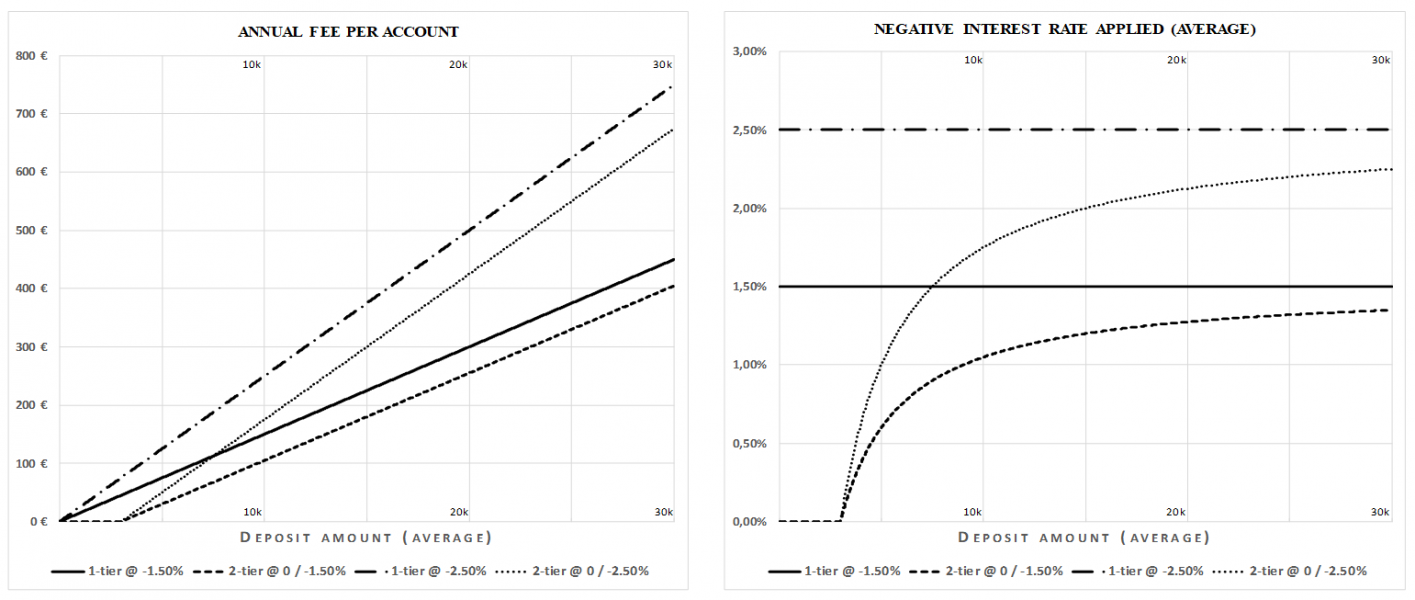

Assuming that the Eurosystem would limit €-CBDC issuance to slightly more than 1 trillion euro, if we divide this figure by an eligible euro area population slightly above 340 million people, this implies an average €-CBDC deposit of around 3,000 euro per person. At this level, and assuming only one digital euro account per person on average, a simple one-tier fee scheme linked to the current Deposit Facility rate (-0.5%) would generate an annual account fee equal to 45 euro (with a penalty spread of 1%) or 75 euro (with a penalty spread of 2%). This is comparable to fees charged on current accounts by many retail banks in Europe, when we include different billing items (for account maintenance, cash withdrawals, transfers, etc.). In practice, different types of negative remuneration or fee schemes can be conceived to charge depositors and payment system users, as we can learn from the variety of pricing strategies adopted within the banking industry. For example, a fee waiver could apply on the first 3,000 euro of €-CBDC deposits, as proposed by Bindseil (2020). Charts 1a-1b below compare the two pricing proposals (one-tier and two-tier) for different amounts held in €-CBDC accounts and across two different penalty spreads (-1% and -2%), given the current level of the Deposit Facility rate.

Charts 1a-1b. Alternative schemes for charging €-CBDC accounts

Source: Fegatelli, 2021.

– Via the reserve requirement instrument

The use of reserve requirements would offer an additional instrument to control €-CBDC flows, like a sort of “emergency brake”. It would focus specifically on the link between commercial bank deposits and €-CBDC holdings, by acting on the rate differential between the two asset types. The opportunity of using reserve requirements might emerge, for instance, following a normalization of monetary policy conditions in which the policy rate turns significantly positive. In such circumstances, if the central bank kept the €-CBDC rate constantly anchored to the policy rate, an increasingly positive gap between the remunerations of €-CBDC and physical cash would arise. This might finally lead to an irreversible extinction of cash (because of its higher holding opportunity cost), violating the Eurosystem principle of neutrality between different means of payment and reducing financial inclusion among the population less keen to use digital technologies.

A plausible alternative is that, for positive policy rates, €-CBDC would become a fixed, zero-interest asset, like cash or gold. However, another serious drawback may follow in this case: Funds from €-CBDC could easily tend to switch to bank deposits or back, depending on the direction of change in the policy rate, with all the related issues for banks’ liquidity management, financial stability, and the conduct of monetary policy. The problem would be the same as in emerging market economies, where a change in policy rates can exacerbate foreign capital flow volatility and trigger flow shifts contrary to the intended policy effect. In a €-CBDC framework, more critically, an analogous rate change may also generate sudden procyclical shifts between €-CBDC and bank deposits.

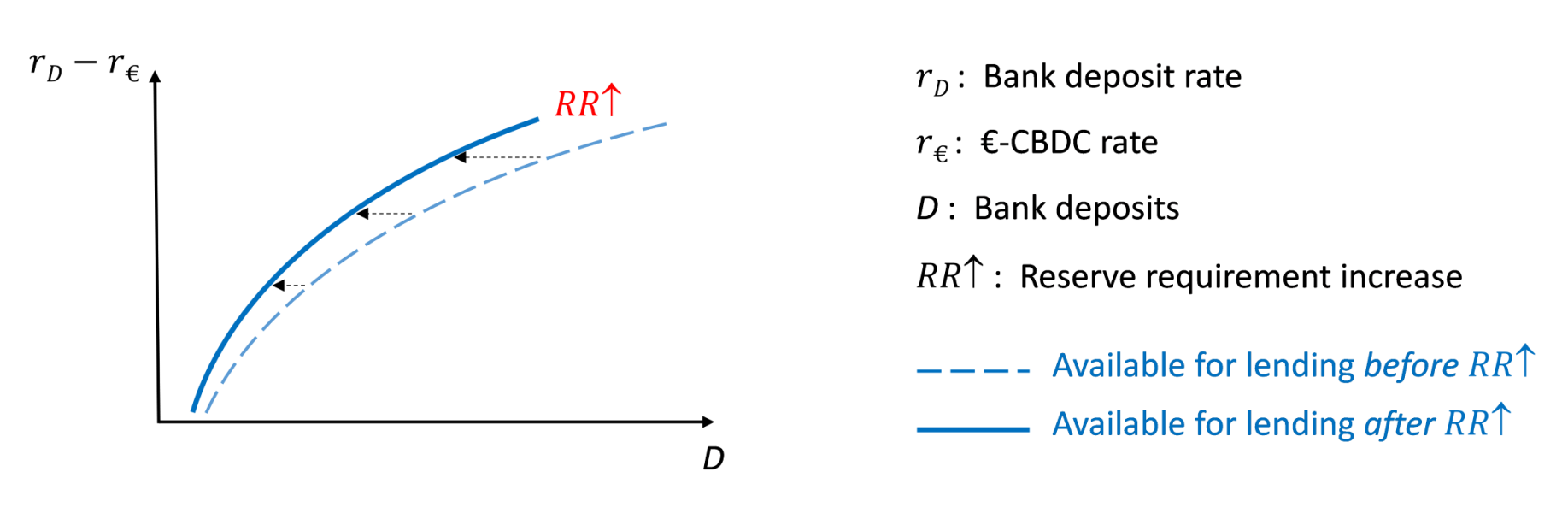

As in the case of emerging market economies with a flexible exchange rate, we could then envisage the same remedy: Using reserve requirements as a countercyclical tool for macroeconomic stabilization to influence bank lending conditions (rates and volumes) without “overcharging” the policy rate. Unlike emerging countries, where reserve requirements are often used as a substitute for the policy rate, in a €-CBDC framework the reserve requirement tool could mostly serve as a complementary measure, in parallel to conventional monetary policy. Thus, when a rise in the policy rate increases the spread between the bank deposit rate and €-CBDC remuneration (fixed at zero), the central bank could raise the reserve requirement to offset the increase in bank deposits and to push the bank deposit rate back towards its previous level. Note that, from an operational point of view, the central bank could always directly observe the flows in and out of the €-CBDC accounts. This would permit a very quick response whenever the rise of a new flow imbalance might threaten financial stability or weaken the transmission of monetary policy.

By using the €-CBDC framework derived from the works of Dutkowsky and VanHoose, Fegatelli (2021) provides an analytical description of this mechanism, which is summarily illustrated in Fig. 2 below.

Figure 2. Using reserve requirements with positive policy rates and non-positive €-CBDC remuneration

As a second condition to avoid a credit squeeze, the central bank should continue to facilitate access to its long-term lending facilities, in order to let illiquid banks replace client deposits converted to €-CBDC with a cost-equivalent source of funding. This is important because the current volume of excess reserves is rather heterogeneous across different types of banking institutions and different euro area countries. This heterogeneity implies that even a limited or controlled €-CBDC issuance might trigger various effects on bank balance sheets and lending, depending on bank business models and jurisdictions. In particular, problems might arise for less liquid banks that depend heavily on retail deposits for funding. The analysis confirms that such banks are most likely located in euro area peripheral countries where parking liquidity in short-term domestic government debt is more convenient than accumulating excess reserves. Especially when the supply of government debt securities is insensitive to interest rate changes, in the medium term these banks would deleverage by reducing their lending rather than their domestic government debt portfolios. €-CBDC issuance would then create stress in the weakest regions of the euro area, with all the related implications for systemic risk on aggregate.

To prevent these problems, the central bank would require to:

In practice, the Eurosystem monetary policy toolkit already includes adequate instruments. Most of these measures have been in place in the euro area for longer than a decade, and their use has been further extended during the pandemic. Under these conditions, if a digital euro were introduced on a large scale, banks substituting lost deposits with central bank borrowing should have no reason to reduce their lending volumes.

Until now, the advent of CBDCs has been widely perceived as a threat rather than an opportunity for commercial banks. In reality, the design of the digital euro and the measures accompanying its introduction are key elements to define the final impact on banks’ business and lending activities. We have seen above that those banks with adequate excess reserves could reduce them, along with their associated cost, by letting part of their retail deposits flow into €-CBDC. This would not compromise bank customer relationships, if the same banks were allowed to act as agents or service providers on behalf of the central bank, offering dedicated access to CBDC and related administrative services to their clients (ECB, 2020). In this scenario, banks could enjoy four advantages.

First, €-CBDC user fees could contribute to bank revenues. The central bank could then transfer corresponding amounts to the banks acting as €-CBDC agents to pay for their services. This would stabilize bank revenues through the cycle (as they would be less dependent on changes in rates and interest margins), while stimulating bank competition based on technology and innovation. Second, even banks that do not act as €-CBDC agents could lower the level of excess reserves and their associated costs under a negative interest rate policy, as said. The reduction in bank leverage would also improve gross capital ratios, with positive implications for cost savings and profitability. Third, banks acting as €-CBDC agents could continue to benefit from their ‘know your customer’ skills. By maintaining the interface with clients on both sides of their balance-sheet, banks could monitor their borrowers’ behavior and observe the risk attitude of net savers, e.g., in order to offer asset management and other ancillary services. Fourth, bank contributions to the deposit insurance guarantee system could decline substantially as they are related to the volume of deposits.

In this manner, many commercial banks could complete the transition from traditional ‘full’ financial intermediaries, taking own risks on both sides of their balance-sheet, to digital banks with a richer and more diversified portfolio of advisory and agent activities. This conversion would follow the trend already started in the aftermath of the Lehman crisis, reflecting several factors including the low interest rate environment, Basel III regulation, unconventional monetary policies and financial digitalization.

For the central bank, issuing a €-CBDC biting mostly on unprofitable bank assets such as excess reserves would imply that its balance sheet might increase only marginally. A new type of liability (the digital euro) would mostly replace other pre-existing liabilities (bank reserves exceeding the minimum requirement and Deposit Facility holdings), without necessarily inflating the Eurosystem balance sheet. This is an important difference compared to many CBDC schemes in the previous literature. The more limited increase in the monetary base means that the central bank would need to allocate fewer new funds on the asset side of its balance sheet (as the offsetting assets have already been “pre-loaded” in the balance sheet via the recent purchase programmes). Moreover, by guaranteeing bank funding against a partial relocation of retail deposits to €-CBDC, the central bank would ensure that money supply remains stable. By managing the volume of €-CBDC, the central bank could also manage the volume of excess reserves in a neutral fashion for larger monetary aggregates. Business cycle fluctuations in the money supply would be less pronounced, also because a higher proportion of base money would be held outside the banking system, so contributing to financial stability.

Bindseil, U. (2020): “Tiered CBDC and the financial system”, European Central Bank, Working Paper Series, N° 2351.

Dutkowsky, D. H., and VanHoose, D. D. (2018): “Breaking up isn’t hard to do: Interest on reserves and monetary policy”, Journal of Economics and Business, 99, 15-27.

Dutkowsky, D. H., and VanHoose, D. D. (2020): “Equal treatment under the Fed: Interest on reserves, the federal funds rate, and the ‘Third Regime’ of bank behavior”, Journal of Economics and Business, 107, 105860.

ECB (2020): “Report on a digital euro”, European Central Bank.

ECB (2021): “Digital euro experimentation scope and key learnings”, European Central Bank.

Fegatelli, P. (2019): “Central bank digital currencies: The case of universal central bank reserves”, Banque centrale du Luxembourg, Working Paper N° 130, July.

Fegatelli, P. (2021): “The one trillion euro digital currency: How to issue a digital euro without threatening monetary policy transmission and financial stability?”, Banque centrale du Luxembourg, Working Paper N° 155, August.

P. Fegatelli: “The one trillion euro digital currency: How to issue a digital euro without threatening monetary policy transmission and financial stability?”, Banque centrale du Luxembourg, Working Paper N° 155, August 2021.

Here, we assume that each €-CBDC account belongs to a single €-CBDC user (e.g., a private individual or a non-banking firm). The €-CBDC account is held in the central bank’s Real-Time Gross Settlement system (e.g., an upgraded version of TIPS – the Eurosystem’s Target Instant Payment Settlement service), and is operated by a supervised intermediary (the bank playing the role of ‘€-CBDC agent’). The latter would be in charge of allocating €-CBDC liquidity into one or more ‘second-tier’ accounts/wallets owned and managed by the same €-CBDC user, either directly or indirectly via a gatekeeper (cf. ECB, 2020 and 2021).

Cf. Fegatelli (2019), section 6.1.