The policy brief is based on ECB Working Paper No 3102. The views expressed are those of the authors and do not necessarily reflect those of the European Central Bank or the Swiss National Bank.

Abstract

This policy brief examines how trade policy shocks affect the US economy. Using a new dataset of official trade statements between 2007 and 2019, combined with market reactions of trade-exposed firms, we identify unanticipated trade policy changes and estimate their macroeconomic effects. We find that protectionism and liberalization have symmetric but opposite effects on output and investment, while large shocks and foreign policies lead to disproportionate impacts. Implemented policies have stronger effects than announcements, and policies communicated via informal communication channels (e.g. President Trump’s tweets) trigger weaker responses. Our findings highlight the importance of credible, measured trade policies for macroeconomic stability.

The recent resurgence of tariffs and retaliatory measures under the new Trump administration has brought trade policy back into the spotlight. As tensions rise and new measures are introduced, the economic implications of such policies demand closer scrutiny. What effects do protectionist measures, such as tariffs, have on the macroeconomy? How large are these effects, and how do they compare to the effects of liberalizing policies? Are the consequences symmetric, or do protectionist shocks have a greater impact? In our recent paper, we tackle these questions by constructing a novel dataset of official trade policy statements related to the United States from 2007 to 2019. By comparing how the stock prices of trade-exposed firms react relative to more domestically focused firms, we are able to isolate the unexpected, or surprise, component of each trade policy. We then assess how macroeconomic variables, such as industrial production, investment, and employment, respond to these policies in the short and medium term.

A trade policy shock is identified on a given day, if a trade policy statement has been issued, and if the stock prices of trade-exposed firms react more strongly than those of domestically focused firms. The size of each trade policy shock is determined by the relative movement in stock prices between firms more exposed to international trade and those operating mainly in the domestic market. We calculate this change over a two-day window after the policy announcement to capture immediate market reactions.

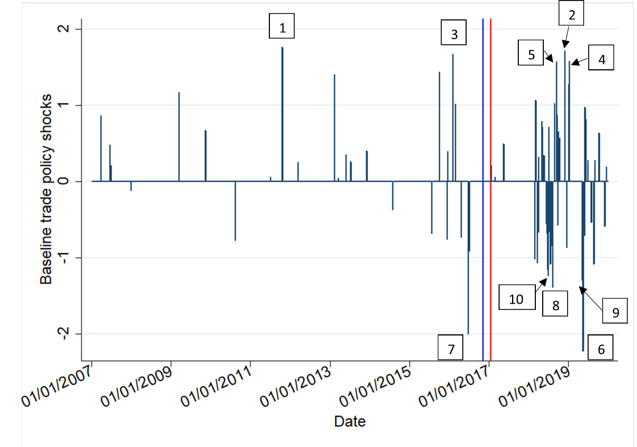

From 2007 to 2019, trade policy shocks grew in size and frequency and became more protectionist, especially after President Trump took office (Figure 1). Furthermore, the identified shocks appear to accurately reflect momentous trade policy changes, i.e. those that were particularly surprising, involved a large share of trade goods, or substantial tariff changes.

The “most liberalizing” day occurred in October 2011, when Mexico announced it would suspend all retaliatory tariffs imposed in response to the US blocking Mexican trucks from entering the country for several years. In contrast, the “most protectionist” day occurred in May 2019, when Trump announced that imports of automobiles and parts from the EU, Japan, and other countries posed a threat to national security and could potentially be restricted.

Figure 1. Daily trade policy shocks

Notes: The vertical lines represent the day on which the 2016 election results were announced (blue) and President Trump took office (red).

The largest liberalizing shocks (2007-2019):

1- Mexico lifts tariffs on dozens of US imports. (21/10/2011)

2- US-Mexico-Canada FTA signed; Trump announces to maintain tariffs at 10% on $200 bn worth of Chinese products, instead of increasing them to 25%. (30/11/2018 & 01/12/2018)

3- Trans-Pacific Partnership agreement signed. (03/02/2016)

4- Talks between the US and China to de-escalate tariff war. (09/01/2019)

5- Trump signs law reducing or eliminating import tariffs on over 1,660 items, including half made in China. (13/09/2018)

The largest protectionist shocks (2007-2019):

6- The Trump administration claims certain cars and car parts threaten US national security; and urge trade partners to limit auto exports. (17/05/2019)

7- UK voted to leave the EU (with implications for future UK-US tariff rates). (23/06/2016)

8- Trump announces raising steel tariff on Turkey from 25% to 50%. (10/08/2018)

9- Trump plans to raise 10% section 301 tariffs on $200 billion of Chinese imports to 25% and threatens to impose tariffs on all Chinese imports. (05/05/2019)

10- Canada imposes tariffs on US products totalling $12.8 bn, half of these affect steel and aluminium (25% tariff rate). (01/07/2018)

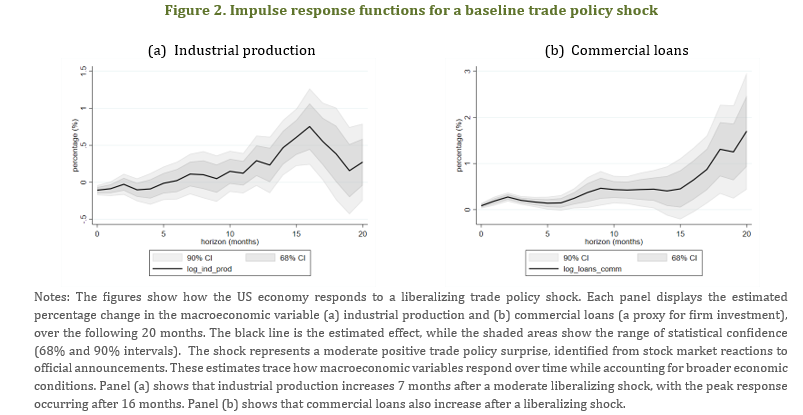

The effects of trade liberalization and protectionist measures on the US economy are similar in magnitude but opposite in direction. When trade barriers are lowered, for example through tariff reductions or trade agreements, industrial production, exports, and commercial loans (a proxy for firm investment) all increase (Figure 2). Conversely, protectionist measures such as tariffs reduce these same indicators. The effects are broadly symmetric, implying that the economic losses from protectionism are roughly as large as the gains from liberalization.

Not all trade shocks affect the economy equally. Trade policy actions taken by foreign countries, such as retaliatory tariffs imposed on US goods, tend to have larger negative effects on the US economy than equivalent measures initiated by the US itself. For example, foreign-initiated protectionist policies lead to sharper declines in investment and employment.

The implementation of trade policies produces stronger and longer-lasting economic effects than mere announcements, likely due to the policy uncertainty associated with the latter. Households and firms seem to adopt a “wait and see” approach, delaying their responses until policies are formally enacted.

Large shocks, whether liberalizing or protectionist, lead to disproportionately larger changes in economic activity. This non-linearity implies that abrupt or broader-based shifts in trade policy can trigger more severe economic disruptions than smaller adjustments.

Informal or less credible announcements, such as President Trump’s tweets, are associated with more subdued, and at times, contradictory macroeconomic reactions. This highlights the importance of credible and transparent communication in shaping economic expectations.

Overall, the macroeconomic impact of trade policy seems multilayered and is subject to substantial heterogeneity, depending on the type and origin of the policy change. Our findings can be valuable for policymakers seeking to make informed decisions about the short and medium-term impact of trade policies on the macroeconomy. For instance, as the second Trump administration introduces new tariffs against almost all trading partners with the stated goal of revitalizing US manufacturing and addressing trade imbalances, it is imperative to understand the overall impact on the US economy. Evidence based on past data suggests that protectionist measures tend to depress industrial production, exports, and firm investment while raising unemployment. Thus, these policies may not only fail to achieve their intended objectives, but also generate outcomes that directly contradict them. Furthermore, if US protectionist actions trigger retaliation from trade partners, such as tariffs imposed on US goods, the resulting economic costs tend to be magnified.