Disclaimer: This policy brief is based on BIS Working Paper, No 1267 “Collateralized lending in private credit”. Views are those of the authors and not necessarily those of the Bank for International Settlements.

Abstract

This policy brief investigates the growing prevalence of collateralised private credit in the U.S., where secured loans now surpass unsecured loans in the direct lending market. Declining lender specialisation and increasing geographical distances between lenders and borrowers have likely amplified informational frictions in lending, driving greater reliance on collateral. Consistent with a real estate collateral channel, rising house prices significantly increase secured direct lending while having a limited effect on unsecured direct loans. Additionally, the increasing involvement of banks in private credit through club deals and revolvers underscores structural changes in the market. These developments challenge the perception of private credit as primarily uncollateralised and highlight its evolving resemblance to syndicated loan markets, with important implications for monetary policy transmission and financial stability.

Private credit—loans made by specialised non‑bank investment vehicles—has become a key source of funding for U.S. companies. With assets under management now north of USD 1.5 trillion, the sector rivals the markets for leveraged loans and high‑yield bonds (Avalos et al., 2025). The boom comes against the wider backdrop of non‑bank financial intermediaries expanding their footprint in mortgages (Buchak et al., 2018), small‑business lending (Gopal et al., 2020), consumer finance (Tang, 2019) and syndicated loans (Aldasoro et al., 2022; 2023), among other areas.

Within this universe, direct lending has grown especially quickly. These are bilateral loans that lenders negotiate directly with borrowers and then hold to maturity.

Direct lenders mainly cater to middle‑market firms that carry more risk than large public companies. They offer tailor‑made financing whose terms often look a lot like equity: contracts are heavy on covenants, allowing the lender to monitor the borrower closely and maintain a relationship over time. Borrowers value the flexibility and bespoke nature of these deals (Block et al., 2024). One oft‑touted benefit is that much private‑credit lending is unsecured, letting firms without tangible assets raise funds. Yet market commentary points to a rising share of collateral‑backed—or “secured”—loans. For brevity we use “secured” and “collateralised” interchangeably.

To shed light on the mix of secured and unsecured direct lending, this brief builds on Aldasoro and Doerr (2025) and uses loan‑level data for U.S. firms from PitchBook covering 2000 Q1–2024 Q4. For each loan we observe the originating fund, the borrower, outstanding amounts, spread, maturity and whether the loan is secured. We treat the outstanding balance as remaining on the lender’s books until the stated maturity.

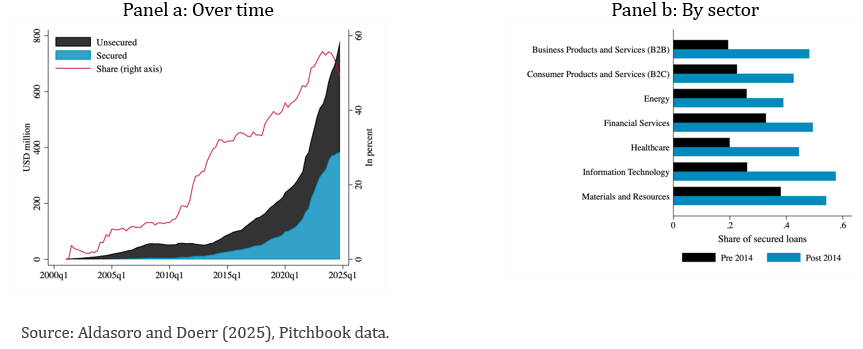

Figure 1a shows that both secured and unsecured direct lending have grown rapidly. Outstanding unsecured balances rose from virtually zero in the early 2000s to just over USD 300 billion by end‑2024, but secured balances grew even faster—from almost nothing to about USD 370 billion—so that secured loans now account for more than half of the total. Crucially, this shift is not driven by any single industry: it appears across the board, as shown in Figure 1b.

Figure 1. The rise of secured direct lending

The pattern lines up with Benmelech et al. (2024), who document that the long decline in secured debt among public firms has reversed in recent years, driven by riskier, non‑investment‑grade issuers. In public markets, safer borrowers seem to preserve flexibility by issuing unsecured debt, while opaque or illiquid firms—like those in private credit—increasingly pledge collateral.

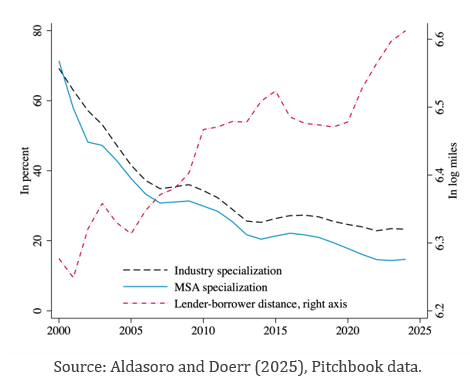

Turning to potential drivers, we find a strong link between collateral use and the information that lenders have about borrower risk. A loan is less likely to be secured when the lender is specialised in the borrower’s industry or region, and more likely when the lender and borrower are geographically distant. These patterns track the idea that collateral mitigates informational frictions and echo evidence from banking (Petersen and Rajan, 2002; Blickle et al., 2023). Over the past 25 years lender specialisation has waned and average lender–borrower distance has grown (Figure 2). These structural changes, possibly induced by a surge of investments in the private credit sector necessitating larger fund size, could result in more severe informational asymmetries. The rise in secured direct lending could therefore reflect the need to mitigate these information frictions with the use of collateral.

Figure 2. Lender specialisation declined over time

Secured loans are smaller, carry wider spreads and run longer than unsecured loans, even after comparing borrowers in the same MSA and industry. Although spreads on both loan types have fallen over time, the decline has been steeper for unsecured facilities. These facts are consistent with the idea that riskier firms pledge assets to secure funding (Benmelech, 2024), even if, for a given firm, better‑collateralised loans may price below unsecured ones (Luck and Santos, 2024).

To probe the role of real‑estate collateral, we focus on local house prices. Anecdotal evidence suggests that many direct loans are backed by real estate. Building on the literature that links real‑estate values to credit (Bahaj et al., 2020; and Ahnert et al., 2025; Schmalz et al., 2017 among others), we ask whether the same mechanism operates in private credit.

Our identification strategy uses cross‑city variation in house‑price growth. First, we instrument MSA‑level prices with the interaction of local housing‑supply elasticity and the federal‑funds rate (Saiz, 2010; Chaney et al., 2012;). Lower rates lift housing demand everywhere, but prices rise more where supply is inelastic. Second, we absorb unobserved shocks with industry‑by‑time and MSA‑by‑time fixed effects, effectively comparing secured and unsecured loans to firms in the same location and sector.

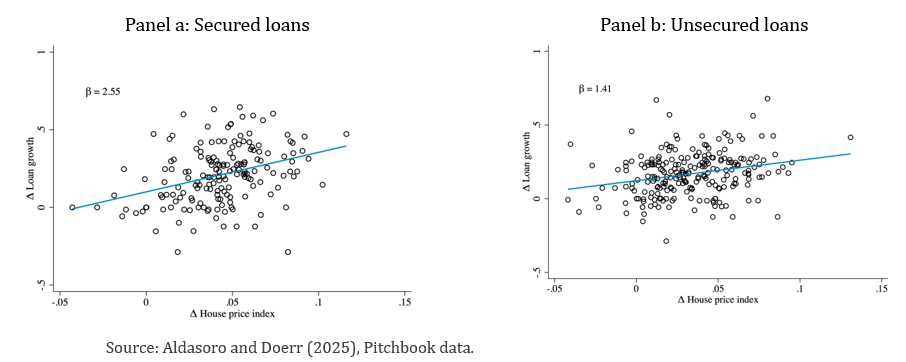

Figure 3 examines the collateral channel of private credit visually. It provides binned scatter plots of average MSA-level loan growth against average MSA-level house price growth for secured (panel a) and unsecured (panel b) direct loans. While there is a positive correlation between house prices growth and lending for both loan types, the correlation is substantially stronger for secured loans. We now investigate this relationship more formally in a regression analysis.

Our regression analysis confirms that higher local house prices boost secured lending far more than unsecured lending. A one‑standard‑deviation rise in prices raises unsecured volumes by an insignificant 10.7 percent but lifts secured volumes by an additional, highly significant 21 percent. We find no material effect on spreads or maturity.

Finally, we document banks’ growing footprint in private credit. Club deals—loans with more than one lender—have become common, now covering about 40 percent of new secured and unsecured facilities. At the same time, the share of revolvers (credit lines) is up. Club deals are especially likely to feature a revolver when at least one bank participates, and both secured and unsecured club deals are increasingly bank‑backed. While our data cannot directly pin down the mechanism, the pattern suggests that banks are partnering with direct‑lending funds to provide credit lines (see, e.g. Haque et al., 2024).

Figure 3. MSA house price growth and direct lending

We close by discussing the implications of these findings for monetary policy transmission. A key selling point of private credit is that specialised funds can screen and monitor opaque borrowers without the need for collateral. The growing prevalence of secured lending—and its tight link to property prices—casts doubt on that narrative. Going forward, private credit may come to look more like the syndicated‑loan market, where a group of lenders originates a package that blends a term loan with a credit line, potentially to be traded later.

Ahnert, T., S. Doerr, N. Pierri, and Y. Timmer (2024). Information technology in banking and entrepreneurship, Management Science (forthcoming).

Aldasoro, I., and S. Doerr (2025). Collateralized lending in private credit. BIS Working Paper no 1267.

Aldasoro, I., S. Doerr, and H. Zhou (2022). Non-bank lenders in the syndicated loan market. BIS Quarterly Review (March).

Aldasoro, I., S. Doerr, and H. Zhou (2023). Non-bank lending during crises. BIS Working Paper no 1074.

Avalos, F., S. Doerr, and G. Pinter (2025). The global drivers of private credit. BIS Quarterly Review (March).

Bahaj, S., A. Foulis, and G. Pinter (2020). Home values and firm behavior. American Economic Review 110(7), 2225–2270.

Benmelech, E., N. Kumar, and R. Rajan (2024). The decline of secured debt. Journal of Finance 79(1), 35–93

Blickle, K., C. Parlatore, and A. Saunders (2023). Specialization in banking, Working Paper.

Block, J., Y. S. Jang, S. N. Kaplan, and A. Schulze (2024, 02). A survey of private debt funds. The Review of Corporate Finance Studies 13(2), 335–383.

Buchak, G., G. Matvos, T. Piskorski, and A. Seru (2018). Fintech, regulatory arbitrage, and the rise of shadow banks. Journal of Financial Economics 130(3), 453–483.

Chaney, T., D. Sraer, and D. Thesmar (2012). The Collateral Channel: How Real Estate Shock Affect Corporate Investment. American Economic Review 102(6), 2381–2409.

Gopal, M. and P. Schnabl (2022). The rise of finance companies and fintech lenders in small business lending. Review of Financial Studies 35(11), 4859–4901.

Haque, S., S. Mayer, and I. Stefanescu (2024). Private debt versus bank debt in corporate borrowing. Working Paper.

Luck, S. and J. A. C. Santos (2024). The valuation of collateral in bank lending. Journal of Financial and Quantitative Analysis 59(5), 2038–2067.

Petersen, M. A. and R. G. Rajan (2002). Does Distance Still Matters? The Information Revolution in Small Business Lending. Journal of Finance 57(6), 2533–2570.

Saiz, A. (2010). The Geographic Determinants of Housing Supply. Quarterly Journal of Economics 125(3), 1253–1296.

Schmalz, M., D. Sraer and D. Thesmar (2017). Housing collateral and entrepreneurship. Journal of Finance, 72 (1), 99-132.

Tang, H. (2019, 04). Peer-to-peer lenders versus banks: Substitutes or complements? The Review of Financial Studies 32(5), 1900–1938.