Using a DSGE model, we study the macroeconomic consequences of a foreign central bank digital currency (CBDC) being available to residents in a small open economy. We find that a gradual and permanent increase in domestic households’ preference for a foreign CBDC leads to a structural reduction in economic activity, especially when the CBDC is designed to be similar to domestic deposits. Imposing capital flow management measures on outflows, relaxing macroprudential policy, or selling foreign reserves can help smooth the transition. We also show that an economy with a large stock of foreign CBDC is better shielded from exogenous increases in the interest rate on foreign debt if the CBDC remuneration remains constant.

Central banks around the world have been increasingly studying the feasibility, the benefits, and the costs of issuing a retail central bank digital currency, henceforth CBDC: this is defined as a liability of the central bank, denominated in the national unit of account, whose access is electronic and available also to households and non-financial firms (BIS, 2021). A CBDC would fill a gap, as households and non-financial firms have typically access to two forms of money: a physical liability of the central bank (cash) and an electronic liability of the banking sector (deposits). Introducing a CBDC may have major macroeconomic and financial implications: this has spurred a growing academic research (see Auer et al., 2022 for a literature review) and a lively debate in policy institutions such as the IMF and the BIS (Soderberf et al., 2022; BIS, 2021).

The major central banks in the world are examining the introduction of a CBDC (e.g., the FED and the ECB) or have already launched a pilot digital currency (e.g., the PBC). The possibility of making retail CBDCs available also to non-residents is one of the options considered in the current policy debate in order to address the existing frictions in cross-border payments (BIS et al., 2022). Should a systemic economy’s CBDC be available also to non-residents, other countries may experience relevant spillover effects, such as capital outflows, currency depreciation, and financial distress. In Moro and Nispi Landi (2023) we address these issues, analyzing the financial implications for an emerging economy of a foreign CBDC available to domestic households.

The study presents a Dynamic Stochastic General Equilibrium (DSGE) model for a small open economy incorporating financial and nominal frictions. In the model, households can hold three liquid assets – domestic cash, local bank deposits, and the foreign CBDC – or invest in domestic bonds. Holding liquid assets entails a utility benefit in contrast to investing in bonds. Banks face a leverage constraint, which makes the lending spread an increasing function of bank leverage. The central bank determines the interest rate, the level of foreign reserves, macro-prudential policy (a subsidy to bank capital), and controls on capital inflows (a tax on foreign deposits) and outflows (a tax on the foreign CBDC).

We carry out three sets of simulations.

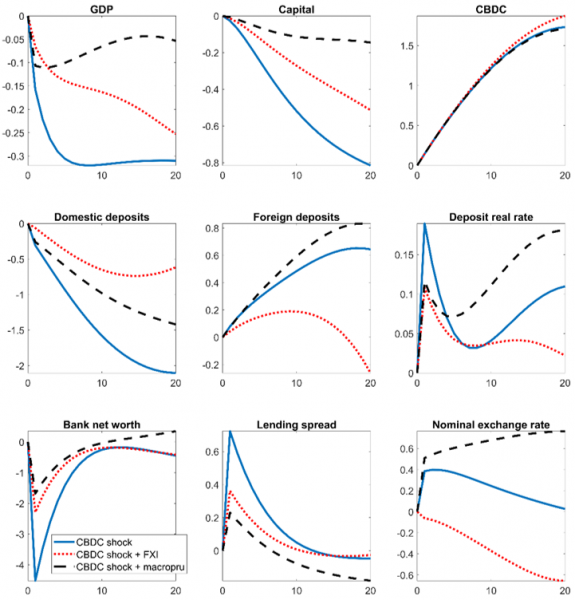

First we simulate a gradual and permanent increase in the foreign CBDC. We assume that the preference for the CBDC gradually increases for 20 quarters and remains permanently higher thereafter (Figure 1, blue solid line). We also assume that the increased preference for the CBDC is offset by an equal reduction in preferences for domestic deposits, that are perceived by domestic households as substitutes for the CBDC. The reduced savings supply to the banking sector leads to higher deposit and lending rates: the latter increases more than the former (i.e. the lending spread goes up), subsequently decreasing capital demand and production. Banks shift from local currency deposits to foreign currency deposits, causing the local currency to depreciate, making foreign currency-denominated deposits more burdensome. Higher financial costs for banks and increased value of foreign liabilities in terms of local currency further drive up loan interest rates, exacerbating the recession.

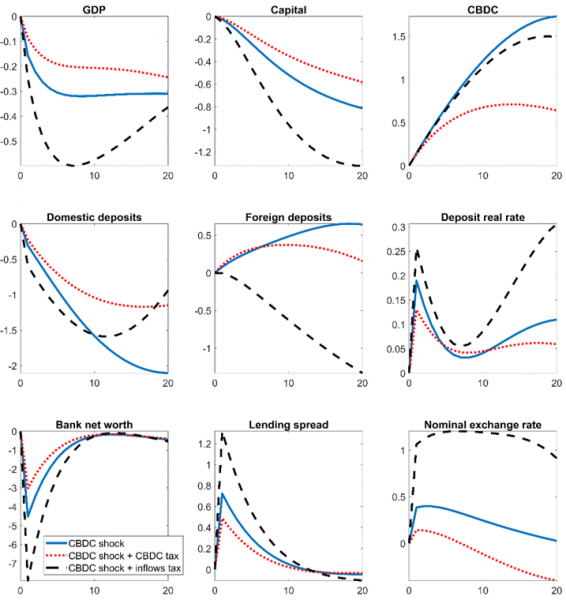

Second, we analyze which policy tools are better suited to tackle the CBDC demand shock. We consider (a) a sterilized gradual sale of foreign currency by the central bank (FX intervention), reaching 2% of GDP after 20 quarters; (b) a gradual subsidy to bank’s equity (macroprudential policy), reaching 25 basis points after 20 quarters; (c) a gradual tax on foreign CBDC holding (a capital control on outflows), reaching 100 basis points after 20 quarters; (d) a gradual tax on foreign deposits (a capital control on inflows), reaching 25 basis points after 20 quarters. All these policy tools are gradually scaled back, when they reach the peak. We find that interventions in the foreign exchange market can curb the depreciation of the emerging economy’s currency, limiting negative effects on foreign currency liabilities of the banking sector (Figure 1, red dotted line). Loosening macro-prudential measures enables banks to have more funds for lending to businesses, thereby mitigating the impact of the crisis (Figure 1, black dashed line). A tax on foreign CBDC investments can reduce the displacement of local currency deposits (Figure 2, red dotted line). A tax on foreign deposits aimed at restricting their increase amplifies the recession as it denies the banking sector a relatively less costly source of financing (Figure 2, black dashed line).1

Figure 1: CBDC demand, FX intervention and macroprudential policy

Notes: response of the economy to a gradual increase in the households’ preference for the foreign CBDC, offset by a gradual reduction in the preference for domestic deposits. The preference shock gradual increases until quarter 20, and remains permanently higher thereafter. The response of GDP, capital, bank net worth, and exchange rate is in percentage deviation compared to the initial level. The response of foreign CBDC, domestic and foreign deposits is in deviation compared to the initial level, scaled by the initial level of GDP. The response of the deposit real rate and the lending spread is in annualized deviation compared to the initial level. Blue solid line: baseline. Red dotted line: the central bank gradually sells foreign reserves amounting to 2% of GDP, after 20 quarters; the intervention is gradually scaled back thereafter. Black dashed line: the subsidy to bank equity is gradually increased up to 25 basis points after 20 quarters; the policy is gradually scaled back thereafter.

Figure 2: CBDC demand and capital controls

Notes: response of the economy to a gradual increase in the households’ preference for the foreign CBDC, offset by a gradual reduction in the preference for domestic deposits. The preference shock gradual increases until quarter 20, and remains permanently higher thereafter. The response of GDP, capital, bank net worth, and exchange rate is in percentage deviation compared to the initial level. The response of foreign CBDC, domestic and foreign deposits is in deviation compared to the initial level, scaled by the initial level of GDP. The response of the deposit real rate and the lending spread is in annualized deviation compared to the initial level. Blue solid line: baseline. Red dotted line: the tax on the CBDC is gradually increased up to 100 basis points, after 20 quarters; the policy is gradually scaled back thereafter. Black dashed line: the tax on foreign deposits is gradually increased up to 25 basis points after 20 quarters; the policy is gradually scaled back thereafter.

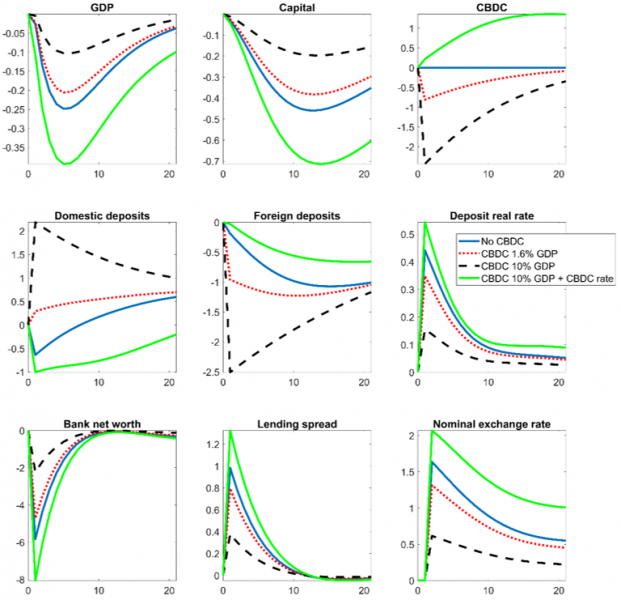

Figure 3: Foreign interest rate shock

Notes: response of the economy to a temporary 100 basis points increase in the foreign interest rate. The response of GDP, capital, bank net worth, and exchange rate is in percentage deviation compared to the initial level. The response of foreign CBDC, domestic and foreign deposits is in deviation compared to the initial level, scaled by the initial level of GDP. The response of the deposit real rate and the lending spread is in annualized deviation compared to the initial level. Blue solid line: households do not hold foreign CBDC. Red dotted line: the stock of foreign CBDC is 1.6% of GDP. Black dashed line: the stock of foreign CBDC is 10% of GDP. Green solid line: the stock of foreign CBDC is 10% of GDP and the CBDC rate increases as much as the foreign interest rate.

Third, we simulate a 100 basis-point temporary increase in the foreign interest rate, comparing the response of the economy under different stocks of foreign CBDC. In the baseline scenario with no foreign CBDC, the shock is recessionary, as it makes foreign deposits costlier by increasing their remuneration and by depreciating the domestic currency (Figure 3, blue solid line). Moreover, the domestic central bank responds by increasing the policy rate, thus amplifying the recession. If households hold foreign CBDC (1.6% of GDP, red dotted line and 10% of GDP, black dashed line), the recession is mitigated, as they replace CDBC with deposits, requiring a lower rise in the deposit rate to clear the market. In this case, a reduction in foreign CBDC holdings works similarly to a sale of foreign reserves by the central bank: the country’s foreign assets decrease, mitigating the currency depreciation that results from the foreign monetary tightening. In the scenario with CBDC equal to 10% of GDP, the shock is almost offset, suggesting that a high stock of the foreign CBDC may serve as a prudential cushion against foreign shocks. However, the importance of the CBDC stock as a cushion to foreign shock holds only if the CBDC is not remunerated or if the remuneration is constant. If the CBDC rate also rises, mimicking the behavior of the foreign interest rate, households do not have any incentive to reduce the stock of the foreign CBDC. They do the opposite, buying the foreign CBDC, attracted by a higher return (Figure 3, green solid line). This is the worst scenario in terms of GDP loss, as it maximizes the reduction in deposit demand, and, as a result, the increase in the deposit rate.

Our results suggest that introducing a foreign CBDC in an emerging market economy may have a disruptive impact, especially if the CBDC is perceived to be similar to domestic deposits. We show that there are several policy instruments that can be deployed to smooth the negative impact of a foreign CBDC: easing macroprudential policy, tightening capital controls on outflows, or selling foreign reserves. We also report that a high stock of the foreign CBDC held by households may serve as a cushion to changes in the foreign interest rate, if the CBDC remuneration does not change accordingly.

Auer, R., J. Frost, L. Gambacorta, C. Monnet, T. Rice, and H. S. Shin (2022): “Central Bank Digital Currencies: Motives, Economic Implications, and the Research Frontier”, Annual Review of Economics, 14, 697–721.

BIS (2021): “Central Bank Digital Currencies for Cross-Border Payments”, BIS Report to the G20. BIS, IMF, and WB (2022): Options for Access to and Interoperability of CBDCs for Cross-Border Payments, Note for the G20.

Moro, A. and V. Nispi Landi (2023): “The External Financial Spillovers of CBDCs”, Temi di Discussione (Bank of Italy Working Papers), N. 1416.

Soderberf, G., W. Bossu, N. Che, J. Kiff, I. Lukonga, T. Mancini-Griffoli, T. Sun, and A. Yoshinaga (2022): “Behind the Scenes of Central Bank Digital Currency,” IMF Fintech Notes, 004.

For comparison, we report the baseline scenario with no policy tools also in Figure 2, blue solid line.