Abstract

Regulators increasingly use supervisory technologies (SupTech) to strengthen bank oversight, yet the extent to which these tools effectively discipline risky bank behavior remains uncertain. Using unique data from the Central Bank of Brazil, we document that following a SupTech event, banks reveal inconsistencies in their risk reporting and cut credit to less creditworthy firms, thereby reducing risk-taking. This disciplining effect operates through a moral suasion channel: SupTech improves banks’ understanding of the regulator’s expectations and monitoring capabilities, prompting more prudent risk management. Our findings offer new insights into the role of SupTech in regulatory enforcement and financial stability.

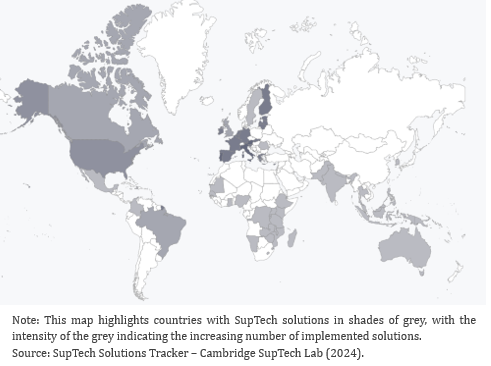

The 2007–2008 global financial crisis and more recent episodes of banking turmoil have underscored the importance of effective bank supervision for financial stability (Barr, 2023; Laeven et al., 2010). In response, regulators worldwide are shifting from traditional compliance-based supervision, which primarily penalizes regulatory non-compliance ex-post, to risk-based supervision, which aims to identify and resolve potential risk exposures ex-ante. Central to this shift has been the adoption of supervisory technologies (SupTech), which leverage advanced data analytics to enhance regulators’ ability to screen and monitor risky bank behavior (Broeders and Prenio, 2018; Di Castri et al., 2019). Figure 1 for instance shows that many countries across the globe—including both advanced and emerging economies—have implemented SupTech applications as of 2024 (Cambridge SupTech Lab, 2024).

Despite the adoption of SupTech by regulators around the world, their effectiveness in disciplining risky bank behavior remains largely unexamined. This lack of empirical evidence poses significant challenges for policymakers tasked with designing and implementing effective supervisory frameworks. In our study (Degryse, Huylebroek, and Van Doornik, 2025), we provide the first empirical analysis of how SupTech influences bank behavior and its broader economic implications.

Figure 1. SupTech adoption around the world

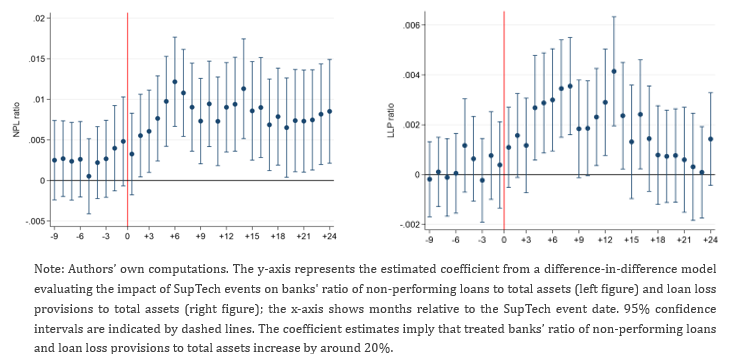

Using unique data from the Central Bank of Brazil—a pioneer in SupTech adoption—we examine the impact of supervisory scrutiny triggered by the central bank’s SupTech tool (“SupTech events”) on banks’ risk reporting and lending decisions, as well as the spillovers on bank-dependent firms. Using a difference-in-differences methodology, we compare the behavior of banks subject to SupTech events with those that are not, before and after these events.

Our results are threefold:

Figure 2. The impact of SupTech events on banks’ risk reporting

The supervisory scrutiny arising from SupTech differs fundamentally from other types of supervisory scrutiny, such as bank sanctions or on-site bank inspections. For instance, unlike bank sanctions, which are imposed in response to regulatory violations, SupTech tools are employed to detect emerging risk exposures at an early stage, even in the absence of formal regulatory breaches. Consistent with this notion, we provide evidence that the effects of SupTech events operate through a moral suasion channel; By improving banks’ understanding of the regulator’s supervisory views, SupTech induces banks to adopt more conservative risk management practices aligned with those views. In support of this, we show that the effects are stronger for:

Finally, we show that SupTech events also have within-municipality spillover effects, as non-targeted banks operating in the same municipality as targeted banks also improve their risk reporting. This suggests that SupTech has far-reaching effects, as it changes (even non-targeted) banks’ perception of the supervisory authority’s capabilities to uncover risky bank behavior.

Overall, our results underscore how SupTech—or risk-based supervision more broadly—can strengthen regulatory compliance by fostering a better alignment between banks’ risk management practices and supervisory objectives. In addition, our study provides novel empirical evidence that moral suasion—long recognized by policymakers as an essential element of the supervisory toolkit (Acharya et al. 2024; Adrian et al. 2023)—can effectively change bank behavior. Our findings provide avenues for further research into the role of SupTech in bank supervision, including on the optimal combination of compliance- and risk-based bank supervision.

Acharya, Viral, Elena Carletti, Fernando Restoy, and Xavier Vives. 2024. Banking turmoil and regulatory reform. Centre for Economic Policy Research.

Adrian, Tobias, Marina Moretti, Ana Carvalho, Hee Chon, Katharine Seal, Fabiana Melo, and Jay Surti. 2023. Good Supervision: Lessons from the Field. International Monetary Fund.

Barr, Michael. 2023. Review of the Federal Reserve’s supervision and regulation of Silicon Valley Bank. Board of Governors of Federal Reserve System.

Bonfim, Diana, Geraldo Cerqueiro, Hans Degryse, and Steven Ongena. 2023. “On-site inspecting zombie lending.” Management Science 69 (5): 2547–2567

Broeders, Dirk, and Jermy Prenio. 2018. Innovative technology in financial supervision (suptech): The experience of early users. Financial Stability Institute.

Cambridge SupTech Lab (2024). SupTech solutions tracker.

Degryse, Hans, Cédric Huylebroek, and Bernardus Van Doornik (2025), “The Disciplining Effect of Bank Supervision: Evidence from SupTech.” CEPR Discussion Paper No. 19988.

Di Castri, Simone, Arend Kulenkampff, Stefan Hohl, and Jermy Prenio. 2019. The suptech generations. Bank for International Settlements.

Granja, João, and Christian Leuz. 2024. “The death of a regulator: strict supervision, bank lending, and business activity.” Journal of Financial Economics 158:103871.

Laeven, Luc, Deniz Igan, Stijn Claessens, and Giovanni Dell’Ariccia. 2010. Lessons and policy implications from the global financial crisis. International Monetary Fund.