The policy brief is based on BIS Working Papers No 1203 “Strike while the Iron is Hot: Optimal Monetary Policy with a Nonlinear Phillips Curve”.

Abstract

The recent surge in inflation has led to a significant increase in the frequency of price changes, making prices more flexible. Conventional models assume constant price change frequency, but state-dependent models, where frequency varies with economic conditions, better explain recent observations. Price flexibility affects the effectiveness of monetary policy. In high inflation periods, frequent price changes make monetary policy more effective in reducing inflation with less economic damage. Therefore, monetary policy should be more aggressive during high inflation to stabilize prices efficiently. This approach allows central banks to achieve a “soft landing” with small impact on economic activity. Overall, central banks should adjust their strategies based on the inflation environment to optimize economic outcomes.

The recent surge in inflation across Europe, the United States, and many other countries raises an important question: Should monetary policy respond differently during high inflation episodes compared to more stable periods? There is growing evidence that the answer is yes. Higher inflation is associated with a higher frequency of price changes – it has more than doubled during the recent inflation spike (Montag and Villar, 2023; Cavallo, Lippi, and Miyahara, 2023). Higher frequency increases the flexibility of the prices, which affects monetary policy effectiveness. The more flexible prices are, the cheaper it is for the central bank to reduce inflation in terms of damage to the overall economic activity.

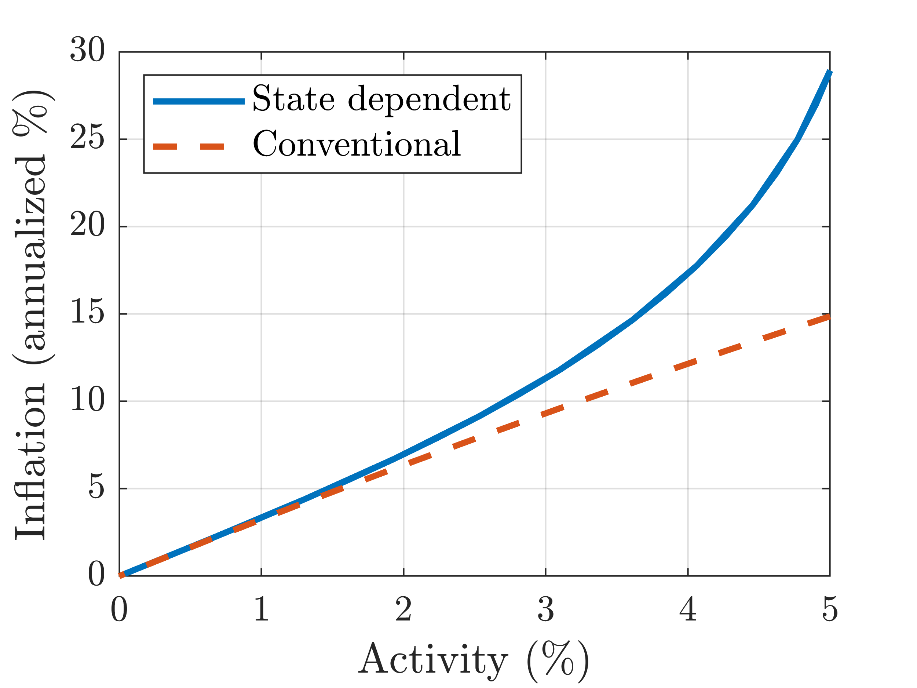

Figure 1. Phillips curve

Notes: The Phillips curve depicts the relationship between inflation and activity for demand disturbances of varying size under standard monetary policy. The solid blue line is the more realistic state-dependent framework, whereas the dashed red line is the conventional assumption of a constant repricing frequency. In the former, a monetary policy tightening in a high inflation environment can have a larger impact on inflation, with less damage to overall economic activity.

In conventional models of monetary policy (Woodford, 2003; Gali, 2008), the frequency of price changes, and, thus, the price flexibility is constant. This implies that monetary policy has a similar effect on output and inflation regardless of the inflation environment. As a result, the relationship between inflation and activity (often captured by the Phillips curve) is approximately linear (see the dashed red line on Figure 1). However, these models are unable to explain higher frequency of price changes in high inflation environments. In contrast, models with state-dependent price setting, where the frequency responds endogenously to economic conditions, can explain this phenomenon (e.g. Golosov and Lucas, 2007). They also imply a state-dependent variation in monetary policy effectiveness. In high inflation periods, when prices are more flexible, monetary policy becomes more effective in reducing inflation without significantly hurting economic growth. As a result, they predict a nonlinear relationship between inflation and activity, as the blue solid line in Figure 1 illustrates. Recent empirical evidence supports the prediction that this relationship is indeed nonlinear (Cerrato and Gitti, 2023; Benigno and Eggertsson, 2024).

How does the response of the price change frequency to inflation affect the optimal conduct of monetary policy? In conventional models with fixed frequencies, two key conclusions emerge. First, monetary policy should offset excess demand shocks, such as disproportional spikes in government spending, to stabilize both inflation and economic activity. Second, policy should lean against cost-push shocks, equally strongly in both high and low inflation environments because the trade-off between inflation and activity remains constant.

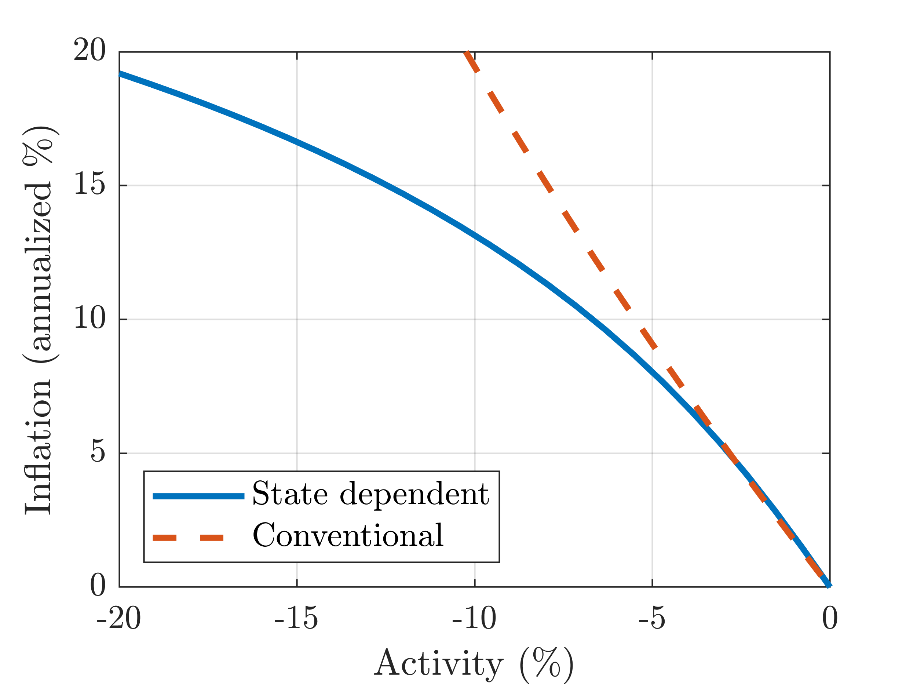

Figure 2. Target rule

Notes: The target rule depicts the relationship between inflation and activity under cost shocks of varying size under optimal monetary policy. In high inflation environment, policy should stabilize inflation relatively more in the state-dependent framework.

How do these conclusions change, when the price change frequency varies and the Phillips curve is nonlinear? Our research (Karadi, Nakov, Nuno, Pasten, and Thaler, 2024) explores this question using a state-dependent-pricing model. We show, first, that excess demand shocks should still be offset – similarly to the conventional model. The reason is that monetary policy can still fully stabilize both inflation and activity.

Second, however, the response to cost-push shocks should be more aggressive in high inflation periods – differently from the conventional model. This is because, during these periods, inflation is easier to stabilize with a smaller impact on economic activity. In other words, monetary policy should “strike while the iron is hot.” Figure 2 shows the relationship between inflation and activity under optimal policy and cost-push shocks. The red dashed line shows that the relationship is approximately linear in the conventional model, implying similar policy prescriptions in high and low inflation environments. The blue dashed line shows the relationship in a model with state-dependent frequency. The relationship is nonlinear and its slope is lower under high inflation environments, implying a more aggressive anti-inflationary stance.

When prices are more flexible, stabilizing inflation becomes less costly in terms of lost output, making a “soft landing” more achievable. The steeper Phillips curve during high inflation periods indicates that central banks can reduce inflation with less economic pain than during normal times. Our research shows that it is indeed the nonlinear Phillips curve that mostly account for the state-dependent policy prescriptions, the relative welfare costs of inflation versus activity is similar in the state-dependent and the conventional models.

The state-dependent price setting framework we used (Golosov and Lucas, 2007) closely matches the U.S. data on the co-movement between inflation and price change frequency (Blanco, Boar, Jones and Midrigan, 2024). While some argue that this framework overestimates price flexibility, our results hold even when we use a more conservative model (Nakamura and Steinsson, 2010).

Overall, our findings suggest that central banks should adjust their approach to monetary policy during periods of high inflation. More aggressive policies can take advantage of the fact that reducing inflation is cheaper, in terms of lost output, when firms adjust their prices more frequently. However, as inflation decreases, this additional power of monetary policy fades, making it harder to push inflation back to normal levels. Thus, central banks may need to be more patient as they complete the “last mile” of reducing inflation after a surge.

Benigno, Pierpaolo and Gauti Eggertsson (2023) “It’s Baaack: The Surge in Inflation in the 2020s and the Return of the Non-Linear Phillips Curve,” NBER Working Papers 31197, National Bureau of Economic Research, Inc.

Blanco, Andres, Corina Boar, Callum J Jones, and Virgiliu Midrigan (2024a) “Nonlinear Inflation Dynamics in Menu Cost Economies,” NBER Working Papers 32094, National Bureau of Economic Research.

Cavallo, Alberto, Francesco Lippi, and Ken Miyahara (2023) “Large Shocks Travel Fast,” NBER Working Papers 31659, National Bureau of Economic Research, Inc.

Cerrato, Andrea and Giulia Gitti (2023) “Inflation Since COVID: Demand or Supply,” unpublished manuscript.

Gali, Jordi (2008) Monetary Policy, Inflation, and the Business Cycle: An Introduction to the New Keynesian Framework: Princeton University Press.

Golosov, Mikhail and Robert E. Lucas (2007) “Menu Costs and Phillips Curves,” Journal of Political Economy, Vol. 115, pp. 171–199.

Karadi, Peter, Anton Nakov, Galo Nuno, Ernesto Pasten and Dominik Thaler (2024). “Strike while the Iron is Hot: Optimal Monetary Policy with a Nonlinear Phillips Curve,” BIS Working Papers, No 1203.

Montag, Hugh and Daniel Villar (2023) “Price-Setting During the Covid Era,” FEDS Notes.

Nakamura, Emi and Jon Steinsson (2010) “Monetary Non-neutrality in a Multisector Menu Cost Model,” The Quarterly Journal of Economics, Vol. 125, pp. 961–1013.

Woodford, Michael (2003) Interest and Prices: Foundations of a Theory of Monetary Policy: Princeton University Press.