References

Autor, D. H., Palmer, C. J., & Pathak, P. A. (2014). Housing market spillovers: Evidence from the end of rent control in Cambridge, Massachusetts. Journal of Political Economy, 122(3), 661–717.

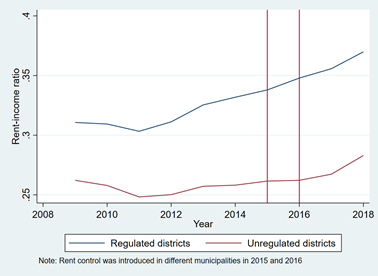

Baye, V., & Dinger, V. (2021). Investment incentives of rent controls and gentrification – Evidence from German micro data (NBP Working Paper, No. 342).

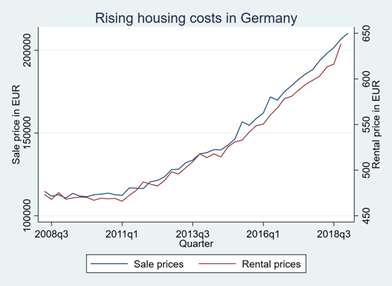

Boelmann, B., & Schaffner, S. (2019). FDZ Data description Real-Estate Data for Germany (RWI-GEO-RED v1) – Advertisements on the Internet Platform ImmobilienScout24 2007-03/2019.

Bracke, P. (2015). House Prices and Rents: Microevidence from a Matched Data Set in Central London. Real Estate Economics, 43(2), 403–431.

Diamond, R., McQuade, T., & Qian, F. (2019). The effects of Rent Control Expansion on Tenants, Landlords, and Inequality: Evidence from San Francisco. American Economic Review, 109(9), 3365–3394.

Federal Statistical Office. (2021a). 14% of the population affected by excessive housing costs in 2019. https://www.destatis.de/EN/Press/2020/10/PE20_428_639.html

Federal Statistical Office. (2021b). Development of owner-occupied dwelling rate, by Land. Federal Statistical Office (Destatis). https://www.destatis.de/EN/Themes/Society-Environment/Housing/Tables/owner-occupied-dwelling-rate.html

Halket, J., & Pignatti Morano di Custoza, M. (2015). Homeownership and the scarcity of rentals. Journal of Monetary Economics, 76, 107–123.

RWI-GEO-RED. (2020a). RWI Real Estate Data (Scientific Use File) – apartments for rent. http://fdz.rwi-essen.de/doi-detail/id-107807immoredwmsufv1.html.

RWI-GEO-RED. (2020b). RWI Real Estate Date (Scientific Use File) – apartments for sale. http://fdz.rwi-essen.de/doi-detail/id-107807immoredwksufv1.html.

Sims, D. P. (2007). Out of control: What can we learn from the end of Massachusetts rent control? Journal of Urban Economics, 61, 129–151.