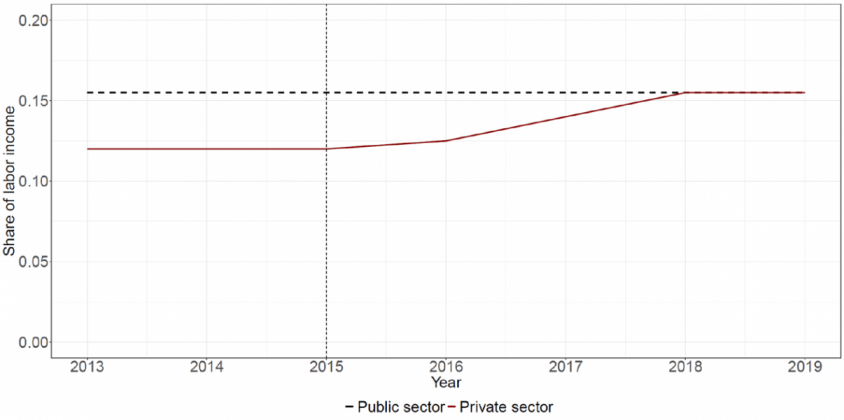

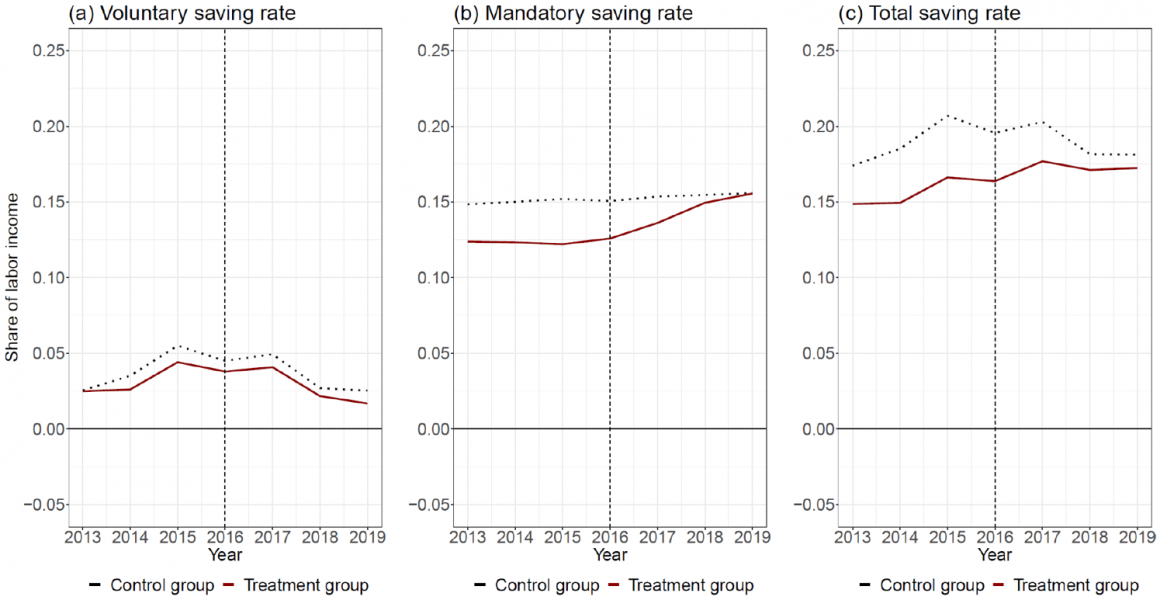

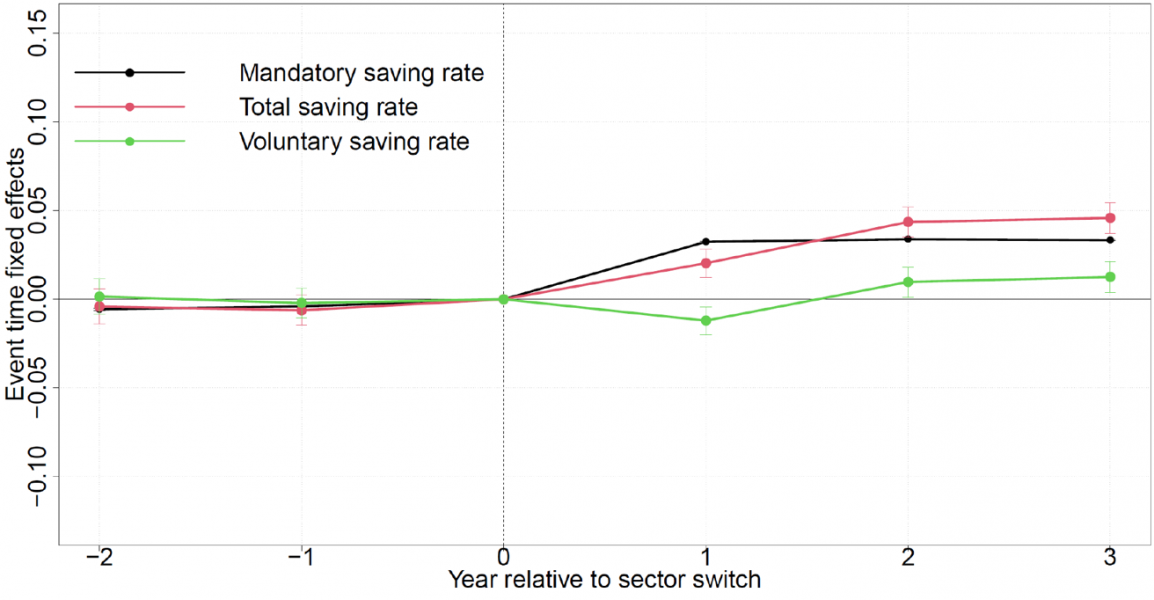

Recently, mandatory pension contributions in Iceland were increased substantially in the private sector while remaining unchanged in the public sector. Taking this as a large natural experiment, we study the effects of this change on households’ voluntary saving using comprehensive third-party reported information on taxpayers’ income, assets, and debt for all taxpayers. We find that households do not reduce voluntary saving when faced with a rise in mandatory saving and future pension income. Our results are supported by an event study of workers switching from the private sector to the public sector. Survey evidence suggests widespread ignorance about the pension contribution and expected pension income.

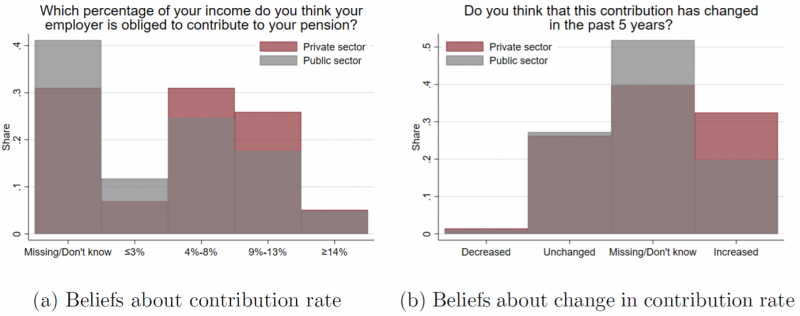

Figure 4: Knowledge about pension saving and the pension reform