References

Ahmed, R, C Borio, P Disyatat, B Hofmann (2021): “Losing traction? The real effects of monetary policy when interest rates are low?”, BIS Working Papers, forthcoming.

Armelius, H, M Solberger and E Spanberg (2018): “Is the Swedish neutral interest rate affected by international developments?”, Sveriges Riksbank Economic Review, no 2018–01.

Bank of England (2018): Inflation Report, August.

Basel Committee on Banking Supervision (BCBS) (2010): An assessment of the long-term economic impact of stronger capital and liquidity requirements, July.

Beaudry, P, D Galizia and F Portier (2020): “Putting the cycle back into business cycle analysis”, American Economic Review, vol 110, no 1, pp 1–47.

Beaudry, P and C Meh (2021): “Monetary policy, trends in real interest rates and depressed demand”, Bank of Canada, Staff Working Papers, 2021-27.

Bindseil, U (2004): Monetary policy implementation: theory, past and present, Oxford University Press.

BIS (2019): Annual Economic Report 2019, June.

——— (2021): Annual Economic Report 2021, June.

Borio, C (1997): “The implementation of monetary policy in industrial countries: a survey”, BIS Economic Papers, no 47, July

——— (2014a): “The financial cycle and macroeconomics: what have we learnt?”, Journal of Banking & Finance, vol 45, pp 182–98, August. Also available as BIS Working Papers, no 395, December 2012.

——— (2014b): “Monetary policy and financial stability: what role in prevention and recovery?”, Capitalism and Society, vol 9, no 2, article 1. Also available as BIS Working Papers, no 440, January 2014.

——— (2017): “Through the looking glass”, OMFIF City Lecture, London, 22 September.

——— (2021): “Back to the future: intellectual challenges for monetary policy”, Finch Lecture, University of Melbourne, 2 September.

Borio, C and P Disyatat (2014): “Low interest rates and secular stagnation: is debt a missing link?”, VoxEU.

——— (2021): “Monetary and fiscal policy: privileged powers, entwined responsibilities”, SUERF Policy Note, May 2021.

Borio, C, P Disyatat and M Juselius (2017b): “Rethinking potential output: embedding information about the financial cycle”, Oxford Economic Papers, vol 69, no 3, July, pp 655–77.

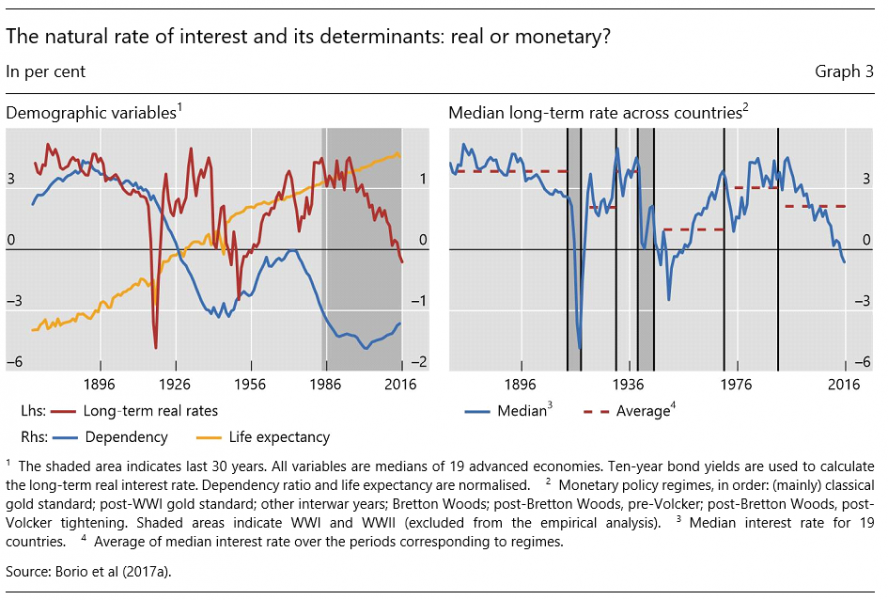

Borio, C, P Disyatat, M Juselius and P Rungcharoenkitkul (2017a): “Why so low for so long? A long-term view of real interest rates”, BIS Working Papers, no 685, December. Forthcoming (shorter version) in the International Journal of Central Banking.

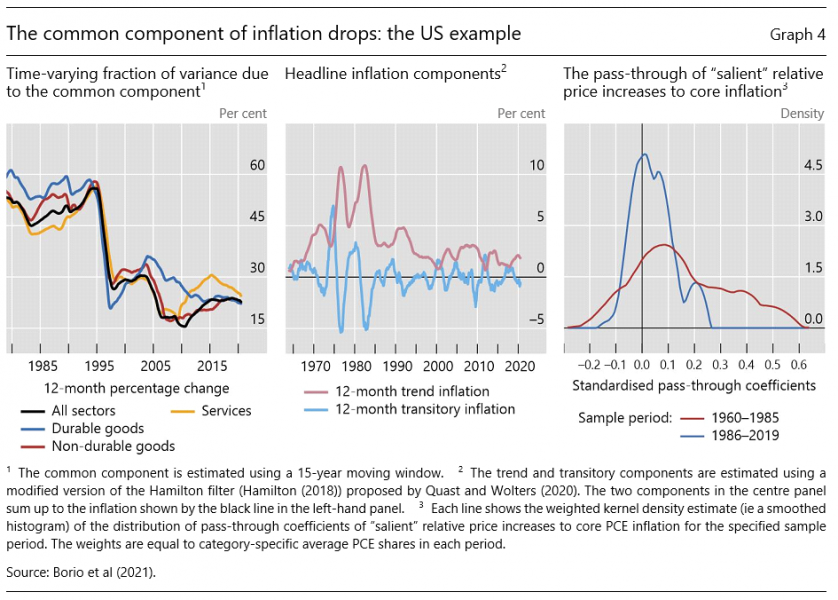

Borio, C, P Disyatat, D Xia and E Zakrajšek (2021): “Monetary policy, relative prices and inflation control”, BIS Quarterly Review, September.

Borio, C, M Drehmann and D Xia (2019): “Predicting recessions: financial cycle versus term spread”, BIS Working Papers, no 818, October; forthcoming in Journal of Macroeconomic Forecasting.

Borio, C, M Erdem, A Filardo and B Hofmann (2015): “The costs of deflations: a historical perspective”, BIS Quarterly Review, March, pp 31–54.

Borio, C, E Kharroubi, C Upper and F Zampolli (2016): “Labour reallocation and productivity dynamics: financial causes, real consequences”, BIS Working Papers, no 534, January.

Brand, C, G Goy and W Lemke (2020): “Natural rate chimera and bond pricing reality”, DNB Working Papers, no 666.

Candia, B, O Coibion and Y Gorodnichenko (2020): “Communication and the beliefs of economic agents”, NBER Working Papers, no 27800.

Carney, M (2017): “[De]Globalisation and inflation”, IMF Michel Camdessus Central Banking Lecture,

18 September.

Carter, T, X Chen and J Dorich (2019): ”The neutral rate in Canada: 2019 update”, Bank of Canada, Staff Analytical Note, no 2019-11.

Cecchetti, S, M Feroli, P Hooper, A Kashyap and K Schoenholtz (2017): “Deflating inflation expectations: the implications of inflation’s simple dynamics”, report prepared for the 2017 US Monetary Policy Forum.

Christensen, J and G Rudebusch (2019): “A new normal for interest rates? Evidence from inflation-indexed debt”, Federal Reserve Bank of San Francisco, Working Papers, no 2017-07.

Claessens, S, M Kose and M Terrones (2012): “How do business and financial cycles interact?”, Journal of International Economics, vol 87, no 1, pp 178–90.

Cohen, B, P Hördahl and D Xia (2018): ”Term premia: models and some stylised facts”, BIS Quarterly Review, September.

Coibion, O, Y Gorodnichenko, S Kumar and M Pedemonte (2018): “Inflation expectations as a policy tool?”, NBER Working Papers, no 24788.

Davis, J, C Fuenzalida and A Taylor (2021): “The natural rate puzzle: Global macro trends and the market-implied r*”, NBER Working Paper Series, no 26560.

Debelle, G (2017): “Global influences on domestic monetary policy”, speech to the Committee for Economic Development of Australia mid-year economic update, Adelaide, 21 July.

Del Negro, M, D Giannone, M Giannoni and A Tambalotti (2017): “Safety, liquidity, and the natural rate of interest”, Brookings Papers on Economic Activity, vol 48, Spring, pp 235–316.

Drehmann, M and M Juselius (2012): “Do service costs affect macroeconomic and financial stability?”, BIS Quarterly Review, September.

Drehmann, M, M Juselius and A Korinek (2017): “Accounting for debt service: the painful legacy of credit booms”, BIS Working Papers, no 645, June.

ECB (2021): Overview of the monetary policy strategy, Frankfurt.

Feldstein, M (2015): “The deflation bogeyman”, Project Syndicate, 25 February.

Forbes, C (2019): “Has globalization changed the inflation process?”, BIS Working Papers, no 791, June.

Friedman, M (1968): “The role of monetary policy,” American Economic Association Papers and Proceedings, vol 58, no 1, pp 1–17.

Fries, S, J-S Mésonnier, S Mouabbi and J-P Renne (2018): “National natural rates of interest and the single monetary policy in the euro area”, Journal of Applied Econometrics, vol 33, no 6, pp 763–79

Gilchrist, S and E Zakrajšek (2020): “Trade exposure and inflation dynamics”, in G Castex, J Gali and D Saravia (eds), Changing Inflation Dynamics, Evolving Monetary Policy, Central Bank of Chile, Series on Central Banking, Analysis and Economic Policies, pp 173–226.

Goodhart, C and M Pradhan (2020): The Great Demographic Reversal: ageing societies, waning inequality, and an inflation revival, SpringerLink.

Greenspan, A (1994): Testimony before the Subcommittee on Economic Growth and Credit Formation of the Committee on Banking, Finance and Urban Affairs, US House of Representatives, 22 February.

——— (2005): “Globalization”, remarks given at the Council on Foreign Relations, New York, New York, 10 March, Federal Reserve Board.

Hamilton, J, E Harris, J Hatzius and K West (2015): “The equilibrium real funds rate: past, present, and future”, presented at the US Monetary Policy Forum, New York, 27 February.

Hicks, J (1967): Critical essays in monetary theory, Clarendon Press.

Holston, K, T Laubach and J Williams (2017): “Measuring the natural rate of interest: international trends and determinants”, Journal of International Economics, vol 108, no 1, pp S59–S75.

Johannsen, B and E Mertens (2016): “The expected real interest rate in the long run: time series evidence with the effective lower bound”, Board of Governors of the Federal Reserve System, FEDS notes, 9 February.

Juselius, M, C Borio, P Disyatat and M Drehmann (2017): “Monetary policy, the financial cycle and ultra-low interest rates”, International Journal of Central Banking, vol 13, no 3. Also available as BIS Working Papers, no 569, July.

Keynes, J (1936): The general theory of employment, interest, and money, MacMillan.

Lagarde, C (2020): “The monetary policy strategy review: some preliminary considerations”, speech at the “ECB and Its Watchers XXI” conference, Frankfurt am Main, 30 September.

Laubach, T and J Williams (2003): “Measuring the natural rate of interest”, Review of Economics and Statistics, vol 85, no 4, pp 1063–70.

Lewis, K and F Vazquez-Grande (2019): “Measuring the natural rate of interest: a note on transitory shocks”, Journal of Applied Econometrics, vol 34, no 3, pp 425–36.

Lubik, T and C Matthes (2015): “Calculating the natural rate of interest: a comparison of two alternative approaches”, Federal Reserve Bank of Richmond, Economic Brief, October, pp 1–6.

Lunsford, K and K West (2019): “Some evidence on secular drivers of safe real rates”, American Economic Journal: Macroeconomics, vol 11, no 4, pp 113–39.

Mankiw, N (2013): Macroeconomics, Eighth edition, London: Macmillan.

McCririck, R and D Rees (2017): “The neutral interest rate”, Reserve Bank of Australia, Bulletin, September, pp 9–18.

Mian, A, L Straub and A Sufi (2020): “Indebted demand”, NBER Working Papers, no 26940.

Ohlin, B (1937): “Some notes on the Stockholm theory of savings and investment I”, The Economic Journal, vol 47, pp 53–69.

Orphanides, A and D Wilcox (1997): “The opportunistic approach to disinflation”, Finance and Economics Discussion Series (FEDS), July.

Orphanides, A and J Williams (2002): “Robust monetary policy rules with unknown natural rates” Brookings Papers on Economic Activity, vol 2002, no 2, pp 1–40.

Powell, J (2018): “Monetary policy in a changing economy”, speech at an economic policy symposium sponsored by the Federal Reserve Bank of Kansas City on “Changing market structure and implications for monetary policy”, Jackson Hole, Wyoming, 24 August.

——— (2020): “New economic challenges and the Fed’s monetary policy review”, speech at an economic policy symposium sponsored by the Federal Reserve Bank of Kansas City on “Navigating the decade ahead: implications for monetary policy”, Jackson Hole, Wyoming, 27 August.

Quast, J and M Wolters (2020): “Reliable real-time output gap estimates based on a modified Hamilton Filter”, Journal of Business and Economic Statistics.

Rachel, L and T Smith (2017): “Are low real interest rates here to stay?”, International Journal of Central Banking, vol 13, no 3, pp 1–42.

Rajan, R (2015): Panel remarks at the IMF conference on “Rethinking Macro Policy III”, Washington DC,

15–16 April.

Robertson, D (1934): “Industrial fluctuation and the natural rate of interest”, The Economic Journal, vol 44, pp 650–56.

Rungcharoenkitkul, P, C Borio and P Disyatat (2019): “Monetary policy hysteresis and the financial cycle”, BIS Working Papers, no 817, October (revised August 2020).

Rungcharoenkitkul, P and F Winkler (2021): “The natural rate of interest through a hall of mirrors”, mimeo.

Selgin, G (1997): “Less than zero: the case for a falling price level in a growing economy”, IEA Hobart Paper, no 132, The Institute of Economic Affairs, April, London.

Sims, C (2010): “Rational inattention and monetary economics”, Handbook of Monetary Economics, vol 3, Chapter 4, pp 155–81

Shirakawa, M (2021): Tumultuous times: central banking in an era of crisis, Blackwell’s.

Sudo, N, Y Okazaki and Y Takizuka (2018): “Determinants of the natural rate of interest in Japan – approaches based on a DSGE model and OG model”, Bank of Japan Research Laboratory Series, no 18-E-1.

Summers, L (2014): “Reflections on the ‘new secular stagnation hypothesis’”, in C Teulings and R Baldwin (eds), Secular stagnation: facts, causes and cures, VoxEU.org eBook, CEPR Press.

Tarullo, D (2017): “Departing thoughts”, Member of the Board of Governors of the Federal Reserve System, remarks at the Woodrow Wilson School, Princeton, 4 April.

Wicksell, K (1898): Geldzins und Güterpreise. Eine Untersuchung über die den Tauschwert des Geldes bestimmenden Ursachen, Jena, Gustav Fischer (English translation: Interest and prices: a study of the causes regulating the value of money, London: Macmillan, 1936).

Williams, J (2018): “The future fortunes of r-star: are they really rising?”, remarks to the Economic Club of Minnesota, Minneapolis, Minnesota, 15 May 2018.

Woodford, M (2003): Interest and prices, Princeton University Press.