Money market funds experienced significant liquidity stress during the COVID-19 crisis, with adverse implications for short-term funding of financial institutions and corporations. Ironically, the outflow was largest and most volatile for money market funds categorised into low volatility funds, in part due to unintended regulatory incentives. To better safeguard the functioning of money markets in the future, regulatory adjustments are called for, with special focus on better managing the liquidity risk of money market funds.

The COVID-19 crisis has brought to light vulnerabilities in the European Money Market Fund (MMF) sector. A sudden ‘dash for cash’ pushed MMFs to either draw down their weekly liquid asset buffers or sell assets in a money market environment that had become increasingly illiquid. The dash for cash was driven by a precautionary demand for liquidity which coincided with increased margin requirements for certain investors, driving up redemptions at MMFs. While the importance of MMFs in the US is relatively well-known, the relevance of MMFs in European money markets is less highlighted. What’s more, domestic private asset investments of MMFs in the euro area are – relative to GDP – one and a half times the size of the US MMF investments. We contribute to existing literature (such as ECB, 2020a; Cipriani and La Spada, 2021; Dunne and Giliana, 2021) by shedding light on the importance of European MMFs for money market functioning with detailed datasets on European MMF holdings (iMoneyNet, Securities Holdings Statistics by Sector) and by sharing implications for the macroprudential policy framework in the euro area.

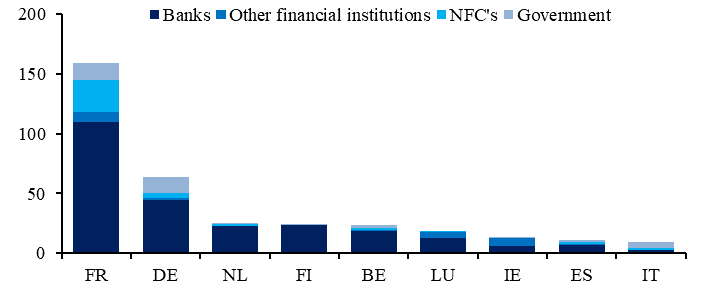

MMFs are an important source of short-term funding for financial institutions and corporations in the euro area, mostly through purchases of commercial paper (CP), certificates of deposit (CD) and government bills (see also FSB, 2020). Low volatility net asset value (LVNAV) funds are the dominant fund type in Europe and faced the most pronounced outflows during the crisis. LVNAV funds mainly invest in private sector securities, in particular denominated in USD, coming in five times higher than EUR-denominated investments.2 Most of EUR-denominated short term debt in the euro area is issued by banks (EUR 550bn), followed by other financial institutions (EUR 170bn) and non-financial corporations (EUR 85bn).3 The share of MMFs in these short-term funding markets is 70 percent.4 While European MMFs are predominantly domiciled in Ireland (EUR 580bn), Luxembourg (EUR 345bn) and France (320bn), SHSS data show that these MMFs invest in short-term debt throughout the entire euro area, (although investments in France dominate, Figure 1).5 Due to their presence in the market for short-term marketable debt, MMFs play an important role in the first step of the transmission of monetary policy to the real economy.

Figure 1: Euro area holdings of MMFs in the euro area (in EUR billions)

Source: Securities Holdings Statistics by Sector (SHS-S), nominal holdings end 2019.

MMF liquidity strains are not an isolated problem as they have important implications for the transmission of monetary policy to the real economy for two reasons. Firstly, short-term marketable debt is important for European banks, especially for those with relatively few deposits. While for most European banks short-term debt makes up only a small portion of total funding (covering less than 3% of total funding needs due to their large share of deposit financing), commercial paper plays an important role in banks’ liquidity management. This is because the commercial paper market is important for banks to obtain funding over 30 days, which improves the liquidity coverage ratio (LCR). Secondly, following the benchmark reform of risk-free rates in the euro area, bank commercial paper rates are directly included in the euro interbank offered rate (EURIBOR).6 EURIBOR serves as an important benchmark for more than EUR 180.000 bn of contracts, of which more than EUR 1.000bn of retail mortgages (EMMI, 2021b). The pronounced outflows in the MMF sector led to a malfunctioning commercial paper market, driving up bank CP rates. As a result, EURIBOR rose to levels last seen in 2016, despite unprecedented monetary easing by the Eurosystem.

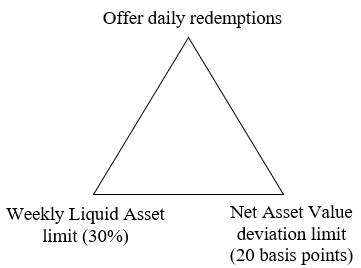

The Covid-19 crisis has shown that in particular LVNAV MMFs were prone to run-risk. ‘Low volatility’ refers to the fact that these funds are required to report a relatively stable asset value. In times of stress LVNAV funds have to sell assets to be able to meet daily redemptions, while at the same time the EU MMF Regulation7 prescribes that they should keep weekly liquid assets (WLA) above 30% of their net asset value (NAV) and the deviation from the mark-to-market value NAV within 20bps (Figure 2). In other words, to meet redemptions funds can either sell their most liquid assets which results in a decline of their WLA or choose to dispose of less-liquid assets resulting in a higher NAV deviation (as funds have to sell against discount prices given low liquidity in the underlying market).8 In case these deviations move outside of the ‘bandwidth’ (collar), a fund needs to convert to a variable net asset value fund (VNAV).

Figure 2: The (impossible) LVNAV regulatory triangle

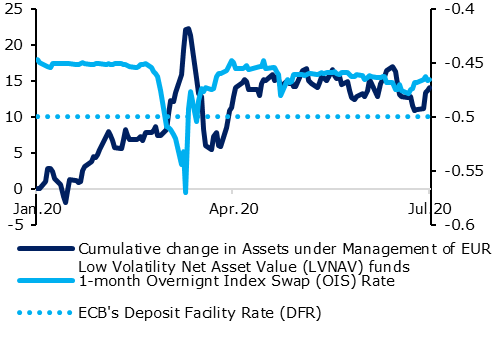

Ironically, low volatility funds have seen the most volatile flows during the onset of the COVID-19 pandemic. Interest rate shocks – originating from expectations on central bank monetary policy actions – contributed to the large flows these funds encountered. In the run-up to the ECB monetary policy meeting in March 2020, markets largely expected the ECB to cut policy rates against the background of huge economic uncertainty. This is reflected in the significant drop of the 1-month OIS rate (light blue line Figure 3). The drop in interest rates led to a gain from derivatives positions via OIS swaps for parties that use those swaps to hedge their interest rate risk, such as pension funds. As a result, MMFs – in their role as cash-management vehicle – experienced relatively large inflows from market participants who put these margin-related inflows at MMFs. However, when the ECB surprised markets by keeping the policy rate (deposit facility rate, DFR) unchanged, this dynamic reversed. Consequently, where market participants first received variation margin, they now had to post sizeable variation margin, causing strong outflows at several funds (Figure 3, see ECB (2020b)).

| Figure 3: Interaction between DFR-OIS spread and MMF flows (Flows in EUR bn, DFR and 1-month OIS RHS)

|

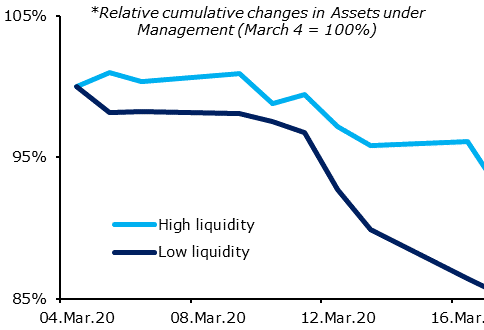

Figure 4: Assets under Management depend on liquidity position individual funds |

|

|

Source: iMoneyNet. Note: While iMoneyNet covers almost the entire US, for the euro area it covers only Ireland and Luxembourg (and thus not France). Funds are grouped in ‘high vs low liquidity’ through determining the average weekly liquid asssets (WLA) per fund over January and February 2020. The median of the average WLA of all funds is used to split the funds during March in ‘High liquidity’ and ‘Low liquidity’ funds. In the figure, we focus on USD LVNAV funds as they experienced the biggest outflow in Europe. Similar findings were reported by ESMA (2021a).

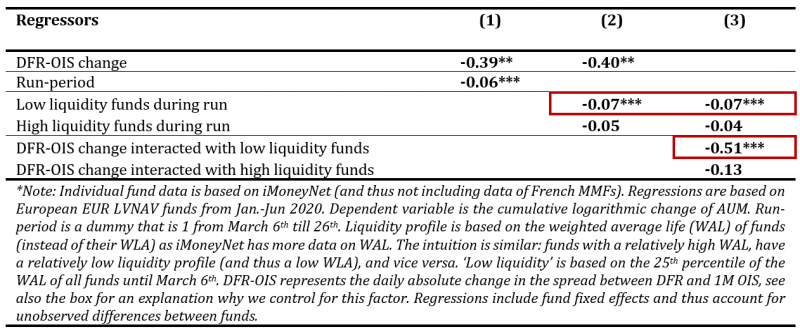

On top of that, liquidity restrictions for LVNAV funds seem to have worked counterproductive as the outflows at MMFs were amplified by regulatory liquidity restrictions. The threat of restrictions triggered procyclical investment behaviour, leading to pre-emptive runs before liquidity restrictions kicked in. Indeed, outflows were more severe among funds with a lower percentage of liquid assets on their books (Figure 3), as also confirmed by our regressions on an individual fund level (Table 1, column 2). When the factors of regulation and interest rate shocks are combined in a regression on an individual fund level, we find that the DFR-OIS spread is only significantly related to MMFs that have a relatively less liquid portfolio (Table 1, column 3). Consequently, the regression analysis confirms that liquidity restrictions introduced by MMF reforms may have amplified the run on MMFs by creating a first-mover advantage.

Table 1: MMF outflows only significant for funds with a relatively low percentage of liquid assets on

their books*

The amplifying role of liquidity regulation at the fund level calls for a revisit of the regulatory framework of MMFs in the euro area. While the ECB has successfully alleviated stress at European MMFs – through the purchase of non-financial commercial paper and extension of lending operations (i.e. TLTROs and collateral easing) – macroprudential policy remains the first line of defence. To safeguard money market functioning in times of stress, two aspects of macroprudential policy deserve special consideration, especially in light of the upcoming MMF Regulation review (ESMA, 2021b)9, and recently published FSB proposals (FSB, 2021).

First, macroprudential policy should aim to reduce the likelihood of adverse feedback loops and amplification effects by MMFs in times of stress. More specifically, the imposition of gates can be decoupled from liquidity requirements, while simultaneously the cost associated with redeeming investments should be passed on to the investors that are withdrawing cash. This can be done for example through swing pricing, anti-dilution levies (ADLs) or liquidity fees. This higher cost of withdrawing lowers the incentive to redeem. Requiring MMFs to have at least one of these mechanisms available could decrease the first mover advantage.

Second, macroprudential policy should reduce liquidity mismatches at MMFs. A first step is to adjust liquidity requirements, for example by accompanying a daily and weekly liquidity requirement with a public debt requirement (ECB, 2020a), which is traditionally more liquid paper. As a next step, liquidity requirements should act countercyclically to ensure MMFs are allowed to draw down on their buffers when needed. New rules could specify when liquidity requirement breaches are permissible. This in turn should not create new threshold effects.

These two macroprudential measures can be incorporated into the European MMF Regulation, as well as into national legislation, thereby preserving a level-playing field across borders. Together, these proposals contribute to the resilience of the MMF sector and will also minimize the likelihood for future central bank action.

Cipriani, M. and G. La Spada (2021) – Preemptive Runs and the Offshore U.S. Dollar Money Market Funds Industry

Dunne, P. and R. Giuliana (2021) – Did liquidity limits amplify money market fund redemptions during the COVID crisis?

ECB (2020a) – How effective is the EU Money Market Fund Regulation? Lessons from the Covid-19 turmoil

ECB (2020b) – Interconnectedness of derivatives markets and money market funds through insurance corporations and pension funds

EMMI (2021a) – EURIBOR Reform

EMMI (2021b) – About EURIBOR

ESMA (2021a) – ESMA report on Trends, Risks and Vulnerabilities, No. 1, 2021

ESMA (2021b) – Consultation on EU Money Market Fund Regulation – Legislative Review

FSB (2020) – Holistic Review of the March Market Turmoil

FSB (2021) – Policy proposals to enhance money market fund resilience: Final report

We would like to thank Joost Bats, who contributed to a previous version of this article.

LVNAV funds are the most prevalent fund type in LU and IE. European MMFs are furthermore categorized into variable net asset value (VNAV, most dominant in FR) and constant net asset value (CNAV) funds. For European LVNAV and VNAV funds the portfolio composition is similar to US prime funds, but only LVNAV funds have tools to mitigate redemption pressure. European CNAV funds are closest to the US government MMFs in terms of asset composition, but in contrast to US gov’t MMFs, they can introduce liquidity restrictions.

Data refer to the end of 2019 (explicitly prior to COVID-19). Source: the ECB’s Statistical Data Warehouse.

20 percent constitute MMFs in the US.

French and Luxembourgish funds invest primarily in euro area assets (resp. 80 and 70 percent) in contrast to Irish funds (i.e. 40 percent).

Interbank offered rates had to be reformed after the LIBOR-scandal. After the reforms, they have to be based on real transactions instead of expert judgement, to diminish the possibility that the benchmarks can be ‘gamed’. For EURIBOR this means it is determined via a so-called ‘waterfall’ methodology, incorporating commercial paper issuance of banks. See also EMMI (2021a).

Regulation (EU) 2017/1131 of the European Parliament and of the Council of 14 June 2017 on money market funds.

ESMA (2021a) reported that no funds breached the +/- 20bps collar, although a few funds were close (e.g. one fund had a 18bps deviation).

By 21 July 2022, the Commission shall review the adequacy of the MMF Regulation from a prudential and economic point of view, following consultations with ESMA.