References

Baker, S R, N Bloom, S J Davis, K Kost, M Sammon and T Viratyosin (2020), “The unprecedented stock market reaction to COVID-19”, NBER Working Paper No. 26945.

Beber, A and M Pagano (2009), “Short-Selling Bans around the World: Evidence from the 2007-09 Crisis”, CEPR Discussion Paper 7557.

Capelle-Blancard, G, and A Desroziers (2020), “The stock market is not the economy? Insights from the COVID-19 crisis”, Covid Economics: Vetted and Real-Time Papers, CEPR.

Cipriani, M. and G. La Spada (2020), Sophisticated and unsophisticated runs. Federal Reserve Bank of New York Staff Reports 956.

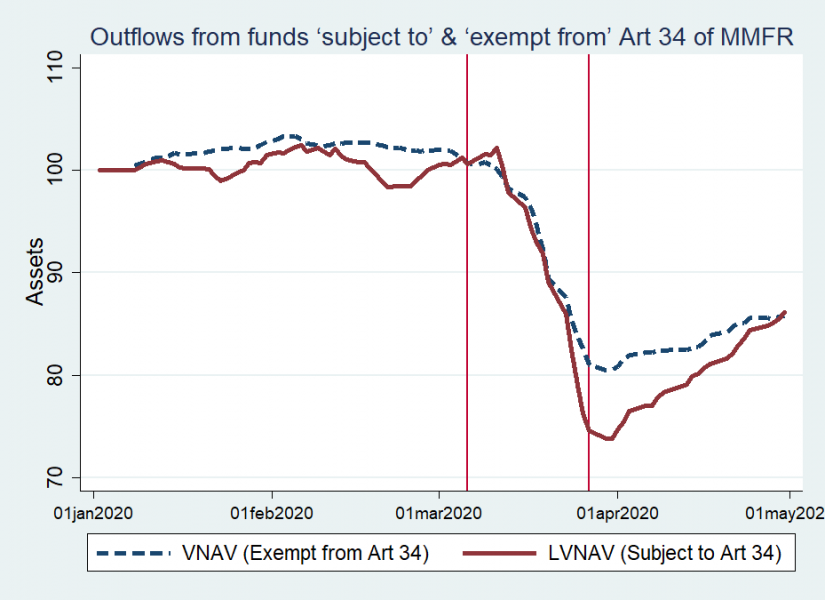

Dunne, P. G. and R. Giuliana (2021), Do liquidity limits amplify money market fund redemptions during the COVID crisis? ESRB Working Paper Series No. 127.

ESRB (2020), Liquidity risks arising from margin calls. European Systemic Risk Board, ESRB Report.

FSB (2021), “Holistic Review of the March Market Turmoil”.

Rousova, L., M. Ghio, S. Kordel, and D. Salakhova (2021), Interconnectedness of derivatives markets and money market funds through insurance corporations and pension funds. ECB Financial Stability Review, November 2020.

Schmidt, L., A. Timmermann, and R. Wermers (2016), Runs on money market mutual funds. American Economic Review 106(9), 2625{2657.