This policy brief is based on BIS Working Papers, No 1255. The views expressed in them are those of their authors and not necessarily the views of the BIS.

Abstract

Policymakers see manufactured homes, the largest source of unsubsidized affordable housing, as a key solution to the acute housing shortage in the US. This brief discusses recent research showing that high market concentration in the manufactured home loan market allows lenders to charge much higher interest rates compared to loans for traditional homes. Further evidence indicates that the rate premium is driven especially by lenders that are integrated with home manufacturers, and that these lenders may be exploiting their market power over borrowers.

For decades, expanding homeownership has been a key public policy goal in the United States and many other countries. Owning a home helps families build wealth and achieve financial stability, especially for historically disadvantaged groups. Homeownership is also associated with higher savings rates and offers financial benefits, such as favorable tax treatment and better returns compared to other investments. Additionally, housing wealth can support entrepreneurship and investment by providing collateral for loans.

However, the dream of homeownership is increasingly out of reach for many due to a severe housing shortage and rising home prices. Construction costs have surged, contributing to a growing gap between housing demand and supply, with recent estimates suggesting a shortfall of four million homes in the US. At the same time, the cost of a typical home has risen sharply over the past few decades, making housing less affordable for many families.

One proposed solution to the housing shortage is manufactured homes. Manufactured homes, also called mobile homes, are prefabricated, permanent residences that are factory-built and then installed on a lot. Their sales price is oftentimes less than half of what a similarly sized on-site home would cost, largely reflecting substantially cheaper construction costs. Policy makers hence place high hopes in manufactured homes to ease supply constraints in the housing market.

Manufactured homes currently house about 17 million Americans, making them the largest source of unsubsidized affordable housing. The market for manufactured home loans is also sizable: between 2018 and 2022, lenders originated almost one million manufactured home mortgages for a total of about $150 billion, predominately to borrowers with lower socio-economic status. The market for manufactured home loans is thus comparable in size to other important loan markets, such as the market for payday loans with an annual volume of $30 billion. And yet, despite its importance and size, the market structure and lending conditions for manufactured home loans have received much less attention than the mortgage market for site-built homes.

This policy brief draws on recent research to provide novel evidence that the market for manufactured home loans is characterized by substantial market concentration that contributes to very high interest rates (Doerr and Fuster, 2025).1

The loan market for manufactured homes is characterized by much higher local market concentration than the market for site-built mortgages. To measure market concentration, we use the Hirschman-Herfindahl Index (HHI), which ranges from zero to one and is a common measure of lenders’ market power and ability to set interest rates . A value closer to zero indicates less market concentration (i.e. more competition), while a value close to one indicates high market concentration (i.e., less competition). In the average county, the HHI for manufactured home loans is more than three times larger compared to site-built mortgages. Moreover, every third county has an HHI that exceeds 0.25, i.e., is classified as highly concentrated, in the manufactured home loan market. This compares to only 2% of highly concentrated counties in the market for site-built loans.

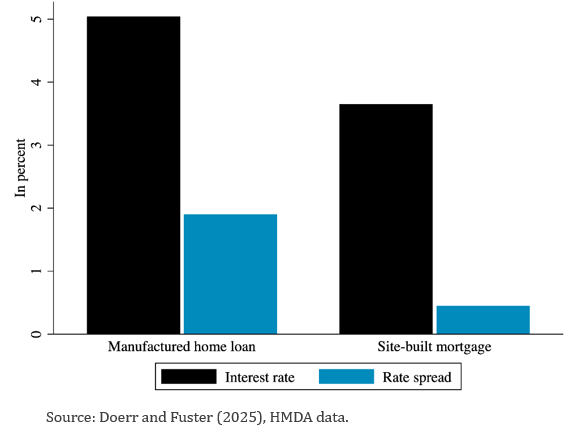

Figure 1 further shows that, compared to site-built mortgages, manufactured home loans have substantially higher interest rates (5% vs 3.6%) and rate spreads (1.9 percentage points (pp) vs 0.5 pp). The latter are defined as the difference between a loan’s interest rate (in terms of annual percentage rate, APR, which incorporates upfront costs) and the average APR on similar-maturity mortgage loans issued to prime borrowers at the same time. Compared to site-built mortgages, borrowers in the manufactured home loan market have lower incomes and are more likely to be white, under 35 or over 62 years old.

Figure 1. Manufactured home loans have very high interest rates

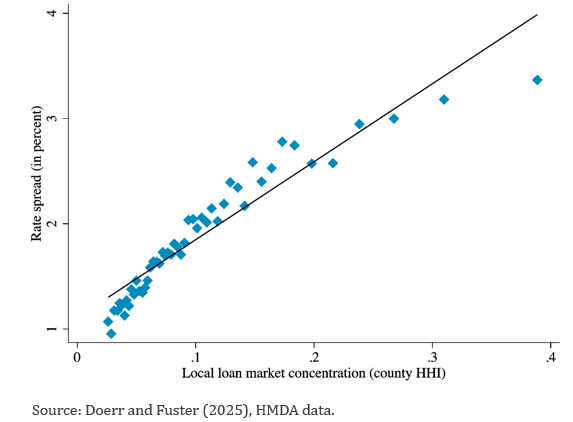

Moreover, there is a significant positive relationship between local market concentration and rate spreads. Figure 2 illustrates this by plotting rate spreads on the vertical axis against the county-level HHI on the horizontal axis. After controlling for a rich set of borrower, loan and location characteristics, Doerr and Fuster (2025) estimate that a 10 basis point (0.1) higher county-level HHI is associated with a 10 basis point higher rate spread. This result stands in stark contrast to analyses for the site-built mortgage market, where studies typically find little relationship between local concentration measures and rate spreads.

Figure 2. More concentrated manufactured home loan markets have higher rate spreads

Additional evidence on the nexus between market concentration and rate spreads comes from loans with rate spreads around the Home Ownership and Equity Protection Act (HOEPA) threshold. HOEPA seeks to ensure that borrowers who take out high-cost loans, defined as having a rate spread exceeding 6.5 pp, have a clear understanding of the terms. High-cost mortgages are therefore subject to additional consumer protections, such as special disclosures and restrictions on loan features. Moreover, they come with various restrictions and require the lender to provide transparency to the borrower about all costs entailed. These requirements imply significantly higher administrative and compliance costs for the lender and make lenders reluctant to originate loans with spreads above the threshold.

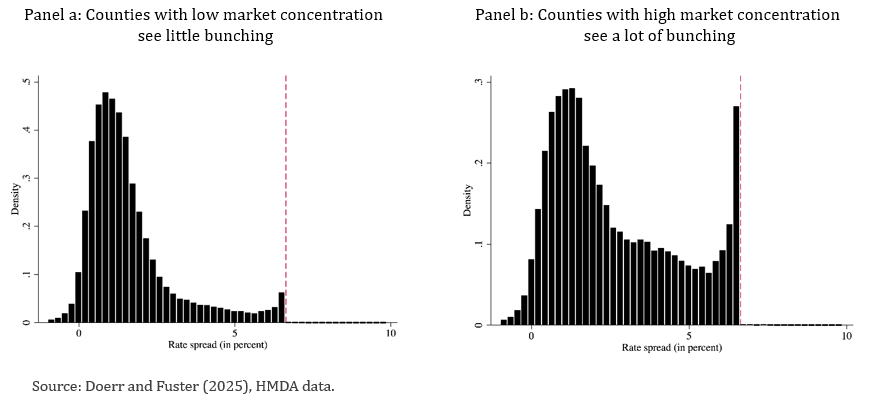

There is a positive and highly significant effect of the HHI on the probability of a loan having a rate spread in the bunching region. Figure 3 shows this by plotting the distribution of rate spreads in counties with a low and a high HHI, respectively. Bunching is much more frequent in concentrated markets with a high HHI. In particular, a 10 bp increase in the HHI within county increases the probability of a loan having a rate spread in the bunching region by 0.15 pp, relative to an unconditional mean of 4%. As discussed in Doerr and Fuster (2025), this bunching suggests market power. In a perfectly competitive market, a threshold above which origination costs discontinuously increase would lead to a “missing mass” of observations right above the threshold, but no bunching. In the presence of market power, however, lenders can charge a markup so that the rate spread exceeds the loan cost. Lenders can thus decide to give up some of their rents to avoid paying the higher costs associated with HOEPA. The resulting bunching below the threshold is then indicative of market power (Bachas et al., 2021; Cox et al., 2023).

Figure 3. Bunching below the HOEPA threshold indicates substantial market power

Moreover, focusing on the introduction of HOEPA in January 2014 shows that the introduction of HOEPA significantly reduced rate spreads in more concentrated markets. And the positive effect of market concentration on bunching below the threshold only emerged after the introduction of HOEPA, while there was no bunching and no correlation between market concentration and bunching prior to 2014. These results further suggest that the relationship between rate spreads and market concentration is not driven by borrowers’ unobservable credit risk, but that market concentration drives rate spreads.

One important contributor to concentration in the manufactured home loan market is the presence of integrated lenders, who account for over 20% of loans. The rate spreads they charge are about 1.8 pp higher than those of nonintegrated lenders, controlling for all the borrower observables as well as county and year fixed effects. These higher rates are the opposite of what one might expect if integrated lenders have informational advantages (e.g., because they know the quality of collateral better than other lenders); instead, they suggest that integrated lenders may be exploiting their market power over borrowers at the point-of-sale of the home.

An alternative explanation for the higher rate spreads of integrated lenders is that they are part of a bundling strategy: cash-constrained buyers may be willing to pay a higher interest rate in return for a lower price on their manufactured home. Doerr and Fuster (2025) test this in two ways, but do not find support for the predictions from bundling. First, rate spreads at integrated lenders are not differentially higher for borrowers with low income (relative to the typical purchase price for a manufactured home in their area), who should benefit most from such bundling. Second, bundling would predict that after HOEPA was introduced, loan amounts and application denial rates at integrated lenders should increase, but there is no evidence supporting these predictions in the data.

A naive look at the US housing market might suggest that while house prices are high, the mortgage market is highly competitive and quite efficient. Cheaper housing options should thus alleviate supply constraints and provide an affordable alternative to the ownership of site-built homes. However, due to high market concentration and lenders’ market power, the cheaper price of manufactured homes may be partly outweighed by higher financing costs in the loan market for these homes. Policy initiatives that promote manufactured housing should thus also consider the lack of competition, and in particular the role of integrated lenders, in the mortgage market for manufactured homes.

An additional insight is that consumer protection regulation in the form of HOEPA can benefit many manufactured home buyers. Due to high market concentration and lenders’ market power, without HOEPA manufactured home loans would have even higher rates on average. Lowering the HOEPA threshold further could thus reduce the cost of financing manufactured homes without materially affecting the supply of loans.

Finally, the evidence from the market for manufactured home loans informs the long-standing debate on market power and loan pricing in the US mortgage market. Most studies have failed to establish a reliable link between market concentration and loan rates for mortgages (Hurst et al., 2016; Bhutta et al., 2024; Buchak and Jørring, 2024; Fuster et al., 2024). Rather, the US mortgage market is generally considered as highly competitive. The findings discussed in this brief show that a segment of the mortgage market that is particularly important for low-income borrowers is characterized by low competition and high spreads, even if the mortgage market as a whole is deemed competitive.

Bachas, N, O Kim, and C Yannelis (2021): “Loan guarantees and credit supply,” Journal of Financial Economics, 139, 872–894.

Bhutta, N, A Fuster, and A Hizmo (2024): “Paying Too Much? Borrower Sophistication and Overpayment in the US Mortgage Market,” Journal of Finance, forthcoming.

Buchak, G and A Jørring (2024): “Competition with Multi-Dimensional Pricing: Theory and Evidence from U.S. Mortgages,” Working Paper.

Cox, N, E Liu, and D Morrison (2023): “Market power in small business lending: A two-dimensional bunching approach,” Working Paper.

Doerr, S and A Fuster (2025): “Affordable housing, unaffordable credit? Concentration and high-cost lending for manufactured homes,” BIS Working Paper, 1255.

Fuster, A, S H Lo, and P S Willen (2024): “The Time-Varying Price of Financial Intermediation in the Mortgage Market,” Journal of Finance, 79, 2553–2602.

Hurst, E, B J Keys, A Seru, and J Vavra (2016): “Regional redistribution through the US mortgage market,” American Economic Review, 106, 2982–3028.

The study is based on public application-level data on manufactured home loans collected under the Home Mortgage Disclosure Act (HMDA).