References

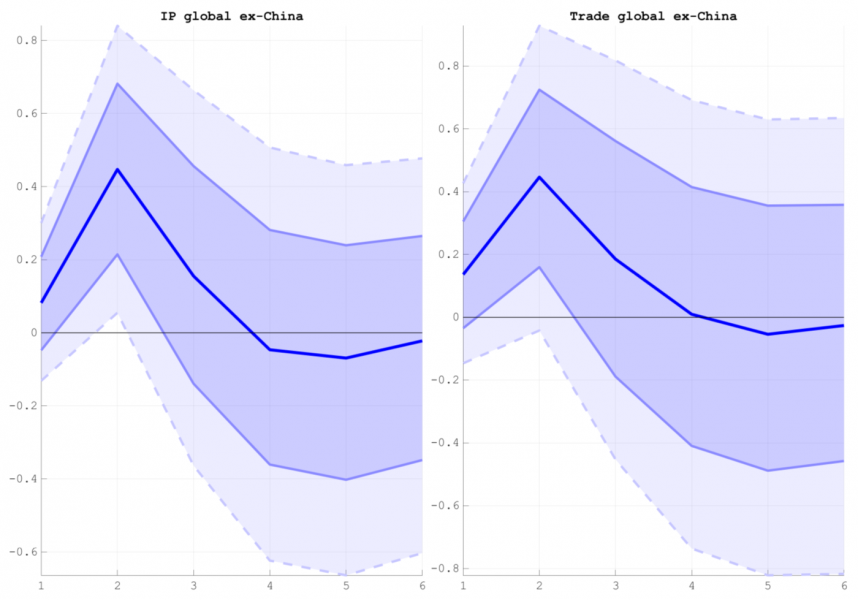

Barcelona, W., Cascaldi-Garcia, D., Hoek, J., and Van Leemput, E. “What Happens in China Does Not Stay in China”, International Finance Discussion Paper, (1360) (2022).

Boehm, C. E. and Kroner, T. N. “The US, economic news, and the global financial cycle”, NBER working paper (2023).

Clark, H., Pinkovskiy, M., and Sala-i Martin, X. “China’s GDP growth may be understated”, NBER working paper (2017).

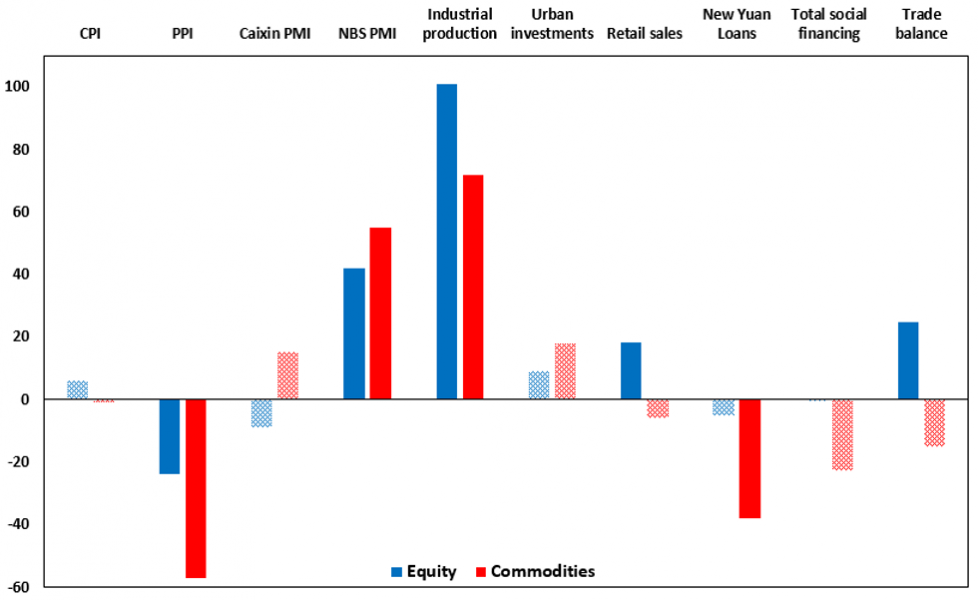

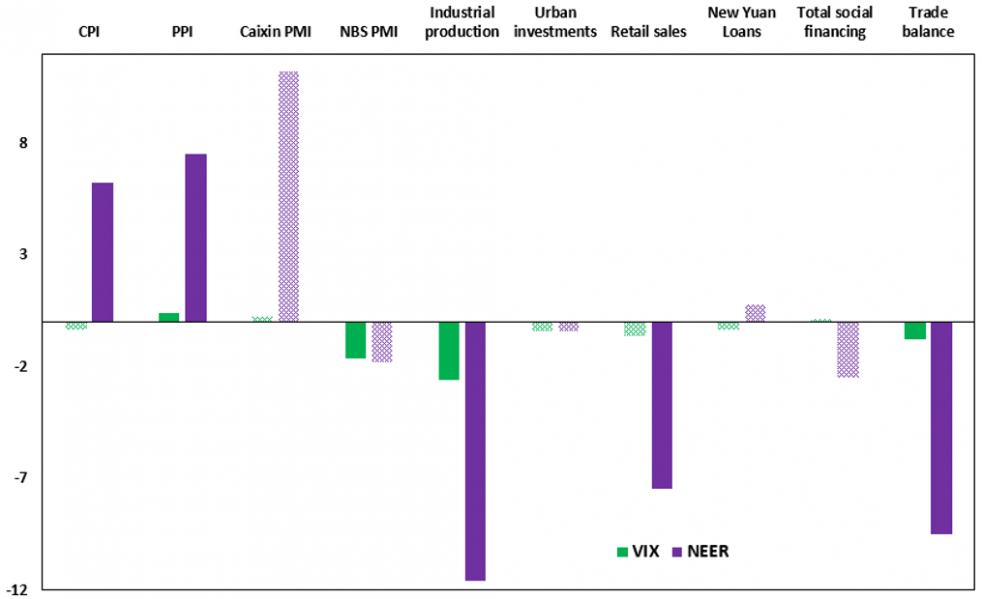

Corneli, F., Ferriani, F., and Gazzani, A. “Macroeconomic News, the Financial Cycle and the Commodity Cycle: the Chinese Footprint”, Economics Letters, forthcoming.

Fernald, J. G., Hsu, E., and Spiegel, M. M. “Reprint: Is China fudging its GDP figures? Evidence from trading partner data”, Journal of International Money and Finance, 114:102406 (2021).

Miranda-Agrippino, S., Nenova, T., and Rey, H. “Global footprints of monetary policies”, CFM, Centre for Macroeconomics (2020).