At the request of the author, this policy brief has been temporarily withdrawn for revision and will likely be reposted upon finalisation of the revision.

Alex Kim is a Ph.D. candidate in accounting at the University of Chicago, Booth School of Business. He received a Master’s degree in Business Administration with a concentration in Accounting and a dual Bachelor’s degree in Economics and Business Administration, Summa Cum Laude, from Seoul National University. His research mainly examines the information processing of investors in the capital market. His research has been featured in major media outlets such as Financial Times, Bloomberg, Fortune, and Forbes, and funded by Ernest R. Wish Ph.D. Research Fellowship and Fama-Miller Center for Finance Research.

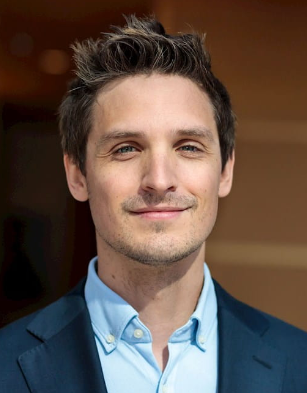

Maximilian Muhn is an Associate Professor of Accounting at University of Chicago, Booth School of Business. He is broadly interested in empirical accounting research. His current work focuses on the determinants and consequences of firms’ financial transparency, as well as the effects of financial market and transparency regulation. Maximilian earned a PhD in accounting from Humboldt University of Berlin and he holds an MSc and a BSc in business administration from the University of Munster, Germany. During his studies, he gained work experience in consulting (McKinsey & Company and Boston Consulting Group), auditing (KPMG and Deloitte) and management accounting (BASF and ThyssenKrupp Steel).

Valeri Nikolaev is James H. Lorie Professor of Accounting and FMC Faculty Scholar at the University of Chicago, Booth School of Business. He studies the role of financial reporting and information in capital markets and contracting. His current research focuses on the transformative effects of emerging technologies, notably Generative AI and Large Language Models, on information processing and market efficiency. Nikolaev’s primary interests revolve around the potential of AI tools to assist investors in making well-informed decisions, thereby fostering more efficient and equitable capital markets. His latest scholarly contributions shed light on unstructured narrative data and emphasize the significance of context when deciphering numerical information.