References

Adelino, M., Schoar, A., & Severino, F. (2012). Credit supply and house prices: evidence from mortgage market segmentation.

NBER Working Paper, No. 17832. National Bureau of Economic Research.

Baron, M., & Dieckelmann, D. (2022). Historical Banking Crises: A New Database and a Reassessment of their Incidence and Severity. In Schularick, M. (ed), Leveraged: The New Economics of Debt and Financial Fragility (Chapter 9, pp. 207-232). University of Chicago Press.

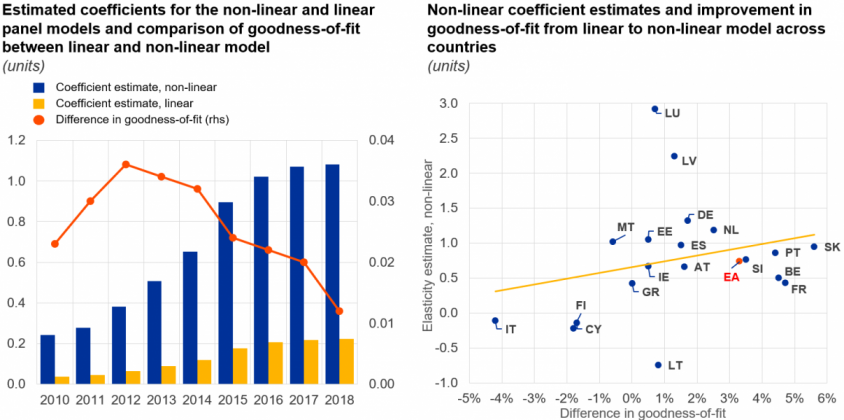

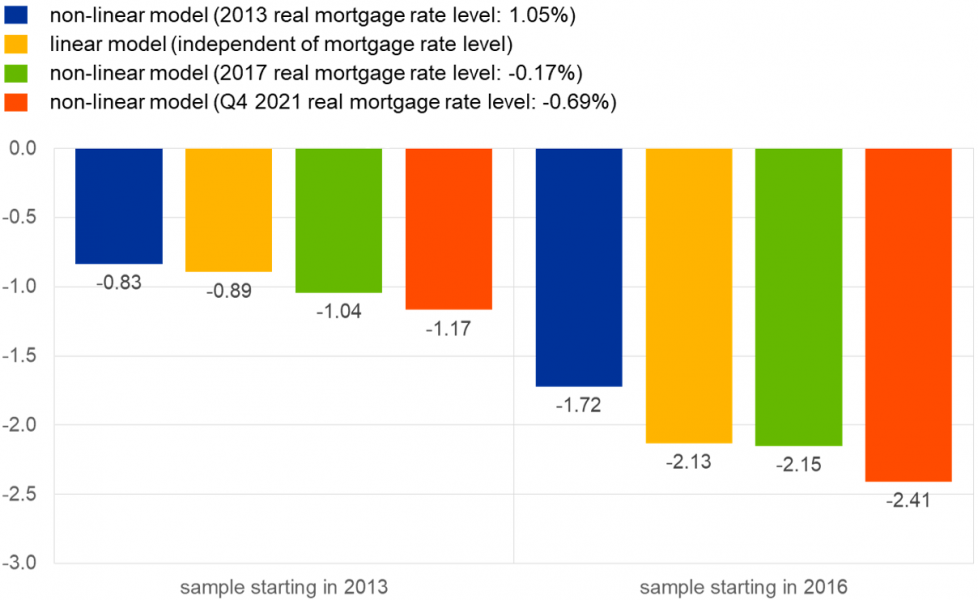

Dieckelmann, D., Hempell, H. S., Jarmulska, B., Lang, J. H., & Rusnák, M. (2023). House prices and ultra-low interest rates: exploring the non-linear nexus. ECB Working Paper, No. 2789. European Central Bank.

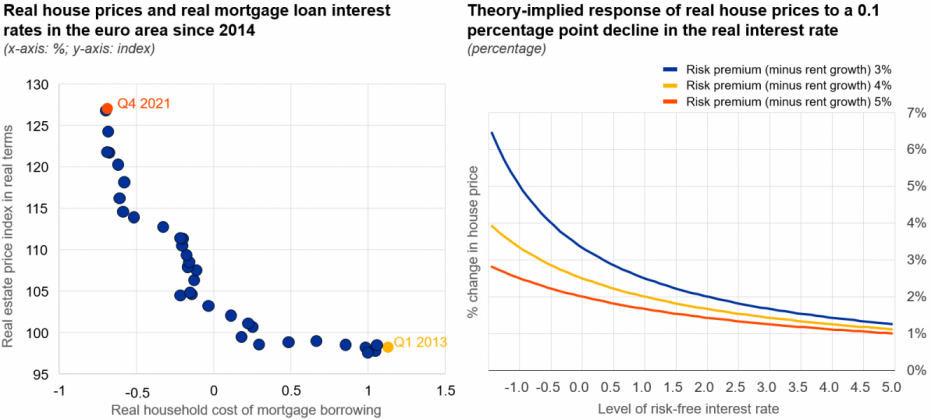

Himmelberg, C., Mayer, C., & Sinai, T. (2005). Assessing high house prices: Bubbles, fundamentals and misperceptions. Journal of Economic Perspectives, 19(4), 67-92.

Iossifov, P., Čihák, M., & Shanghavi, A. (2008). Interest Rate Elasticity of Residential Housing Prices. IMF Working Paper, No. 08/247. International Monetary Fund.

Igan, D., Kohlscheen, E., & Rungcharoenkitkul, P. (2022). Housing market risks in the wake of the pandemic. BIS Bulletin, No. 50. Bank for International Settlements.

Jordà, Ò., Schularick, M., & Taylor, A. M. (2015). Betting the house. Journal of International Economics, 96(1), S2-S18.

Kuttner, K. N. (2012). Low interest rates and housing bubbles: still no smoking gun. In Evanoff, D. D., Holthausen, C., Kaufman, G.

C., Kremer, M. (eds.), The Role of Central Banks in Financial Stability: How Has It Changed? (pp. 159-185). World Scientific Publishing.

Lim, G. C., & Tsiaplias, S. (2016). Non-linearities in the relationship between house prices and interest rates: Implications for monetary policy. Melbourne Institute Working Paper Series, No. 2/16. University of Melbourne.