This Policy Brief is based on Banco de España Documentos de Trabajo. N.º 2328. The views expressed in this policy brief are those of the author and do not necessarily reflect those of the Deutsche Bundesbank or the Banco de España.

Many economies around the world set up ambitious climate goals. Carbon pricing is considered an important policy tool to reach them. We analyse different pricing scenarios and their consequences for Germany and Spain using the environmental multi-sector dynamic general equilibrium model EMuSe. In particular, we study the effects of unilateral, European and global carbon pricing schemes, including a border adjustment mechanism. Unilateral attempts of Germany or Spain lead to a permanent negative effect on output in these economies. However, in a common European carbon pricing scheme long-run output effects are positive as less damage from emissions overcompensates the increase in marginal production costs. We also find evidence for carbon leakage, which a border adjustment mechanism reduces only slightly. While Germany benefits from border adjustment, Spain actually loses. In the end, Europe as a whole has a strong incentive to get the rest of the world on board as the downturn is then shorter and long-run benefits are larger.

Key policy insights:

Many economies around the world have agreed upon ambitious climate goals. Mitigation policies that are currently discussed center around pricing carbon emissions. Moreover, border adjustment mechanisms and the formation of climate clubs range high on the political agenda. This policy brief summarizes the results of Hinterlang (2023), who analyses different carbon pricing regimes with a focus on two European economies, Germany and Spain.

The present analysis builds on the model presented by Ernst et al. (2023), who use a three-region version of the environmental multi-sector model EMuSe (see Hinterlang et al., 2023). The model is calibrated for Germany (or Spain, respectively), the rest of Europe and the rest of the world.1

The model features a detailed input-output production structure. Each region consists of eleven different production sectors. The sectors vary in factor intensity, use of intermediate inputs, and contribution to final demand. Moreover, the model includes international trade of goods and assets. We specify the sector-specific parameters using the most recent release of the World Input-Output-Database (WIOD; see Timmer et al., 2015). Emissions occur as a by-product of production and carbon intensities differ by sector. We use environmental accounts provided by the European Commission and output data from the WIOD in order to calibrate these. Firms in each sector engage in costly abatement activities if there is a positive carbon price. The global stock of carbon increases with unabated emissions and firms suffer production damage depending on this stock of pollution. Abatement cost and damage function parameters differ between Europe and the rest of the world. Due to a lack of data, they are identical across sectors and European countries.

For each of the two calibration variants (Germany or Spain, rest of Europe and the rest of the world), we simulate the following four policy scenarios:

Based on NGFS (2022), we feed the carbon price path of a net zero emissions scenario exogenously into the model. The carbon border adjustment of scenario 3 entails that Europe taxes all imports from the rest of the world while exports to the third region are tax exempt. Production technologies are assumed to be constant. Hence, apart from endogenous change in abatement, the model abstracts from any structural transformation.

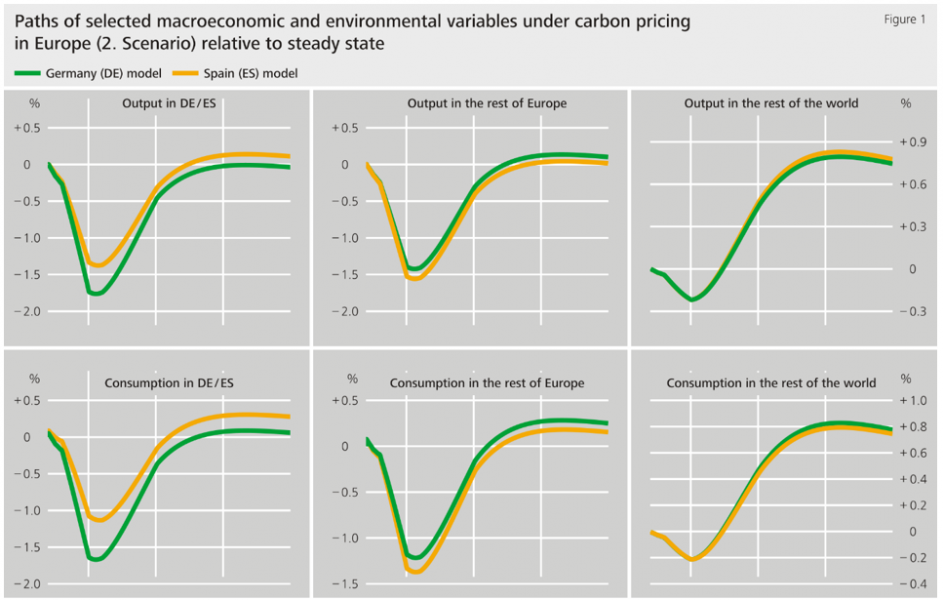

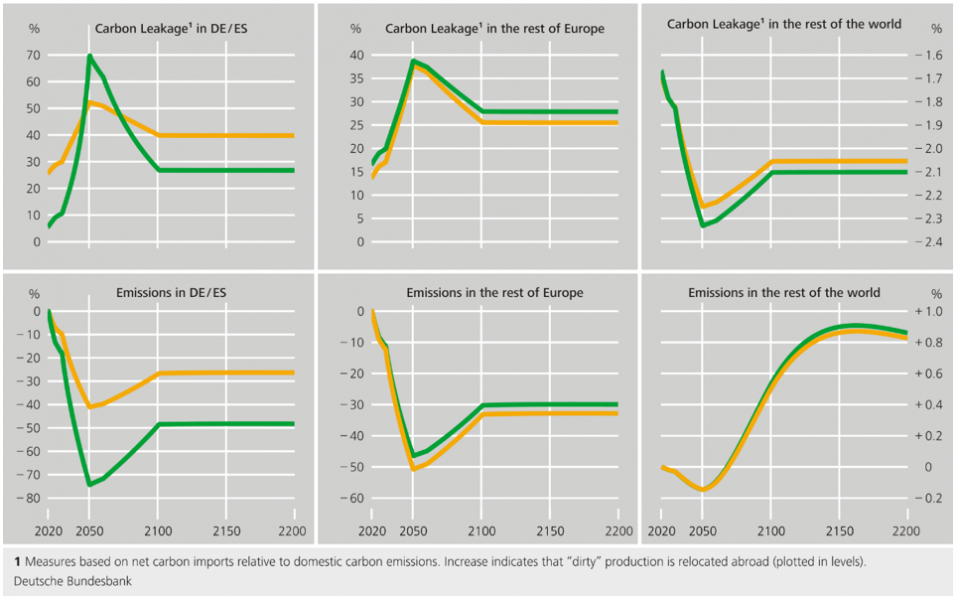

Figure 1 shows the results for our baseline scenario, in which Europe as a whole introduces the carbon price (simulation 2). They are depicted relative to the initial steady state. Green lines refer to the German calibration, orange lines to the Spanish one. In line with the findings of Ernst et al. (2023), we observe that carbon pricing leads to a long-lasting contraction of output. It takes time before the positive effect of reduced emissions damage overcompensates the effect from higher marginal production costs, increasing relative prices and weaker demand. The drop in output is more pronounced in Germany than in Spain. The reason is that Germany on average has a larger emission intensity of its output. While e.g. the agricultural sector pollutes moderately more in Spain, the emission intensity of the German energy sector is roughly three times higher than the Spanish one. For the same reason, emissions decrease more in Germany than in Spain in response to carbon pricing. We find evidence for carbon leakage in all regions participating in carbon pricing. While the rest of the world also faces small output losses in the beginning, it soon benefits from positive trade-spillovers, i.e. carbon leakage, and falling emissions.

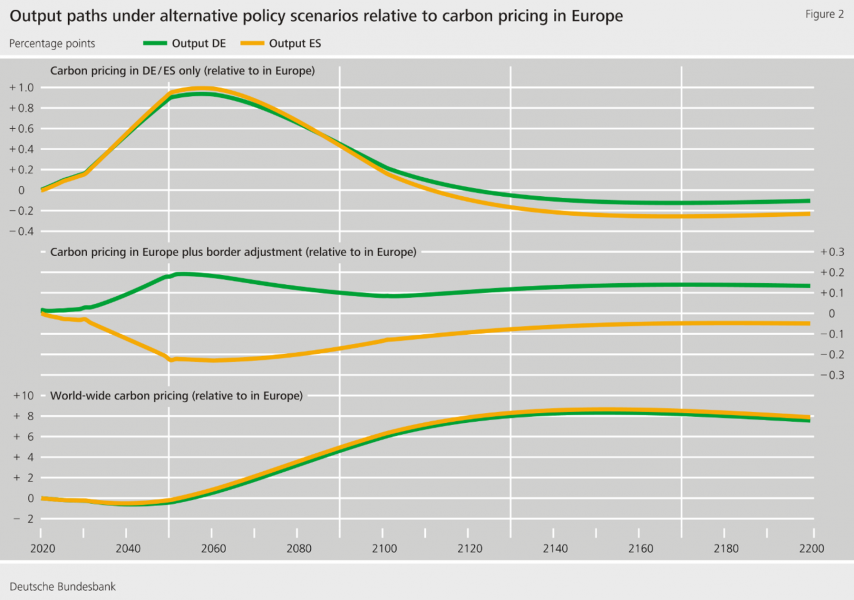

In Figure 2, we plot output developments in Germany and Spain under the alternative policy scenarios, all relative to our baseline scenario (simulation 2). We see that output would be larger during the transition but lower in the long run if the individual country introduces carbon pricing unilaterally (1. scenario). The reason is that a European carbon price places an additional burden on the German and Spanish economy due to close trade relationships within Europe. If the rest of Europe also conducts a policy that reduces demand (at least temporarily), imports from Germany and Spain fall. However, the long-run effect is positive since the emissions damage reduction is more sizable in this case.

Interestingly, the third scenario reveals that Germany benefits from a border adjustment mechanism, while Spain loses. This is mainly for two reasons. First, Germany exports more to the rest of the world than Spain does. Since exports are tax exempt under the simulated border adjustment, Germany benefits more strongly from such a mechanism. Second, Spain has a larger exposure towards dirty intermediate inputs from the rest of the world. Hence, Spain’s imports of intermediate inputs become relatively more expensive. In Spain, this cost-push apparently outweighs the positive effects, which yields an overall negative effect on output during the transition. For both model calibrations, it is still true that border adjustment reduces carbon leakage and the world emissions stock only to a small extent.

Finally, the fourth scenario illustrates that Europe has a strong incentive to get the rest of the world on board. Under global carbon pricing, the transition costs might be slightly larger but the downturn phase is shorter in Europe. In addition, the long-run benefits are much larger, which holds worldwide.

The detailed production structure of the model and structural differences between the German and Spanish economy offer further insights on sectoral effects of carbon pricing. In general, emission-intensive sectors (like the German energy sector, for example) are more affected by carbon pricing. However, sectors with a high export share to non-participating regions (such as the German manufacturing sectors that fall under the European emission trading system ETS) may benefit from stronger foreign demand even though their emission intensity is large. Moreover, dirty sectors with a weak dependence on intermediate inputs of their own (as the Spanish ETS transport sector, for example) or of other dirty sectors suffer less. In line with Ernst et al. (2023), we find that the border adjustment mechanism mainly protects emission intensive domestic sectors. Hence, the additional emissions reduction due to border adjustment is limited. In Spain, the energy sector benefits most because of its low emissions intensity compared to its foreign counterparts.

Our results imply that a European carbon pricing scenario initially increases transition costs compared to a unilateral carbon price, but positive effects from a larger emissions reduction pay off in the long run. Moreover, border adjustment is found to be beneficial for Europe as a whole, but this might not be the case for individual countries. While Germany gains from border adjustment, countries like Spain that depend more on relatively emission intensive imports from the rest of the world might actually lose. Finally, the most desirable scenario for Europe as a whole is a global carbon pricing scheme.

Ernst, A., N. Hinterlang, A. Mahle and N. Stähler (2023). Carbon pricing, border adjustment and climate clubs: Options for international cooperation. Journal of International Economics 144 (103772).

Hinterlang, N., A. Martin, O. Röhe, N. Stähler and J. Strobel (2023). The Environmental Multi-Sector DSGE model EMuSe: A technical documentation. Technical Paper 03/2023, Deutsche Bundesbank.

Hinterlang, N. (2023). Effects of Carbon Pricing in Germany and Spain: An Assessment with EMuSe. Working Paper N.° 2328, Banco de España.

NGFS (2022). NGFS Climate Scenarios Database. Technical Report, September 2022, Network of Central Banks and Supervisors for Greening the Financial System.

Timmer, M. P., E. Dietzenbacher, B. Los, R. Stehrer and G. J. De Vries (2015). An illustrated user guide to the world input-output database: The case of global automotive production. Review of International Economics 23(3), 575-605.

A detailed description of the EMuSe model including codes for sample applications and the calibration toolkit are available on the Bundesbank homepage: The Environmental Multi-Sector DSGE model EMuSe: A technical documentation | Deutsche Bundesbank.