This policy brief is based on Bartsch, F., Busies, I., Emambakhsh, T., Grill, M., Simoens, M., Spaggiari, M., & Tamburrini, F. (2024). Designing a macroprudential capital buffer for climate-related risks. ECB Working Paper No. 2943. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank.

Abstract

Climate change poses unprecedented risks to financial stability, requiring new and targeted approaches to mitigate its impact. To this end, our paper explores the design of a macroprudential capital buffer tailored to address climate-related risks, building on granular data and state-of-the-art climate stress testing methods. We first project losses due to climate transition risk by leveraging on the ECB top-down climate stress test. We document a large dispersion of banks’ exposure to transition risk, with the highest losses concentrated in the portfolios of banks characterized by lower excess capital. We then present a calibration methodology for a climate-related systemic risk buffer (SyRB), which enables to tailor bank-specific buffer requirements and to address the build-up of climate-related systemic risks in the banking sector, while limiting adverse impacts on bank lending. The focus of our application lies on transition risks, however, the flexibility of the framework allows to capture all types of climate risks in general and over different time horizons.

Climate-related risks are likely to represent a systemic risk for the financial system. This is due to specific features of these risks, such as (1) the irreversibility of climate-related risks; (2) their broad impact which limits risk diversification; (3) the non-linearity of climate change which increases the likelihood of tail-events; (4) complex interactions and the co-occurrence of climate-related risks with other (climate and non-climate) risk sources; (5) the fundamental uncertainty of these risks, further magnified by the reliance on imperfect historical data which may lead to risk underestimation, excessive build-up of risks and procyclical financing decisions. Should these vulnerabilities materialise, simultaneous shocks across sectors and regions could occur, spread, and amplify across the financial system through classic systemic risk channels. These considerations expose the limitations of conventional risk management tools to address the systemic aspects of climate change and highlight the need for a macroprudential approach complementing ongoing supervisory efforts to increase the preparedness of individual financial institutions against climate-related risks.

Our paper explores how macroprudential capital buffers in the form of a systemic risk buffer (SyRB), 1 can be tailored to address the systemic aspects of climate-related risks. The systemic risk buffer (SyRB) has been identified as a possible tool to address climate-related risks in the EU (EC, 2021; ECB/ESRB, 2022; ESRB, 2023; ECB/ESRB, 2023), however no established methodology to design and calibrate a climate SyRB has been developed so far. We fill this gap by introducing a novel methodology that builds on climate stress testing. Starting from an application targeting the transition risk dimension of climate change in the euro area banking sector, we propose a methodological framework for a climate multi-rate SyRB. Our application is based on projections from the 2023 ECB top-down climate stress test (SUERF Policy Brief No. 735 and Emambakhsh et al., 2023), which allows to address the largely forward-looking nature of climate risks and to calibrate the prudential response based on a severe, but realistic green transition scenario. By calibrating buffer rates based on granular estimates of climate-related losses, our framework also avoids the need to rely on broad classification systems of sectors highly exposed to climate (transition) risk prevalent in the literature, which could have the negative side-effect of hindering credit for the green transition of firms and exacerbate transition risks.

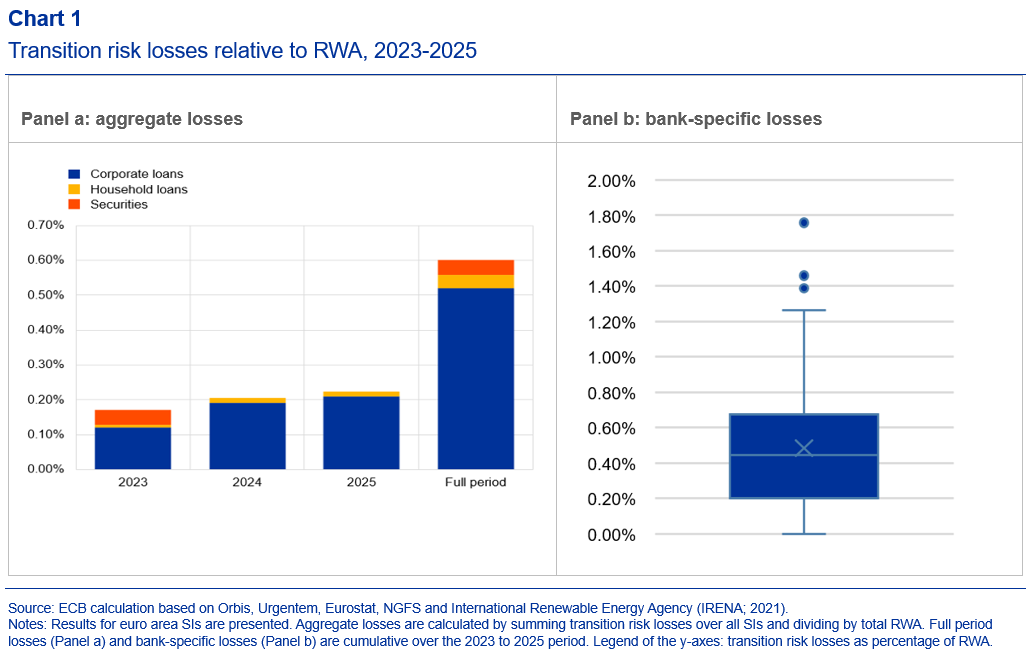

In the first step, we estimate the magnitude of climate transition risk losses for euro area banks building on the 2023 ECB top-down climate stress test. We start with projected probabilities of default (PDs) for non-financial corporations and households for the accelerated transition scenario over the 2023-2025 period2 from the climate stress test. This scenario assumes an immediate intensification of the transition process that brings the economy on a pathway compatible with net-zero emissions by 2050. Using granular data on the loan and securities portfolios of 107 euro area significant institutions (SIs), we project annual losses on banks’ corporate loan, household loan and corporate debt securities, both within and outside the euro area. We isolate losses due to the acceleration of transition efforts from the ones originating from current climate policies and broader macroeconomic developments (i.e. referred to as current policies scenario), assuming that banks have already adequately provisioned for these expected risk components and/or because these losses are targeted by other capital buffer requirements.

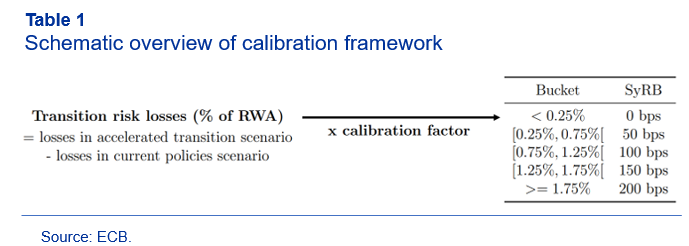

In the second step, we calibrate bank-specific buffer requirements based on a bucketing approach. Table 1 provides a schematic overview of the calibration framework. Due to the large heterogeneity of banks’ exposure to transition risk, we follow a multiple-rate structure, in which banks are allocated to different risk buckets depending on each bank’s projected transition risk losses. We then assign different buffer rates to banks allocated to different buckets with steps of 50 bps.3 In our baseline calibration, we consider a one-to-one mapping of projected losses into SyRB requirements. We then consider also different calibration factors that can be used to take into account possible overlaps with other capital (buffer) requirements or mitigate some of the limitations and uncertainties of the stress test framework.

The proposed bucketing methodology provides macroprudential authorities with flexibility to tailor the framework to the specificities of each jurisdiction. The bucketing approach is a pragmatic solution for the calibration of the SyRB, it also has the advantage of being simple and predictable, with a clear relation between the different buckets and the associated SyRB requirement. Moreover, the approach is aligned with the frameworks used for other buffers, such as the O-SII/G-SIB buffer and the P2G calibration. Nonetheless, given that some banks will potentially be very close to one of the thresholds, actual policy implementation might require some expert judgement to avoid cliff-effects or window-dressing.

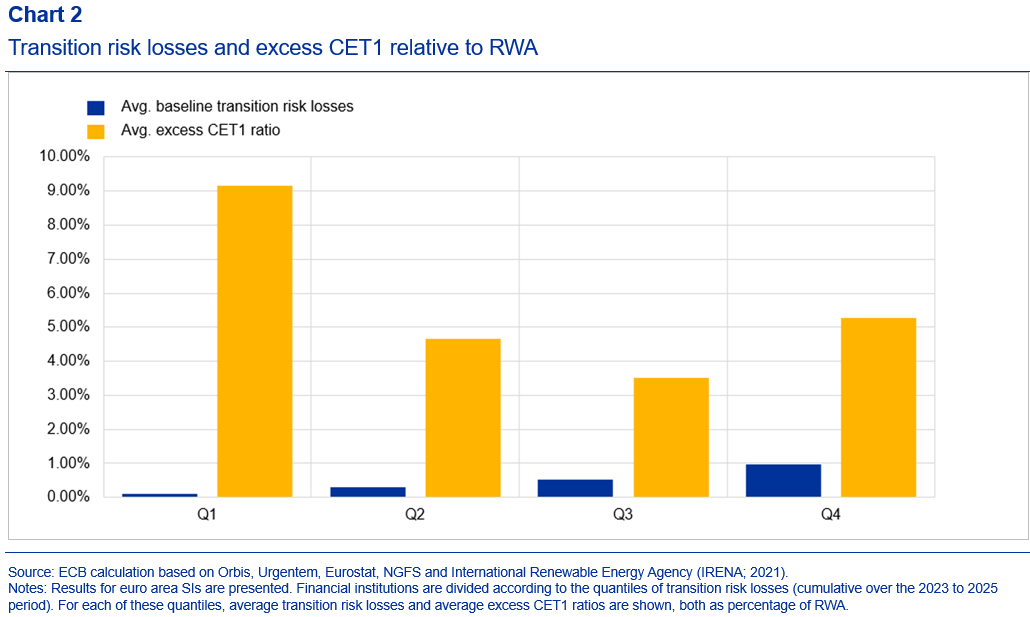

Our results suggest that transition risk may result in significant losses with large dispersions within the banking system. Over the 2023-2025 period, an unanticipated acceleration of the transition leads to an increase in projected losses of approximately €52 Bn for euro area SIs, corresponding to 0.60% of aggregate risk-weighted assets (RWA) (Chart 1, panel a). Our results indicate a high dispersion of losses across banks. Median bank losses are below 0.50% of RWAs, while a handful of banks have projected losses well above 1% over the 2023-2025 period (Chart 1, panel b). Moreover, we find that the highest exposures to transition risk are concentrated in banks with lower excess capital, used as a proxy for bank vulnerability (Chart 2). This highlights the importance of climate risk from a financial stability perspective.

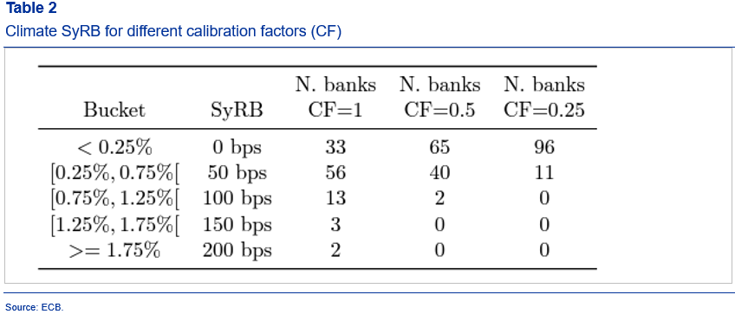

Our baseline calibration approach results in capital buffer requirements that would adequately cover euro area banks’ losses stemming from transition risk. Our baseline approach leads to a SyRB requirement of 50 bps for 56 banks, while 18 banks receive a SyRB requirement of 100 bps or more. For 33 banks, projected losses do not warrant a SyRB requirement (Table 2). On aggregate, this implies that additional capital mobilized by the proposed climate SyRB amounts to €51 Bn, compared to transition losses of approximately €52 Bn. The SyRB is therefore able to almost fully offset the impact of a transition shock on capital positions at the system-wide level. This can be attributed to the calibration factor equal to unity, which implies that estimated losses are translated almost one-to-one into capital requirements. Robustness checks confirm that the proposed methodology delivers comparable outputs when changing the sample of banks and time horizon, as well as under more adverse scenarios.

The choice of the calibration factor entails a trade-off between higher resilience against unexpected transition risk losses and the possible cost of the required capital increase. Lower calibration factors imply a lower SyRB for most institutions and a lower amount of aggregate capital raised, i.e. €29 Bn with a calibration factor of 0.5 and €1.5 Bn with a calibration factor of 0.25 (Table 2). A more conservative calibration factor would additionally cater for model uncertainty and possible overlaps with other capital (buffer) requirements.

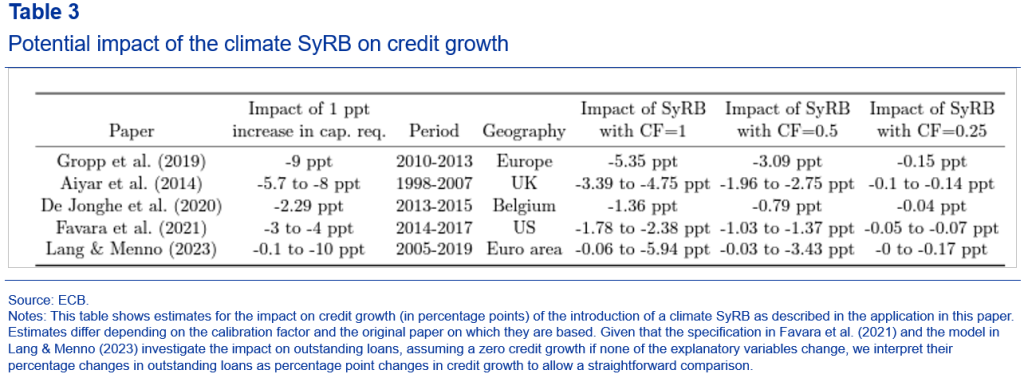

The impact of the proposed SyRB on bank lending would be modest. For the choice of the optimal calibration factor, policymakers need to find the balance between banks’ climate resilience and short-term credit growth. Higher calibration factors (and therefore higher capital ratios) will increase banks’ loss absorption capacity if transition risk materializes, but at the same time they could lead to an adverse impact on bank lending and the real economy in the short term, which would be particularly concerning at a time when banks need to finance the green transition. We provide a back-of-the-envelope estimate of the potential negative impact of introducing a climate SyRB under different calibration factors on banks’ credit supply, relying on estimates from the literature that assess the impact of a 1 percentage point increase in capital requirements on banks’ lending to NFCs. Our calculations suggest that the impact of the higher capital requirements due to the SyRB on bank lending would depend on the state of the micro-financial environment. If the buffer was introduced in non-stressed times, building on the estimates of Lang & Menno (2023), the impact would range from 0.06 percentage points with a calibration factor of 1, over 0.03 percentage points with a calibration factor of 0.5, to 0 percentage points with a calibration factor of 0.25 (Table 3).

Our paper contributes to the debate on the design and calibration of macroprudential policy tools for mitigating climate-related risks. The proposed harmonized framework to calibrate a macroprudential capital buffer at the system-level could guide regulatory authorities when taking action. We propose a calibration methodology based on granular data and a state-of-the art climate stress test approach, which allows to address the largely forward-looking nature of climate risks and to calibrate the prudential response based on a severe, but realistic, climate risk scenario. The estimated losses are then used to calibrate a SyRB to offset the system-wide losses attributed to the green transition. While translating transition risk losses one-to-one into different buckets would fully offset the estimated aggregate losses, we show that the use of alternative calibration approaches allows to fine-tune the additional capital requirements to account for policy trade-offs and mitigating factors.

Climate-related risk may result in significant losses for the banking system and our analysis makes an important step forward towards the design of macroprudential tools for addressing climate-related risks for financial stability.4 While our application focuses on a transition risk scenario, our general framework can be used flexibly in broader applications, targeting transition and/or physical risks more generally as well as longer time horizons, depending on the specific needs and information available to macroprudential authorities.

Aiyar, S., Calomiris, C. W., & Wieladek, T. (2014). Does macro-prudential regulation leak? Evidence from a UK policy experiment. Journal of Money, Credit and Banking, 46(s1), 181214.

De Jonghe, O., Dewachter, H., & Ongena, S. (2020). Bank capital (requirements) and credit supply: Evidence from pillar 2 decisions. Journal of Corporate Finance, 60, 101518.

EC (2021). Proposal for a Directive of the European Parliament and the Council amending Directive 2013/36/EU as regards supervisory powers, sanctions, third-country branches, and environmental, social and governance risks, and amending Directive 2014/59/EU. Report.

ECB/ESRB (2022). The macroprudential challenge of climate change. Report.

ECB/ESRB (2023). Towards macroprudential frameworks for managing climate risk. Report.

Emambakhsh, T., Fuchs, M., Kördel, S., Kouratzoglou, C., Lelli, C., Pizzeghello, R., Salleo, C., & Spaggiari, M. (2023). The road to Paris: stress testing the transition towards a net-zero economy. ECB Occasional Paper, (328).

ESRB (2017). Final report on the use of structural macroprudential instruments in the EU. Report.

ESRB (2023). ESRB advice on the prudential treatment of environmental and social risks. Report.

Favara, G., Ivanov, I., & Rezende, M. (2021). GSIB surcharges and bank lending: Evidence from US corporate loan data. Journal of Financial Economics, 142(3), 1426–1443.

Gropp, R., Mosk, T., Ongena, S., & Wix, C. (2019). Banks response to higher capital requirements: Evidence from a quasi-natural experiment. The Review of Financial Studies, 32(1), 266–299.

Lang, J. H. & Menno, D. (2023). The state-dependent impact of changes in bank capital requirements. ECB Working Paper, (2828).

The SyRB, which is part of the EU macroprudential toolkit, can be employed to address systemic risks that are not covered by microprudential regulation or by other macroprudential tools. According to EU law, the level of the SyRB may vary across institutions or sets of institutions as well as across subsets of exposures (see ESRB, 2017).

Following a similar approach as for the RRE SyRB, we use a three three-year period (2023 2023-2025) for our calibration exercise.

According to EU law the SyRB has to be set in steps of 0.50 percentage points or multiples thereof (cf. Article 133(9) CRD). The magnitude of the SyRB matches the losses projected in the middle of each bucket.

The projected losses should be interpreted as a lower bound given the focus on transition risk and the absence of some systemic risk channels, such as second-round effects, in the stress test model. Future improvements in stress testing will allow to capture additional systemic risk channels through which climate-related shocks may propagate.