Disclaimer: This policy brief is based on Banco de Portugal, Working Paper, No 04 2025. The views expressed in this paper are those of the authors and should not be taken as the views of the Banco de Portugal, the Banka Slovenije and the Eurosystem.

Abstract

The objective of the Dividend Prudential Target (DPT) rule is to counteract the bankers’ tendency to smooth dividends, which would lead to capital depletion during downturns. Therefore, the DPT rule interacts with macroprudential policies to influence bank resilience and credit cycles. Stronger enforcement of the DPT rule enhances welfare by promoting capital retention and strengthening banks, especially when combined with a responsive countercyclical capital buffer (CCyB). While the CCyB smooths the credit cycle, its release during downturns can deplete bank capital, a risk that the DPT mitigates. The DPT’s effectiveness depends on enforcement strength, CCyB responsiveness, and the banking system’s capital and risk characteristics.

Understanding the historical evolution of banks’ dividend policies sheds light on the forces shaping dividend decisions and their broader financial implications. Banks have traditionally practiced “dividend smoothing” — maintaining stable payouts despite changes in earnings — to signal stability, meet market expectations, align stakeholder interests, and reduce information asymmetry.

However, macroprudential restrictions, like the ECB’s recent dividend bans, limited banks’ autonomy and negatively impacted share prices and funding costs by creating uncertainty and reducing mutual fund ownership (Andreeva et al. 2023; Mücke 2023; Cáceres and Lamas 2023). Clear communication helped moderate these effects (Ampudia et al. 2023), and despite drawbacks, restrictions strengthened credit supply and systemic stability (Sanders et al. 2024; Acharya et al. 2011).

Existing models used to study these effects ignore borrower and bank defaults, missing the key impact on bank resilience and possibly overstating credit supply benefits. This paper addresses that gap by analysing the DPT rule in the DSGE model of Clerc et al. (2015), which includes default risk and that we extend to include banks’ preference for dividend smoothing, calibrated to Portugal and Slovenia — two countries with contrasting banking systems.

Three main transmission channels are identified: (i) stronger bank resilience through higher retained earnings, particularly in less capitalized systems; (ii) credit downturn smoothing, more effective in systems with lower credit risk exposure; and (iii) redistribution from patient households to impatient households and firms.

The model builds on the 3D model of Clerc et al. (2015). In the model, bankers allocate profits between retained earnings and dividends. Empirical evidence shows that firms, including banks, often prioritize maintaining smooth dividend payouts even during periods of stress (Floyd et al. 2015; Acharya et al. 2017; Koussis and Makrominas 2019). Reflecting this behavior, we introduce a cost penalizing deviations from the steady-state dividend level, under the assumption that bankers have a preference for dividend smoothing over time.

Under the Dividend Prudential Target (DPT) rule, bank dividends are adjusted according to the deviations of a macroprudential indicator from its equilibrium, forcing bankers to deviate from their preference of keeping a stable dividend distribution. This indicator is chosen to capture potential systemic risks, such as buildup of financial vulnerabilities. In this analysis, we use total credit as the macroprudential variable, given its relevance for concerns about bank deleveraging and the DPT’s role in smoothing the credit cycle and interacting with countercyclical capital buffers.

To support the resilience of the banking system during periods of stress while ensuring ongoing credit provision, two counteracting forces are introduced when bankers decide on the allocation between dividends and retained earnings. Regulatory restrictions on dividends during stress periods lead to higher retained earnings, thereby strengthening bank capitalization but requiring bankers to deviate further from their preferred steady state dividend distribution.

Given the bankers’ preferences for dividend smoothing, the DPT induces more volatility in dividends but results in a more stable dividend-to-wealth ratio over the financial cycle. The DPT transmits its effects through three main channels. First, it enhances bank resilience by limiting equity dilution during periods of elevated risk, a role that becomes particularly important when capital buffers are released and could otherwise be used for dividend payouts. Second, it helps smooth the credit cycle downturn by allowing banks to use retained earnings to sustain lending, which supports the economic recovery but may simultaneously increase financial vulnerabilities if banks roll over risky loans. This second effect is more prominent in banking systems with lower credit risk exposure, as evidenced by a stronger credit impact in Portugal compared to Slovenia. Third, the DPT creates a redistributive effect by temporarily shifting resources from patient households, who would otherwise receive the dividends, to impatient households and firms that benefit from continued access to credit.

The introduction of the DPT rule changes bankers’ behavior by creating a non-linear dynamic in their optimal choice between distributing dividends and retaining earnings. The combined effect of the penalty for deviating from the DPT target and the intrinsic preference for dividend smoothing introduces a wedge in the usual relationship between dividends and retained earnings. This wedge induces an adjustment in retained earnings whenever dividends diverge from the DPT-specified target.

The degree to which bankers prioritize dividend smoothing weakens the effectiveness of the DPT in steering bank behavior. The overall impact of the DPT depends on three key factors: the responsiveness of the rule to fluctuations in the chosen macroprudential indicator; the strength of the penalty for deviating from the DPT target; and the intensity of bankers’ preference for smoothing dividends.

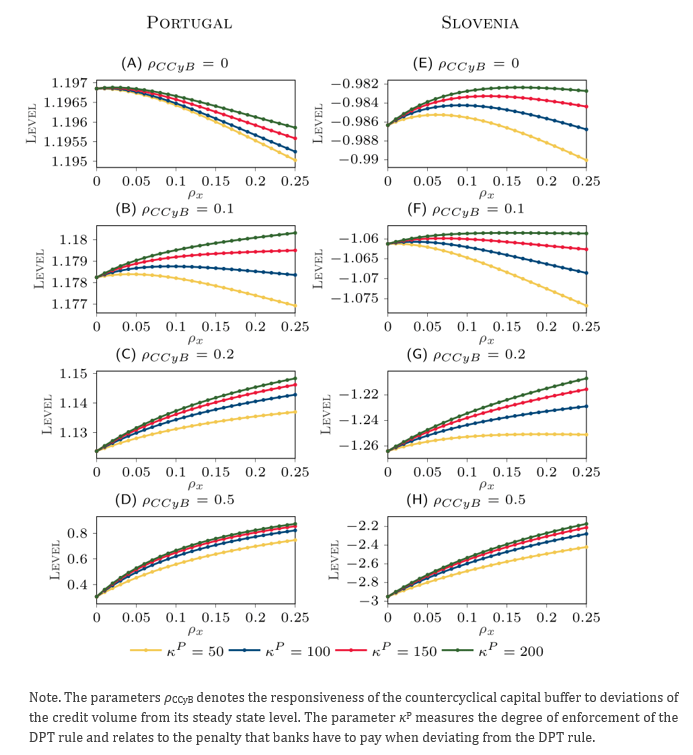

Figure 1 highlights how social welfare responds to changes in the responsiveness of the DPT rule to financial vulnerabilities and the strength of its enforcement. There is an optimal degree of DPT responsiveness that maximizes welfare for each combination of capital buffer levels, enforcement strength, and country-specific factors. A more responsive DPT rule promotes credit smoothing, benefits borrowers, and helps preserve bank resilience, ultimately reducing contributions to deposit insurance funds. However, this comes with the trade-off of lower dividend payouts for bank owners during downturns.

The figure also reveals a complementarity between the DPT and the countercyclical capital buffer: higher CCyB allow a broader range of welfare-improving DPT settings. In contrast, when CCyB responsiveness is small and overall capital requirements are already high, the additional benefits of the DPT rule diminish, as banks already have a strong resilience base and less need for further credit smoothing.

Another important insight is the role of enforcement. Stronger enforcement of the DPT rule increases welfare gains by reducing banks’ deviations from the target, strengthening the positive effects on credit stability and financial resilience. These gains become even more pronounced when countercyclical buffers are released during downturns, as the DPT helps maintain bank capital levels and mitigate potential negative effects on lending and economic activity.

These findings are consistent with real-world evidence from the COVID-19 pandemic, where dividend restrictions on banks across Europe were widely respected, even when they were formally issued as recommendations, suggesting that strong enforcement mechanisms are feasible and effective in practice.

Figure 1. Social welfare for different combinations of CCyB and the DPT rule

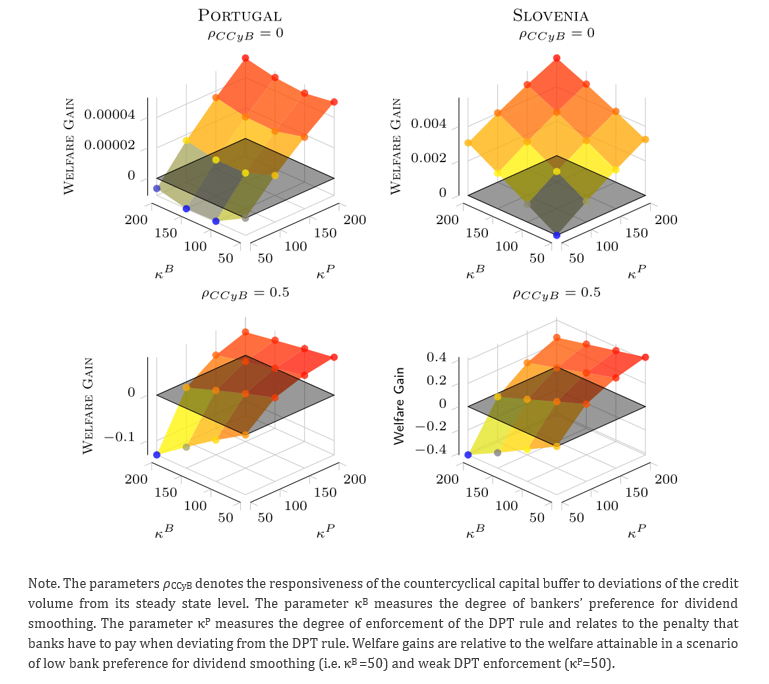

Figure 2 presents the welfare attainable across different combinations of the degree of preference for dividend smoothing (denoted by κB) and the penalty for deviating from the DPT rule (denoted by κP), given the optimal degree of responsiveness of the DPT to the credit cycle.

The results show that a stronger tendency by bankers to smooth dividends often reduces welfare, especially when enforcement of the DPT rule is weak. Dividend smoothing leads to higher volatility in bank equity and credit supply, increasing risks for borrowers and raising default probabilities. However, in some cases—such as assuming the absence of the CCyB in the parametrization for Slovenia—greater smoothing does not necessarily harm welfare, likely because patient households benefit from steadier dividend income or because the optimal DPT adjustment better protects borrowers.

Stronger enforcement of the DPT rule consistently improves welfare by discouraging excessive dividend smoothing and narrowing the conflict between bankers and borrowers. Although Portugal and Slovenia show similar qualitative patterns, the effects are more pronounced in Slovenia, partly due to its lower targeted return on equity, which limits income gains for patient households and heightens the benefits of improved credit conditions for impatient borrowers.

Figure 2. Social welfare in light of bankers’ preference for dividend smoothing and the DPT

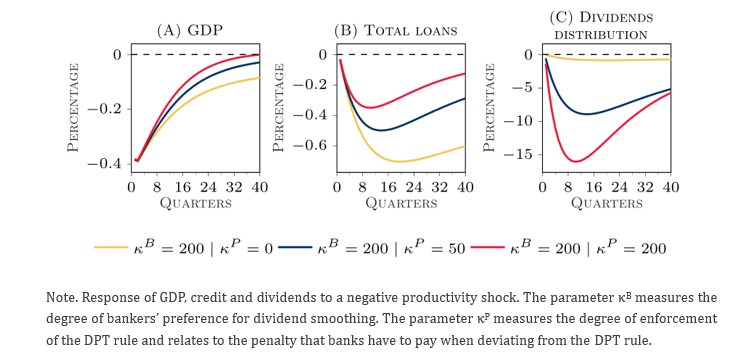

To better understand the short-term effects of the DPT rule we simulate a negative productivity shock. The shock causes a drop in credit and GDP (Figure 3). However, in presence of the DPT rule, the credit downturn is smaller and the recovery starts earlier and is faster. These positive effects of the DPT are bigger when the degree of enforcement of the DPT rule is stronger. The rationale is the following. In absence of the DPT rule, banks allocate more net worth to dividends rather than retaining earnings, weakening their equity and capital ratios, which worsens the credit contraction and slows down the recovery. In contrast, the DPT rule accelerates the recovery in the medium-to-long term by mitigating the credit contraction and supporting the banking system resilience through a better capitalization.

Figure 3. Synergy of bankers’ dividend smoothing and the DPT in an economic slowdown scenario: Productivity (TFP) shock of 1%

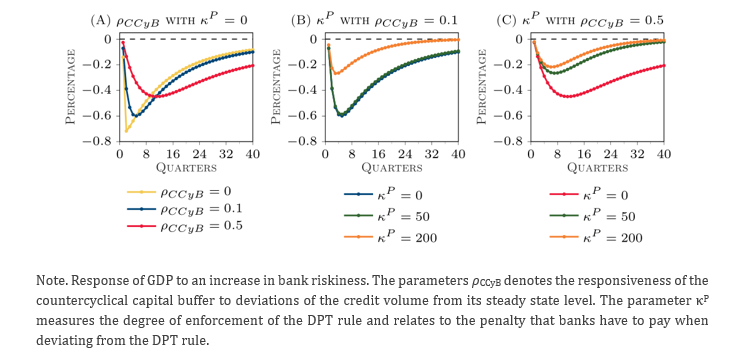

Figure 4 examines the interaction between the CCyB and DPT rule, by showing the response of GDP to an increasing bank riskiness shock, across different calibrations of the CCyB and DPT rule. The banking system shock exposes banks to higher default risk and leads to reduced lending and lower GDP.

Without the DPT rule, the release of the CCyB helps smooth the drop in GDP but slows down the long-term recovery, as banks end up with lower capital ratios and this limits the credit supply in the recovery phase. Both effects are more pronounced when the CCyB release is larger. By preserving the bank resilience, the DPT rule boosts the positive effect of the CCyB release in the downturn and mitigates its negative effect during the recovery phase. When the CCyB release is larger, the positive impact of the DPT rule is significant even when its level of enforcement and the related responsiveness to the credit cycle are lower. The reason is that, even a small increase in capital ratios is important for bank resilience when banks have lowered their capital ratios significantly.

Figure 4. Influence of the CCyB and the DPT on the dynamics of GDP under a financial distress event: Increase in bank riskiness

This paper examines the interaction of different transmission channels of the Dividend Prudential Target (DPT) rule within a DSGE model, where banks face default risk and bankers prefer smoothing dividends. The key finding is that stronger enforcement of the DPT rule by macroprudential authorities leads to higher welfare gains. The optimal DPT response to financial vulnerabilities depends on DPT enforcement and the CCyB rate. Our analysis shows that the DPT and CCyB complement each other: while the CCyB helps smooth the credit cycle, its release during downturns—especially with ongoing dividend payouts—can reduce bank capital ratios. The DPT counters this by promoting capital retention and bank resilience. Simulations indicate that when the CCyB rate is high, increasing DPT responsiveness is optimal, and the welfare gains from the DPT rule grow with the intensity of the CCyB release.

Simulations for two economies highlight that the DPT is more effective when initial bank capitalization is lower and that its ability to smooth the credit cycle is limited in systems with higher credit risk exposure.

Acharya, Viral V., Irvind Gujral, Nirupama Kulkarni, and Hyun Song Shin (2011). “Dividends and Bank Capital in the Financial Crisis of 2007-2009.” NBER Working Papers 16896, National Bureau of Economic Research, Inc.

Acharya, Viral V., Hanh T. Le, and Hyun Song Shin (2017). “Bank Capital and Dividend Externalities.” Review of Financial Studies, 30(3), 988–1018.

Ampudia, Miguel, Manuel A. Muñoz, Frank Smets, and Alejandro Van der Gothe (2023). “System-wide dividend restrictions: evidence and theory.” BIS Working Papers 1131, Bank for International Settlements.

Andreeva, Desislava, Paul Bochmann, and Julius Schneider (2023). “Evaluating the impact of dividend restrictions on euro area bank market values.” Working Paper Series 2787, European Central Bank.

Cáceres, Esther and Matías Lamas (2023). “Dividend Restrictions and Search for Income.” Working Papers 2332, Banco de España.

Clerc, Laurent, Alexis Derviz, Caterina Mendicino, Stephane Moyen, Kalin Nikolov, Livio Stracca, Javier Suarez, and Alexandros P. Vardoulakis (2015). “Capital Regulation in a Macroeconomic Model with Three Layers of Default.” International Journal of Central Banking, 11(3), 9–63.

Floyd, Eric, Nan Li, and Douglas J. Skinner (2015). “Payout policy through the financial crisis: The growth of repurchases and the resilience of dividends.” Journal of Financial Economics, 118(2), 299–316.

Koussis, Nicos and Michalis Makrominas (2019). “What factors determine dividend smoothing by US and EU banks?” Journal of Business Finance & Accounting, 46(7-8), 1030–1059.

Mücke, Christian (2023). “Bank dividend restrictions and banks’ institutional investors.” SAFE Working Paper Series 392, Leibniz Institute for Financial Research SAFE.

Sanders, Emiel, Mathieu Simoens, and Rudi Vander Vennet (2024). “Curse and blessing: The effect of the dividend ban on euro area bank valuations and syndicated lending.” Journal of Banking & Finance, 163(C).