This policy brief is based on ECB, Working Paper No. 3011. The views expressed are those of the authors and do not necessarily reflect those of the ECB, De Nederlandsche Bank or the Eurosystem.

Abstract

This policy brief examines climate-linked bonds as an innovative financial instrument for managing and mitigating climate risks. These bonds can be issued by governments or supranational organizations to enhance market completeness and facilitate climate risk pricing and trading. Climate-linked bonds are designed so that their payouts are linked to the realization of specific climate variables, such as average land temperature or atmospheric greenhouse gas concentrations. These bonds thereby ensure that governments have a direct fiscal incentive to accelerate the green transition. Climate-linked bonds also make explicit the government’s implicit role as the ultimate insurer of long-term climate risks. The welfare benefits of the bonds arise because economic agents face climate risks asymmetrically, allowing for more efficient risk distribution in an economy through trading.

Climate change is one of the great challenges of our time, with far-reaching consequences for ecosystems, economies and societies globally. Governments, financial institutions and companies need innovative ways to manage and mitigate climate risks and to stimulate sustainable growth. In a recent ECB working paper (Broeders, Dimitrov and Verhoeven, 2025) we discuss an innovative financial instrument that may serve these purposes: climate-linked bonds. The climate-linked bond is a fixed-income instrument whose coupon or face value is linked to the realization of a specific indicator of climate change, associated with long-term climate damages, such as average global temperatures or the concentration of greenhouse gases in the atmosphere. As such, climate-linked bonds are similar to inflation-linked bonds, whose coupon or face value is adjusted for actual inflation, providing long-term investors with protection against rising inflation.

We envision climate-linked bonds as financial instruments that can be issued by governments and supranational organizations. Both are best positioned to issue climate-linked bonds because they also govern climate policy. The proceeds obtained from issuance may be tied to sustainable projects, as is the case for green bonds, although this is not strictly necessary. As long as the underlying climate indicator to which the bond payoff is adapted accurately reflects the impact of climate change and long-term climate damages, climate-linked bonds will be an effective risk-hedging instrument.

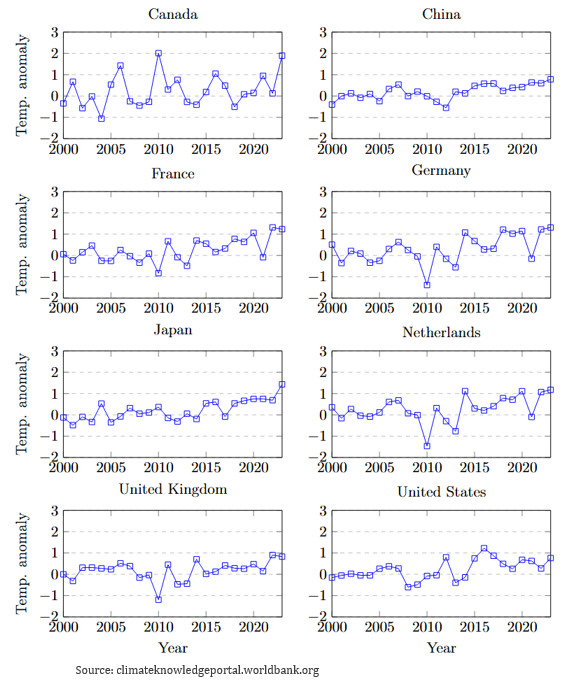

One option in the design of these bonds, for example, is to link their payoff to temperature anomalies, typically expressed as the difference between the observed average annual temperature and the long-term average temperature over a reference period. Figure 1 shows this temperature anomaly relative to the average temperature over 1991-2020 for eight countries. Positive temperature anomalies indicate temperatures that are warmer than the long-term average, while negative anomalies indicate cooler than average. Interest payments on climate-linked bonds can be tied to these fluctuations, with the option to include an additional feature that ensures the coupon is never negative. The calibration of the fluctuations must strike a balance between providing sufficient incentives to achieve the aforementioned benefits on one hand, and preventing excessive volatility in the bond payments on the other.

Recently, transition bonds have been proposed in the literature, which at first glance appear similar to climate bonds (Erlandsson, 2024). With transition bonds, the coupon is also adjusted in discrete steps, but this is based on the issuer’s performance relative to sustainability targets. Further, transition bonds are linked to self-imposed targets that result from political processes, whereas climate bonds are tied to objective indicators such as temperature anomalies.

Figure 1. Temperature anomalies for major economies relative to the average over 1991-2020

Climate-linked bonds offer economic benefits by efficiently redistributing climate risk among various economic agents, who are differently exposed to these risks. Individuals facing higher climate risks, such as those in flood-prone areas, can transfer part of their exposure to others who are less exposed through financial markets. Governments can facilitate these risk transfers efficiently by issuing climate-linked bonds.

We identify three key welfare benefits:

Furthermore, issuing climate-linked bonds signals a government’s commitment to long-term climate action, boosting investor confidence. These bonds align the financial incentives of governments with measurable sustainability outcomes, for example when linked to greenhouse gas reductions. For investors, climate-linked bonds provide protection against long-term climate risks while offering returns linked to sustainability performance. They also have a portfolio diversification potential, as their returns are less correlated with traditional market cycles. Furthermore, they eliminate the need for complex – and often less precise – rebalancing strategies often required for climate risk hedging (Engle et al., 2020).

Naturally, the question arises what incentives governments have to issue climate-linked bonds given that these instruments will pay-off more in bad states of the world with strong climate change. First, governments can directly lower their borrowing costs by issuing these bonds, as investors seeking climate-hedging assets are willing to accept a lower expected yield on the bonds in return for a credible climate policy. Second, these bonds act as a credible commitment mechanism for climate action, aligning the incentives of both current and future governments to maintain climate policies and ensure long-term policy continuity.

One particular benefit of climate-linked bonds is that they can be indexed to slow-moving climate indicators that influence climate change over the long run. Consequently, they do not impose an immediate financial burden on governments during extreme climate events. There are no one-time or sudden triggers in the bond payouts, rather their payoffs adjust gradually, allowing governments to focus on long-term climate policies without having to compromise on shorter-term disaster relief spending. Furthermore, to the extent that climate-linked bonds help to slow down climate change, they contribute to lowering the costs for governments related to climate change. In fact, postponing the transition exacerbates all climate-related risks and costs, both physical and transitional. A one-decade delay could lead to a 40% increase in the net present value cost of addressing climate change (Shadbegian, Stock and Furman, 2015).

Climate-linked bond prices are determined by the (discounted) market expectations of the climate-adjusted cash flows and by the climate premium that investors are willing to pay for a hedge against the potential impact of climate variables. This means that the bond price at the time of issuance depends not only on standard financial factors, such as interest rates and issuer creditworthiness, but also on the expected climate dynamics and the willingness of investors to pay a climate risk premium. Consequently, climate policies that could adversely impact the climate transition will increase current bond prices, providing investors with a hedge against a slow and inefficient transition with governments doing too little too late.

A thoughtful design of the institutional framework and the climate-linked adjustment mechanism can create the right incentives for the governments to tackle climate change. For instance, linking bond adjustments to a country’s emissions can directly encourage policymakers to balance economic growth with carbon reduction efforts. This is especially relevant in light of the recent Draghi report, which emphasizes both the need to decarbonize and the need to increase sharply investment in innovation and defense in order to keep European economies resilient and competitive (Draghi, 2024).

Alternatively, linking the bond payoff to temperature levels may relate more directly to the expected climate damages in an economy. However, a free-rider problem may arise when the bond payoff is tied to a global climate variable like temperature levels, as individual countries may benefit from the efforts of others to reduce climate risk, without contributing proportionally to the necessary mitigation efforts. While, it is true that such free-riding incentives may exist, we also know that a climate coalition can help reinforce collective commitment to climate goals. Such a coalition, suggested among others by Nordhaus (2015), can exert soft force by granting trade benefits to like-minded climate-goal compliant partners while enforcing trade restrictions against countries that refuse to comply.

Advanced climate forecasting models and high-quality climate data are crucial for market trust in these instruments. These factors are also crucial for accurate bond pricing. Standardizing climate indicators and bond specifications internationally will enhance credibility and facilitate global issuance and the liquidity of these instruments.

In Broeders, Dimitrov, and Verhoeven (2025), we develop a stylized model of demand and supply for climate hedging which reveals how the equilibrium price of climate-linked bonds is determined. In our model, the economy consists of a population of economic agents who save during the first period of their lives and consume from their savings in the second period. These agents decide whether to invest in nominal government bonds or by investing in a bond with a climate-adjustable payoff. In this setting, a part of the population is exposed to the negative consequences of climate change as any climate damages occurring in the future will depreciate the value of their savings. Another part of the population will not experience such damages. This difference creates an opportunity to enhance aggregate welfare by enabling the two types of agents to trade on climate risk. It is then beneficial for one counterparty to issue a climate-linked bond, while the other can purchase it, facilitating the distribution and management of climate-related risks. In equilibrium, the agents exposed to climate damages will demand a hedging instrument which provides a higher payoff in adverse states of the world, when climate variables and, related to that, damages are both high. As a result, they will be willing to buy a climate-linked bond at a premium, accepting lower expected yields compared to a conventional bond, with a coupon that adjusts upward when climate variables are high. This hedging demand then will be a function of how well the climate-linked asset correlates to climate damages. Agents not exposed to climate damages, conversely, will be inclined to issue the climate-linked bond due to its more favorable expected risk-adjusted performance. Additionally, their willingness to bear risk will be driven by the potential to profit from states of the world in which climate damages remain low.

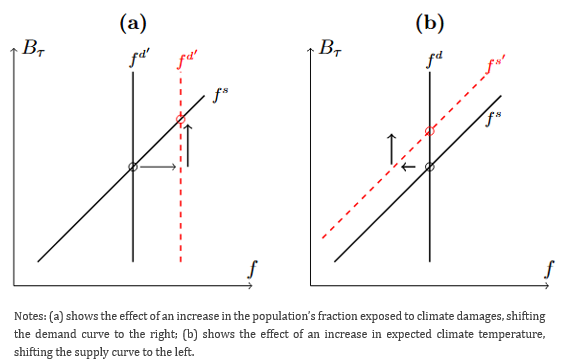

In Figure 2 we show graphically the outcome of this analytical setting. The equilibrium price of the climate-linked bond () and the equilibrium amount of bonds outstanding () appears at the intersection where demand () meets supply (). Note that the demand for bonds is price-inelastic, while the willingness to issue bonds increases with a higher bond price. The reason is that the demand for climate-linked bonds stems purely from the need to hedge long-term climate risks. The supply, on the other hand, depends on the willingness of issuers to provide these instruments at various price levels.

We vary two features of the model to evaluate the sensitivity of the bond price to external shifts. First, when the fraction of the population exposed to climate-related risks increases, the demand for these bonds goes up, and given an unchanged supply dynamics for climate hedging assets, their price increases. Intuitively, this is equivalent to saying that if the demand for insurance in the economy goes up, the price of the insurance in equilibrium will also rise, everything else constant. This is illustrated in panel (a) of Figure 2 which shows the impact of shift in the demand curve to the right. Second, a higher expected temperature anomaly increases the expected climate damages experienced by the exposed agents in the population, and this increases the price they are willing to pay for climate insurance. The supply of bonds in principle goes down, however the higher price incentivizes issuers still to supply enough bonds to cover the hedging demand, as shown in panel (b) in which the hedging supply curve shifts to the left and the equilibrium price moves upward. In equilibrium, still the same amount of bonds is provided but now at a higher price.

Note that while we envision that governments and supranational organizations will be key issuers of climate-linked bonds, this simple setting allows us to disentangle to basic factors affecting the demand and supply of these bonds. Understanding these market dynamics is key for policymakers and investors looking to enhance the effectiveness of climate-related financial instruments.

Climate-linked bond prices are determined by the (discounted) market expectations of the climate-adjusted cash flows and by the climate premium that investors are willing to pay for a hedge against the potential impact of climate variables. This means that the bond price at the time of issuance depends not only on standard financial factors, such as interest rates and issuer creditworthiness, but also on the expected climate dynamics and the willingness of investors to pay a climate risk premium. Consequently, climate policies that could adversely impact the climate transition will increase current bond prices, providing investors with a hedge against a slow and inefficient transition with governments doing too little too late.

A thoughtful design of the institutional framework and the climate-linked adjustment mechanism can create the right incentives for the governments to tackle climate change. For instance, linking bond adjustments to a country’s emissions can directly encourage policymakers to balance economic growth with carbon reduction efforts. This is especially relevant in light of the recent Draghi report, which emphasizes both the need to decarbonize and the need to increase sharply investment in innovation and defense in order to keep European economies resilient and competitive (Draghi, 2024).

Alternatively, linking the bond payoff to temperature levels may relate more directly to the expected climate damages in an economy. However, a free-rider problem may arise when the bond payoff is tied to a global climate variable like temperature levels, as individual countries may benefit from the efforts of others to reduce climate risk, without contributing proportionally to the necessary mitigation efforts. While, it is true that such free-riding incentives may exist, we also know that a climate coalition can help reinforce collective commitment to climate goals. Such a coalition, suggested among others by Nordhaus (2015), can exert soft force by granting trade benefits to like-minded climate-goal compliant partners while enforcing trade restrictions against countries that refuse to comply.

Advanced climate forecasting models and high-quality climate data are crucial for market trust in these instruments. These factors are also crucial for accurate bond pricing. Standardizing climate indicators and bond specifications internationally will enhance credibility and facilitate global issuance and the liquidity of these instruments.

Figure 2. Supply (f^s), Demand (f^d) and equilibrium price (B_τ) of Climate-Linked Bonds

The existence of a well-functioning market for climate-linked bonds provides significant benefits for financial stability and risk management. By enabling investors to hedge against the long-term impact of climate change, these bonds help distribute risk more efficiently across the economy. This reduces the financial strain on individual businesses and governments, particularly those in regions highly exposed to climate change. Moreover, as more participants engage in the market, bond prices reflect a broader consensus on climate risk, serving as a useful indicator for policymakers assessing the economic costs of climate change.

Beyond direct financial hedging, climate-linked bonds also encourage proactive climate policies. As the market develops, higher demand for these bonds signals the growing recognition of climate risks in financial decision-making. This, in turn, can incentivize companies and governments to adopt sustainable practices that reduce their exposure to such risks. A deep and liquid market for these instruments can also lead to innovation in financial products, such as climate derivatives (Chikhani and Renne, 2022), further expanding the toolkit available to investors and institutions seeking to manage climate-related uncertainties. We show how the availability of climate-linked bond prices subsequently helps in pricing weather-related options.

Recent political developments, such as the U.S. withdrawing from the Network for Greening the Financial System and financial institutions exiting climate alliances, have pressured international climate efforts. However, scientific evidence continues to confirm climate change’s acceleration, with several critical tipping points already reached, such as the Greenland ice sheet melting and the degradation of the Amazone rainforest. In 2015, data indicated the plus 1.5°C threshold would be breached by 2045, but now it’s predicted to happen already in 2034 (C3S, 2025).

Against this background, various parties have recently highlighted the growing consequences of climate damages and the need for action. The ECB and EIOPA, for example, have proposed a European solution to address the impacts of climate damages, consisting of two pillars (ECB and EIOPA, 2024). The first pillar is an EU public-private reinsurance scheme aimed at increasing insurance coverage for natural disasters with low coverage. This scheme bundles private risks within the EU for better diversification and promotes national solutions, funded by risk-based premiums. Participation in this scheme is voluntary. The second pillar is an EU fund for public disaster financing, which improves the management of disaster risks in member states. The fund supports reconstruction after severe disasters and requires member states to implement risk-reducing measures in advance. Funding comes from contributions by member states, based on their risk profiles, and participation is mandatory for all EU member states. In addition to these measures, climate-linked bonds could serve as an effective supplementary policy tool, offering a market-based mechanism to manage and transfer climate risks while encouraging investment in climate mitigation and adaptation efforts.

Now is an opportune time to develop climate-linked bonds as a financial tool for signaling a commitment to tackle climate change. Expanding participation in their issuance can create a global sustainable finance network. Climate clubs, as envisioned by Nordhaus (2015), can foster the adoption of these instruments and can discourage free riding. Innovations such as linking the bonds payoff also to biodiversity indicators can further enhance the effectiveness and reach of the specialty bonds.

Overall, climate-linked bonds offer a new approach to integrating financial markets with climate action. By tying financial incentives to climate outcomes, they provide governments with accountability mechanisms and investors with a tool to manage climate risk. Their success depends on international cooperation, transparency, and ongoing innovation.

Bettarelli, L., D. Furceri, M. Ganslmeier and M. Schiffbauer (2025), The Economic Costs of Temperature Uncertainty, IMF Working Paper, 2025(26).

Broeders, D. and D., Dimitrov and N. Verhoeven (2025), Climate-Linked Bonds, ECB Working Paper No. 3011, Available at SSRN: https://ssrn.com/abstract=5091140.

C3S (2025), We’ve ‘lost’ 19 years in the battle against global warming since the Paris Agreement, Copernicus Climate Change Service, https://climate.copernicus.eu/.

Chikhani, P. and J.-P. Renne (2022), Climate linkers: Rationale and pricing. In Proceedings of the EUROFIDAI-ESSEC Paris December Finance Meeting 2022, 2022.

Draghi, M. (2024). The Future of European Competitiveness Part A: A competitiveness strategy for Europe.

ECB and EIOPA (2023), Policy options to reduce the climate insurance protection gap, https://www.ecb.europa.eu/pub/pdf/other/ecb.policyoptions_EIOPA~c0adae58b7.en.pdf.

ECB and EIOPA (2024), Towards a European system for natural catastrophe risk management, https://www.ecb.europa.eu/pub/pdf/other/ecb.climateinsuranceprotectiongap_EIOPA202412~6403e0de2b.ga.pdf.

Engle, R.F., S. Giglio, B. Kelly, H. Lee, and J. Stroebel (2020), Hedging Climate Change News, The Review of Financial Studies, 33(3): 1184–1216.

Erlandsson, U. (2024), Transition linkers, available at SSRN: https://ssrn.com/abstract=5031221.

Nordhaus, W. (2015), Climate clubs: Overcoming free-riding in international climate policy, American Economic Review, 105(4): 1339–1370.

Reimann L., A.T. Vafeidis and L.E. Honsel (2023), Population development as a driver of coastal risk: Current trends and future pathways, Cambridge Prisms: Coastal Futures. 2023; Aug. 1:e14. doi:10.1017/cft.2023.3.

Ripple, W.J., C. Wolf, T.M. Newsome, et al. (2021), World scientists’ warning of a climate emergency 2021, BioScience, 71: 894–898.

Shadbegian, R., J. Stock and J. Furman (2015), The cost of delaying action to stem climate change: A meta-analysis, VOXEU, 25 February, https://cepr.org/voxeu/columns/cost-delaying-action-stem-climate-change-meta-analysis.