Disclaimer: This policy brief includes research content published by Amundi Investment Institute “Economy and Markets” published in May 2025. Amundi Investment Institute has granted SUERF a limited right to re-publish this research on an information only basis.

Abstract

With its rapid advancements in critical technologies, today, China is a formidable competitor to the developed West for global technology leadership. Innovation can take many forms, including process innovation – in which China excels – leveraging its large and dynamic manufacturing base. However, this is not enough. Technological progress also hinges on a nation’s ability to develop and spread innovation, to boost aggregate productivity and potential growth. On this, China’s innovation strategy has become increasingly centralised, with the government favouring specific sectors and systematically cracking down on others. A dynamic private sector and decentralised approach are essential for new technologies to spread and become accessible, fostering progress. In this respect, the environment for Chinese companies and institutions to innovate has deteriorated recently. Today, the United States and its allies still hold significant advantages in capital markets and innovation ecosystems, while Chinese regulators crack down on the financial sector. For China to sustain its technological rise, it must prioritise final-demand innovation. While top-down, state-driven approaches have been effective in certain areas, they may not be sufficient to boost long-term growth. If China’s policies continue to stifle these market forces, its technological rise may plateau. China’s future success will depend on whether it can balance its top-down, state-driven approach with the bottom-up forces of consumer demand and commercialisation.

Technology has been a battleground for superpowers for a long time. In 1969, the CIA concluded that the technological gap between the Soviet Union and the developed West was vast and widening. If the former maintained a centrally planned regime, it would never catch up with the West. Much has changed since then and the geopolitical landscape has shifted profoundly, yet the race for technological leadership among economic powers is more intense than ever. Today, the United States faces a new rival: China. With its rapid advancements in critical technologies, China is positioned as a formidable competitor to the developed West. In his recent report on Europe’s competitiveness, former ECB President Mario Draghi highlights how the Eurozone is competing directly with China in nearly 40% of the export sectors and has to close the innovation gap with China. In this paper, we explore China’s current standing in the global technological race, while addressing common misperceptions about its innovation capabilities. We examine the broader implications for global power dynamics and the challenges China faces as it strives for technological leadership.

The current discourse on China’s technological capabilities often falls into two extreme positions:

Both perspectives – whether viewing China as a mere copycat or as an existential threat – fail to capture the complexities of its technological ascent. Sceptics often adopt a narrow definition of innovation, equating it solely with originality in design. However, innovation can take many forms, including process innovation, which is an important feature of China’s innovation landscape. China excels in this regard, leveraging its large and dynamic manufacturing base to drive innovation through iterative processes. Thus, China’s emergence as a global innovation power is closely linked to its robust manufacturing capabilities and active participation in the global value chain.

However, one should not simply extrapolate from China’s past successes. Progress in technology hinges on a nation’s ability to both develop and diffuse innovation. Successful diffusion translates into productivity gains, a vital source of long-term growth in an era marked by an ageing population and high public debt. Yet, China’s innovation strategy has become increasingly centralised, with the government favouring specific sectors and systematically cracking down on e-commerce platforms, gaming and healthcare over the past three years. The anti-corruption campaign in the financial sector has also stifled capital allocation, forcing promising private companies to exit the market.

Global examples, including those from China, demonstrate that a dynamic private sector and decentralised approaches are essential for new technologies to proliferate and become widely accessible, ultimately fostering progress. Proper incentives for commercialisation must be established. Amid low consumer confidence, persistent deflationary pressures and increased scrutiny from abroad, the environment for Chinese companies and institutions to innovate has deteriorated. Considering these challenges, China is entering a phase in which the pace of its technological advancement is likely to moderate.

China’s technological ascent has been remarkable, particularly measured by scientific research publications and their influence, and the number of qualified patents.

Research capability

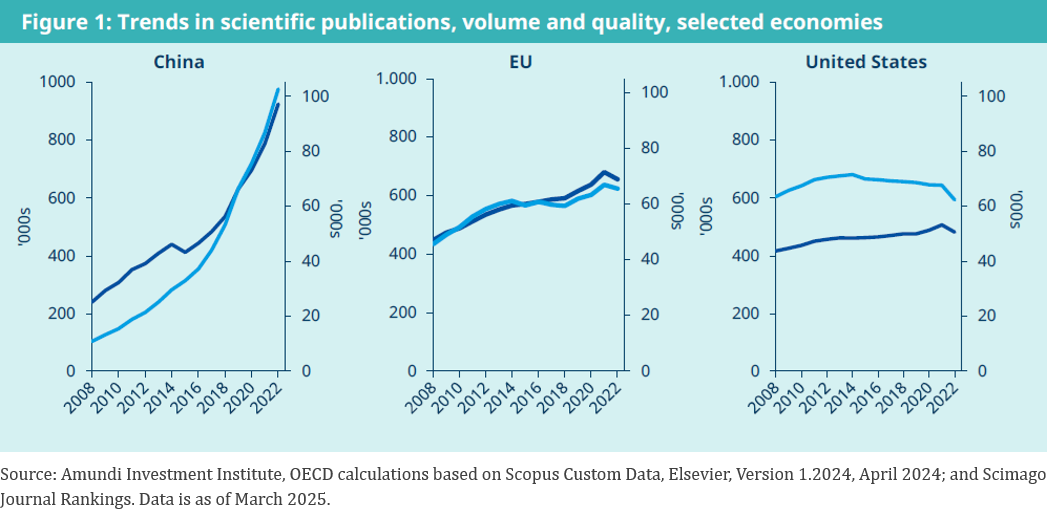

China has made significant strides in academic research. The Nature Index, which tracks high-quality research publications, shows that seven out of the top ten academic institutions globally are Chinese. This is a notable improvement from just a few years ago. In specific fields, such as chemistry (nine out of the top ten institutions) and earth & environmental sciences (eight out of ten), China is dominant. However, in corporate research, China lags, with no Chinese companies ranking in the top ten globally in 2024. In the QS University Rankings, China fares less favourably, although its top institution, Tsinghua University, ranks within the top 20 globally, excelling in computing sciences. The impact of academic research is often assessed through citation counts. In this respect, China overtook the United States in 2019 as the leader in the world’s top 10% most cited papers, and its lead has widened in the subsequent three years (see figure 1). In 2022, China produced 28.8% of the world’s total top 10% most cited publications, while the EU and the United States each accounted for less than 20%.

China’s ascent in international academic influence has historically been associated with an increase in talent exchanges among the global community, particularly through the presence of Chinese students and researchers in STEM (science, technology, engineering, and mathematics) fields at US universities. In 2018-19, Chinese nationals comprised 16% of all US graduate students. In the AI field, the United States and China had the greatest number of collaborations in publications in 2010-21 across the globe. With tightened US immigration and visa policies affecting Chinese students, accusations of espionage, and a narrowed renewal of the United States-China Science and Technology Agreement, cross-country collaboration should decline further, directly impacting China’s global academic influence. Since 2016, rising United States-China tensions have resulted in Chinese graduates becoming less likely to remain in the United States post-graduation and securing employment there, while Chinese researchers have significantly reduced their citations of US research1.

Technology output

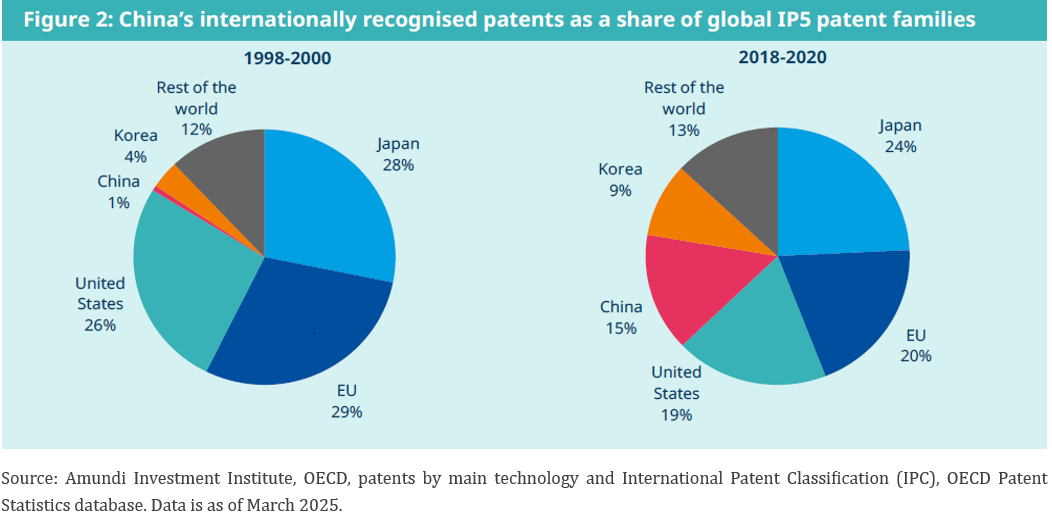

While R&D spending is often considered an important metric, it reflects primarily inputs rather than outcomes. In this analysis, we focus on patents as a more direct measure of technological output, as they provide a clearer indication of a country’s innovation capabilities. China’s patent output has surged in recent years. In 2023, China surpassed the United States in total patent filings, with over 70,000 patents compared to fewer than 60,000 in the United States, according to the World Intellectual Property Organisation (WIPO). The data also reveals that China’s patent growth has been particularly strong in areas like batteries, biotechnology, machine learning and semiconductors. For instance, China has made substantial progress in DRAM memory, silicon carbide and quantum computing, fields where the United States once led (see Appendix).

Interestingly, in specific categories like OLED and batteries, the United States appears to have ‘thrown in the towel’, while China continues to accelerate. This shift suggests that China is not merely following in the footsteps of Western innovation but is actively pushing the boundaries. Among internationally recognised patents, particularly within the IP5 patent families (a forum of the five largest intellectual property offices globally), China’s share increased significantly from just 1% of the global total in 1998-2000 to 15% in 2018-20 (see figure 2). Notably, more than half of these patents originated from the information and communications technology (ICT) sector in 2020. To exclude completely China’s domestic bias that may favour local inventions, the OECD’s triadic patent indicator – which considers patents jointly registered only with European, Japanese and US patent offices – reveals a steady increase in China’s patent filings, reaching approximately 40% of the US level in 2021.

Technology diffusion

The accessibility of infrastructure, the adoption rates of key technologies among businesses, and the availability of skilled engineers are indicative of a country’s capacity for technology diffusion. However, no single analysis or measure can be exhaustive due to limitations in data availability, the unpredictability of technological advancements, and the challenges in determining which technologies are most critical for societal progress. China has a distinct advantage in developing affordable infrastructure, albeit at the cost of rising unproductive debt and local fiscal stress. The country boasts sophisticated logistics networks, a high penetration of digital infrastructure (with 1 billion 5G subscribers), relatively low costs for water and electricity, and affordable industrial land, all of which facilitate the adoption of new technologies.

Moreover, China produces the highest number of STEM graduates globally (4.7 million), followed by India (2.6 million) and the United States (0.6 million). The British industrial revolution in the 18th and 19th centuries illustrates how a skilled labour force could accelerate the adoption of new inventions, no matter where they originated2. As a result, China is in close competition with the United States in the adoption of key technologies. China leads in manufacturing automation, as evidenced by its robot density (units of robots per employee), yet it lags in the adoption of AI, with 24% of US organisations fully implementing generative AI technologies compared to 19% in China.

While the above indicators help illustrate the presence of technology, they neglect organisational behaviours, entrepreneurial spirit and political/institutional features that are crucial for driving technology diffusion. The Soviet Union, despite its talented scientists and significant R&D spending, struggled to translate technological advancements into widespread societal productivity. This failure was largely due to its centralised, bureaucratic approach to technology diffusion, which stifled adoption. This highlights how technology diffusion is a critical equivalent – if not more important – as technology advancements.

BOX 1. AI race, a complex terrain

Regarding AI, our initial goal of assessing which country out of the United States or China is ahead has derived inconsistent answers depending on data sources. The United States leads in the number of foundational models, but there is strong momentum behind China’s models, notwithstanding privacy and political impediments to their adoption in Western countries. Patent count analysis similarly leads to an inconsistent picture. Academic research and university rankings favour China on a trending basis, while US hyperscalers retain a dominant market share. Overall, rather than establishing a definitive conclusion on that question, we expect some fragmentation. The DeepSeek event has probably inaugurated a sustainable trend towards efficiency.

DeepSeek in itself has a relative importance, but it is the methods used (none of them new) that are inspiring competitors to try multiple combinations of parameters, numbers of experts, quantisation, labelling, reinforcement learning, and test-time computing, with large language models (LLMs) remaining black boxes. Overall, this event should be positive for AI adoption, hence investors’ attention shifting from the core to the edge, from infrastructure to applications and use cases. Finally, shareholders and investors may have the final say, depending on how complacent they are prepared to be towards excessive capex against monetisation.

In contrast to the Soviet Union, China has been far more successful in translating technological advancements into economic gains. For example, China’s EV and semiconductor sectors have seen rapid growth and global competitiveness. China’s rise in technology has been significantly propelled by its dynamic private sector, which thrives in a manner that often contrasts with the country’s centralised political image. A prime example is Shenzhen, which has evolved from a fishing village into a bustling metropolis of migrants. Although the city has a relatively low percentage of highly educated workers compared to other major Chinese cities, it boasts the highest concentration of R&D personnel and is home to a few tech giants, which contribute substantially to China’s Information and Communications Technology (ICT) progress. This phenomenon highlights the effectiveness of a decentralised innovation ecosystem, where local governments allow for greater flexibility, and demonstrates how localised, business-friendly policies and a liberal labour market can foster technological advancement, even without top-notch talent.

The success of Shenzhen also challenges the notion that China’s centralised political system will inevitably lead to stagnation. Arguably, the room for local autonomy has been eroded in the aftermath of Covid-19. While China’s private sector has been a key driver of its technological ascent, several challenges remain that could impede the country’s progress:

Historically, sanctions have been effective in slowing technological progress. In the cases of Iran and Russia, sanctions have led to more militarised societies, and weakened their private sectors and middle classes. China may face similar outcomes if sanctions expand further. The Chinese government’s increasing focus on military-civilian fusion suggests a more defensive stance in response to Western sanctions.

BOX 2. China’s semiconductors against rest of the world’s; decoupling vs. deflation

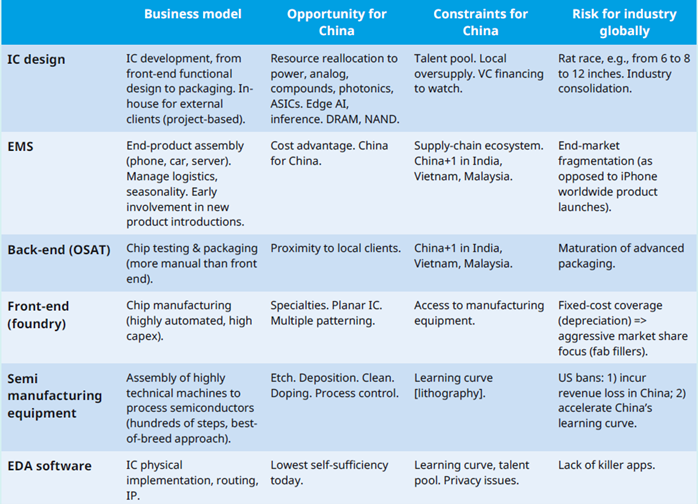

Decoupling is happening gradually, through selected job listings in hardware or software, showing job postings located in China from selected companies are decelerating. Related skills include integrated circuit (IC) design, software, cloud, and AI. We sum up the path of least resistance for China in developing a local semiconductor ecosystem in the table below, which is sorted from easiest to difficult.

Geopolitical fragmentation may offer local investment opportunities in the short term, while, in the long run, it would mean lower growth for everyone (lower networking effect and scale leverage). China’s semiconductor companies show that US sanctions have at best a limited effect; at worst, they are accelerating China’s progress and sourcing 70-90% of components locally. Decoupling should apply most to leading-edge semiconductors: China is probably a decade to five years behind on the extreme ultraviolet (eUV) path (the most advanced lithographic process), although this has to be watched. Decoupling is much less clear-cut for discrete and analog. For instance, European companies – and to a lesser extent US ones – are sourcing power ICs, silicon carbide and optical transceivers from China. Quarterly earnings from Chinese foundries do not show an abrupt fall in US revenue, but rather a gradual decline with some phases of acceleration. Duplication of fabs – which are semiconductor plants – is hitting efficiency. Shareholders’ attitude towards capital intensity still needs to be watched and was partially triggered by DeepSeek. Every player in the foundry space has a good and specific reason to invest.

Source: Amundi, corporate data as of 7 April 2025. IC are chips, typically hundreds to billions of silicon transistors packed on a few square millimetres designed to perform an active — more rarely passive — electrical output function. DRAM (Dynamic Random Access Memory) and NAND flash (name based on Boolean gate) are two types of memory circuits; DRAM is fast, NAND is dense. ASICs (application-specific integrated circuits) are chips designed for a specific purpose, can be found either in toys, or in a server dedicated to online searches. EDA (Electronic Design Automation) is the software tool that cares for the physical implementation of functional logic specifications onto electrical circuits and routing, in a space-constrained substrate. Lithography, deposition, cleaning, doping, testing are steps in the manufacturing process of chips. These steps are referred to as front-end manufacturing. OSAT (Outsourced Assembly and Test) is the cutting, dicing, and packaging of silicon chips after the front-end steps, followed by individual and system testing. These steps are referred to as back-end packaging. The frontier between front-end and back-end tends to blur, as packaging is moving closer to the silicon part, for cost, performance, and thermal reasons. EMS come after front-end and back-end and consist in assembling active and passive ICs onto a PCB board (epoxy resin), connecting several boards with cables and connectors, and placing them into a casing, adding a cooling system, if necessary, to form the final product, like a smart watch, an AI server, a PC, a smartphone, a car, or a robot.

The race for technological leadership between China and the West is far from over. While China has made significant strides, particularly in patent filings and scientific research, it faces numerous challenges, both geopolitical and domestic. The United States and its allies still hold significant advantages in capital markets and innovation ecosystems, while Chinese regulators crack down on the financial sector. For China to sustain its technological rise, it must prioritise end-demand innovation. While top-down, state-driven approaches have been effective in certain areas, they may not be sufficient to maintain long-term growth. If China’s policies continue to stifle these market forces, its technological rise may plateau.

Ultimately, the key to long-term technological leadership lies in a nation’s ability to commercialise and spread its innovations. As the Soviet Union’s experience shows, technological discovery alone is insufficient for sustained growth. China’s future success will depend on whether it can balance its top-down, state-driven approach with the bottom-up forces of consumer demand and commercialisation.

Investment implications

The United States hosts the world’s most efficient capital market that incubates pioneering innovators (from 0 to 1). Its single and unified market provides a fertile ground for enterprises to expand their scale with unparalleled ease. China has developed the world’s largest and most cost-efficient manufacturing sector. With its intricate and highly developed supply chains, it empowers companies to innovate through execution and scaling (from 1 to 100). Numerous Chinese manufacturers, with their ‘can-do’ spirit, produce goods that others often find economically unfeasible to replicate. Investing in Chinese tech leaders via selecting ‘scaling champions’ is a viable approach, considering the high barriers to entry created by their cost efficiency.

Although corporate China exhibits competitiveness across multiple domains, geopolitical tensions and deflationary pressures loom large, potentially undermining its profitability and long-term growth prospects. A strategic shift towards stimulating consumer demand is crucial to fighting deflation and sustaining China’s technological ascendancy. A failure to escape deflation may weaken the investment case for China tech. Asia commands the lion’s share in the production of sophisticated information technology hardware. Attempting to relocate these established supply chains to the United States would almost certainly result in diminished profit margins, reduced yield rates and escalated costs for downstream consumers. Companies with higher pricing power and gross margins are likely to better absorb the costs of reshoring, thus mitigating therisks associated with America First policies.

In this respect, it is worth mentioning the very active subsidies programme from the Chinese government, at every level of an industry that the government considers as strategic (e.g., within the semiconductor industry, subsidies are given to the upstream companies such as chemical or semi-equipment providers, to midstream fabs and subsidies are given to the downstream buyers of the end products). This process around subsidies at every level to develop an ecosystem from scratch at an unprecedented speed and scale is now proven, which China’s policymakers have learned from their previous successful experience in low/midend manufacturing.

We conducted an analysis of 450,000 patents from the United States and China, focusing on applicant countries in the years 2015, 2018, 2023, and 2024. These years were selected to exclude the disruptions caused by Covid- 19 in 2019-22. To that database, we applied:

We applied supervised research on categories and abstracts. These are our main findings, listed from general to specific:

Flynn, Robert, et al. Building a wall around science: The effect of US-China tensions on international scientific research. No. w32622. National Bureau of Economic Research, 2024.

Kelly, Morgan, Joel Mokyr, and Cormac Ó. Gráda. “Precocious Albion: a new interpretation of the British industrial revolution.” Annual Review of Economics 6.1 (2014): 363-389.