References

Afonso, A. and Sousa-Leite, J. “The transmission of unconventional monetary policy to bank credit supply: evidence from the TLTRO”. The Manchester School, 88:151–171, 2020.

Andreeva, D. C. and Garcia-Posada, M. “The impact of the ECB’s targeted long-term refinancing operations on banks’ lending policies: The role of competition”. Journal of Banking & Finance, 122:105992, 2021.

Barbiero, F., Burlon, L., Dimou, M., Toczynski, J., 2022. “Targeted monetary policy, dual rates and bank risk taking,” Working Paper Series 2682, European Central Bank.

Batsaikhan, U. and Jourdan, S. “Money looking for a home”. Positive Money Europe, 2021.

Benetton, M. and Fantino, D. “Targeted monetary policy and bank lending behavior”. Journal of Financial Economics, 142(1):404–429, 2021.

Böser, F. and Colesanti Senni, C. “CAROs: Climate risk-adjusted refinancing operations”. Available at SSRN 3985230, 2021.

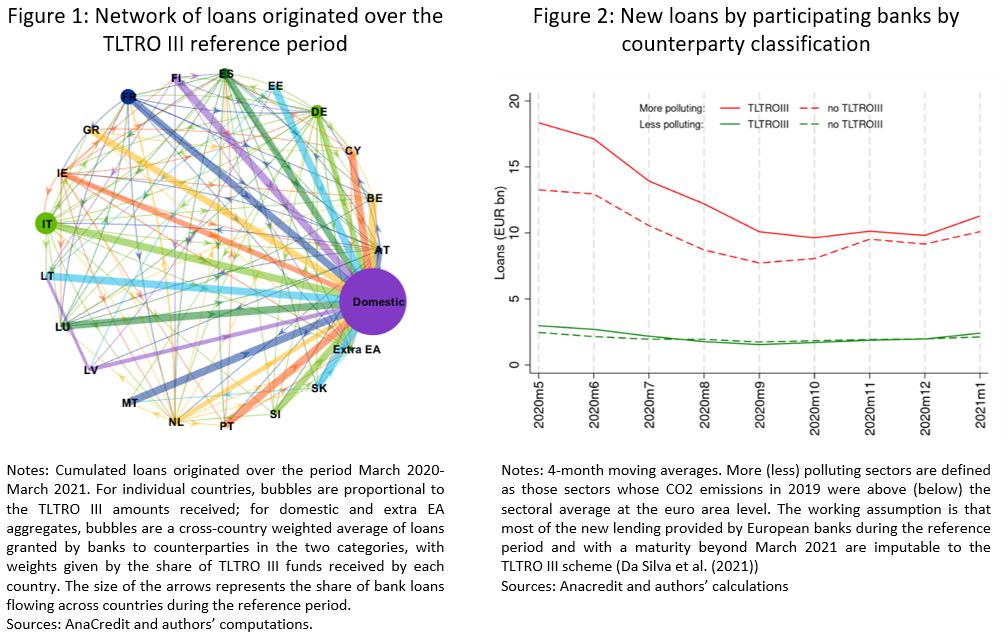

Colesanti Senni, C., Pagliari, M.S., van ‘t Klooster, J., 2023. “The CO2 content of the TLTRO III scheme and its greening,” Working Papers 792, DNB.

Da Silva, E., Grossmann-Wirth, V., Nguyen, B., and Vari, M. “Paying Banks to Lend? Evidence from the Eurosystem’s TLTRO and the Euro Area Credit Registry”. Banque de France Working paper, (848), 2021

Diluiso, F., Annicchiarico, B., Kalkuhl, M., and Minx, J. C. “Climate actions and macro-financial stability: The role of central banks”. Journal of Environmental Economics and Management, 110:102548, 2021

Giovanardi, F., Kaldorf, M., Radke, L., Wicknig, F., “The preferential treatment of green bonds,” Review of Economic Dynamics, 2023

Matikainen, S., Campiglio, E., and Zenghelis, D. “The climate impact of quantitative easing”. Policy Paper, Grantham Research Institute on Climate Change and the Environment, London School of Economics and Political Science, 36, 2017.

Monnet, E. and van ‘t Klooster, J. “Using green credit policy to bring down inflation: what central bankers can learn from history”. The INSPIRE Sustainable Central Banking Toolbox, Policy Briefing Paper no 13., 2023.

Oehmke, M. and Opp, M. “Green capital requirements”. Swedish House of Finance Research Paper, (16), 2021

Oustry, A., Erkan, B., Svartzman, R., and Weber, P.-F. “Climate-related risks and central banks’ collateral policy: A methodological experiment”. Banque de France Working Paper, (790), 2020

Van ’t Klooster, J. and van Tilburg, R. “Targeting a sustainable recovery with green tltros”. Sustainable Finance Lab Positive Money Europe, 2020.