This policy brief is based on Castelli et al. (2025). The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with. Research for this paper was financed by the Anniversary Fund of the Oesterreichische Nationalbank (Project No. 18800). Support provided by Oesterreichische Nationalbank for the early stages of this research is gratefully acknowledged.

Abstract

Foreign direct investment (FDI) plays a vital role in Europe’s economic development, especially in transferring technology and enhancing regional capabilities. This study explores two often-overlooked factors shaping FDI in the EU: regulatory distance (RD) from the investor’s home country and revealed technological advantage (RTA) of the host region. Using firm-level data from 2000 to 2018, we show that high regulatory divergence – particularly in technical and sanitary standards – deters FDI, especially from non-EU countries. In contrast, EU regions with technological strengths that match foreign firms’ innovation interests attract more investment. However, parent companies tend to avoid duplicating their own technological strengths, indicating nuanced strategic decisions. These findings have direct implications for EU industrial, regulatory and innovation policies.

While traditional determinants of foreign direct investment (FDI) – such as political, institutional and economic stability; market size; and factor costs – are well-known, two factors are gaining ground in Europe’s increasingly complex policy and innovation landscape: regulatory heterogeneity and technological compatibility. Regulatory distance (RD), defined as the divergence in regulatory objectives between the home and host countries, and revealed technological advantage (RTA), which measures regional specialisation in technology fields, are pivotal in shaping where and how much multinational enterprises (MNEs) invest.

This brief draws on a recent working paper by Castelli et al. (2025) funded by Austria’s central bank, the OeNB, that uses a novel dataset combining Orbis financial and patent data, regulatory indicators of non-tariff measures (NTMs) notified to the World Trade Organisation (WTO), and European Patent Office patent records to study FDI stocks across EU NUTS 2 regions from 2000 to 2018. The insights are timely, as the EU seeks to boost strategic autonomy and green innovation under its Green Deal Industrial Plan.

Rather than merely following capital flows, FDI is increasingly following knowledge. Today, MNEs assess potential destinations not only based on market size or cost competitiveness, but also on whether they can plug into regional ecosystems of innovation. This knowledge-seeking dimension of FDI – especially in high-technology or R&D-intensive operations – is increasingly relevant for policymakers aiming to shape regional development trajectories.

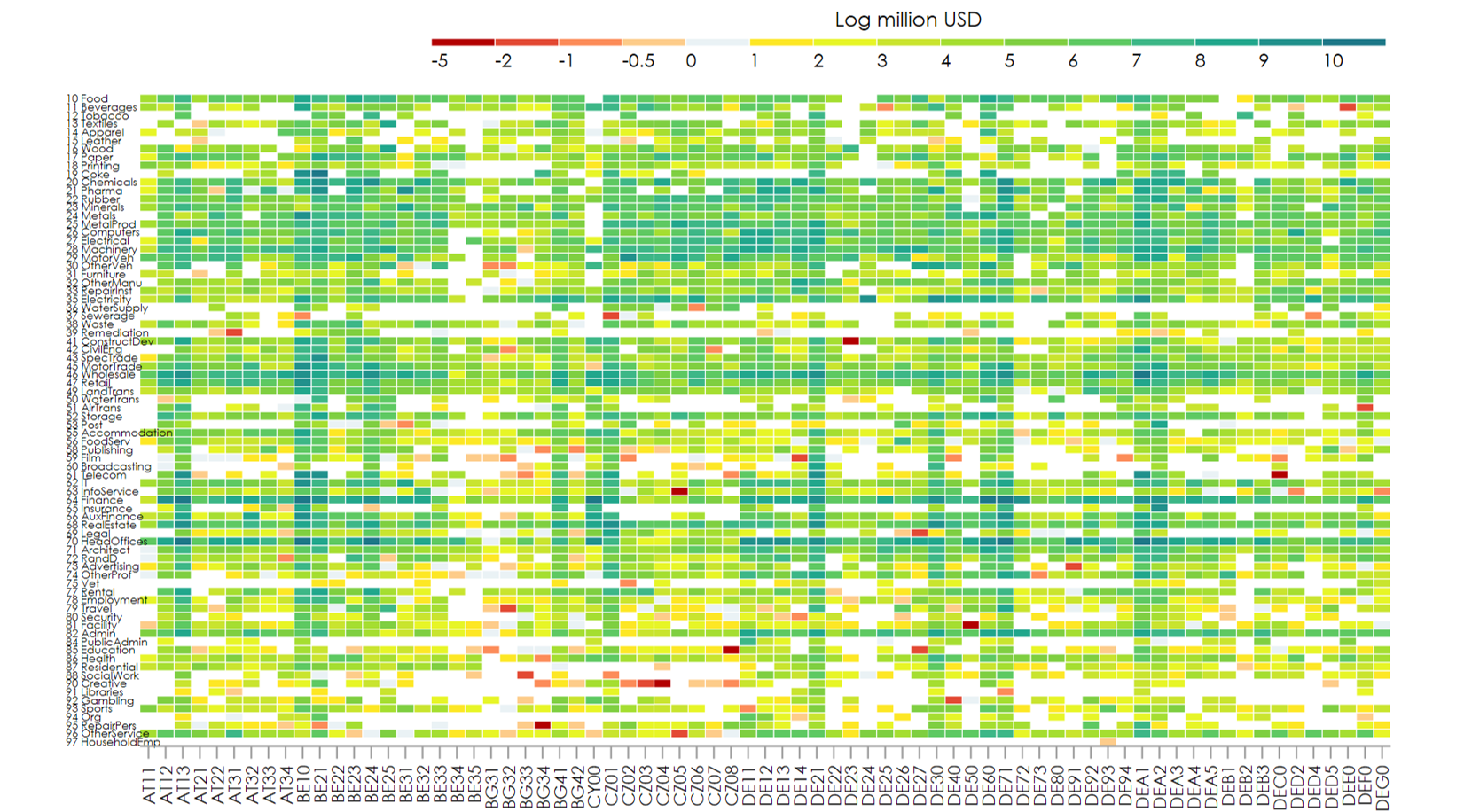

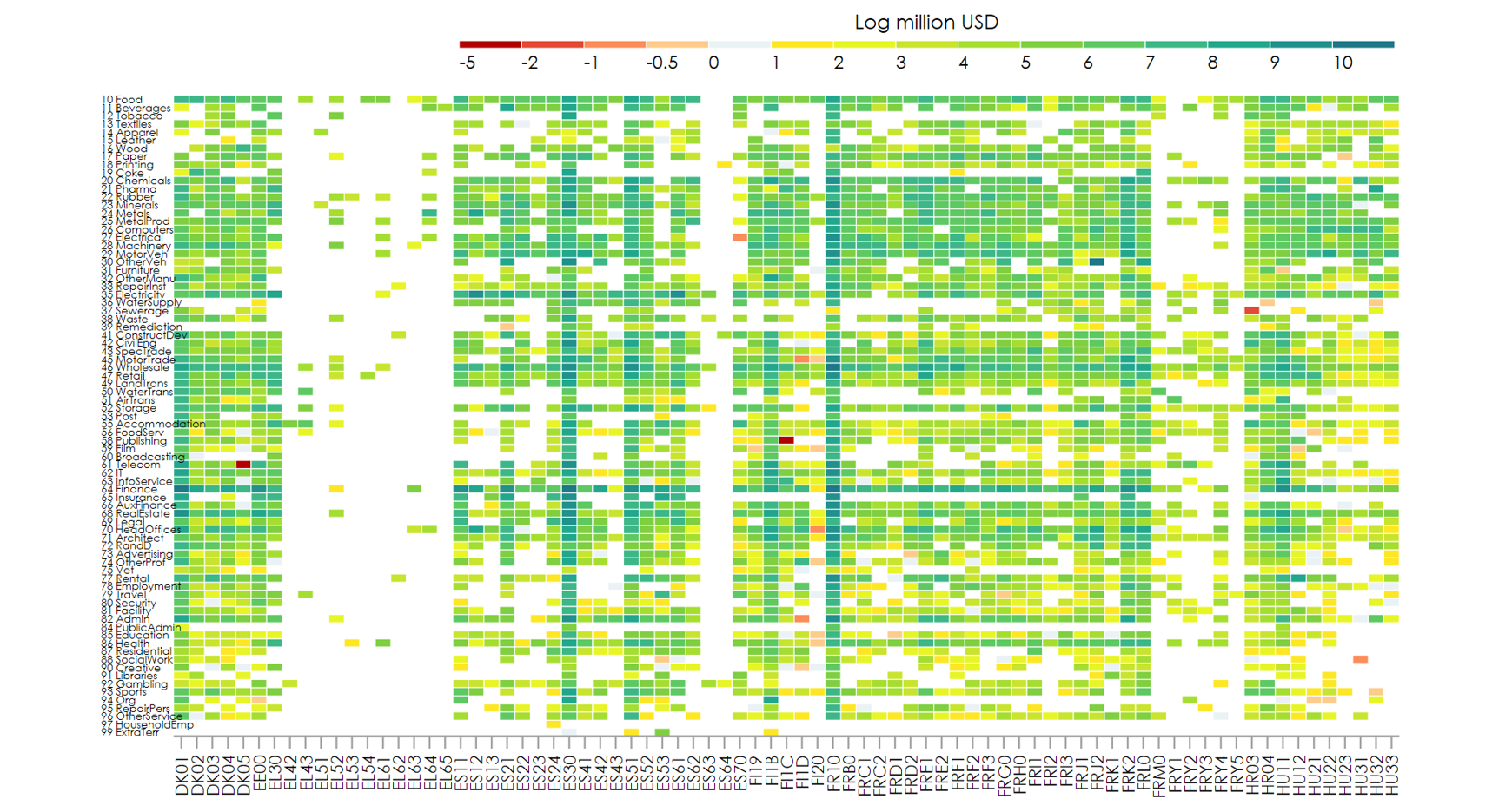

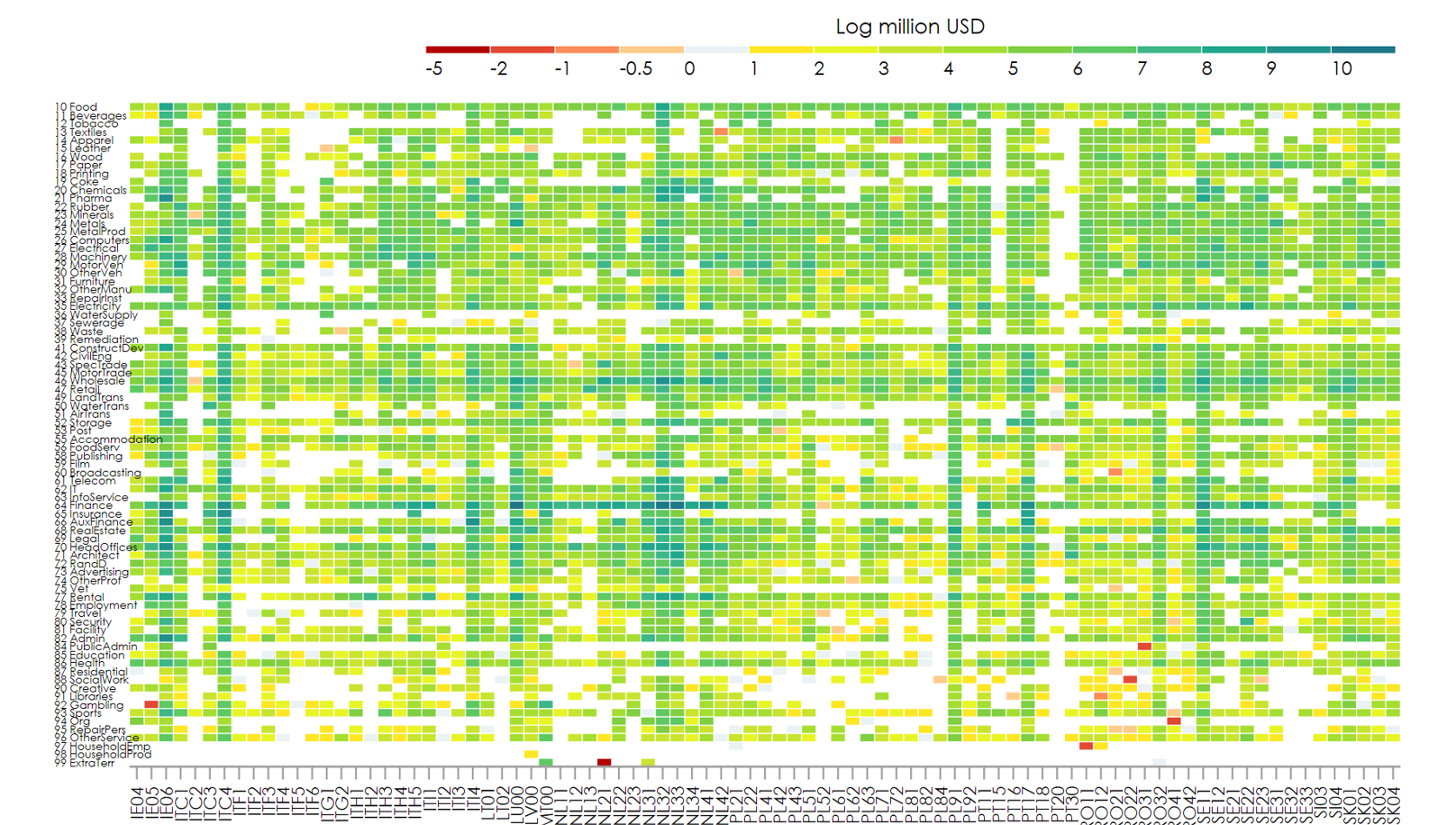

Looking across Europe, our findings reveal significant sectoral and geographical variations in FDI intensity and its underlying drivers. Figures 1-3 show the total assets held by foreign-owned subsidiaries averaged across years that are measured in millions of US dollars in logarithmic (log) form, where rows represent the NACE two-digit sectors and the columns the regions at the NUTS 2 level (Rev. 2.0 2016). The colours are centred around zero: yellow to green shades indicate positive and higher log values (i.e. FDI exceeding USD 1 million), while orange to red shades denote negative log values, corresponding to foreign-owned total assets below USD 1 million.

Financial services (NACE 64), real estate (68), and head office activities (70) consistently exhibit the highest foreign ownership across EU regions. These are followed closely by medium- and high-tech manufacturing sectors, such as machinery (28), fabricated metals (25), and motor vehicles (29), indicating that both service- and technology-intensive industries attract substantial foreign capital. Notably, foreign-owned assets exceed USD 1 million in many regions, while in others, particularly peripheral areas, FDI remains negligible.

A detailed inspection of regional patterns (as shown in Figures 1-3) reveals that regions such as Île-de-France (FR10), Oberbayern (DE21), Comunidad de Madrid (ES30), Wien (AT13) and Hovedstaden (DK01) host the largest volumes of foreign investment across most sectors, with finance dominating the asset allocation. In stark contrast, peripheral regions – especially in Bulgaria, Romania and parts of Poland – exhibit low or absent foreign investment across sectors, even where cost advantages exist. These disparities highlight the uneven geographical distribution of FDI in the EU.

Moreover, data on RTA, derived from patenting activity by inventors in each region, confirm that technologically advanced regions tend to coincide with high FDI intensity. Regions with strong RTAs in various cooperative patent classification (CPC) technology classes also show heightened MNE presence, reinforcing the idea that foreign investors seek technological complementarities. Conversely, several peripheral regions do not show any RTA in numerous technology fields, reflecting limited innovation ecosystems.

Importantly, while tax havens – such as Luxembourg (LU00) and Cyprus (CY00) – top the rankings in FDI volumes due to financial sector inflows, manufacturing FDI is more closely aligned with regional RTAs. This co-location of knowledge and capital underlines a growing trend of knowledge-seeking FDI, where foreign subsidiaries embed themselves into regional innovation systems.

Overall, these stylised facts support our main thesis: that FDI in the EU is not merely driven by cost considerations, but also by a complex interaction of sectoral specialisation, technological compatibility and regulatory environment. EU cohesion policy and FDI strategy should therefore be better aligned to address both technological divides and regulatory frictions. FDI can become a tool for reducing regional disparities if – and only if – policies are tailored to enhance absorptive capacity and facilitate technology-driven investment in lagging regions.

NTMs, including technical barriers to trade (TBTs) and sanitary and phytosanitary (SPS) measures, represent some of the most complex regulatory hurdles faced by investors. These encompass rules on health, safety, the environment, animal and plant health, and product standards, which are typically imposed to mitigate negative externalities associated with harmful products or production processes that markets fail to address on their own. While often legitimate in intent, such regulations can vary significantly across countries in their objectives and implementation, creating costly obstacles (and therefore deterrents) for firms seeking to expand across borders.

Our analysis confirms that greater regulatory distance in TBTs and, in some cases, SPS measures significantly reduces the total assets of foreign subsidiaries in the EU, particularly when the investor originates from outside the Union. This is largely because, within the European single market, regulations are either harmonised and imposed by the EU or mutually recognised for intra-EU trade, even when individual member states adopt independent regulatory measures towards third countries.

The negative effect is most pronounced and statistically significant when the regulatory mismatch relates to the sector of the MNE’s subsidiary rather than that of the parent firm. This suggests that although regulatory divergence may reflect legitimate national policy objectives, it can also act as a hidden barrier to FDI by distorting supply chains between the home and host countries. MNEs may be discouraged from investing in regions where adapting products to divergent technical standards entails costly restructuring of production, compliance or certification processes.

Moreover, the evidence supports the so-called “tariff-jumping” hypothesis only for tariffs, but not for NTMs. In fact, tariffs may sometimes encourage FDI as firms relocate production inside trade barriers. However, owing to their complexity, discretion and lack of harmonisation, NTMs tend to repel rather than attract investment.

On the flip side, our study uncovers a powerful pull factor: regions that exhibit an RTA in fields aligned with a subsidiary’s innovation interests tend to attract significantly higher FDI. This is particularly true in sectors like advanced manufacturing, green technology and digital industries. We measure this alignment by calculating the overlap between a firm’s patenting activity and the technological specialisation of a region. When foreign firms identify complementary local strengths, they are more likely to establish a presence, integrate into local R&D networks, and co-develop innovations.

Interestingly, the reverse holds true when examining parent companies: they tend to avoid investing in regions that replicate their own core innovation competencies. This may reflect concerns about market cannibalisation, intellectual property risks or insufficient differentiation. In other words, while subsidiaries benefit from local strengths, parent firms seek to avoid redundancy. Superstar MNEs, meaning those at the technological frontier, often aim to protect their core intellectual property within the boundaries of their ownership structures. At the same time, they strategically invest in regions that specialise in complementary technologies in order to diversify and enhance their innovation portfolios. In this way, spillovers tend to flow from local industries to the subsidiaries of MNEs.

This dual dynamic – subsidiary pull, parent push – offers fresh insight into how technological considerations influence not just the location but also the scale and scope of FDI.

Streamlining regulation across the EU: Efforts to harmonise standards and regulations, particularly around TBTs and SPS measures, can significantly improve the EU’s attractiveness to global investors. While harmonisation and mutual recognition of regulations in the European single market allow intra-EU trade to flow as smoothly as possible, there is a need for extra-EU regulatory convergence to attract innovative foreign capital. Policymakers should strengthen mutual-recognition frameworks and work through free trade agreements and international platforms (e.g. the WTO and the OECD) to converge regulatory goals and objectives.

Leveraging regional technological strengths: FDI strategies should be more closely aligned with regional innovation ecosystems. National and regional development agencies can map patent landscapes to identify niche specialisations and target MNEs accordingly. These landscapes can be developed across technology classes, helping to identify promising locations for the development of technologies desired by MNE subsidiaries.

Supporting complementarity instead of duplication: Rather than merely scaling existing sectors, regional development policies should promote technological niches that complement foreign innovation capabilities. This requires targeted R&D subsidies, tech transfer support and fostering university-industry linkages.

Tailoring incentives to innovation-sensitive sectors: Tax credits, infrastructure investment and regulatory flexibility should be calibrated to attract FDI in high-R&D sectors. Uniform subsidies across regions may not yield optimal outcomes without this sectoral focus. Therefore, the EU should pursue regulatory convergence in sectors where it seeks to promote innovation spillovers to domestic firms. This can be achieved by introducing regulations with new objectives, those not previously adopted by the EU but implemented by a desired trading partner (the home country of foreign MNEs), and vice versa – that is, the trading partner should adopt new regulations targeting objectives pursued by the EU in those sectors. Such convergence should not result in the removal of regulations that are essential for mitigating the negative externalities associated with products and production processes.

Promoting regulatory impact assessment: EU member states should systematically assess the FDI implications of regulatory changes, particularly in innovation-intensive sectors. Ex-ante regulatory impact assessments could help to avoid unintended deterrents.

This research underscores that not all FDI is equal. Regulatory distance can push investment away, while technological compatibility can pull it in, but only under the right strategic alignment. For policymakers, this means focusing less on the volume of FDI and more on its strategic fit with local capacities and policy frameworks. By recognising and addressing these dual drivers, the EU can attract more transformative FDI, meaning investment that not only brings capital but also upgrades regional economies and supports broader policy goals, ranging from climate protection to competitiveness. Encouragingly, the EU already has many of the building blocks in place, such as advanced patent systems, a strong single market and regional development tools. What’s needed now is a policy bridge, one that connects innovation with investment and regulation with opportunity.

Figure 1. Total assets of foreign-owned firms by NUTS 2 Rev 2.0 (2016) and NACE two-digit sectors: Group 1

Figure 2. Total assets of foreign-owned firms by NUTS 2 Rev 2.0 (2016) and NACE two-digit sectors: Group 2

Figure 3. Total assets of foreign-owned firms by NUTS 2 Rev 2.0 (2016) and NACE two-digit sectors: Group 3

Castelli, C., Davies, R. B., Mendoza, J. F. & Ghodsi, M. (2025). Drivers of FDI in the EU: Regulatory distance and revealed technological advantage. wiiw Working Paper No. 264. The Vienna Institute for International Economic Studies, June. https://wiiw.ac.at/drivers-of-fdi-in-the-eu-regulatory-distance-and-revealed-technological-advantage-p-7343.html