This policy brief is based on Casado, A. & Martinez-Miera, D. (2025).“Banks’ specialization and private information”, Banco de España Working Paper, No. 2539. The views expressed in this policy brief are those of the authors and do not necessarily represent the views of the Banco de España or the Eurosystem.

Abstract

Casado and Martinez-Miera (2025) uses comprehensive loan-level data from Spain, as well as confidential regulatory risk assessments, to document new evidence on the geographical and sectoral specialization of banks’ lending activities. This paper highlights how specific sources of specialization are more relevant for evaluating different types of borrowers. Specifically, loans to micro and small firms exhibit reduced probabilities of default in local markets where banks specialize, whereas loans to medium-sized and large firms experience lower probabilities of default in sectors in which banks specialize. Relatedly, the article also provides evidence of a direct link between bank specialization and better private information by banks, by leveraging confidential data on banks’ private risk assessments reported to regulators. These findings support the informational value of specialization and have important implications for financial stability and credit allocation.

Banks play a central role in screening and monitoring borrowers, often relying on their information advantages to assess credit risk (Leland and Pyle, 1977; Diamond, 1984). While banks can obtain non-transferable firm-specific information through their relationship with a given borrower, they can also focus their lending activities on specific local markets or sectors, effectively specializing in those dimensions. In doing so banks might develop transferable expertise that enhances their ability to evaluate similar firms (Paravisini et al., 2023; Blickle et al., 2023).

An important aspect of bank specialization is that banks can focus on various dimensions, such as specific local markets or industry sectors, among others. We argue that, given that firms can differ in the sources of information more relevant to assess their future performance and default, different dimensions of specialization might be more relevant for assessing credit risk and perform more accurate risk assessments of different types of firms.

This study leverages almost the universe of commercial and industrial loans granted to Spanish firms between 2018 and 2024 by nearly 100 banks and over 700,000 active firms sourced from the Spanish Credit Register, covering over 9 million newly originated loans. The first objective is to examine how banks’ geographic and sectoral specialization relates to realized credit defaults. By integrating this dataset with confidential internal risk ratings reported under the Internal Ratings-Based (IRB) approach, the authors assess the accuracy of banks’ probability of default (PD) estimates. These ratings serve as a proxy for private information (Howes and Weitzner, 2023), allowing the study to provide direct evidence of the informational advantages embedded in specialized lending practices, the second objective of the study.

Spanish banks display pronounced and persistent patterns of specialization across both geographic and sectoral dimensions. Local specialization is defined as the share of a bank’s outstanding commercial and industrial (C&I) lending concentrated in a specific municipality relative to its total lending, while sectoral specialization follows the same approach across 20 non-financial sectors based on the European NACE classification. On average, banks allocate close to 40% of their lending to their top municipality and 37% to their top sector, with these shares remaining stable over time, highlighting the persistence of specialization.

To better capture deviations from a fully diversified portfolio and document some patterns of specialization of Spanish banks, the study also introduces a measure of excess specialization, which reflects the extent to which a bank over-invests in a given municipality or sector relative to a benchmark of full diversification. Using this metric, banks exhibit to allocate approximately 34% of their lending to their top municipality and 23% to their top sector relative to the share a perfectly diversified bank would allocate.

The first objective of this study is to examine the relationship between bank geographical and sectoral specialization and realized ex-post loan default. By comparing the default probabilities of new loans granted to firms of different sizes, located in municipalities or operating in sectors where banks specialize, the authors identify a clear relationship between specialization and credit default.

The estimation strategy controls for a wide range of factors, including municipality-sector-size-time fixed effects to reduce differential demand problems (following Degryse et al., 2019), bank-time fixed effects, and variables capturing bank market power, relationship length, and loan characteristics such as size, interest rate, maturity, collateralization, and loan type. These controls enable comparisons across similar types of firms while accounting for differences in municipality and sector size, bank-specific overall lending advantages, bank-wide shocks that might influence the reporting of defaulted loans, and potential firm-specific informational advantages, among other things.

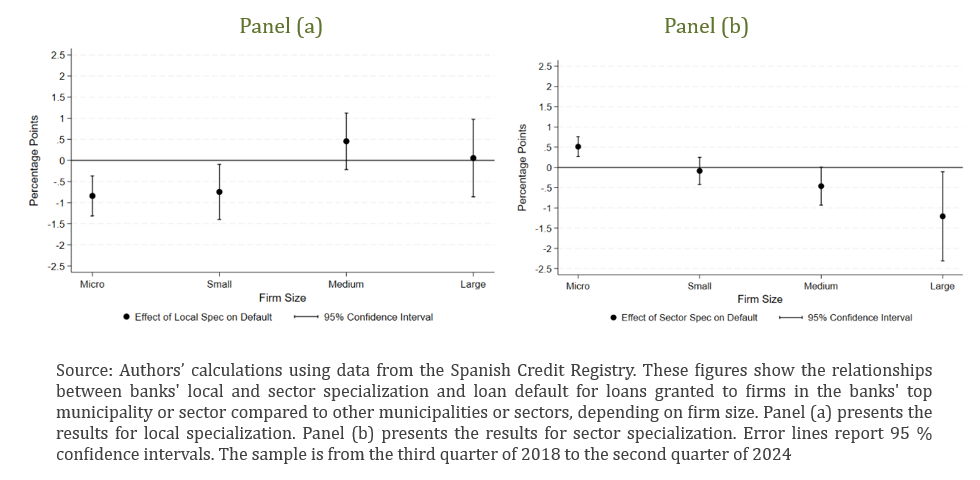

The results reveal that local specialization is associated to lower default rates for micro and small firms, while sector specialization exhibits a similar pattern for medium and large firms (Figure 1). Specifically, loans to micro and small firms in a bank’s top municipality are 0.84 percentage points (p.p.) and 0.75 p.p. less likely to default, respectively. For medium and large firms, loans in a bank’s top sector are 1.21 p.p. and 0.46 p.p. less likely to default.

Figure 1. Loan default across specialization dimensions and firm sizes

The second objective of this study is to provide direct evidence linking specialization to enhanced private information. Using banks’ internal probability of default (PD) estimates, reported under the Internal Ratings-Based (IRB) approach, the authors assess how well these PDs predict actual defaults.

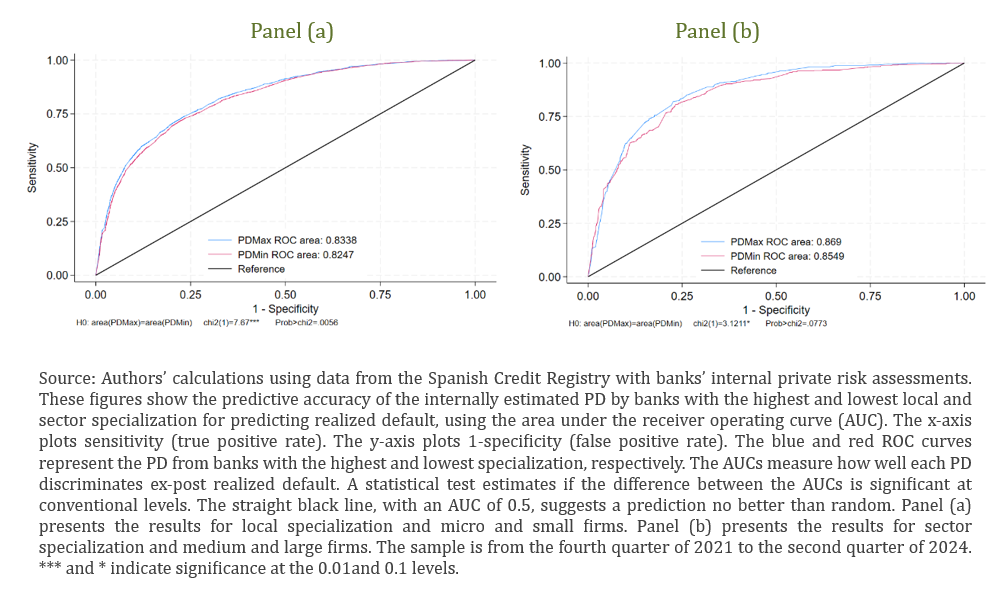

They compare the predictive accuracy of PDs assigned by specialized versus non-specialized banks for the same firm, which controls for any possible difference in the risk of firms. They do so using the Area Under the Receiver Operating Curve (AUROC) that can be interpreted as a measure of ex-post default discrimination. Given the previous results on loan default, the analysis focuses on locally specialized banks for micro and small firms, and sector-specialized banks for medium and large firms.

The findings show that PD estimates from specialized banks consistently outperform those from non-specialized banks in predicting realized defaults (Figure 2). For micro and small firms, locally specialized banks achieve an AUROC nearly 1 p.p. higher. For medium and large firms, sector-specialized banks outperform by 1.41 p.p. These differences are statistically significant at conventional levels and economically meaningful. Regarding the economic relevance of these findings, it is useful to highlight that prior literature highlights that even a 1 p.p. improvement in AUROC is considered relevant in the credit scoring industry (Iyer et al., 2016).

Figure 2. Banks’ private information across specialization dimensions

Casado and Martinez-Miera (2025) provides evidence that the relationship between local and sector specialization and loan default varies with firm size. Crucially, it offers direct evidence on the link between specialization, whether geographic or sectoral, and enhanced private information held by banks. These findings carry meaningful policy implications. Regulators and policymakers should recognize that specialization is strongly related to banks’ ability to assess credit risk. While portfolio concentration may increase exposure to localized or sector-specific shocks, fostering specialization might also strengthen financial stability by leveraging informational lending advantages. Finally, supervisors may consider integrating specialization metrics into the evaluation of internal models and risk assessments to better capture the quality of banks’ private information.

Blickle, K., Parlatore, C., & Saunders, A. (2023). “Specialization in banking”, National Bureau of Economic Research.

Casado, A. & Martinez-Miera, D. (2025). “Banks’ specialization and private information”, Banco de España Working Paper, No. 2539.

Degryse, H., De Jonghe, O., Jakovljević, S., Mulier, K., & Schepens, G. (2019). “Identifying credit supply shocks with bank-firm data: Methods and applications”, Journal of Financial Intermediation, 40, 100813.

Diamond, D. W. (1984). “Financial intermediation and delegated monitoring”, The Review of Economic Studies, 51(3), 393-414.

Iyer, R., Khwaja, A. I., Luttmer, E. F., & Shue, K. (2016). “Screening peers softly: Inferring the quality of small borrowers”, Management Science, 62(6), 1554-1577.

Leland, H. E., & Pyle, D. H. (1977). “Informational asymmetries, financial structure, and financial intermediation”, The Journal of Finance, 32(2), 371-387.

Paravisini, D., Rappoport, V., & Schnabl, P. (2023). “Specialization in bank lending: Evidence from exporting firms”, The Journal of Finance, 78(4), 2049-2085.

Weitzner, G., & Howes, C. (2023). “Bank information production over the business cycle”, Available at SSRN 3934049