This policy brief is based on Bank of Italy Working Paper, No 906 “Banks’ carbon pledges: amazing or a maze?”. The views expressed herein are those of the authors and do not necessarily represent the views of Banca d’Italia.

Abstract

So far, transition risk and banks’ climate policies have been assessed with backwards-looking metrics, such as financed emissions. This work aims to strengthen the still scarce knowledge of forward-looking metrics, such as decarbonization pledges. The analysis uses a rich dataset on the climate targets of major euro area banks, drawn from different sources, combined with information on the financial features of intermediaries and their lending policies. The decarbonization targets are extremely heterogeneous between banks in terms of time horizons, scope, ambition, and reference indicators. Banks’ commitments have weak, varied and delayed effects on credit policies towards carbon-intensive sectors. The euro area banking system is not yet aligned with the Paris Agreement goals, reflecting the limited progress of financed companies toward the climate transition.

Despite the current geopolitical headwinds, the European Union (EU) has confirmed its commitment to tackle climate risks and the goals of the Paris Agreement, although with greater attention now to safeguard the competitiveness and growth of the European economy and financial system. With up to 1.3 trillion euros per year of investment needed to accelerate the EU green transition (Nerlich et al. 2025), the banking sector has an important role to play to reallocate capital from carbon-intensive to clean assets in the EU. The climate transition risk of banks has so far been assessed through backward-looking metrics (i.e. financed carbon emissions). Among forward-looking measures, banks’ decarbonization pledges (i.e. the quantitative pillar of transition plans) can complement the picture and be translated into alignment measures such as implied temperature rise (ITR), which are still less explored.

By exploiting a uniquely rich dataset of banks’ carbon pledges spanning the 2018-2023 period, sourced from four major repositories, such as MSCI ESG research, Carbon Disclosure Project (CDP), Science-Based Targets Initiative (SBTi), and Glasgow Financial Alliance for Net-Zero (GFANZ), we shed light on different types of decarbonization goals of the euro area banking system as disclosed through sustainability and TCFD reports, surveys, investor coalitions or third- party validation initiatives. We first analyze the pledges’ content and characteristics, highlighting the differences and the main challenges in using several sources and assessing the pledges.

Looking at over 1,300 carbon pledges by 129 banks (of which 99 are significant institutions), representing about 70% of total euro area lending to non-financial corporations, we focus on the commitments on the financed emissions (i.e. banks’ scope 3 emissions), as they represent the largest share of banks’ carbon emissions. These are the emissions related to the banks’ portfolios and can be reduced via credit reallocation and pricing policies or engagement with the clients, or via the clients’ autonomously decided decarbonization processes. The following new findings stand out.

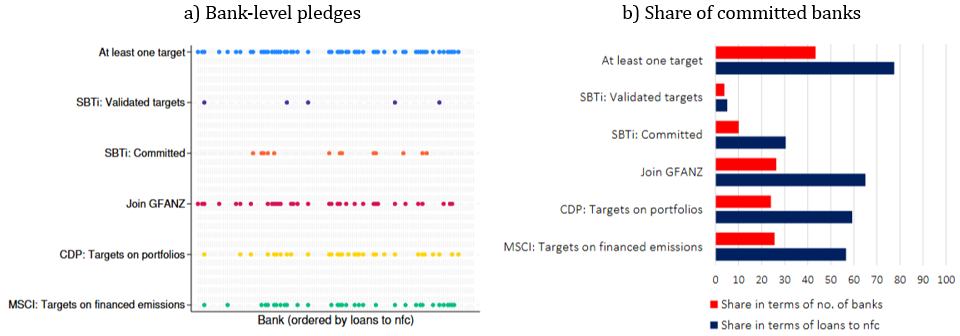

In the sample, 56 banks have set at least one carbon commitment until the end of 2023 (the remaining 73 did not publish or take pledges); these banks account for the vast majority of the credit granted to non-financial corporations within our sample. Banks differ in the type and number of pledges they make (Figure 1, panel a).

Figure 1. Banks’ commitments on financed emissions by data source

Note: Data on banks’ commitments to reduce financed emissions collected until the end of 2023. The y-axis displays the alternative types of pledge considered in the analysis. At least one target refers to any bank with at least one target among the types/repositories considered. In panel a), on the x-axis, banks are sorted according to their total loans to non-financial corporations (nfc). See Angelico & Bernardini (2024) for more details on the commitments.

Information on carbon pledges is fragmented, difficult to interpret, compare, or combine, and often differs across data sources. Challenges derive from the fact that each bank makes multiple commitments over time that differ in scope (i.e. scope 1, 2, or 3), base and target years, and metrics used to set the target (i.e., absolute emissions or intensities). In addition, some of those targets refer to specific business lines, such as lending to the real estate, automotive, cement, steel, or coal sectors, which are characterized by different carbon emission measures.

Different data sources provide various kinds of information, therefore, they are complementary and not alternative. Among the data providers analyzed, MSCI ESG Research and CDP collect information disclosed by banks, through reports, websites, or surveys, while GFANZ and SBTi provide information only on the banks’ objectives established within these two initiatives.

The heterogeneity and fragmentation of the data pose crucial challenges to investors and authorities in assessing the targets of banks, whose incentives to set credible and ambitious targets are loose. This is why it remains key to establish a common disclosure framework and a reliable collection of banks’ carbon commitments. The still limited number of committed banks (especially within the SBTI framework, which is particularly thorough) highlights the complexity of setting goals and the relevant reputational risk if targets are not achieved (Figure 1, panel b).

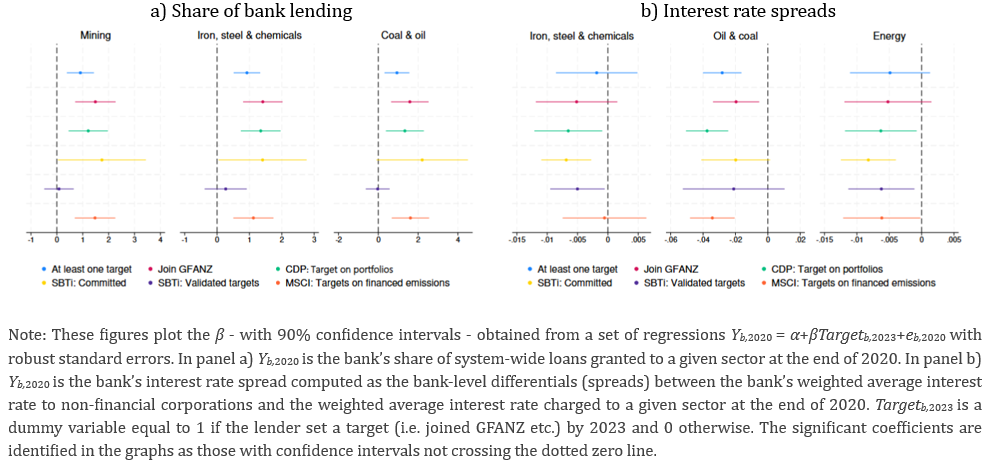

Analyzing the banks’ ex-ante financial and lending features, we find that those more likely to set carbon pledges are the ’significant’ and larger banks with higher scope 3 absolute emissions, granting most of system-level credit to a few high-emitting sectors as identified by the IEA (2021), such as mining, energy, transport, and manufacturing (Figure 2, panel a)). At the same time, the loan portfolios of these committed banks are not more concentrated to such high-emitting sectors.

Figure 2. Banks’ commitments and ex-ante credit policies to carbon-intensive sectors

These results may reflect the fact that larger banks face significant public pressure and might be more likely to advertise their pledges by joining international initiatives and communicating them to the public. Noteworthy, the disclosure of carbon pledges by these banks is systemically important given that they grant most of the lending to high-

emitting sectors and, therefore, bear a greater share of transition risk, which refers to the risk of financial loss due to a rapid shift in the economy towards a low-carbon future, especially in the case of a disorderly and abrupt transition.

While the described characteristics are common for most banks setting different kinds of carbon commitment, we cannot identify commonalities that fit all pledges, meaning that institutions with different features tend to set different target types. For instance, banks with SBTi-validated targets cover only a tiny portion of the lending granted to the high-emitting sectors. Moreover, banks committed to certain pledges lend to specific high-emitting sectors at a lower rate than their own average (Figure 2, panel b)).

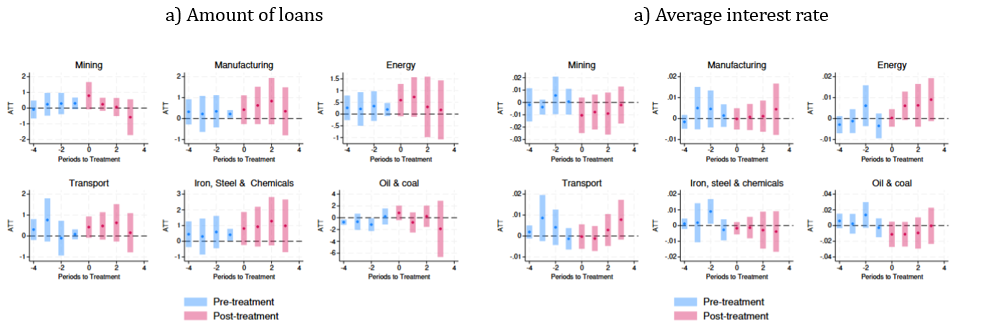

We test if banks divest over time from high-polluting sectors and change credit prices to firms in such sectors, by employing the diff-in-diff methodology proposed by Callaway & Sant’Anna (2021). Figure 3 shows that if we consider all kinds of pledges together, without differentiating among them, we do not find any change in the quantity of loans granted to high-emitting sectors (panel a) nor the price applied to them (panel b).

Figure 3. Pre and post commitments’ effects on lending to high-emitting sectors

Note: The figure displays the effect of setting at least one decarbonization target on the bank’s amount of loans (in log) (panel a) and on the weighted average interest rate charged by the bank (panel b) to a given sector, with 95% confidence bands and the zero on the horizontal axis marking the date the commitment was announced. See Angelico & Bernardini (2024) for more explanations.

However, when we consider the different types of climate commitments separately, the SBTi-related pledges, despite the limited number of observations, appear to be more influential in steering banks’ lending policies toward a carbon-risk-aware behavior, via disinvestment or credit reallocation at sector level. This influence may be attributed to the pressure for soundness and accountability exerted by external verification. Noteworthy, the effects slowly emerge after the commitment, consistent with the long-term nature of the pledges and the need to avoid the risks of an abrupt transition, which could curb rather than facilitate green investments, as highlighted by Angelini (2024), Hartzmark & Shue (2023), Bartocci et al. (2024) and Columba et al. (2024). While the GFANZ-Net Zero Banking Alliance initiative is loosening its ambition (as reported by the media outlets), we find that joining GFANZ, as well as other pledges, does not substantially affect the sectoral credit allocation and policies toward the high-emitting sectors at least in the short term.

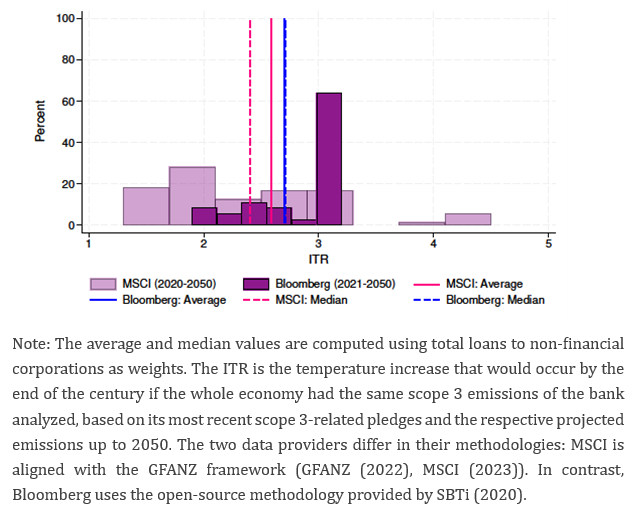

The ITR is a common and intuitive indicator that translates carbon pledges into potential temperature rise at the end of the century (as if the whole economy behaves similarly). According to this alignment metric, the European banking system (proxied by our sample) is not well aligned with the Paris Agreement’s goals to limit the temperature increase well below 2°C relative to the preindustrial levels. The ITR for our bank sample is indeed on average between 2.4°C and 2.71°C, which is consistent with the forecast range 2.1-2.8°C of the first UN Global Stocktake conducted in 2023 (Figure 4).

Figure 4. Banks’ implied temperature rise (ITR) by source

This result, on the one hand, underscores the urgent need to improve corporate decarbonization efforts, which are still lagging behind and could help reduce this misalignment; on the other hand, ITR assessment should consider the opaqueness of the underlying assumptions and the heterogeneity across data providers, which make ITR challenging to employ for financing and investment decisions as well as for micro- or macroprudential analysis.

The decarbonization of the production system in the euro area put the banking system at the core, given its central role in financial intermediation. An analysis of carbon pledges of a bank sample representative of almost 70% of lending to non-financial corporations shows that climate commitments are more likely to be set by larger banks with greater loans to high-emitting sectors, and at relatively lower interest rates. Further, decarbonization goals are heterogeneous across banks, and information is fragmented and difficult to interpret and compare. When it comes to the ex-post effects of climate commitments on bank lending to carbon-intensive sectors, we find that they are weak, diverse depending on the type of pledges, and delayed. ITR metrics point out that the European banking system is far from aligned with the Paris Agreement’s goals and underscore the need for decarbonization efforts by banks’ corporate borrowers. In a nutshell, European banks’ carbon commitments appear amazing; however, concretely assessing them is a maze to get through.

Angelico, C. & Bernardini, E. (2024), Banks’ carbon pledges: amazing or a maze?, Bank of Italy Occasional paper 906.

Angelini, P. (2024), Portfolio decarbonisation strategies: questions and suggestions, Bank of Italy Occasional paper 840.

Bartocci, A., Cova, P., Landi, V. N., Papetti, A. & Pisani, M. (2024), Macroeconomic and environmental effects of portfolio decarbonisation strategies, Bank of Italy Occasional paper 874.

Callaway, B. & Sant’Anna, P. H. (2021), ‘Difference-in-differences with multiple time periods’, Journal of Econometrics 225(2), 200–230.

Columba, F., Fabiani, A., Gallo, R. & Meucci, G. (2024), The real effects of the European sustainable finance regulation, Technical report, Bank of Italy. Mimeo.

GFANZ (2022), Measuring portfolio alignment, Technical report, GFANZ.

Hartzmark, S. & Shue, K. (2023), Counterproductive sustainable investing: the impact elasticity of brown and green firms, Technical report, Available at SSRN. December 2023.

IEA (2021), Net zero by 2050, Technical report.

MSCI (2023), Implied temperature rise methodology, Technical report, MSCI ESG Research.

Nerlich, C., Ulbrich, P., Andersson, M., Pasqua, C., Abraham, L., Ban´kowski, K., Emambakhsh, T., Ferrando, A., Grynberg, C., Groß, J., Hoendervangers, L., Kostakis, V., Momferatou, D., Rau-G¨ohring, M., Rariga, J., Rusinova, D., Setzer, R., Spaggiari, M., Tamburrini, F. & Vinci, F. (2025), ‘Investing in Europe’s green future: Green investment needs, outlook and obstacles to funding the gap’, SSRN Electronic Journal.

SBTi (2020), Temperature rating methodology. A temperature rating method for targets, corporates, and portfolios, Technical report.