References

Abbott, K.W., Green, J.F. and Keohane, R.O. 2016. Organizational Ecology and Institutional Change in Global Governance. International Organization. 70(2), pp.247–277.

Ameli, N., Drummond, P., Bisaro, A., Grubb, M. and Chenet, H. 2019. Climate finance and disclosure for institutional investors: why transparency is not enough. Climatic Change.

Ameli, N., Kothari, S. and Grubb, M. 2021. Misplaced expectations from climate disclosure initiatives. Nature Climate Change. 11(11), pp.917–924.

Aramonte, S., & Avalos, F. (2021). The rise of private markets., BIS Quarterly Review, December 2021

Assunção, J., Gandour, C., Rocha, Romero and Rocha, Rudi 2020. The Effect of Rural Credit on Deforestation: Evidence from the Brazilian Amazon. The Economic Journal. 130(626), pp.290–330.

Azizuddin, K. 2021. ESG data market ‘fertile ground for potential conflicts of interest’, says European regulator. Responsible Investor.

Bezemer, D., Ryan-Collins, J., van Lerven, F. and Zhang, L. 2021. Credit policy and the ‘debt shift’ in advanced economies.

Socio-Economic Review.,

https://doi.org/10.1093/ser/mwab041Bolton, P., Despres, M., Pereira da Silva, L.A., Samama, F. and Svartzman, R. 2020.

The green swan: central banking and financial stability in the age of climate change [Online] Banque de. Bank for International Settlements

(BIS). Available from:

https://www.bis.org/publ/othp31.pdf.

Chenet, H., Ryan-Collins, J. and van Lerven, F. 2021. Finance, climate-change and radical uncertainty: Towards a precautionary approach to financial policy. Ecological Economics. 183, pp.106957–106957.

Deleidi, M., Mazzucato, M. and Semieniuk, G. 2020. Neither crowding in nor out: Public direct investment mobilising private investment into renewable electricity projects. Energy Policy. 140, p.111195.

Donovan, C., Fomicov, M., Gerdes, L.K. and Waldron, M. 2020. Energy Investing: Exploring Risk and Return in the Capital Markets. CCFI & IEA.

ECB 2022.

Supervisory assessment of institutions’ climate- related and environmental risks disclosures [Online]. Frankfurt: European Central Bank. Available from:

link.

Ford, G., Kedward, K., Krebel, L., Ryan-Collins, J., Vaccaro, J. and van Lerven, F. 2022. Fat Tails, Tipping Points and Asymmetric Time Horizons: Dealing With Systemic Climate-Related Uncertainty in the Prudential Regime. SSRN Electronic Journal. (19 October).

Gabor, D. 2016. The (impossible) repo trinity: the political economy of repo markets. Review of international political economy. 23(6), pp.967–1000.

Gabor, D. (2021). The wall street consensus. Development and Change, 52(3), 429-459.

Grubb, M., Drummond, P., Poncia, A., McDowall, W., Popp, D., Samadi, S., Penasco, C., Gillingham, K., Smulders, S., Glachant, M., Hassall, G., Mizuno, E., Rubin, E., Dechezleprêtre, A. and Pavan, G. 2021.

Induced innovation in energy technologies and systems: a review of evidence and potential implications for CO 2 mitigation [Online]. HAL. Available from:

https://EconPapers.repec.org/RePEc:hal:journl:hal-03189044.

Hall, S., Foxon, T.J. and Bolton, R. 2017. Investing in low-carbon transitions: energy finance as an adaptive market. Climate Policy. 17(3), pp.280–298.

Hepburn, C., O’Callaghan, B., Stern, N., Stiglitz, J. and Zenghelis, D. 2020. Will COVID-19 fiscal recovery packages accelerate or retard progress on climate change? Oxford Review of Economic Policy. 36(Supplement_1), pp.S359–S381.

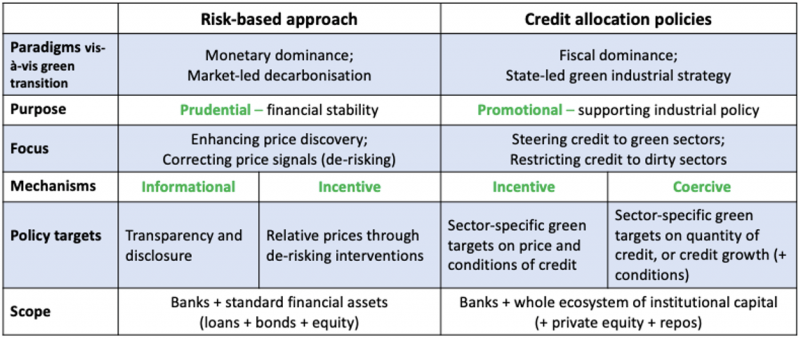

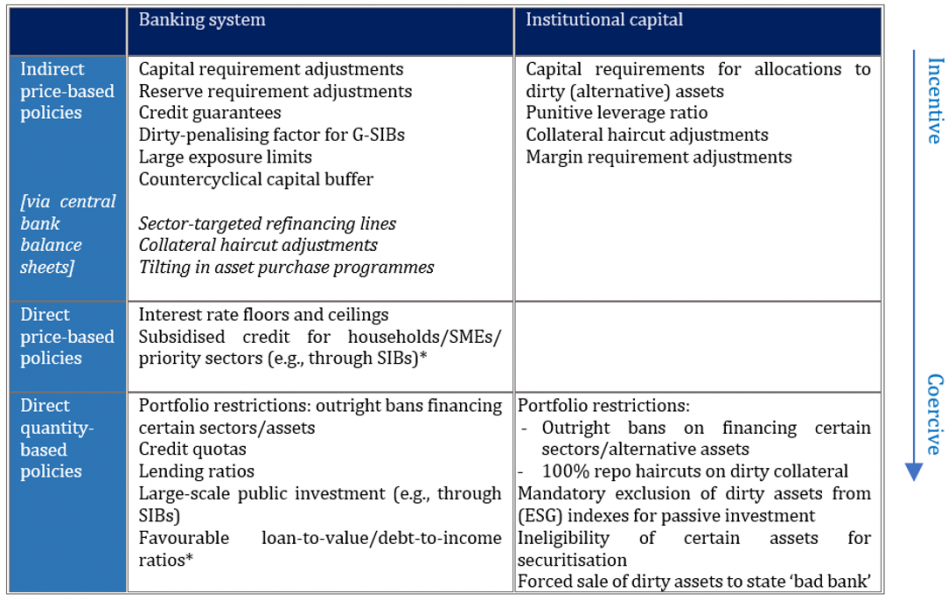

Kedward, K., Gabor, D. and Ryan-Collins, J. (2022). Aligning finance with the green transition: From a risk-based to an allocative green credit policy regime. UCL Institute for Innovation and Public Purpose, Working Paper Series (IIPP WP 2022-11).

https://www.ucl.ac.uk/bartlett/public-purpose/wp2022-11.

Knox-Hayes, J. and Levy, D. 2014. The Political Economy of Governance by Disclosure: Carbon Disclosure and Nonfinancial Reporting as Contested Fields of Governance In: A. Gupta and M. Mason, eds. Transparency in Global Environmental Governance: Critical Perspectives. Cambridge, MA: MIT Press.

Loriaux, M., Woo-Cummings, M., Calder, K., Maxfield, S. and Perez, S. 1997. Capital Ungoverned: The Dismantling of Activist Credit Policies in Interventionist States. Ithaca NY: Cornell University Press.

Mazzucato, M. and Penna, C.C. 2016. Beyond market failures: The market creating and shaping roles of state investment banks. Journal of Economic Policy Reform. 19(4), pp.305–326.

Mazzucato, M. and Semieniuk, G. 2018. Financing renewable energy: Who is financing what and why it matters. Technological Forecasting and Social Change. 127, pp.8–22.

McGee, J. 2014. The Influence of US Neoliberalism on International Climate Change Policy In: N. E. Harrison and J. Mikler, eds. Climate Innovation [Online]. Energy, Climate and the Environment Series. London: Palgrave Macmillan. Available from:

https://doi.org/10.1057/9781137319890_8.

Mikheeva, O. and Ryan-Collins, J. 2022. Governing finance to support the net-zero transition: Lessons from successful industrialisations. Institute for Innovation and Public Purpose Working Paper Series. (WP2022/1).

Monnet, E. 2018. Controlling Credit: Central Banking and the Planned Economy in Postwar France, 1948–1973. Cambridge University Press.

O’Reilly, E. 2020.

Decision of the European Ombudsman in joint inquiry 853/2020/KR on the European Commission’s decision to award a contract to BlackRock Investment Management to carry out a study on integrating environmental, social and governance (ESG) objectives into EU banking rules [Online]. European Ombudsman. Available from:

https://www.ombudsman.europa.eu/en/decision/en/135363.

Schröder, M., Ekins, P., Zulauf, M. and Lower, R. 2011.

The KfW experience in the reduction of energy use in and CO2 emissions from buildings [Online]. UCL Energy Institute and LSE Housing and Communities. Available from:

https://sticerd.lse.ac.uk/dps/case/cp/kfwfullreport.pdf.

Smoleńska, A. and van ’t Klooster, J. 2022. A Risky Bet: Climate Change and the EU’s Microprudential Framework for Banks. Journal of Financial Regulation. 8(1), pp.51–74.