COVID-19 has led to profound turmoil and severe disruptions in our lives and economies. Even more than the 2008–2009 global financial crisis (GFC) – which was most directly felt in the United States and in Europe – the current pandemic-induced crisis is affecting nearly all countries around the world. In a recent article (Buysse and Essers, 2020), we provide an overview of the economic developments in emerging market economies (EMEs), with a focus on those that have been systemically important for the world and/or euro area economy: China, India, Brazil, Russia and Turkey. A decade ago, EMEs succeeded in weathering the crisis rather well and were the engine of the subsequent global recovery. Based on our overview, we conclude that EMEs will most likely not play that role again throughout the COVID-19 crisis.

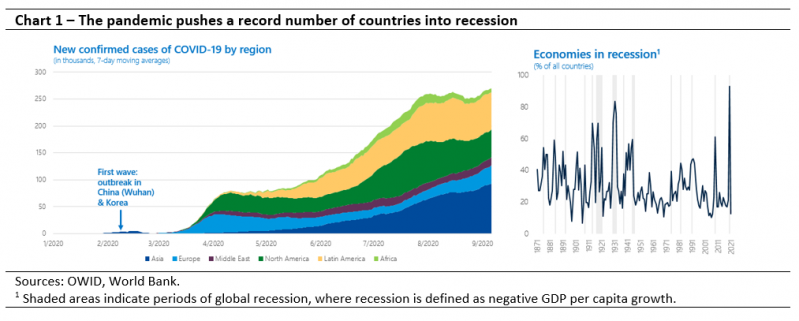

COVID-19 is the first infectious and deadly disease to turn into a truly global pandemic, in a short time window. The new coronavirus causing the disease originated in China and spread mostly to other East Asian countries in February. By March, the pandemic had already reached Europe and the US. And since May, EMEs have become the pandemic’s new epicentre. Parts of Latin America (e.g. Brazil and Mexico) and Asia (e.g. India and the Philippines) have been particularly hard hit (Chart 1, left panel). COVID-19 will go down in history as the first pandemic to trigger a global recession on its own. Moreover, the resulting crisis is expected to be the deepest since World War 2, much deeper than the GFC, and the most synchronised ever, with a record number of countries experiencing negative GDP per capita growth in 2020 (Chart 1, right panel).

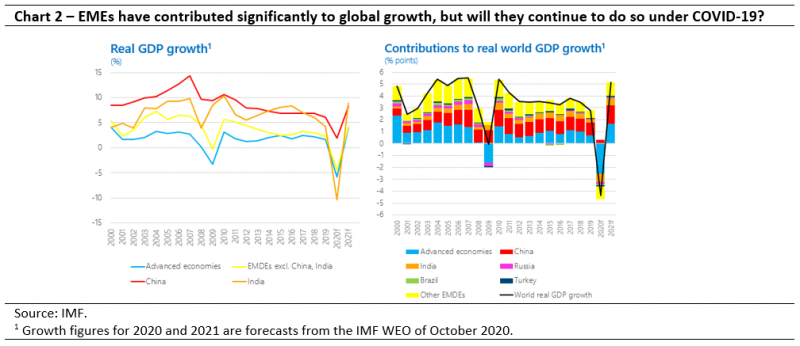

Emerging market and developing economies (EMDEs)2 have contributed significantly to global economic growth over the last two decades. Taken together, the group of EMDEs has consistently experienced faster GDP growth than advanced economies (Chart 2, left panel). However, these overall trends mask important underlying country differences. As in the remainder of this article, we zoom in on a selection of five large EMEs to examine those in greater detail: China, India, Russia, Brazil and Turkey. Chart 2 (right panel) shows that the large and increasing contribution of EMDEs to world GDP has to a great extent been driven by China and, in the second instance, India. Both countries also acted as a key counterbalancing force during the 2008-2009 GFC and led the post-GFC recovery. These divergent growth patterns between large EMEs and advanced economies revived the debate about “decoupling” (Buelens, 2013). Apart from China and India, most other EMDEs were also growing faster than advanced economies before, during and in the wake of the GFC, but the difference compared to advanced economy growth shrank to a small margin (less than one percentage point) by 2014, when commodity prices collapsed and stayed relatively low thereafter.

Enter the COVID-19 crisis. This time around it seems highly unlikely that EMEs will take up the role of backstop to the world economy and lead the economic recovery to the same extent as they did during the GFC. As we will show in this article, large EMEs, including China and India, are more severely hit by the current crisis, both directly and indirectly. Moreover, the effects of the COVID‑19 pandemic came on top of ongoing, more idiosyncratic stress factors in the countries considered. China entered the crisis with lower economic growth, a larger fiscal deficit, and extraordinarily high corporate leverage (Buysse et al., 2018). While India was still among the world’s fastest growing economies, it had been grappling with severe problems in its non-bank financial sector and an associated credit crunch. Brazil was slowly recovering from a deep recession in 2015-2016, hampered by great uncertainty surrounding fiscal and structural reforms, including those concerning the pension system and energy sector. Russia saw only moderate growth in a context of subdued oil prices and EU-US economic sanctions, and in March 2020 it was fighting an oil price war with Saudi Arabia, triggered by the failure to agree on oil production cuts. Finally, Turkey had just bounced back from recession in 2018 following an episode of capital flight and sharp currency depreciation. Its recovery was supported by an expansionary fiscal policy and (unsustainably) fast credit provision by state-owned banks. When COVID-19 hit, most major EMEs therefore found themselves in a worse position and had less policy space relative to 2008.

Just how large the contributions of EMEs to global economic growth will end up being in 2020 and the years to come is subject to a much larger-than-usual degree of uncertainty, due to the unique and still unfolding nature of the COVID-19 crisis. Much will depend on the further course of the coronavirus, which is hard to predict, as well as the responses of consumers, businesses and governments. China is the only large EME expected to contribute positively to world GDP growth in 2020, and only slightly so, in contrast to 2008-2009 (Chart 2, right panel). For 2021, the October IMF forecasts imply that China’s contribution will be almost as large as that of all advanced economies combined, outstripping its own contribution in post-GFC year 2010. The country’s increased weight in the global economy is projected to more than compensate for its lower growth rate in 2021 compared to 2010. Conversely, India, Brazil, Russia and Turkey are all projected to experience deeply negative GDP growth in 2020. The contribution of these four (and most other) EMEs to 2021 global growth is assumed to be positive but smaller than in 2010. It remains to be seen how accurate these projections will turn out to be but, as we will demonstrate in the following sections, there does not seem to be much cause for optimism.

The first infections by the new coronavirus surfaced in the Chinese city of Wuhan in late December 2019. Confronted with an exponential rise in the number of infections and deaths, the Chinese government on January 23 decided to place Wuhan and much of the surrounding province of Hubei under a complete lockdown. The Chinese authorities succeeded in rapidly confining the spread of the virus. Starting mid-February, mobility and activity restrictions were gradually removed, and in early April, the lockdown of Wuhan was lifted. As a first mover, China provided the world with a blueprint of a containment strategy. Drawing on lessons learned from previous health crises, Korea responded to its own COVID-19 outbreak with a rather unique and less disruptive containment strategy. It combined fast and extensive testing, contact tracing, and isolation of positive cases, while avoiding a full-scale lockdown. After managing their first outbreaks, both countries have so far effectively prevented new localised infection clusters from turning into second waves.

As China and Korea were the first to impose containment measures and then the first to again loosen them, their confinement strategy and economic developments have been closely monitored elsewhere. To some extent, monthly indicators in the euro area, such as industrial production, retail sales and exports, have indeed followed those of China and Korea with a lag. However, there are also some notable differences in the patterns of recovery between China, on the one hand, and the euro area and Korea, on the other. In China, the post-lockdown rebound in industrial production has been considerably faster than that in retail sales, whereas the opposite has been true in the euro area and Korea. This partly reflects the different focus of policy. China has focused on the supply side: instructing the reopening of factories early on, supporting large producers and boosting public investment. However, China’s household demand remains relatively weak due to significant job losses, only partly cushioned by the country’s limited social welfare system, and to increases in precautionary savings. In contrast, the euro area and Korea have focused on the demand side: providing generous income support to households via state-funded job retention schemes (euro area), or the entitlement of temporary workers to unemployment benefits (Korea).

The first quarter of 2020 saw China’s first economic contraction since 1978: GDP dropped by 6.8 % year on year. However, China also managed to engineer what looks like a V-shaped recovery in the second quarter, with the economy again growing at a rate of 3.2 %. Investment growth was the main driver of this recovery, with state-owned enterprises taking the lead (Zenglein and Kärnfelt, 2020). The recovery continues to strengthen, with growth of 4.9 % in the third quarter, making China one of the very few countries expected to register a positive annual growth rate of around 2 % in 2020, according to the IMF, ECB and OECD.

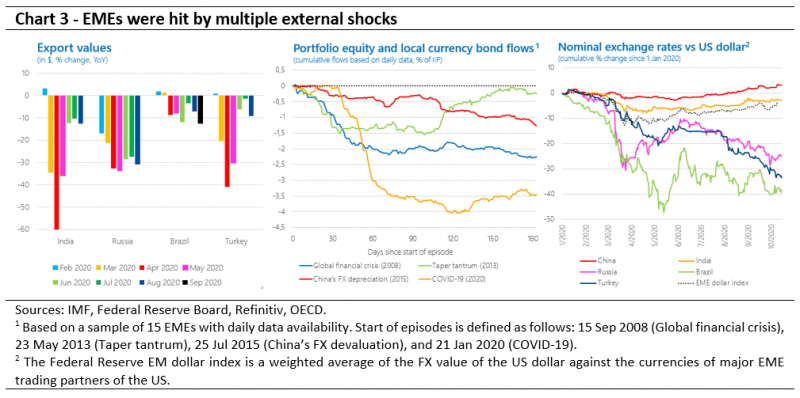

Even before the virus reached their shores, other EMEs already felt the repercussions of the developments in China and the advanced economies. The “third wave” of the pandemic (East Asia being the first wave and Europe and the US being the second wave) dealt a severe blow to their already ailing economies. EMEs were hit by multiple external shocks, often similar in nature to those observed during the GFC but typically steeper.

World trade fell rapidly, due to a combination of supply chain dislocations related to virus containment measures, weaker demand, and new export restrictions (World Bank, 2020).3 The 12% drop in world goods trade from March to April 2020 was the sharpest month-on-month decline on record. By June, world trade started to recoup some of its losses. The exports of major EMEs have not been spared (Chart 3, left panel). Within services trade, tourism in particular has been severely curtailed by the COVID-19 crisis. As country borders closed, international travel collapsed in March and reached its nadir by the end of April, when the number of commercial flights was only about a quarter of the traffic in early January. The recovery since then has been slow.

The decline in world trade volumes was accompanied by a steep drop in commodity prices, starting in late January, at the time of the Wuhan lockdown, and then intensifying as the spread of the coronavirus transformed into a pandemic. Oil prices suffered an especially steep drop, which was initially magnified by abundant supply (courtesy of an oil price war between Russia and Saudi Arabia). Oil prices gradually recovered from May onwards but are expected to remain close to $ 40 per barrel on average over 2020, according to most forecasts. Such prices are much lower than most oil exporters’ fiscal break-even prices, i.e., the prices needed to balance the government budget (BIS, 2020).

Given the mounting concerns about the COVID-19 fallout and threats to EMEs’ growth models (often dependent on trade, commodity exports and/or global value chains), international investors retrenched. In March alone, more than $ 80 billion in portfolio capital was withdrawn from EMEs, a much steeper move than during the GFC, the 2013 taper tantrum, or the 2015 Chinese shock devaluation (Chart 3, middle panel). Cumulative portfolio outflows between mid-January and May added up to more than $ 120 billion, or nearly 4 % of asset holdings. By June, the capital from foreign institutional and retail investors started to return but the recovery remained tepid and uneven. After the initial, broad-based sell-off, investors began to differentiate more among EMEs, taking into account countries’ vulnerabilities and prospects. Several countries, including Turkey, were still seeing large capital outflows, whereas others, including China, saw net inflows.

The initially large capital outflows went hand in hand with a sharp depreciation of EME currencies. For example, over the first quarter of 2020 alone the Brazilian real and Russian rouble both lost up to 30 % of their value against the US dollar (Chart 3, right panel). Whereas the rouble went on to make up part of that loss over the second quarter, the real tanked further and registered a cumulative depreciation of almost 50 % by mid-May, before a correction took place. The Turkish lira also depreciated by 20% between January and early May. Over the summer, EME currencies remained relatively stable vis-à-vis the dollar. Recent months have seen renewed depreciation pressures.

EME assets were of course not the only ones affected. Whereas the early lockdown in China seemed to have little effect on global financial markets, the new coronavirus infection cluster in Italy as of late February led to a sharp worldwide correction in risky asset classes. Some of the fastest equity price drops ever were observed, even though in percentage terms the peak-to-through sell-off was still much smaller than during the GFC. China’s equity markets held up comparatively well throughout these gyrations, likely the result of the country’s relative success with containing domestic virus outbreaks and its strong economic rebound. Global market conditions largely stabilised from the end of March onwards, following the announcement of an array of new measures by the Federal Reserve, ECB and other central banks in advanced economies and EMEs, and of large fiscal stimulus packages.

The severe health effects and direct and indirect economic impacts of the COVID-19 crisis on EMEs depend partly on pre-existing country characteristics, which can make countries vulnerable because of the exposure to particular shocks they imply and/or their effect on countries’ resilience, i.e., their ability to bounce back from shocks.

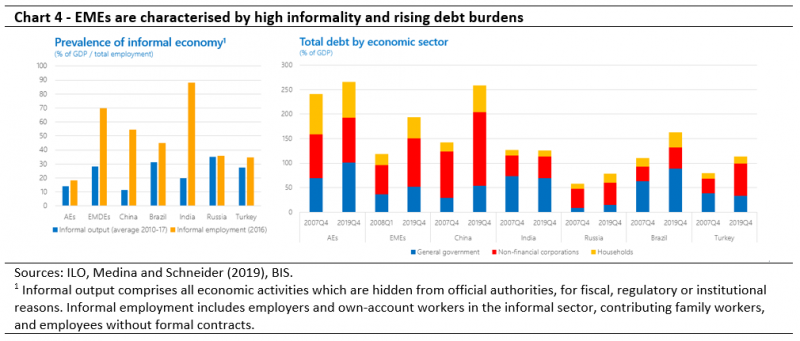

Higher informality in EMEs (Chart 4, left panel) exacerbates the effects of COVID-19 through various channels (World Bank, 2020). Informal workers often live and work in crowded places, enabling the spread of the coronavirus. Informal firms also tend to operate in the services sector, which has been harder hit by lockdowns and other containment measures. Workers in poorer countries typically have less scope to engage in teleworking, and the inability to work from home is particularly pronounced for the (informally) self-employed, who thus bear a greater cost of social distancing policies (Gottlieb et al., 2020). Moreover, informal workers are typically excluded from government benefits and have low savings of their own to buffer temporary income losses during containment.

Another source of vulnerability are EMEs’ fiscal and external positions, which were often weaker anno 2019 than on the eve of the GFC. Hence, EMEs had less policy space than in 2008-2009. Even before the COVID-19 crisis, overall debt levels were on the rise in most EMEs. Government, corporate and household debt all increased relative to GDP, but at varying speeds and from different starting points in individual countries (Chart 4, right panel). The COVID-19 crisis itself is expected to add substantially to public debt burdens, due to significantly lower economic growth, a further sharp deterioration of fiscal balances (because of relief packages and other additional spending, plus lower revenues), and possibly the realization of contingent liabilities.

The COVID-19 crisis has again brought into focus two important dimensions of EME debt: first, the degree to which it is denominated in foreign currency, which makes EMEs vulnerable to currency depreciations; and second, the dependence on non-resident investors (Cantu et al., 2020). With respect to the first dimension, most EME governments have now overcome “(domestic) original sin”, defined as the inability to borrow domestically long-term, at fixed rates, and in local currency (Hausmann and Panizza, 2011). Indeed, following major crises in the 1990s and early 2000s, EMEs deliberately reduced their exposure to potential currency devaluations by developing their (local currency) government bond markets at home. However, several EMEs still have a substantial share of their internationally issued government bonds denominated in foreign currency.

On the second issue, non-resident investors held close to 20 % of EME local currency government securities as of mid-2019, up from about 10 % back in 2007. Hofmann et al. (2020) show that EMEs with higher foreign ownership in their local currency bond markets have experienced significantly larger increases in their local currency bond spreads during the COVID-19 pandemic, with exchange rate depreciation acting as a key aggravating factor. This can be explained by what Carstens and Shin (2019) have called the “original sin redux”, i.e., borrowing in local currency from foreign lenders mitigates the currency mismatches for the borrower but shifts them to the lender. EME currency depreciation lowers the value of assets in terms of foreign investors’ own currencies (in which their risk limits also tend to be denominated). Large depreciations may therefore prompt foreign investors to engage in asset sales, pushing up EME local currency bond spreads in the process. Such dynamics have indeed played out in recent months.

More so than governments, (non-financial) corporate borrowers in many EMEs have increasingly turned to external sources of funding since the GFC, much of it in bonds and loans denominated in foreign currencies. This exposes them to sudden stops and potentially adverse balance sheet effects (depending on the company’s asset structure). While the absolute increase in foreign currency-denominated corporate debt is most spectacular in China, it is also apparent in other EMEs, notably Turkey and Russia whose companies have taken on much additional euro-denominated debt in recent years. One should note that traditional international financial statistics, based on the borrowers’ residency rather than their nationality, tend to underestimate the foreign currency debts of firms (Avdjiev et al., 2020).

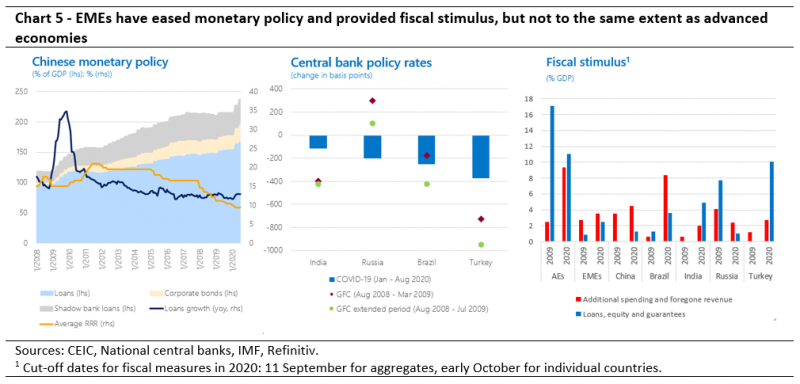

In the first months following the outbreak of the pandemic, the People’s Bank of China continued its easing cycle, which had already started in 2018. Even though a comparison of China’s monetary policy response in the current crisis versus the GFC is not straightforward, because of the continuous adaptations to the monetary policy framework, one striking difference is the development of credit growth, which now shows only timid signs of accelerating (Chart 5, left panel). However, there does seem to be a pickup in Chinese shadow financing and corporate bond debt issuance.

Thanks to the adoption of more flexible policy frameworks over time, combining inflation targeting with exchange rate intervention, active use of macroprudential tools, and sometimes capital flow management measures, other EME central banks have found it more feasible to cut interest rates (Chart 5, middle panel) than during the GFC, in spite of exchange rate pressures and capital outflows. They also introduced a myriad of additional and unconventional measures to stabilise financial markets and restore confidence, including new (often first-time) long-term asset purchase programmes. The announcement of quantitative easing (QE) interventions by EMEs had noticeable direct short-term impacts on local currency government bond yields, on average even more so than QE announcements in advanced economies (Hartley and Rebucci, 2020). These positive initial market reactions suggest that the programmes successfully restored investor confidence and did not lead to higher inflation expectations, for example due to fears of fiscal dominance.

EME central banks also engaged in liquidity provision through an expansion of standing facilities, a lowering of reserve requirements, and new specialised facilities aimed at SMEs and others. Moreover, some central banks organised foreign exchange (typically US dollar) auctions, and adapted macroprudential rules and other regulations, such as restrictions on bank/corporate dividends, short-selling bans, etc.

Crucial as these central bank responses may have been, they have important limitations. As emphasised by the BIS (2020), central bank tools can provide temporary financing, but cannot transfer real resources. As such, these toolkits can only assist borrowers in surviving if their income losses are not too great. This points to the key, complementary role of fiscal policy.

IMF estimates as of September put the average discretionary fiscal stimulus for EMEs at 3.5 % of GDP, which is considerable and already larger than their fiscal impulse during the GFC. It is also an underestimation, as some EMEs have announced additional measures since those estimates were made. Yet, the EME stimulus is still much smaller than the estimated 9.3 % of GDP in fiscal support that advanced economies have mobilised (Chart 5, right panel). It is believed that narrower fiscal space in EMEs has constrained their fiscal response. In EMEs, about 60 % of the total value of fiscal measures consist of additional spending and delayed or foregone revenues due to discretionary decisions and have a direct impact on government budgets. The other 40 % covers instruments such as loans, equity injections and guarantees, including through state-owned banks and enterprises. The latter type of support helps maintain solvency and limit bankruptcies but could also further worsen public finances down the line.

At first glance, the fiscal stimulus provided by the Chinese government seems to be more generous than its stimulus in 2008-2009. Alas, such a cursory comparison is misleading. Some observers estimate China’s fiscal stimulus in response to the GFC as high as RMB 4 trillion, or 12.5 % of China’s 2008 GDP, once one takes into account that the total package was spread over several years and largely implemented at the sub-national level through local state-owned enterprises (Fardoust et al., 2012). Regards the current crisis, as of October, an estimated RMB 4.6 trillion, or 4.5 % of 2019 GDP, of new discretionary measures have been announced. Of course, more stimulus may follow, as history learns that China is eager to step up its efforts when growth prospects falter, but the increased leverage since the GFC has reduced Chinese policy space. Also this time around much of the stimulus will be implemented by China’s local governments in the form of projects, focused on improving “new” infrastructure such as 5G, electric car charging facilities, data centres, artificial intelligence, etc. (Haasbroeck, 2020).

The size and composition of other large EMEs’ fiscal responses has been quite heterogeneous. Brazil has suspended compliance with budgetary rules and passed large emergency support packages involving additional spending as well as public bank credit lines and government guarantees. Support measures in India and Turkey have also been rather generous, but predominantly they take the form of credit provision, guarantees and equity injections. In Russia, high sensitivity of budget balances to fluctuations in energy prices, and limited access to international capital markets (due to sanctions) have impelled its government to act more cautiously, as reflected in a relatively modest direct fiscal impulse.

While EMEs have employed their own monetary and fiscal policies as a first line of defence in the battle against the economic fallout from the COVID-19 pandemic, this may not suffice if the crisis persists over a longer period, especially not for those EMEs that are fiscally constrained and/or may experience problems in accessing external finance at reasonable cost, going forward.

With the notable exception of China, which for now seems to be recovering from the crisis largely on its own, EMEs may be counting on policy actions in advanced economies. Indeed, the decisive and extraordinarily large monetary and fiscal stimulus of advanced economies early on in the pandemic has contributed to the stabilisation of global financial markets and allowed (mostly higher-rated) EME governments and companies to issue hard currency debt at an historically high pace in the second quarter of 2020 (Mühleisen et al., 2020). The strength of EMEs’ economic recovery will depend heavily on global interest rates remaining low and on a resumption in external demand for their exports from advanced economies.

The most vulnerable EMEs may also have to rely on the “global financial safety net”, which includes bilateral support from central bank currency swaps, support from regional financing arrangements, and multilateral support including IMF lending (Essers and Vincent, 2017). The US Federal Reserve has been quick to reactivate its GFC-era currency swap arrangements with Brazil and Mexico, and has initiated a new, temporary Foreign and International Monetary Authorities (FIMA) Repo Facility, allowing a wider range of EME central banks to exchange their holdings of US Treasury bonds into US dollars. The ECB, too, has opened currency swap lines with Bulgaria and Croatia, and repo lines with Romania, Hungary, Serbia, Albania and North Macedonia. By analogy with FIMA, the ECB also created its own emergency repo facility with wider country eligibility, called the Eurosystem Repo Facility for Central Banks (EUREP). Whereas these and other central bank swap and repo arrangements may have instilled confidence in some EMEs and brought down cross-currency basis swap spreads, they were largely precautionary. Actual drawing on these facilities by EMEs has been minimal so far.

While the support provided by regional financing arrangements aimed at EMEs4 has been almost negligible (Segal and Negus, 2020), multilateral development banks – most notably the World Bank, the Asian Development Bank and the Inter-American Development Bank – and the IMF have attempted to fill the void. The IMF in particular has ramped up its central role in the global financial safety net. Between the intensification of the COVID-19 pandemic in late March 2020 and mid-October, the IMF approved a record total of more than $ 101 billion in financial assistance to 81 EMDEs, and more support is in the pipeline. Most of the IMF arrangements have been structured as rapid-disbursing emergency financing facilities to low-income countries and smaller EMEs. Larger EMEs are keeping the IMF at arm’s length, partly because of their governments’ aversion to the reform programmes that accompany traditional IMF arrangements and/or the perceived financial market stigma attached to seeking IMF support. The IMF has established a new Short-term Liquidity Line (SLL), a revolving backstop facility with strict eligibility, but the instrument has had no takers so far. Several commentators have argued that the IMF could do more to help EMEs weather the COVID-19 crisis, with proposed measures including further tweaking of the terms of existing lending facilities; the creation of new lending instruments with greater access limits, longer repayment periods, and wider country eligibility; and substantial (re-)allocations of Special Drawing Rights (SDRs) to add to countries’ international reserves.5

Altogether, the direct and indirect consequences of the COVID-19 pandemic led to unprecedented steep drops in EMEs’ real economic activity. In contrast to leading economies China and Korea, all other major EMEs’ economic growth went into deeply negative territory. In the second quarter of 2020, India’s GDP plunged by almost 24 % compared to the same period in 2019; Brazil, Russia and Turkey lost between 8 % and 11 % of GDP year-on-year. Higher frequency indicators suggest that the economies of these countries bottomed out and the recovery was underway in the third quarter of 2020. However, expectations for the services sector remained downbeat for India and Brazil.

The latest (October) IMF forecasts for EME growth in 2021 tend to exceed pre-COVID forecasts, reflecting an expected steady recovery from the likely record output drops in 2020. Whether such a scenario will actually materialise remains to be seen. Indeed, as evident from the very wide range of private sector growth forecasts, the outlook for EMEs’ growth paths is still clouded in great uncertainty.

EMEs will most likely not play the same supportive role for the world economy throughout the COVID-19 crisis as at the time of the GFC. Several reasons stand out.

First of all, the COVID-19 crisis is very different from the GFC, or other large crises for that matter. With the notable exception of China, nearly all major EMEs are expected to experience strongly negative growth in 2020, unlike in 2009. This is the combined result of the severe direct impact the spread of the coronavirus and associated containment measures have had on economic activity in EMEs, as well as of the multiple external shocks that have hit them more indirectly, through the pandemic’s bearing on world trade and international financial markets.

Second, certain structural characteristics of EMEs, including weaker health systems and relatively large informal sectors, are making it more difficult for them to get the pandemic under control and are contributing to its economic damage in places such as Brazil and India, where the coronavirus still thrives. Some countries may also struggle to get access to and/or quickly distribute vaccines against COVID-19 once they become available.

Third, major EMEs were already suffering from idiosyncratic stress factors, macroeconomic vulnerabilities, and slowing economic growth before the COVID-19 crisis struck. In fact, if one excludes China and India, EMEs’ percentage point contribution to world economic growth had shrunk considerably in recent years, compared to its post-GFC highs.

Fourth, while EMEs have deployed countercyclical monetary and fiscal stimulus, often exceeding their policy responses during the GFC, overall it remains several times smaller than the rescue packages that advanced economies have staged. The ongoing deterioration in fiscal and external positions, exacerbated by the COVID-19 crisis, implies that for many EMEs the initially modest policy space is further shrinking. Hence, EMEs will to a large extent depend on the policy actions of advanced economies for their recovery, including a resumption of demand for their exports and a continued accommodative monetary policy stance by advanced economy central banks, in addition to multilateral support. Even China, which for now seems to be recovering from the crisis largely on its own, still needs the extra growth impulse from external demand for a solid anchoring of its recovery. There is a real risk that the COVID-19 crisis will be used as an excuse for reshoring and to further ramp up trade protectionism, which would stifle China’s and other EMEs’ economic growth.

Finally, while the latest projections still assume a relatively swift recovery and positive contribution of EMEs to world growth in 2021, bringing and keeping the virus under control is a necessary condition. In addition, high and rapidly rising sovereign and corporate debt levels will require deleveraging at some point, weighing on growth over the medium-term.

Avdjiev S., P. McGuire and G. von Peter (2020), “International dimensions of EME corporate debt”, BIS, Quarterly Review, June, 1-13.

BIS (2020), Annual Economic Report 2020, June.

Buelens C. (2013), “Decoupled and resilient? The changing role of emerging market economies in an interconnected world”, NBB, Economic Review, September, 23-39.

Buysse K. and D. Essers (2020), “The world economy under COVID-19: Can emerging market economies keep the engine running?”, NBB, Economic Review, September, 7-35.

Buysse K., D. Essers and E. Vincent (2018), “Can China avoid the middle-income trap?”, NBB, Economic Review, June, 63-77.

Cantu C., T. Goel and J. Schanz (2020), “EME government debt: Cause for concern?”, BIS Quarterly Review, June, Box, 15-16.

Carstens A. and H. S. Shin (2019), Emerging markets aren’t out of the woods yet, Foreign Affairs, 15 March.

Essers D. and E. Vincent (2017), “The global financial safety net: In need of repair?”, NBB, Economic Review, September, 87-112.

Fardoust S., J. Y. Lin and X. Luo (2012), Demystifying China’s fiscal stimulus, World Bank Policy, Research Working Paper, 6221, October.

Gottlieb C., J. Grobovsek and M. Poschke (2020), “Working from home across countries”, Covid Economics: Vetted and Real-Time Papers, 8, 71-91, April.

Haasbroeck M. (2020), Stimulus package reveals China’s financial constraints, MERICS Short Analysis, 13 July.

Hartley J. S. and A. Rebucci (2020), An event study of COVID-19 central bank quantitative easing in advanced and emerging economies, NBER, Working Paper, 27339, June.

Hausmann R. and U. Panizza (2011), Redemption or abstinence? Original sin, currency mismatches and countercyclical policies in the new millennium, Journal of Globalization and Development, 2(1), August.

Hofmann B., I Shim and H. S. Shin (2020), Emerging market economy exchange rates and local currency bond markets amid the Covid-19 pandemic, BIS Bulletin, 5, April.

Medina L. and F. Schneider (2019), Shedding light on the shadow economy: A global database and the interaction with the official one, CESifo, Working Paper, 7981, December.

Mühleisen M., T. Gudmundsson and H. Poirson Ward (2020), COVID-19 response in emerging market economies: Conventional policies and beyond, IMF, Blog, 6 August.

NBB (2020), “Global Economy and euro area”, Report 2019 – Economic and financial developments, March, Chapter 1.

Segal S. and O. Negus (2020), International financial institutions’ ongoing response to the Covid-19 crisis, Center for Strategic and International Studies, Commentary, 24 August.

World Bank (2020), Global Economic Prospects, June.

Zenglein M. J. and M. Kärnfelt (2020), Stimulus measures drive China’s economic rebound, Mercator Institute for Chinese Studies, MERICS Economic Indicators, Q2/2020, 23 July.

The article has previously been published in BFW digitaal / RBF numérique 2020/9.

The EMDE classification follows the IMF and, at the moment of writing, consisted of 155 (non-advanced) economies, including many low-income countries. The IMF does not formally break down the EMDE category into sub-groups of emerging market economies (EMEs) and non-EMEs.

World trade had already been weakened before the COVID-19 pandemic by the lingering US-China trade war and a deceleration in global investment and manufacturing production (NBB, 2020).

These arrangements include the Chiang Mai Initiative Multilateralization, the Latin American Reserve Fund, the Eurasian Fund for Stabilization and Development, and the Arab Monetary Fund.

The SDR is an international reserve asset created by the IMF. It is not a currency but rather constitutes a potential claim on the freely usable currencies of IMF members, including the US dollar, the euro, the Japanese yen, the British pound and the Chinese renminbi. SDRs are normally allocated to members in proportion to their shares of IMF quotas.