The banking industry in Europe is entering the corona recession with strong capital levels and ample liquidity, though still only moderate profitability. Revenues will come under substantial pressure this year, loan loss provisions will jump and net income will fall materially – many banks may well make losses. However, there is likewise massive support from the public sector, with governments propping up the real economy, central banks the financial markets and supervisors relaxing rules for banks. This should mitigate the hit. Nevertheless, the risks are profound and a prolonged shutdown could even trigger a renewed banking crisis. Enormous uncertainty regarding its depth and length notwithstanding, the current crisis may well turn out more severe than the macro-financial shock scenario underlying the latest European bank stress test. Its magnitude could possibly even exceed the financial crisis and the Great Recession.

In the corona crisis, countless small businesses and corporations are fighting for survival, and employees are fearing for their jobs. This will have a huge impact on the European banking industry, on all fronts. First, revenues: net interest income is likely to suffer as scared and struggling customers (after an initial spike due to precautionary measures) take out fewer loans because of heightened income/profit uncertainty. Loan growth, even though lacklustre, had been one of the few bright spots in recent years. Fee income may suffer, too: in the payments business, the number of transactions is set to decline in line with economic activity. In asset management, while trading volumes should rise, investors will likely prefer safer asset classes where margins are lower. Also, both fees based on the volume of assets under management and based on overall performance will most probably be lower than under the benign capital market conditions of 2019. In investment banking, fewer companies will take the risk of acquiring other firms and only those in urgent need of fresh capital will issue new stock at depressed share price levels. Many start-ups will postpone their IPO to wait for a more accommodating environment. Finally, trading income includes, among other things, earnings from securities trading on clients’ behalf, valuation gains and losses on securities as well as the impact of exchange rate movements. It is more volatile than the other revenue components, but overall much less prominent than a decade ago because banks hardly do proprietary trading any more.

Where do banks stand going into the crisis? Total revenues at Europe’s top 20 banks were solid in 2019, up 3% yoy, driven mostly by trading income which recovered from the decline in the previous year (+12%) and other income (+18%). However, the two core components continued to be rather weak: net interest income was at least 1% higher, despite margin pressure due to extremely low interest rates; fee and commission income was flat yoy. During the 2008 crisis, total revenues fell 24% yoy (though this included writedowns on a range of “toxic assets/securities”).

Second, loan loss provisions. Late in the economic cycle after a decade-long expansion, provisions had already risen 18% last year, although from a record-low level. Now in the corona recession, despite all mitigating actions taken by governments, they will surge, providing an immediate burden for banks’ P&L. In the financial crisis, loss provisions at the leading European banks jumped to 4.3 times the pre-crisis level.

Third, profitability. Expense levels are quite inflexible and cannot be reduced in lockstep with the likely strong decline in revenues, resulting in a massive deterioration in the operating margin. With the additional hit from surging loan losses on top of that, net income could easily turn negative this year. Last time, profits collapsed from EUR 131 bn in 2006 to EUR -53 bn in 2008. Now, and in stark contrast to their much more profitable US peers, European banks are entering the crisis with a net income of only EUR 74 bn for the largest institutions (-17% yoy). Post-tax ROE fell 2 pp to a moderate 6%. At least costs have shrunk four years in a row, with operating expenses in 2019 down 1% again. The cost-income ratio, adjusted for one-offs, stayed constant at 63% though.

Bottom line, due to their very business model as an industry serving the entire economy, banks’ performance is closely tied to the overall economic cycle. Decoupling impossible. However, all similarities with the financial crisis and the Great Recession notwithstanding: the timing and the focus of the crisis is different. Back then, the slump in financial markets, the huge writedowns on mortgage securitisations and other complex structured credit products came first, in 2007 and 2008, while the real economy crash followed some time later, in 2009. In the corona crisis, financial market stress, disrupted industrial supply chains and the shutdown of public life including much of the services sector is all happening at once. This is also the second big difference: this time, there are no major imbalances in financial markets that need to be corrected (hence, there will probably be no significant writedowns), but instead the services sector is at the core of the current troubles, while it was only marginally affected in the financial crisis.

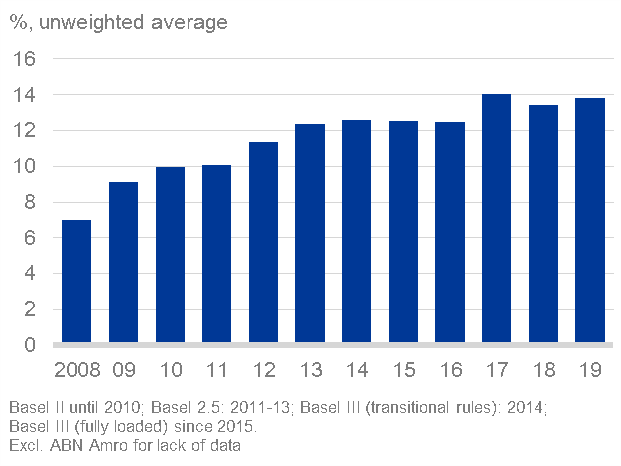

With all these negative repercussions, how well prepared is the banking industry in terms of capital and liquidity which were the scarcest resource in 2007-09? In Europe, banks have strengthened their buffers so much in the decade since the financial crisis that capital and liquidity ratios are broadly sufficient to withstand a normal downturn. Last year, the fully loaded Basel III CET1 ratio rose 0.4 pp to 14% (unweighted average) for the 20 largest institutions. The fully loaded leverage ratio climbed 0.2 pp to 5.1% and the liquidity coverage ratio (LCR) edged up 1 pp to a very solid 149%.

CET1 (Core Tier 1) ratio of Europe’s 20 major banks

Sources: Company reports, Deutsche Bank Research

But this is unlikely to become a normal recession. The economy is expected to shrink a massive 6.9% in the euro area this year (4.2% in the US, 6.5% in the UK), the largest drop since the Second World War. The downturn will then be even more pronounced than in 2009, in the aftermath of the financial crisis, when output contracted by 4.5% in the EMU (2.5% in the US and 4.2% in the UK). Such an environment could trigger a systemic banking crisis. National authorities as well as the ECB as the supervisor of the largest banks in the Banking Union and the European Banking Authority (EBA) have already responded by suspending countercyclical capital buffers and allowing banks to temporarily operate below the level of capital and liquidity resulting from the capital conservation buffer, the Pillar 2 guidance (which covers other risks, such as concentration, reputational or legal risk) and the LCR.

In some countries like Germany, Italy and Spain, the government is providing large-scale asset guarantees to banks (in certain instances even covering 100% of the credit risk) as part of efforts to maintain liquidity for companies in these extraordinary times. Otherwise, in some cases, banks might still refrain from providing new credit (which could exacerbate the recession) as many firms’ turnover is down to zero and there is no clarity about how long the shutdown measures will last. But also with regard to outstanding loan commitments, if there were widespread defaults by small and larger firms, this could overwhelm the banking system at least in a number of countries. Given that bail-in regimes are not designed for systemic crises, public support for banks would be back on the table. Therefore, the cost to society would certainly be lower if a wave of insolvent businesses could be avoided, even if that required outright financial support in some cases. In a longer-lasting crisis, this would have to go beyond funding through government-guaranteed loans (which nevertheless amount to more debt) and also beyond the short-term liquidity in the form of grants through which e.g. France, the UK and Germany support very small firms and self-employed.

With respect to households, short-time work schemes are being implemented in many European countries and should mitigate somewhat the increase in unemployment, at least as long as the crisis is over relatively soon. Thus, in the short term, private insolvencies might not become a pressing problem for banks, yet the picture would surely change in a prolonged lockdown.

Among larger euro-area countries, credit growth in recent years had been the strongest in France and Germany, raising debt levels and vulnerability somewhat. In France, debt levels are among the highest in Europe and loans to households (corporations) rose in total 26% (27%) since end-2014. In Germany, retail (corporate) credit growth had been 19% (23%) over the same period of time but private-sector debt levels are still among the lowest in Europe. Across the leading European banks, total asset growth last year had been remarkable, at 5% (risk-weighted assets were up only 1%, total equity 3%).

An important side aspect to watch is the role of foreign banks. In the last major crisis, foreign banks sometimes fled to their home turf, leaving customers behind in markets where they had often expanded only shortly before. This was the case for instance in Germany before and after 2008. At least the first part of the story sounds strikingly similar. Foreign-owned banks have been lending to German companies at above market-average speed since 2014, with growth peaking in 2018. The current crisis will be another crucial test of foreign banks’ commitment to their clients in many countries also in gloomy times.

All in all, although banks and regulators have by and large done their homework since the last crisis and are entering this one in a relatively sound position, a deep recession which lasted several quarters would probably also plunge the banking system in several countries into crisis if governments did not provide broad support to companies and households and successfully prevented massive layoffs and a surge in corporate and private insolvencies. When the EBA conducted the latest stress test for large European banks in 2018, the “adverse scenario” for the EU envisaged a maximum

Thus, the scenario was more benign than what seems currently under way (e.g., the stress test also simulated a modest 10% reduction in the oil price, compared to the recent peak-trough crash of 70%). Under these assumptions, the average core (fully loaded CET1) capital ratio of the surveyed banks dropped from 14% to 10.1%. With today’s starting point identical to the one used in the stress test (though we use an unweighted average and a smaller sample, the stress test a weighted average), the current decline will almost certainly become more severe than projected at the time and the aggregate capital ratio could plummet into single digits. On the other hand, the stress test was based on a static balance sheet and did not take into account banks’ mitigating measures such as de-risking and raising/injecting capital from private or public sources. This should help contain the damage. Finally, it is the very essence of capital and liquidity buffers to breathe in line with the economic cycle and to shrink in times of crisis. Hence, the litmus test is out – just letting the buffers work would be a real achievement for the industry and its supervisors and regulators. In that sense, the authorities’ recent announcements are definitely encouraging for banks and their customers. After the crisis, there should be enough time to rebuild capital positions.

First published by Deutsche Bank Research ; © Copyright 2020 Deutsche Bank AG, Deutsche Bank Research, 60262 Frankfurt am Main, Germany. All rights reserved.