This note proposes an index to measure the relationship between monetary policy communication and market sentiment, where market sentiment is proxied by a Twitter-based metric: the Central Bank Surprise Index. A higher similarity between central bank announcements and Twitter-based market sentiment implies fewer surprises, i.e. more consistency between monetary policy messages and market reactions. This measure is computed for three major central banks: the Federal Reserve, the European Central Bank and the Bank of England. Among other things, we look at three famous announcements: a) Mario Draghi’s conference call on July 26, 2012; b) Mario Draghi’s conference call on June 27, 2017; and c) the “Economic Prospects for the Long Run” speech held by Ben S. Bernanke on May 18, 2013. The first two cases are known for being a source of surprises. Consistently we observed very low similarity scores in the cases a) and b). In the third case we observed a high similarity score.

In recent years academics and central bankers (Bini Smaghi 2007) have zoomed in on communication policy as an autonomous policy area (D’Amato et al. 2003, Woodford 2005, Blinder 2009, Neuenkirch 2011a, Ericsson 2016, Stekler and Symington 2016), given that communication may greatly influence macroeconomic outcomes.

The literature sheds light on the impact of central bank communication on macroeconomic variables, such as exchange rates (Fratzscher 2004, Jansen and De Haan 2004, Sager and Taylor 2004, Melvin et al. 2009, Conrad and Lamia 2010), interest rates (Guthrie and Wright 2000, Kohn and Sack 2004, Gurkaynak et al. 2005, Woodford 2005, Brand et al. 2006, Anderson et al. 2006, Hausman and Wongswan 2006, Anderson 2007, Ehrmann and Fratzscher 2007, Heinemann and Ullricht 2007, Rosa and Verga 2007, Lucca and Trebbi 2009, Hayo and Neuenkirch 2010, Ranaldo and Rossi 2010, Neuenkirch 2011b, Tang and Yu 2011, Beck et al. 2012, Smales 2012, Hendry 2012, Chirinko and Curran 2013, Egert and Kocenda 2013, Lamia and Sturm 2013, Kamada and Miura 2014, Carvalho et al. 2014, Hayo et al. 2014, Galardo and Guerrieri 2017, Hansen et al. 2020), stock prices (Rosa 2011, Kurov 2012), and general financial (Ehrmann and Talmi 2017, Jubinski 2017) and real variables (Hansen and McMahon 2016). Monetary policy news can also affect exchange rates via the interest-rate channel (Ferrari et al. 2017).

Therefore, the communication policy adopted by each central bank must be carefully studied (Aidarova and Seyitov 2011, Garcia Herrero and Girardin 2013). In particular, at least three aspects should be highlighted: content, procedures and timing. First, the content of communication must be distinguished. The content can, for instance, be either quantitative (Hayo and Neuenkirch 2010) or qualitative, and the statements can be backward looking or forward looking. Furthermore, the topic of the communication is important (e.g., macroeconomic aspects, including inflation (Cihak et al. 2012), fiscal policies (Allard et al. 2012) or financial stability (Born et al. 2010 and 2014, Cihak 2006, Osterloo et al. 2011, Cihak et al. 2012, Correa et al. 2017).

Second, the communication procedures must be considered (Ehrmann and Sondermann 2012). It can take such forms as a press release (Jansen and De Haan 2010, Lucca and Trebbi 2009, Fay and Gravelle 2010, Acosta and Meade 2015, Hansen and McMahon 2016, Ehrmann and Talmi 2017) or a press conference (Heinemann and Ullricht 2007, Ulricht 2008, Rosa and Verga 2007, Berger et al. 2010, Sturm and De Haan 2011). Other forms might depend on who is the communication sender (i.e., committees, Kohn and Sack 2004, Reeves and Sawicki 2006, Reinhart and Sack 2006, Andersson et al. 2006a and 2006b; individuals, Jansen and De Haan 2004, Ehrmann and Fratzscher 2007, Rozkrut 2008). For example, Reeves and Sawicki (2006) find that communication made on behalf of the entire policy-making committee is a particularly strong market mover compared to communication delivered on a personal basis.

Another aspect to be considered in relation to procedures is the consistency of communication. Jansen and de Haan (2010) test the extent to which the ECB uses consistent language in its communication. They find consistency overall, even though the ECB’s communication is flexible enough to adapt to changing circumstances. Acosta and Meade (2015) study the similarity of FOMC post-meeting statements and show that they have become more similar over time, especially since the global financial crisis. Nevertheless, FOMC statements have also become more complex since the onset of unconventional monetary policy, as shown by Herna ndez-Murillo and Shell (2014). Another matter of interest regarding consistency is how much importance the central bank attributes to the personal views of its committee members. This aspect differs across central banks. For example, the ECB and the Bank of England follow a collegial approach to communication and exhibit a high degree of consistency. In contrast, communication from the Federal Reserve is significantly more dispersed (Ehrmann & Fratzscher 2005a).

The role of language is also crucial (Gerlach 2004, Heinemann and Ullricht 2007, Boukus and Rosemberg 2006, Rosa and Verga 2007, Bulir et al. 2008, Smidkova and Bulir 2008, Berger et al. 2010, Kawamura et al. 2016, Hansen and McMahon 2016). In measuring the content and the tone of central banks’ communication, two approaches have been used (Ehrmann and Talmi 2017): human coding and automated coding. In addition computational linguistic tools have been used to analyse monetary policy communication (Lucca and Trebbi 2009, Bailey and Schonhardt-Bailey 2008, Hendry and Madele 2010, Hendry 2012, Fligstein et al. 2014, Acosta 2015, Schonhardt-Bailey 2013, Hernandez-Murillo and Shell 2014, Hansen et al. 2014, Amaya and Filbien 2015, Hansen and McMahon 2016, Schmeling and Wagner 2016, Hubert and Labondance 2017). Recently, social media, especially Twitter, has been explored as an information device for central bankers (Carretta et al. 2016) and markets (Guindy and Riordan 2017, Snow and Rasso 2017).

Third, the timing of communication must be investigated (Ehrmann and Fratzscher 2005b, Hu et al. 2015) from at least two points of view: in absolute terms by distinguishing periodical, institutional announcement, which is predictable, from announcements that are not; and in relative terms with respect to the functioning of financial markets (e.g., if the announcements are communicated when markets are closed or open) or the habits of investors (Guindy and Riordan 2017). With regard to institutional communication, the literature has emphasized the role of minutes and their timeliness (Reinhart and Sack 2006, Bank of England 2005).

In this vein the aim of this note is to present an index – which has been developed in Masciandaro et al. 2020 – that measures the relationships among central bank communication and market sentiment. The market sentiment is proxied using a Twitter-based metric: the Central Bank Surprise Index. A higher similarity between central bank announcements and the market sentiment implies less surprises, i.e. more consistency between monetary policy messages and Twitter-based market reactions.

The index has been used to analyse three major central banks: the Federal Reserve, the European Central Bank (ECB) and the Bank of England. Notably, the link between tweeting on monetary policy and market sentiments has been studied recently in relation to US President Trump’s tweets on US monetary policy (Camous and Matveev 2019, Bianchi et al. 2019).

We observe a rather stable similarity index in the case of the Federal Reserve Bank over the period 2012-2017. On the other hand, a slight decrease can be observed for the Bank of England and the European Central Bank. Regarding the market sentiment around the monetary policy announcements, the measures of similarity appear to be quite different for the Bank of England, the Federal Reserve Bank and the ECB. In the case of the ECB in particular, we note a sharp drop in the similarity index in the days before a meeting and an increase in the days following a meeting.

The paper is organized as follows. Methodology and data are presented in section two while the applications of the index can be found in section three. Section four concludes.

Our objective is to transform daily tweets about the monetary policy decisions of the Bank of England, the European Central Bank and the Federal Reserve Bank into a numerical measure of similarity that reflects the distance between market expectations and the information provided in central bank transcripts. In this section, we describe our methodology for constructing the similarity measure.

2.1 Data Collection

We focus on official communication about monetary policy committee decisions from the three most important central banks: the Bank of England, the European Central Bank and the Federal Reserve. From their official websites, we retrieved transcripts of meetings in which a monetary policy decision was announced. Our sample comprised:

Even though we can only match these communications with tweets as of 2011, we included older transcripts, as a larger set of documents improves the accuracy of the algorithm that we use for the natural language processing (NLP) analysis.

In the first step of our analysis, we collected all Twitter messages related to monetary policy decisions. Specifically, we collected tweets that: (a) mentioned the official Twitter account of the bank (e.g., @bankofengland); (b) contained a number sign followed by the bank’s acronym (e.g., #ecb); (c) contained a number sign followed by the governor’s surname (e.g., #draghi) or (d) contained the hashtag #interestrates. Using the “Get Old Tweets” module in Python, we collected all Twitter messages with these characteristics published in the period from seven days prior to the focal central bank’s monetary policy announcement until two days after that announcement.

In the following Table we show the keywords used for each bank together with the number of codified Twitter messages and the period of analysis.

| Bank | Keywords | Number of tweets | Timeframe |

| Bank of England2 | @bankofengland, #bankofengland, #boe, #interestrates |

325,462 | Since 2011 |

| European Central Bank | @ecb, #draghi, #ecb, #interestrates |

609,447 | Since 2011 |

| Federal Reserve | @federalreserve, #Yellen, #fed, #interestrates |

952,806 | Since 2011 |

We manually checked several random selected tweets to ensure that we only retrieved tweets related to reactions to central banks’ announcements. We found that unrelated tweets typically contained one of the acronyms indicated in the Table (e.g., #ecb) but were written in a language other than English. To avoid the inclusion of irrelevant tweets in our sample, we eliminated tweets not in English. Eliminating these tweets had an additional advantage, as some of the pre-processing steps that we describe below relied on pre-existing dictionaries that were developed only for the English language. The final sample of tweets is reported in the Table.

2.2 Metrics: Building the Central Bank Surprise Index

Text pre-processing

We pre-processed the text in both the central bank transcripts and the Twitter messages by lower-casing all words. For tweets, we also removed all URLs and mentions of other Twitter users. For central bank transcripts, we removed standard introductions to speakers. We then broke streams of text into single words called “tokens”. Thereafter, we eliminated “stop words” – words that occur frequently in our corpus but have little meaning. For this purpose, we used the stop words dictionary in NLTK. We also removed all tokens that consisted only of non-alphanumeric characters. Moreover, we removed emoticons as well as the symbols @ and # from tweets.

Next, we lemmatized the words using WordNetLemmatizer from the Python module NLTK. Lemmatization entails reducing words to a common root form, called a “lemma”, to limit the presence of synonyms. Then we performed stemming, which implies conflating the various forms of a word into a common representation known as the “stem”. For instance, as a result of this process, the words “ate” and “eating” are both reduced to the common stem “eat”. Stemming and lemmatization rely on pre-existing dictionaries for the English language, which explains why we eliminated non-English tweets from our corpus. We relied on Porter Stemmer in the Python module NLTK for our stemming. Finally, we introduced collocation – the combination of two words that have higher probabilities of co-occurring together than separately. For instance, the tokens “new” and “york” have higher chances of co-occurring as “New York” than separately. In this case, collocations transform the two separate tokens into just one: “new_york”.

Our corpus comprises two types of documents: bank transcripts and tweets. As we are interested in how the similarity between bank conference calls and the market’s response after the call influences market prices – as interest rates and exchange rates – we gathered the tweets published in the interval between 48 hours before and 48 hours after a speech. The tweets were split into 12-hour segments around the speech. The intervals are illustrated in the following Table. Thus, we have eight groups of tweets to measure against the content of the speeches.

| Tweet Intervals (delta hours from the speech) | ||

| [-48, -36) | a_lag_4836 | 48 to 36 hours before the speech |

| [-36, -24) | b_lag_3624 | 36 to 24 hours before the speech |

| [-24, -12) | c_lag_2412 | 24 to 12 hours before the speech |

| [-12, 0) | d_lag_1200 | Up to 12 hours before the speech |

| [0, +12) | e_fwd_0012 | Up to 12 hours after the speech |

| [+12, +24) | f_fwd_1224 | 12 to 24 hours after the speech |

| [+24, +36) | g_fwd_2436 | 24 to 36 hours after the speech |

| [+36, +24) | h_fwd_3648 | 36 to 48 hours after the speech |

Vector representation: doc2vec

Our approach consists of using neural networks to compute vector representations of words, including their context, through embedding. To perform this task, Mikolov et al. (2013) propose using word2vec, which learns word embeddings and aims to predict the occurrence of a word given the surrounding words (context). In this model, every word is mapped to a unique vector, which is represented by a column in weight matrix W. The algorithm constructs a vocabulary from the input corpus and then learns word representations by training a neural network language model. The model is trained using stochastic gradient descent with back propagation. When the model converges, it represents words as word embeddings – meaningful, real-value vectors of configurable dimensions (usually 150-500 dimensions). The neural network learns a word’s embedding based on its contexts in different sentences. As a result, the words that occur in similar contexts are mapped onto close vectors.

As an extension of word2vec, Le and Mikolov (2014) introduced doc2vec to learn embeddings of sentences and documents (or sentence embeddings). Doc2vec is an extension of word2vec that learns to capture entire sentences and paragraphs. By treating each document as a word token, the word2vec methodology is used to learn document embeddings (Bhatia, Han Lau and Baldwin 2016). As with word2vec, training occurs through back propagation. This type of document embedding allows for texts to be represented as dense, fixed-length feature vectors that take their semantic and syntactic structure into account.

We used a freely available implementation of the doc2vec algorithm included in the GENSIM Python module. We asked for 300-dimensional vectors.

Both methods allow us to represent our documents as vectors. We then measure similarity between documents as the cosine of the angle between the two corresponding vectors (i.e., the normalized inner product of the two vectors).

We tested the validity of our two similarity measures by looking at three famous announcements: a) Mario Draghi’s conference call on July 26, 2012; b) Mario Draghi’s conference call on June 27, 2017; and c) the “Economic Prospects for the Long Run” speech held by Ben S. Bernanke on May 18, 2013. The first two cases are known for being triggers of surprises. Hence, we should observe very low similarity scores between the documents related to events a) and b) and the Twitter document containing relevant tweets after the calls. The data support our contention. In the third case, the markets correctly interpreted Ben Bernanke’s message and in fact we observed a high similarity score. Now we believe it is useful to present a few descriptive statistics regarding our measure of similarity in the following Figures.

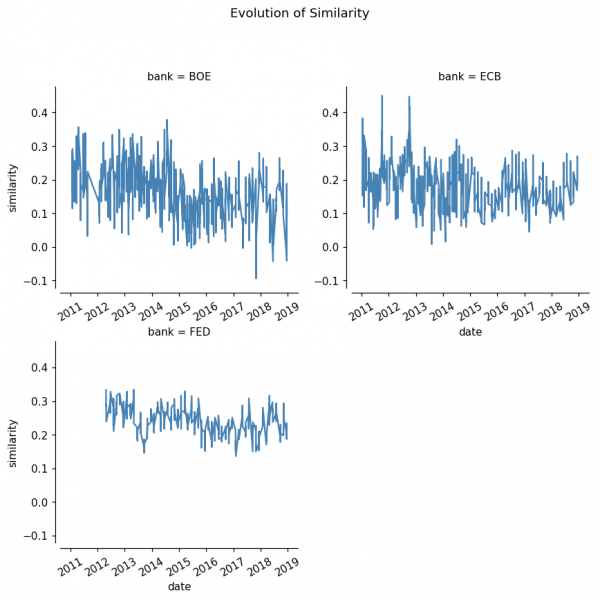

Figure 1 presents the evolution of the similarity measures for each of the three central banks. We observe a rather stable similarity index in the case of the Federal Reserve Bank over the period 2012-2017. On the other hand, a slight decrease can be observed for the Bank of England and the European Central Bank. It is worth noting that if we narrow our analysis to the post-2012 period for the ECB and the Bank of England, we find a more stable index. One possible explanation of the latter might be the increasing number of Twitter users and/or messages concerned with monetary policy decisions, which could naturally lead to increased variability in opinions. The increased level of noise that might come from a rise in the number of uninformed Twitter users appears to distance the policy announcements from market perceptions.

Figure 1. Evolution of the Central Bank Surprise Index Over Time

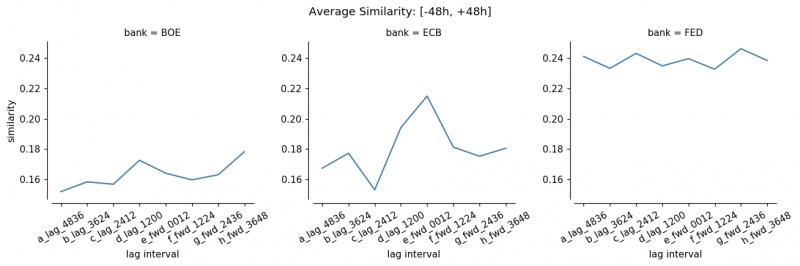

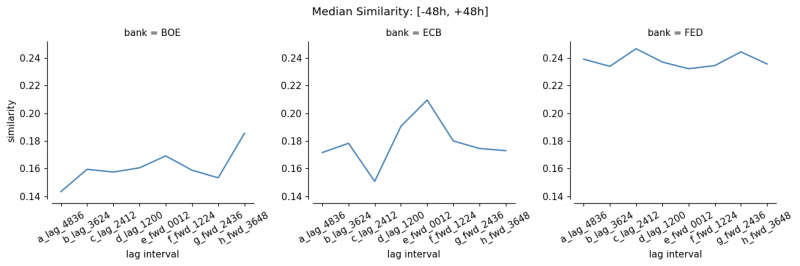

Moreover Figure 2 shows the average and median values of the Similarity Index during the period [t-2; t+2], around the monetary policy announcements. The values of the measure of similarity appear to be quite different for the Bank of England, the Federal Reserve Bank and the ECB. In the case of the ECB in particular, we note lower similarity index in the days before a meeting and higher in the days after a meeting. This suggests that although markets find it more difficult to forecast the ECB’s policy directions prior to the announcement, especially on the day of the announcement, a closer consensus is reached afterwards. The pattern is similar for the Bank of England, although the differences before and after the announcement are not as stark as in the case of the ECB. Finally, little difference is observed for the Federal Reserve.

Figure 2. Evolution of the Similarity Index around the Monetary Policy Announcements

This note aimed at presenting a first step in exploring the relationship between central bank communication and market sentiment using tweets on monetary policy. Market sentiment is proxied using a Twitter-based metric: the Central Bank Surprise Index. A higher similarity between central bank announcements and the market sentiment implies fewer surprises, i.e. more consistency between monetary policy messages and market reactions.

We translated daily tweets about the monetary policy decisions of the Bank of England, the European Central Bank and the Federal Reserve Bank into a numerical measure of similarity that reflects the distance between market expectations and the information provided in central banks’ transcripts.

Three preliminary tests were implemented. First, we look at three famous announcements: a) Mario Draghi’s conference call on July 26, 2012; b) Mario Draghi’s conference call on June 27, 2017; and c) the “Economic Prospects for the Long Run” speech held by Ben S. Bernanke on May 18, 2013. The first two cases are known for being a source of surprises. Consistently we observed very low similarity scores in the cases a) and b). In the third case we observed a high similarity score.

Second, we analyzed the evolution of the similarity measures for each of the three central banks. We observe a rather stable similarity index in the case of the Federal Reserve Bank over the period 2012-2017. On the other hand, a slight decrease can be observed for the Bank of England and the European Central Bank. When we narrowed our analysis to the post-2012 period for the ECB and the Bank of England, we found a more stable index.

Third, we studied the market sentiment around the monetary policy announcements. The values of the measure of similarity appear to be quite different for the Bank of England, the Federal Reserve Bank and the ECB. In the case of the ECB we noted lower similarity index in the days before a meeting and higher in the days after a meeting. The pattern is similar for the Bank of England, although the differences before and after the announcement are not as stark as in the case of the ECB. Finally, little difference is observed for the Federal Reserve, with a high and stable similarity index.

Future steps will test econometrically the link between this Twitter-based measure of monetary policy surprise and stock market reactions as well as exchange rate variations. For example, a higher change in the similarity index around a monetary policy announcement might be associated with higher stock market and exchange rate volatility.

Acosta, M., (2015), FOMC Responses to Calls for Transparency, Finance and Economics Discussion Paper Series, Board of Governors of the Federal Reserve System, n.60.

Acosta, M. and Meade, E., (2015), Hanging on Every Word: Semantic Analysis of the FOMC’s Post Meeting Statement, FEDS Notes, mimeo.

Aidarova, A. and Seyitov, T., (2011), Communication Policy of the National Bank of the Kyrgyz Republic as a Monetary Policy Element, National Bank of the Kyrgyz Republic, Working Paper Series, n. 1.

Allard J., Catenaro M., Vidal J.P. and Wolswijk, G., (2012), Central Bank Communication on Fiscal Policy, ECB Working Paper Series, n.1477.

Amaya, D. and Filbien, J.Y., (2015), The Similarities of ECB’s communication, Finance Research Letters, 13, 234-242.

Andersson, M., (2007), Using Intraday Data to Gauge Financial Market Responses to FED and ECB Monetary Policy Decisions, ECB Working Paper Series, n. 726.

Andersson, M., Dillen, H. and Sellin, P., (2006a), Monetary Policy Signaling and Movements in Term Structure of Interest Rates, Journal of Monetary Economics, 53, 1815-1855.

Andersson, M., Hansen L.J. and Sebestyen, S., (2006b), Which News Moves the Euro Area Bond Market?, ECB Working Paper Series, n. 631.

Bailey, A. and Schonhardt-Bailey, C., (2008), Does Deliberation Matter in FOMC Monetary Policymaking? The Volcker Revolution of 1979, Polit. Anal., 16, 404-427.

Bank of England, (2005), Do Financial Markets React to Bank of England Communication?, Quarterly Bulletin, Winter, 431-439.

Beck M.K., Hayo B. and Neuenkirch, M., (2012), Central Bank Communication and Correlation between Financial Markets: Canada and the United States, MAGKS Working Paper Series, n. 1.

Berger, H., De Haan J. and Sturm, J.E., (2010), Does Money Matter in the ECB Strategy? New Evidence Based on ECB Communication, International Journal of Economics and Finance.

Bianchi, F., Kung H. and Kind T., (2019), Threats to Central Bank Independence: High-Frequency Identification with Twitter, NBER Working Paper Series, n. 26308.

Bini Smaghi, L., (2007), The Value of Central Bank Communication, Financial Market Speech Series, Landesbank Hessen – Thuringen, Brussel, November 20.

Blinder, A., (2009), Talking about Monetary Policy: The Virtues (and Vice?) of Central Bank Communication, BIS Working Paper Series, n. 274.

Born B., Ehrmann M. and Fratzscher, M., (2010), Macroprudential Policy and Central Bank Communication, CEPR Discussion Paper Series, n. 8094.

Born B., Ehrmann M. and Fratzscher M., (2014), Central Bank Communication on Financial Stability, Economic Journal, 124, 701-734.

Boukus, J. and Rosenberg, J.V., (2006), The Information Content of FOMC Minutes, Federal Reserve Bank of New York, mimeo.

Brand C., Buncic D. and Turunen, J., (2006), The Impact of ECB Monetary Policy Decisions and Communication on the Yield Curve, ECB Working Paper Series, n. 657.

Bulir A., Cihak M. and Smidkova, K., (2008), Writing Clearly: ECB’s Monetary Policy Communication, IMF Working Paper Series, n. 252.

Camous A. and Matveev D., (2019), Furor over the FED: Presidential Tweets and Central Bank Independence, Bank of Canada, Staff Analytical Note, n.33.

Carretta, A., Farina, V. and Fattobene, L., (2016), European System of Central Banks and Communication: What Do Social Media Reveal?, Bancaria, November, 7-18.

Carvalho C., Corderio F. and Vargas J., 2014, Just Words? A Quantitative Analysis of the Communication of the Central Bank of Brazil, mimeo.

Chirinko R.S. and Curran, C., (2013), Greenspan Shrugs: Central Bank Communication, Formal Pronouncements and Bond Market Volatility, Cesifo Working Paper Series, n. 4236.

Cihak, M., 2006, How Do Central Banks Write on Financial Stability?, International Monetary Fund, mimeo.

Cihak M., Jansen D.J. and Bulir, A., (2012), Clarity of Central Bank Communication on Inflation, IMF Working Paper Series, n. 9.

Conrad, C. and Lamla, M., (2010), The High Frequency Response of the EUR-USD Exchange Rate to ECB Communication, Journal of Money, Credit and Banking, 42, 1391-1417.

Correa, R., Garud, K., Londono, J.M. and Mislang, N., (2017), Sentiment in Central Banks’ Financial Stability Reports, International Finance Discussion Papers, Board of Governors of the Federal Reserve System, n. 1203.

D’Amato J.D., Morris S. and Shin, H.S., (2003), Communication and Monetary Policy, Cowles Foundation Discussion Paper Series, n. 1405.

Egert B. and Kocenda, E., (2013), The Impact of Macro News and Central Bank Communication on Emerging European Forex Markets, Cesifo Working Paper Series, n. 42.88.

Ehrmann M. and Fratzscher, M., (2005a), Communication and Decision Making by Central Bank Committees: Different Strategies, Same Effectiveness?, ECB Working Paper Series, n.488.

Ehrmann M. and Fratzscher, M., (2005b), The Timing of Central Bank Communication, ECB Working Paper Series, n.565.

Ehrmann M. and Fratzscher, M., (2007), Explaining Monetary Policy in Press Conferences, ECB Working Paper Series, n. 767.

Ehrmann M. and Sondermann, D., (2012), The Reception of Public Signals in Financial Markets: What If Central Bank Communication Becomes Stale?, ECB Working Paper Series, n.1077.

Ehrmann, M. and Talmi, J., (2017), Starting from a Blank Page? Semantic Similarity in Central Bank Communication and Market Volatility, ECB Working Paper Series, n. 2023.

Ericsson, N., (2016), Eliciting GDP Forecasts from the FOMC’s Minutes Around the Financial Crisis, International Journal of Forecasting, 32, 571-583.

Fay, C. and Gravelle, T., (2010), Has the Inclusion of Forward Looking Statements in Monetary Policy Communication Made the Bank of Canada More Transparent?, Bank of Canada Staff Discussion Paper Series, n.15.

Ferrari, M., Kearns, J. and Schrimpf, A., (2017), Monetary Policy’s Rising FX Impact in the Era of Ultra Low Rates, BIS Working Paper Series, n. 626.

Fratzscher, M., (2004), Communication and Exchange Rate Policy, ECB Working Paper Series, n. 363.

Galardo M. and Guerrieri C., (2017), The Effects of Central Bank’ Guidance: Evidence from the ECB, Bank of Italy, Working Paper Series, n. 1129.

Garcia Herrero A. and Girardin, E., (2013), China’s Monetary Policy Communication: Money Markets not Only Listen, They Also Understand, Hong Kong Institute for Monetary Research, Working Paper Series, n.2.

Gerlach, S., (2004), Interest Rates Setting by the ECB: Words and Deeds, CEPR Discussion Paper Series, n. 4775.

Guindy, M.A. and Riordan, R., (2017), Tweeting the Good News: Returns and Price Informativeness, mimeo.

Gurkaynak, R.S., Sack, B. and Swanson, E., (2005), Do Actions Speak Louder Than Words? The Response of Asset Prices to Monetary Policy Action and Statements, International Journal of Central Banking, 1, 55-93.

Guthrie, G. and Wright, J., (2000), Open Mouth Operations, Journal of Monetary Economics, 46, 489-516.

Hayo B., Kutan A.M. and Neuenkirch, M., (2014), The Impact of Central Bank Communication on European and Pacific Equity Markets, MAGKS Working Paper Series, n. 27.

Hayo B. and Neuenkirch, M., (2010), Canadian Interest Rate Setting: The Information Content of Canadian and US Central Bank Communication, MAGKS Working Paper Series, n. 35.

Hansen S. and Mc Mahon, M., (2016), Shocking Language: Understanding the Macroeconomic Effects of Central Bank Communication, Journal of International Economics, 114-133.

Hansen S., Mc Mahon, M. and Tong, M., (2020), The Long-Run Information Effect of Central Bank Communication, ECB Working Paper Series, n. 2363.

Hausman, J. and Wongswan, J., (2006), Global Asset Prices and FOMC Announcements, Board of Governors of the Federal Reserve System, Working Paper Series.

Heinemann F. and Ullricht, K., (2007), Does It Pay to Watch Central Bankers Lips? The information Content of ECB Wording, Swiss Journal of Economics, 143(2), 155-185.

Hendry, S., (2012), Central Bank Communication or the Media’s Interpretation: What Moves Markets?, Bank of Canada Working Paper Series, n.9.

Hendry, S., Madeley, A., (2010), Text Mining and the Information Content of Bank of Canada Communications, Bank of Canada Working Paper Series, n.31.

Hernandez-Murillo, R. and Shell, H., (2014), Rising Complexity of the FOMC Statement, Economic Synopses, 23.

Hu R., Wei Q. and Zhang, Q., (2015), The Timing of Central Bank Communication: Evidence from China, mimeo.

Jansen, D.J. and De Haan, J., (2004), Look Who’s Talking: ECB Communications During the First Years of EMU, CESifo Working Paper Series, n.1263.

Jansen, D.J. and de Haan, J. (2010). “An Assessment of the Consistency of ECB Communication using Wordscores”. DNB Working Paper No. 259 / August 2010.

Jubinski, D., (2017), Central Bank Actions and Words: The Intraday Effects of FOMC Policy Communications on Individual Equity Volatility and Returns, Financial Review, 52 (4), 701-724.

Kamada K. and Miura, K., (2014), Confidence Erosion and Herding Behavior in Bond Markets: An Essay on Central Bank Communication Strategy, Bank of Japan Working Paper Series, n. 14.

Kawamura K., Kobashi Y., Shizume M. and Ueda, K., (2016), Strategic Central Bank Communication: Discourse and Game – Theoretical Analyses of the Bank of Japan’s Monthly Report, CAMA Working Paper Series, n. 11.

Kohn, D.L. and Sack, B., (2004), Central Bank Talk: Does It Matter and Why?, In: Bank of Canada (Ed.), Macroeconomics, Monetary Policy, and Financial Stability, Bank of Canada, Ottawa, 175-206.

Kurov, A., (2012), What Determines the Stock Market’s Reaction to Monetary Policy Statements? Review of Financial Economics, 21, 175-187.

Lamia M.L. and Sturm, J.E., (2013), Interest Rate Expectations in the Media and Central Bank Communication, KOF Working Paper Series, n.334.

Lucca D.O. and Trebbi, F., (2009), Measuring Central Bank Communication: An Automated Approach with Application to FOMC Statements, Chicago Booth Research Paper Series, n.34.

Masciandaro, D., Romelli, D. and Rubera, G., 2020, Tweeting on Monetary Policy and Market Sentiments: The Central Bank Surprise Index, Bocconi University, Baffi Carefin Research Paper Series, n. 134.

Melvin, M., Saborowski, M., Sager, M. and Taylor, M.P., (2009), Bank of England Interest Rate Announcements and the Foreign Exchange Market, International Journal of Central Banking, 6, 211-247.

Neuenkirch, M., (2011a), Managing Financial Market Expectations: The Role of Central Bank Transparency and Central Bank Communication, MAGKS Working Paper Series, n. 28.

Neuenkirch, M., (2011b), Monetary Policy Transmission in Vector Autoregressions: A New Approach using Central Bank Communication, MAGKS Working Paper Series, n. 43.

Osterloo, S., De Haan, J. And Jong-A-Pin, R., (2011), Financial Stability Reviews: A First Empirical Analysis, Journal of Financial Stability, 2, 337-355.

Ranaldo, A. and Rossi, E., (2010), The Reaction of Asset Markets to Swiss National Bank Communication, Journal of International Money and Finance, 29(3), 486-503.

Reeves, R. and Sawicki, M., (2006), Do Financial Markets React to Bank of England Communication?, European Journal of Political Economy, 23(1), 207-227.

Reinhart, V. and Sack, B., (2006), Grading the Federal Open Market Committee’s Communications, Federal Reserve Board of Governors, January, mimeo.

Rosa, C., (2011), Words that Shake Traders. The Stock Market’s Reaction to Central Bank Communication in Real Time, Journal of Empirical Finance, 18, 915-934.

Rosa, C. and Verga, G., (2007), On the Consistency and Effectiveness of Central Bank Communication: Evidence from the ECB, European Journal of Political Economy, 23(1), 146-175.

Rozkrut, M., (2008), It’s Not Only What is Said, it’s Also Who the Speaker is – Evaluating the Effectiveness of Central Bank Communication, National Bank of Poland Working Paper Series, n. 47.

Sager, M.J. and Taylor, M.P., (2004), The Impact of ECB Governing Council Announcements on the Foreign Exchange Market: A Micro Structural Analysis, Journal of International Money and Finance, 23, 1043-1051.

Smales, L.A., (2012), RBA Monetary Policy Communication: The Response of Australian Interest Rate Futures to Changes in RBA Monetary Policy, Pacific Basic Finance Journal.

Smidkova, K. and Bulir, A., (2008), Striving to Be “Clearly Open” and “Crystal Clear”: Monetary Policy Communication of the CNB, IMF Working Paper Series, n. 84.

Snow, N.M. and Rasso, J., (2017), If the Tweet Fits: How Investors Process Financial Information Received via Social Media, mimeo.

Stekler, H.O. and Symington, H., (2016), Evaluating Qualitative Forecasts: The FOMC’s Minutes 2006-2010, International Journal of Forecasting, 32, 559-570.

Sturm J.E. and De Haan, J., (2011), Does Central Bank Communication Really Lead to Better Forecasts of Policy Decisions? New Evidence Based on a Taylor Rule Model for the ECB, Review of World Economics, 147(1), 41-58.

Tang M.K. and Yu, X., (2011), Communication of Central Bank Thinking and Inflation Dynamics, IMF Working Paper Series, n.27.

Ullricht, K., (2008), Inflation Expectations of Experts and ECB Communication, North American Journal of Economics and Finance, 19(1), 93-108.

Woodford, M., (2005), Central Bank Communication and Policy Effectiveness, NBER Working Paper Series, n. 11898.

Donato Masciandaro, Department of Economics, Bocconi University and SUERF.

Davide Romelli, Trinity College Dublin and SUERF Research Affiliate.

Gaia Rubera, Department of Marketing, Bocconi University.

The authors gratefully acknowledge financial support from the Baffi Carefin Centre, Bocconi University. Giacomo Barone and Alessandro Prudenziati provided excellent research assistance.

The number sign with the governor’s surname was not used for this bank because it is a common last name with different meanings, so it would be found in numerous irrelevant tweets.