We examine how discount rates affect the nature and composition of innovation within an industry through the lens of a tractable theoretical framework. Challenging conventional wisdom — which suggests that higher discount rates should depress long-term investment such as research and development (R&D) — our model shows that higher discount rates need not discourage firm innovation when accounting for the industry equilibrium. Higher discount rates deter fresh entry — effectively acting as entry barriers — but encourage R&D through the intensive margin, which can lead to a higher industry innovation rate on net. Simultaneously, discount rates also affect the quality of innovation, namely, high discount rates foster explorative over exploitative innovation. Considering fluctuations in discount rates, the model further rationalizes observed empirical patterns in the cyclicality of R&D.

Research and development (henceforth, R&D) is a long-term investment decision for firms: It requires outflows for an uncertain period of time, has a long gestation, and bears an uncertain outcome. Corporate finance textbooks suggest that higher discount rates should penalize cash flows expected in the far future and, thus, should discourage investment, especially longer-term ones such as R&D. Yet, this line of reasoning neglects that firms do not operate in isolation: Their incentives to invest in R&D largely depend on their operating environment, which is also affected by discount rates. As a result, the overall impact of discount rates on R&D investment is not obvious.

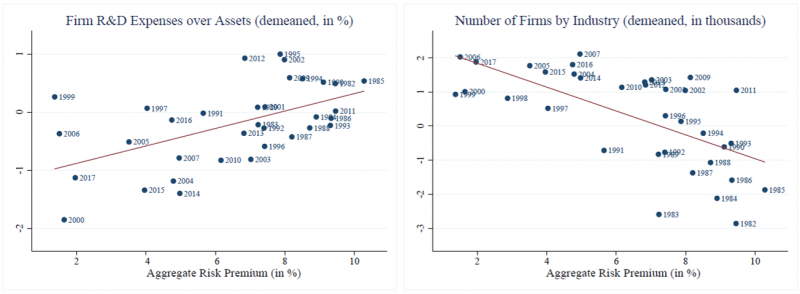

As a starting point, Figure 1 empirically documents that higher discount rates need not reduce innovation. As the aggregate risk premium increases, the left panel shows that US firms invest a larger fraction of their assets on R&D on average, controlling for firm fixed effects — suggesting that discount rates have a positive impact on the intensive innovation margin. Simultaneously, however, the right panel suggests that higher discount rates discourage innovation in the extensive margin: A higher aggregate risk premium relates to significantly fewer firms, net of industry fixed effects.

We develop a theoretical framework that rationalizes these empirical facts. Our framework studies how discount rates affect corporate R&D while stressing the importance of studying innovation in industry equilibrium. Our framework also acknowledges that innovations can be heterogeneous. Vertical (or explorative) innovations are path-breaking technological improvements that revolutionize an industry, which then trigger Schumpeterian creative destruction and cause the exit of incumbent firms in that industry. By contrast, horizontal (or exploitative) innovations are incremental and create new product lines within the existing technology frontier, then only causing partial displacement by eroding the operating profits of incumbent firms. Our framework also recognizes that firms in an industry differ in their ability to produce and innovate — for instance, incumbents may or may not invest in innovation, whereas start-ups only innovate and do not produce. In this setting, we investigate how discount rates affect the industry equilibrium and innovation incentives by focusing on the market price of risk — i.e., the main common component of firms’ discount rates.

Figure 1: Firm-level R&D, number of firms, and discount rates

Notes: The left panel plots the average ratio of R&D over total assets of public US firms in Compustat between 1982 and 2017, net of firm-fixed effects, against the aggregate risk premium developed by Haddad, Loualiche, and Plosser (2017). The right panel plots the average number of firms by industry-year, net of industry-fixed effects, for the same time period and set of industries, using data from the Business Dynamics Statistics (BDS) project covering both public and private firms.

To disentangle the strengths at play, we develop our analysis in steps and start by considering the case in which the market price of risk is constant and firms only invest in vertical innovation. When abstracting from industry dynamics, we confirm the conventional wisdom that a higher market price of risk discourages firm R&D. Yet, when allowing for endogenous industry dynamics with entry, this result is overturned. Specifically, we prove that a higher market price of risk discourages entry by new firms and yet encourages innovation by incumbents, consistent with the evidence in Figure 1. Furthermore, compounding these offsetting effects, the model predicts that the market price of risk has a non-monotonic effect on the industry-level rate at which new technologies emerge. A higher market price of risk can spur the advent of new technologies if the increase in R&D by active firms (the intensive margin) more than offsets the decline in the mass of entrants (the extensive margin).

Our predictions continue to hold when allowing for horizontal innovation, in which case the incumbent firms in the industry experience profit erosion due to the introduction of competing product lines. We show that different types of innovation exhibit different sensitivity to discount rates. While the rate of vertical innovation increases with the market price of risk due to the ensuing lower threat of creative destruction, the rate of horizontal innovation is non-monotonic. First, as the market price of risk increases, the lower competition coming from the extensive margin spurs both horizontal and vertical innovation. Simultaneously, however, the greater engagement in innovation in the intensive margin makes the threat of exit via creative destruction more likely, then reducing the expected profits from horizontal innovation.1 This second strength dominates when the market price of risk is sufficiently high. Hence, a greater market price of risk stimulates the more explorative type of innovation.

Our predictions continue to hold when we allow incumbent firms not only to innovate in-house but also to acquire entrants — a rising trend in recent decades. In this case too, we confirm that the extensive innovation margin decreases with higher discount rates whereas innovation increases in the intensive margin. Interestingly, target firms become scarcer as discount rates increase, resulting in acquisitions of innovating entrants becoming less likely, consistent with the evidence in Haddad, Loualiche and Plosser (2017).

When we allow the market price of risk to vary over time, we empirically validate the predictions of our model by capturing the cyclicality of R&D at both the firm and aggregate levels. We acknowledge that the market price of risk is countercyclical and assume that the economy switches over two states, one with a low market price of risk (the good state or expansion) and the other with a high market price of risk (the bad state or recession). We show that active firms optimally set a higher innovation rate when the market price of risk is higher but, at the same time, fewer firms are active. That is, active firms face lower competition in innovation in bad states of the economy thanks to a lower threat of creative destruction and of product obsolescence which, in turn, encourage their investment in R&D. Our paper then reconciles the Schumpeterian view that firms should invest more in bad states of the economy with the evidence that R&D is procyclical at the aggregate level.2

Interestingly, the model predictions on R&D cyclicality are consistent with recent empirical studies.

Babina, Bernstein, and Mezzanotti (2023) find that the intensive margin of innovation is resilient during downturns, whereas the extensive margin drops due to a substantial decline in patenting by entrepreneurs — aligned with our prediction that incumbents benefit from lower entry. Babina, Bernstein, and Mezzanotti (2023) also find that innovation shifts towards more impactful patents during downturns — hinting at greater exploration when the market price of risk increases, consistent with our model and the evidence in Manso, Balsmeier, and Fleming (2021). Furthermore, our results strengthen when acknowledging that firms’ ability to finance entry deteriorates during recessions, an aspect that we embed in an extension, aligned with the empirical findings in Brown, Fazzari, and Petersen (2009).

Babina, T., Bernstein, A., and Mezzanotti, F. (2023). Financial Disruptions and the Organization of Innovation: Evidence from the Great Depression. Review of Financial Studies, Forthcoming.

Barlevy, G. (2007). On the Cyclicality of Research and Development. American Economic Review 97, pp. 1131-1164.

Brown, J., Fazzari, S., and Petersen, B. (2009). Cash Flow, External Equity, and the 1990s R&D Boom. Journal of Finance 64, 151-185.

Bustamante, M.C., and Zucchi, F. (2023). Innovation, Industry Equilibrium, and Discount Rates. ECB Working paper No. 2835.

Comin, D., and Gertler, M. (2006). Medium-term Business Cycles. American Economic Review 96, pp. 523-551.

Griliches, Z. (1984). Patent Statistics as Economic Indicators: A Survey. In R&D and Productivity: The Economic Evidence, pp. 287-343.

Haddad, V., Loualiche, E., and Plosser, M. (2017). Buyout Activity: The Impact of Aggregate Discount Rates. Journal of Finance 72, 371-414

Manso, G., Balsmeier, B., and Fleming, L. (2021). Heterogeneous Innovation over the Business Cycle. Review of Economics and Statistics 1-50.

In fact, horizontal innovators expect to exit due to creative destruction at a higher frequency.

See, e.g., Griliches (1984), Comin and Gertler (2006), or Barlevy (2007).