The ongoing digital transition in the payment landscape offers countless advantages to many people. However, certain segments of the population encounter difficulties navigating this digital world, particularly individuals within groups at risk. Little is known about their payment behaviour and preferences. Using data from the 2022 Dutch Survey on Consumers’ Payments (SCP) among over 19,000 individuals, we shed light on this topic. Our research focuses on people with low digital literacy, disabilities or financial difficulties. Our findings suggest that cash is an important means of payment to many, especially for people with low digital literacy, people who are blind or visually impaired, people with limited or no hand function, people with a mild intellectual disability and people who find it difficult to make ends meet on their income. 28% of the SCP participants say they cannot do without cash and 7% say they always pay with cash at points of sale (POS), but these percentages are higher for the aforementioned focus groups.

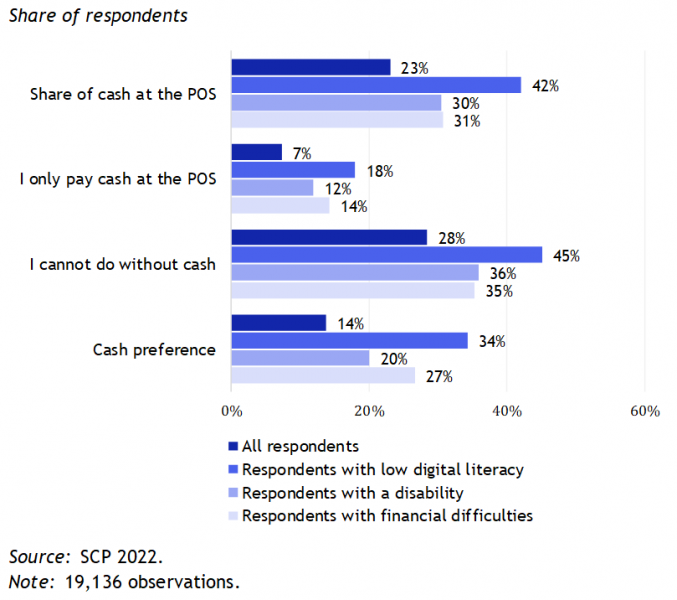

Our study highlights that there is a need for cash, particularly among groups at risk. Figure 1 outlines the variables that were considered to describe cash importance in our study. On average, respondents use cash for 23% of their POS transactions, 7% always pay cash at the POS, 28% self-report they cannot do without cash and 14% have a preference for cash. Cash is notably more important for groups at risk. The first group for which this holds, consists of people who are struggling to cope in today’s digital world. 1 in 20 respondents consider their digital skills to be insufficient. 18% of these people only use cash at POS, and no less than 45% say they cannot do without cash. Additionally, people with physical or intellectual disabilities also attach great importance to cash. 12% always use cash at POS and over 1 in 3 say they cannot do without cash. The importance of cash is related to the type of disability. Groups that relatively often prefer paying in cash are blind and visually impaired people, people with limited hand function and people with mild intellectual disabilities. Finally, we find that cash is also important for people who are struggling to make ends meet. About 1 in 10 respondents in our study find it difficult or very difficult to make ends meet. Of this group, 14% always use cash at POS and over 1 in 3 say they cannot do without banknotes and coins.

Figure 1: There is a need for cash, especially among groups at risk

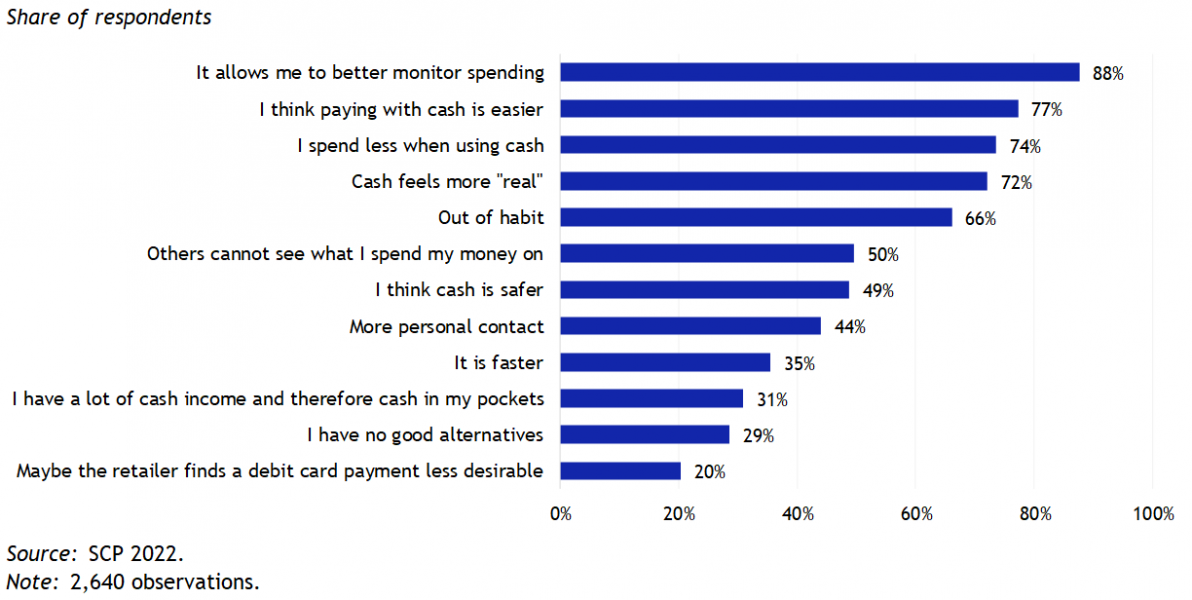

Numerous factors contribute to the preference for cash over digital payments. Our survey offers a deeper understanding of these factors (see Figure 2). Notable, 77% of respondents who express a preference for cash highlight its ease of use compared to debit cards. This finding underscores the challenges various groups of individuals face when attempting to embrace digital payment methods. The dominant rationale for favouring cash is its capacity to facilitate better spending tracking. 88% of the respondents who express a preference for cash indicate that this is a consideration for them to use cash. Additionally, more than 7 in 10 respondents who prefer cash over debit cards indicate that cash helps them to prevent overspending and that cash feels more real.

Figure 2: Respondents’ reasons for preferring cash to debit cards

Even though many parties involved in the payment industry are continuously developing their payment solutions to enhance accessibility for a broader audience, there will always be people for whom the use of digital payments poses significant challenges. This is why we anticipate that the importance of cash will endure in the foreseeable future. Our results therefore underline the key role that cash still plays in society.