Recent spikes in energy prices have raised concerns about the risks energy price shocks pose for firm performance. Using cross-country firm-level data, this Policy Brief shows that immediately following an energy price shock, firms reduce their capacity utilisation and their productivity declines, but that positive productivity gains may show up in the medium term. The potential for gains is higher in less energy-intensive sectors and for firms most likely to invest in energy saving technologies.

Rising energy prices resulting from the strong post-COVID19 economic recovery and the war in Ukraine raised concerns about firms’ economic performance, particularly in energy-intensive sectors (Bialeck et al., 2023). Beyond exogenous price changes, the increasing reliance on carbon pricing to achieve climate change goals also means that energy prices are expected to remain high over the medium term (Garicano et al., 2022).

Large energy price increases generate a tension between short- and medium-term policy objectives. On the one hand, policymakers may want to temporarily shield corporations from energy price shocks to preserve jobs and competitiveness. On the other hand, a strong price signal may be needed to provide incentives to invest in energy saving technologies and achieve the green transition (Alvarez and Molnar, 2021). To design polices that reconcile these potentially conflicting goals, understanding the dynamics of responses to energy price shocks and the conditions under which different impacts on firms materialise is key.

Against this backdrop, André et al. (2023) estimates the impacts of energy price changes on firms’ productivity, distinguishing between the short- and the medium- term impact, on which the current literature is limited. Updated measures of sectoral energy prices estimated through country-level prices of different energy sources and sectoral energy mixes, based on Sato et al. (2019), allow capturing country-industry-year variation in energy prices.

To assess the impact of significant variations in energy prices, we focus on changes in energy prices of at least 10% (mild price shock) or at least 15% (severe price shock). Controlling for other country-level and sector-level shocks as well as for time-invariant country-sector characteristics, we isolate the effect of energy price shocks on firms’ productivity in every year from the shock up to four years later.

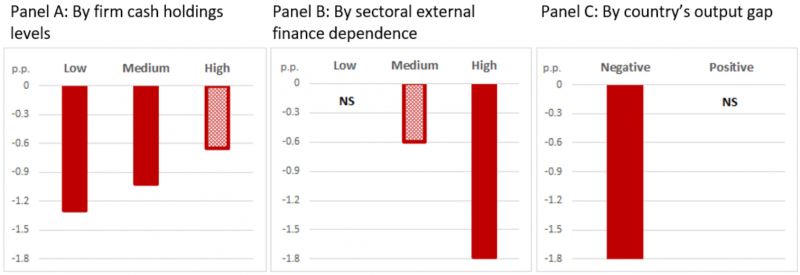

Figure 1: The short-term response of productivity to a severe energy price shock

Note: Responses to a 1.5 standard deviation (over 15%) energy price shock. A bar with a solid fill indicates results that are statistically significant at the 1% level, while a pattern fill indicates results significant at the 10% level and “NS” results that are not statistically significant. Low, medium and high stand respectively for 10th, 50th and 90th percentile of the distribution of the interaction variable of interest; the only exception is the output gap, as in the estimation we use a binary variable taking value 1 for output above potential (i.e. positive gap) or and 0 for output below potential (i.e. negative gap). Source: André, Costa, Demmou, and Franco (2023).

We find that immediately following an energy price shock, firms adjust their capacity utilisation, affecting their productivity. Our estimates suggest that a severe price shock reduces the average firm productivity growth by one percentage point in the following year. The firms most affected are those operating in energy-intensive sectors, as well as firms that are financially constrained or small (Figure 1, Panel A and B). This impact is also contingent on macroeconomic conditions: when a country’s economy is running above potential (i.e., positive output gap), energy price increases have a milder negative short-term impact (Figure 1, Panel C).

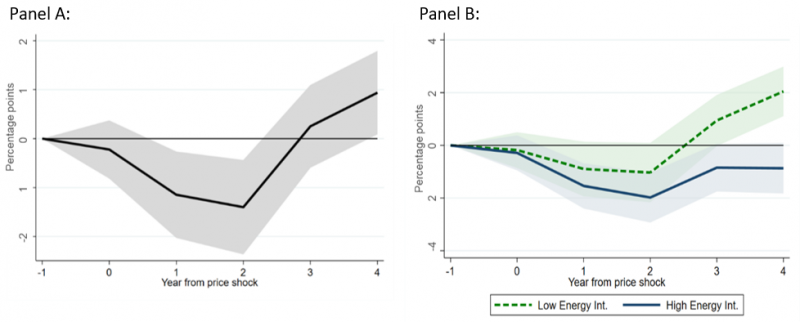

Under certain conditions, this adverse impact can be reversed, and firms may display positive productivity gains in the medium term. Specifically, a mild energy price shock is associated with an increase in productivity growth of around 0.9 percentage points four years after the shock (Figure 2, Panel A). However, these gains are confined to the least energy-intensive sectors (Figure 2, Panel B). They also disappear in the case of severe shocks.

Figure 2: The medium-term response of productivity to a mild energy price shock

Note: Panel A: The thick black line represents the average change in firms’ productivity growth following a one standard deviation (over 10%) energy price shock. Panel B: The blue solid (green dashed) line represents the average change in firms’ productivity growth following a mild energy price shock in high (low) energy intensity sector. The shaded area represents the 90% confidence interval around the estimates. Source: André, Costa, Demmou, and Franco (2023).

Our analysis offers some insights into the mechanism behind these dynamics, hinting that investment could be a channel through which this sign reversal operates. In the absence of information on firm-level energy-efficiency investment, we provide indirect evidence of this process.

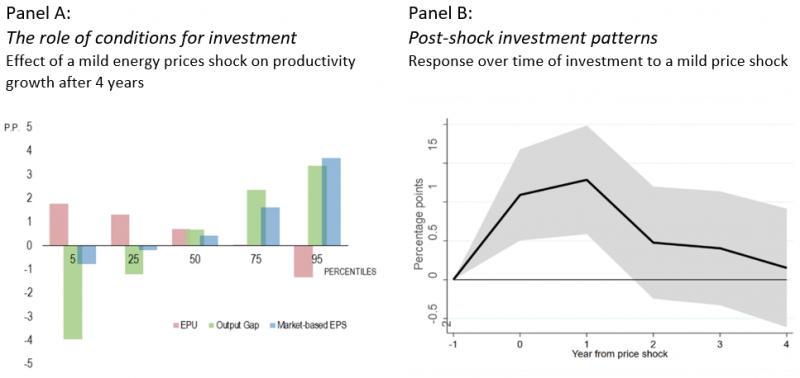

First, energy price shocks are more likely to raise productivity when coupled with favourable conditions for investment, as for example in countries with growing economies or more stringent environmental policy, where managers are more likely to be aware of energy-efficient technologies. Conversely, under high economic policy uncertainty, firms face lower productivity gains as they are likely to delay irreversible investment, including energy efficiency investment (Figure 3, Panel A). Second, mild energy price shocks stimulate firms’ investment (Figure 3, Panel B). Newer and more energy-efficient capital vintages may drive the positive effects on productivity growth in the longer term.

Figure 3: Medium-term productivity gains: an investment tale?

Note: Panel A: The bars represent the average change of firms’ productivity growth in the fourth year after a mild (over 10%) energy shock for different percentiles of an indicator of energy policy uncertainty (EPU), the output gap, and the market-based component of an indicator of environmental policy stringency (EPS). Panel B: The thick black line represents the average change in firms’ capital investment ratio growth following a mild (over 10%) energy price shock. The shaded area represents the 90% confidence interval around the estimates. Source: André, Costa, Demmou, and Franco (2023).

Our results shed light on the conditions under which the costs and the gains of an energy price shock materialise, pointing to two main implications for policymakers. First, when faced with a relatively mild shock, firms may experience medium-term productivity improvements. Thus, maintaining well-defined price signals on fossil fuel energy to incentivise firm-level decarbonisation could come at low costs, especially during business cycle expansions. Second, incentives to invest in energy efficiency, such as carbon pricing, environmental regulations and reduced policy uncertainty, are crucial to unlock productivity gains. However, when a shock is more extreme, support may be needed to offset potential scars to the corporate sector, especially for small and financially constrained firms, which are the most at risk.

André, C., Costa, H., Demmou, L., Franco, G. (2023), “Rising energy prices and productivity: short-run pain, long-term gain?”, OECD Economics Department Working Paper No 1755, https://doi.org/10.1787/2ce493f0-en.

Alvarez, C. F., Molnar, G. (2021), “What is behind soaring energy prices and what happens next?”, IEA commentary October 2021, https://www.iea.org/commentaries/what-is-behind-soaring-energy-prices-and-what-happens-next.

Bialek, S., Schaffranka, C., Schnitzer, M. (202), “The energy crisis and the German manufacturing sector: Structural change but no broad deindustrialisation to be expected”, Voxeu 17 Jan 2023, https://cepr.org/voxeu/columns/energy-crisis-and-german-manufacturing-sector-structural-change-no-broad.

Garicano, L., Rohner, D., Weder di Mauro, B. (2022), “Increased urgency for the green transition in Europe”, Voxeu 23 Sep 2022, https://cepr.org/voxeu/columns/increased-urgency-green-transition-europe.

Sato, M., Singer, G., Dussaux, D., Lovo, S. (2019), “International and sectoral variation in industrial energy prices 1995–2015”, Energy Economics, Vol. 78, pp. 235-258, https://doi.org/10.1016/j.eneco.2018.11.008.