We augment the ECB’s New Area-Wide Model with disaggregate energy, carbon emissions and a role for abatement to explore how an increase in carbon prices consistent with the transition to an interim net-zero emission target affects the euro area economy. Our results suggest that the euro area will experience a transitory rise in inflation and a lasting, albeit moderate decline in GDP. The short and medium-term effects depend on the monetary policy reaction, on the path of the carbon price increase and on its credibility. Expanding the supply of clean energy is key for containing the decline in GDP, while consumption inequality can be mitigated by redistributing fiscal revenues to low-income households.

The transition to a “net-zero” economy, as set out by the European Commission in the European Green Deal, constitutes a structural force that will be a possibly significant contributor to euro area macroeconomic dynamics over the next decades (see, e.g., Pisani-Ferry, 2021, Lane, 2022, and Schnabel, 2022). These dynamics will depend on the transition pathway, notably for the price of carbon emissions. The transition will cause marked structural shifts in aggregate supply and the composition of aggregate demand in the longer term, but also impact inflation and real activity in the short to medium term. In this brief we present a model-based assessment of the macroeconomic effects of transition policies aimed at reducing carbon emissions in the euro area, with a focus on tax policies that raise the price of carbon emissions.

We augment the ECB’s New Area-Wide Model (NAWM, cf. Coenen et al., 2008) with a framework of disaggregated energy production and use, where intermediate-good firms and households demand an energy composite for production and consumption purposes. The energy composite is produced by a perfectly competitive firm, which combines “dirty” and “clean” energy inputs. These inputs are in turn produced by two sets of monopolistically competitive firms: firms in the dirty energy sector combine imported “fossil” resources, the use of which causes carbon emissions, with a capital-labour bundle, whereas firms in the clean energy sector combine domestic “green” renewable resources with a capital-labour bundle. The energy composite is then utilised as a distinct input in the production of intermediate goods, and as a separate good in households’ aggregate consumption bundle. Importantly, our specification of imperfect competition across firms in the clean and dirty energy sectors allows for sectoral energy prices to be passed through to intermediate-good and aggregate consumption prices in a staggered fashion.

Our approach of employing a large-scale DSGE model, tailored to provide quantitative prescriptions regarding the effectiveness of carbon transition policies, is related to that of other model-based studies carried out at policy institutions, such as Varga et al. (2021), Bartocci et al. (2022), Carton et al. (2022) and Ernst et al. (2022). In contrast to those works, our focus however is on exploring the impact of transition policies on both inflation and economic activity and on examining the interplay of this impact with the conduct of fiscal and monetary policy, which is of particular relevance for central banks.1

Notably, our modelling strategy differs from other approaches that employ Integrated Assessment Models (IGAMs) or Computable General Equilibrium (CGE) models in that our model places emphasis on understanding the macroeconomic effects of transition policies in the short to medium term. The strength of these alternative classes of models predominantly lies in their ability to capture sectoral reallocations over a longer time horizon and the two-way interaction between climate and the economy, while abstracting from micro foundations that enable a quantitative assessment of the transmission channels of climate change on the macro economy.

To reach the European Union’s net-zero emission target by 2050, as set out in the European Green Deal, the price of carbon emissions in the euro area needs to be raised significantly and in a timely manner. To this end, our central scenario is empirically grounded in measures of Effective Carbon Rates (ECRs) provided by the OECD, which capture the price of carbon emissions at the sectoral and country level.

Specifically, our central carbon transition scenario assumes a steady and linear increase in the euro area average ECR to an interim target rate of €140/tCO2 over the period from 2022 to 2030. The assumed target rate is broadly consistent with estimates of the International Energy Agency (IEA), according to which advanced economies need to raise the price of carbon emissions to $140/tCO2 until 2030 in order to meet their longer-term net-zero pledges, provided that the prospective effects from additional non-price policy measures in their overall decarbonisation strategy as well as technological advancements are achieved (see IEA, 2022).

For the rest of the industrialised world, the average ECR is assumed to increase by the same amount as for the euro area but in relative terms; that is, by 65.3%.

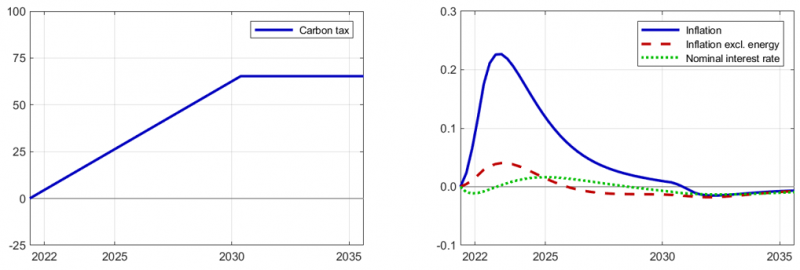

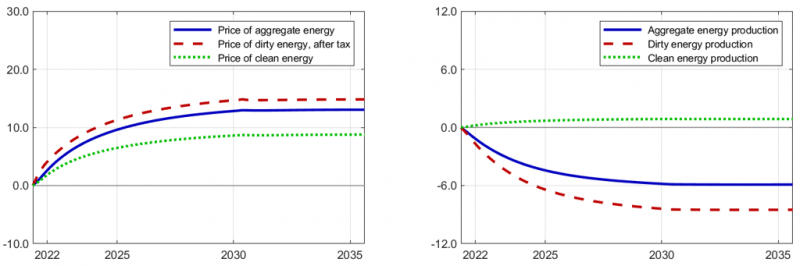

Our simulation results suggest that the assumed increase in the price of carbon emissions has a limited overall impact on the economy, as shown in Figure 1. Consumer price inflation rises as higher energy prices feed both directly and indirectly into the price of the aggregate consumption bundle of households. The rise in annual inflation is gradual and hump-shaped, reaching a peak of around 0.2 percentage point in the course of 2023, before slowly receding by the end of 2030. On average, inflation increases by less than one-tenth of a percentage point over the scenario period from 2022 to 2030. At the same time, higher energy prices put only modest upward pressure on inflation excluding energy via their impact on intermediate-good production costs.

On the real side, aggregate consumption falls moderately by about 0.7% over the medium to longer term. The fall in investment is markedly stronger, with a decline of close to 2.5% at the trough. The implied decline in aggregate demand translates into a gradual but lasting fall in GDP by around 1.2%, shaving off about one-eighth of a percentage point from GDP growth per annum over the scenario period.

At the sectoral level, the increase in carbon prices operates by affecting relative energy prices. Hence, the aggregate energy producer is incentivised to substitute away from utilising more costly dirty energy and into utilising clean energy.

Due to the lower use of dirty energy in aggregate energy production and the overall fall in aggregate energy use, carbon emissions are reduced by roughly 7% in the medium to longer term. Clearly, as the carbon tax increase in our central scenario is the only policy measure considered, this reduction must necessarily fall short of the targeted emissions levels of a comprehensive net-zero decarbonisation strategy.

Figure 1: Effects of the carbon tax transition scenario

Note: This figure shows the dynamic responses of key variables to the carbon tax transition scenario. Inflation is measured as the annual rate of change in consumer prices, and the nominal interest rate is annualised. Net trade is reported as a share of GDP, and energy prices are expressed relative to consumer prices. All dynamic responses are shown as percentage deviations from baseline values, except for the dynamic responses of inflation, the interest rate and net trade, which are shown as percentage-point deviations.

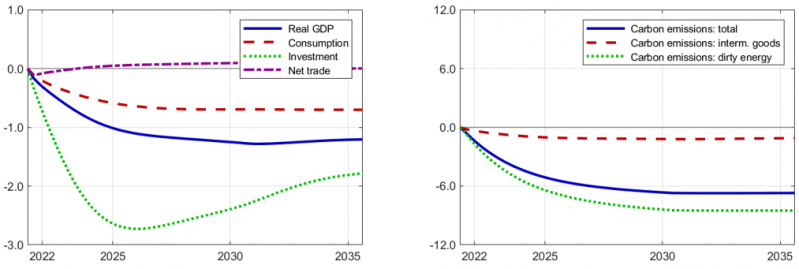

A side effect of the increase in the carbon tax is that it disproportionately affects financially constrained households which only earn labour income. The fiscal authority can address this side effect by distributing a larger share of the additional tax revenues raised to these households in the form of targeted transfers. The scenario results obtained under the targeted transfer scheme are shown in Figure 2. For aggregate consumption (and other aggregate variables), they are very similar to the results under the benchmark scheme with evenly distributed transfers, suggesting that the aggregate effects of the redistribution of revenues under the targeted transfer scheme are minor. However, the redistribution of revenues has important effects on inequality, measured here as the dispersion of consumption effects across households. Under the benchmark scheme, consumption of both constrained and unconstrained households falls permanently, yet with the decline in consumption of the constrained households being considerably stronger. By contrast, under the targeted transfer scheme, the decline in consumption of the constrained households is noticeably dampened, whereas the decline in consumption of the unconstrained household is intensified.

Figure 2: Distributional impacts of transfers to households

Note: This figure shows the dynamic responses of aggregate and disaggregate consumption to the carbon tax transition scenario for alternative specifications of the carbon tax-related transfer scheme. The dynamic responses are shown as percentage deviations from baseline values.

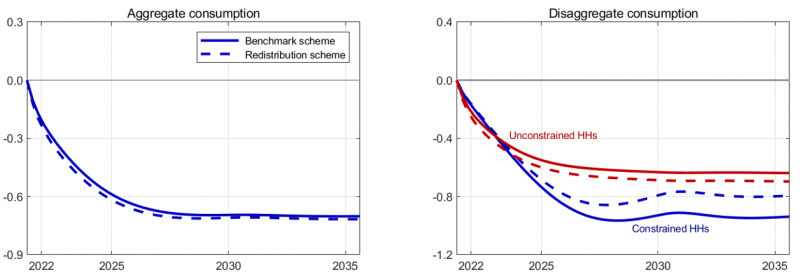

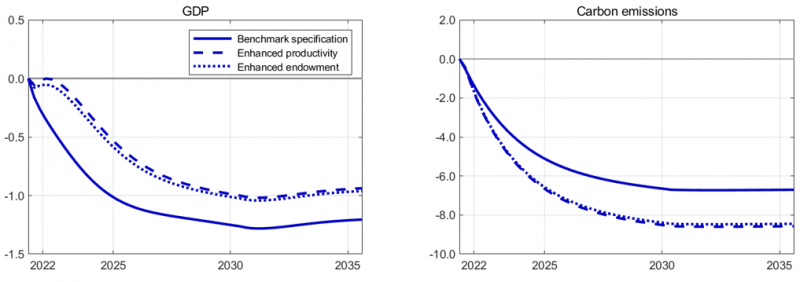

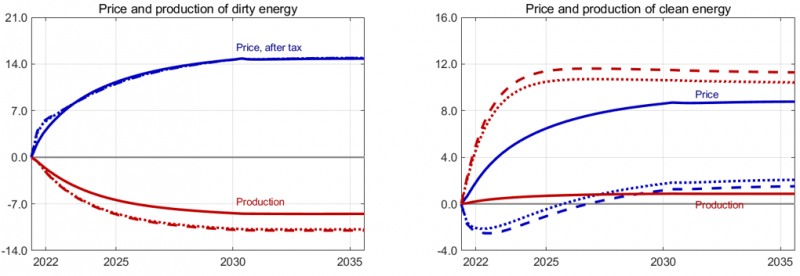

Our central scenario so far has assumed that the supply of green resources as well as the efficiency of clean energy production have remained invariant during the carbon transition. Yet, it would be natural to expect that both dimensions change over time, either as the result of additional government policies, or due to technological innovation. We revisit the central scenario, allowing this time for a 10% increase in either the productivity of clean energy production or the endowment of green resources.

The results of the scenario with the alternative specifications of clean energy supply are shown in Figure 3. Compared to the benchmark case, the decline in GDP is diminished over all horizons. These effects can be explained by the different adjustment paths for the prices and the production volumes of the energy components. As the supply of green resources grows, or as the technology of clean energy production improves, the upward pressure on the price of clean energy, which results from the desire of the aggregate energy producer to switch from dirty to clean energy inputs, is essentially offset, while clean energy production increases very strongly. This translates into a smaller increase in the aggregate price of energy and a diminished decline in aggregate energy production. As household income and firm profitability benefit from lower increases in energy prices, both consumption and investment demand rise, which in turn results in an increase in GDP.

A consequence of enhancing the supply of clean energy is that the resulting reduction in carbon emissions is greater than in the benchmark case, reaching approximately 8.5%. This reflects the fact that enhancing the supply of clean energy enables the shift towards the use of clean energy inputs in the production of aggregate energy.

Figure 3: Enhancing the supply of clean energy

Note: This figure shows the dynamic responses of key variables to the carbon tax transition scenario when the supply of clean energy is enhanced through higher productivity or a larger endowment of green resources, where either productivity or the endowment is raised by 10%. Energy prices are expressed relative to consumer prices. All dynamic responses are shown as percentage deviations from baseline values.

Airaudo, F., Pappa, E. and Seoane, H., 2022, “Greenflation: The cost of the green transition in small open economies”, unpublished manuscript, Universidad Carlos III de Madrid.

Annicchiarico, B. and Di Dio, F., 2015, “Environmental policy and macroeconomic dynamics in a New Keynesian model”, Journal of Environmental Economics and Management, 69, pp. 1-21.

Bartocci, A., Notarpietro, A. and Pisani, M., 2022, “Green fiscal policy measures and non-standard monetary policy in the euro area”, Temi di Discussione 1377, Banca d’Italia.

Carton, B., Evans, C., Muir, D. and Voigts, S., 2022, “Getting to know GMMET: The theoretical structure and simulation properties of the Global Macroeconomic Model for the Energy Transition”, unpublished manuscript, International Monetary Fund.

Coenen, G., McAdam, P. and Straub, R., 2008, “Tax reform and labour-market performance in the euro area: A simulation-based analysis using the New Area-Wide Model”, Journal of Economic Dynamics and Control, 32(8), pp. 2543-2583.

Del Negro, M., di Giovanni, J. and Dogra, K., 2023, “Is the green transition inflationary?”, Staff Reports No. 1053, Federal Reserve Bank of New York.

Dupraz, S., Lisack, N., Marx, M. and Matheron, J., 2022, “Greenflation: Price stability and the decarbonization of the economy”, unpublished manuscript, Banque de France.

Ernst, A., Hinterlang, N., Mahle, A. and Stähler, N., 2022, “Carbon pricing, border adjustment and climate clubs: An assessment with EMuSe”, Discussion Papers 25/2022, Deutsche Bundesbank.

Ferrari, A. and Nispi Landi, V., 2022, “Will the green transition be inflationary? Expectations matter”, Questioni di Economia e Finanza 686, Banca d’Italia.

Heutel, G., 2012, “How should environmental policy respond to business cycles? Optimal policy under persistent productivity shocks”, Review of Economic Dynamics, 15(2), pp. 244-264.

IEA, 2022, World Energy Outlook 2022, International Energy Agency.

Känzig, D., 2021, “The unequal economic consequences of carbon pricing”, unpublished manuscript, London Business School.

Lane, P., 2022, “Inflation in the near-term and the medium-term”, opening remarks at MNI Market News Webcast, 17 February 2022.

Pisani-Ferry, J., 2021, “Climate policy is macroeconomic policy, and the implications will be significant”, Policy Briefs PB21-20, Peterson Institute for International Economics.

Priftis, R. and Schoenle, R., 2023, “Energy supply shocks and the fiscal monetary policy mix”, unpublished manuscript, European Central Bank.

Schnabel, I., 2022, “A new age of energy inflation: Climateflation, fossilflation and greenflation”, panel remarks at The ECB and its Watchers XXII conference, 17 March 2022.

Varga, J., Roeger, W. and in’t Veld, J., 2021, “E-QUEST – A multi-region sectoral dynamic general equilibrium model with energy: Model description and applications to reach the EU climate targets”, European Economy Discussion Papers 2015-146, European Commission.