Using survey data from Italy, we study the effects of the 2021 energy crisis on the energy input choices of medium and large-sized industrial firms. Our instrumental variable (IV) strategy, based on the availability of fixed-price contracts subscribed before the crisis, reveals an average infra-annual price elasticity of demand very close to zero for both electricity and natural gas. Large energy consumers subject to the European Union Emission Trading System (EU ETS) have significantly larger natural gas elasticities and were able to partially substitute gas with other fossil fuels.

The surge in natural gas and electricity wholesale prices that started in mid-2021 has sparked widespread concerns regarding the EU industrial sector and the economy more broadly. The magnitude of its detrimental effects and the effectiveness of the policies designed to address them are closely linked to the price elasticity of energy demand (Bachmann et al., 2022; Gros, 2022), a crucial parameter for which there is a dearth of evidence. In this policy brief, we summarize a recent empirical study (Alpino, Citino, and Frigo, 2023), estimating the infra-annual elasticities of electricity and gas demand for the year 2021.

The study draws on data from the Bank of Italy’s Survey of Industrial and Service Firms (Invind). This dataset offers insights into the physical quantity and monetary value of gas and electricity consumption on a bi-annual basis, enabling the calculation of average prices paid by individual firms and their change between the first and second semester of 2021. Additionally, the survey records information on whether firms rely on fixed-price energy supply contracts, a safeguard against wholesale price increases. Leveraging these data, we construct an instrumental variable that predicts within-year price changes at the firm level and allows the identification of the demand elasticities of interest. We restrict the sample to industrial companies that have a minimum of 50 employees, excluding energy generation and refineries.

For the subsample of firms subject to the EU Emissions Trading System (EU-ETS), we supplement the baseline variables with administrative data on annual energy consumption by fossil fuel from ISPRA (Italian Institute for Environmental Protection and Research). Excluding energy companies and refineries, firms subject to the EU-ETS (less than 400) account for more than half of aggregate industrial consumption of natural gas.

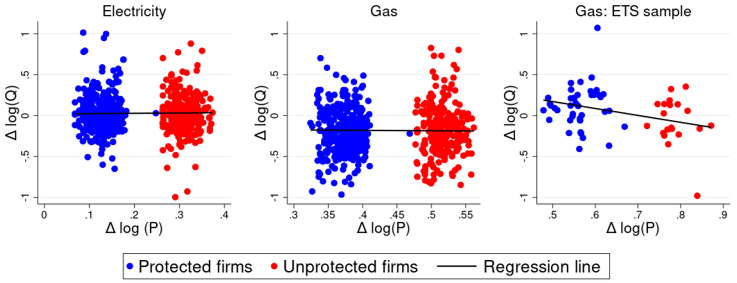

Figure 1: Infra-annual price elasticity of energy demand in 2021- IV estimates

Note: The figure provides a graphical visualization of the IV-estimates of a specification where the outcome is the difference in log energy consumption between the second and the first semester 2021 (y-axis), the endogenous regressor is the difference in log energy price between the second and the first semester 2021 (x-axis), the excluded instrument is a dummy for firms that procured energy through fixed-price contracts signed at the beginning of 2021 (“Protected firms” in the legend) and controls include: sector fixed effects, size class fixed effects, macro-region fixed effects, turnover in 2020, employment, share of self-generated electricity, a dummy for emission accounting, a dummy for firms included in the EU-ETS, and a dummy for electricity intensive firms according the Italian regulation. Each panel reports results of a different IV regression. The estimated elasticity is the slope of the black regression line.

This paper sheds light on energy consumption patterns among medium and large industrial firms in Italy and provides estimates of their price elasticity of demand for natural gas and electricity. The analysis reveals that, on average, these elasticities were relatively small in 2021, except for firms subject to the EU-ETS, where gas demand exhibited higher responsiveness. In the longer run, firm demand may of course have reacted differently to the initial shock, as well as reflected the further increases in wholesale prices resulting from the war outbreak in 2022, and the changes in expectation regarding the length of the energy crisis. In order to address these issues, we plan to extend the analysis to 2022 using a similar set of questions included in the latest Invind survey wave.

Alpino, Citino, Frigo. (2023). “The effects of the 2021 energy crisis on medium-sized and large industrial firms: evidence from Italy.” Occasional Paper No. 776, Bank of Italy.

Bachmann, Baqaee, Bayer, Kuhn, Löschel, Moll, Peichl, Pittel, and Schularick (2022). “What if? The economic effects for Germany of a stop of energy imports from Russia.” ECONtribute Policy Brief No. 028.

Gros (2022). “Why gas price caps and consumer subsidies are both extremely costly and ultimately futile”, CEPS Policy Insights No 2022-28 / August 2022.