This policy brief is based on the paper: Škrinjarić , T. (2023), What are the short-to-medium-term effećts of extreme weather on the Croatian economy?, CNB Working Papers, W-70, Croatian National Bank. The views expressed in this study reflect the author’s opinions and are not necessarily those of the Croatian National Bank or Bank of England. The paper was written at a time when the author was affiliated with the Croatian National Bank.

This research examines the short-to-medium-term effects of weather changes on the Croatian economy by observing a simple model of an economy that includes changes in extreme weather events. Monthly data from 1999 to 2022 on the growth of the index of industrial production, inflation, energy inflation, changes in the unemployment rate, and selected weather variables are utilized to estimate several Vector Autoregression (VAR) models. The main finding indicates that inflation is mainly affected by weather shocks, especially drought. This means that monetary policy needs to consider this, mainly due to weather extremes being more frequent and of greater magnitudes. Furthermore, the insurance industry could also benefit from such findings due to the first quantification of such results on Croatian data.

In the last couple of years, we have experienced increased scientific research that tries to assess the effects of extreme weather events on the economy. In addition, the media coverage on this topic is vast, with constant talks about the consequences of climate change and extreme disasters on the economy. Therefore, a need exists to quantify these effects so policymakers can adjust their measures and instruments accordingly. In the working paper of the same name as this brief, we try to get answers on how extreme weather affects prices, energy prices, overall growth, and unemployment in Croatia. The empirical part of the paper uses monthly data from 1999 to 2022 for year-on-year growth rates of the index of industrial production, inflation, energy inflation, changes in the unemployment rate, and selected weather variables. Considering the relatively short period for which the analysis is carried out, we can discuss short-term and medium-term effects.

The extreme weather data was collected from the new IFAB (2022) database and consisted of six indicators: extreme cold, drought, wind, rain (precipitation), temperature, and an overall index. Individual VAR (vector autoregression) models have been estimated for every weather variable alongside the macroeconomic variables. Some of the main results include the following. Extreme cold shocks increase inflation up to one quarter after the shock, while droughts increase total and energy inflation with lagged effects from 6 to 18 months after the shock. At the same time, the effect on energy inflation is stronger due to the hydropower dependence on electricity production in Croatia. The delayed reaction after six months and beyond can also result from the response of the agricultural output, which, when affected by drought, achieves worse results after a specific time (after spring and summer have passed), which results in higher prices in autumn and winter. Precipitation shocks reduce inflation approximately one-quarter to one year after the shock, which is beneficial.

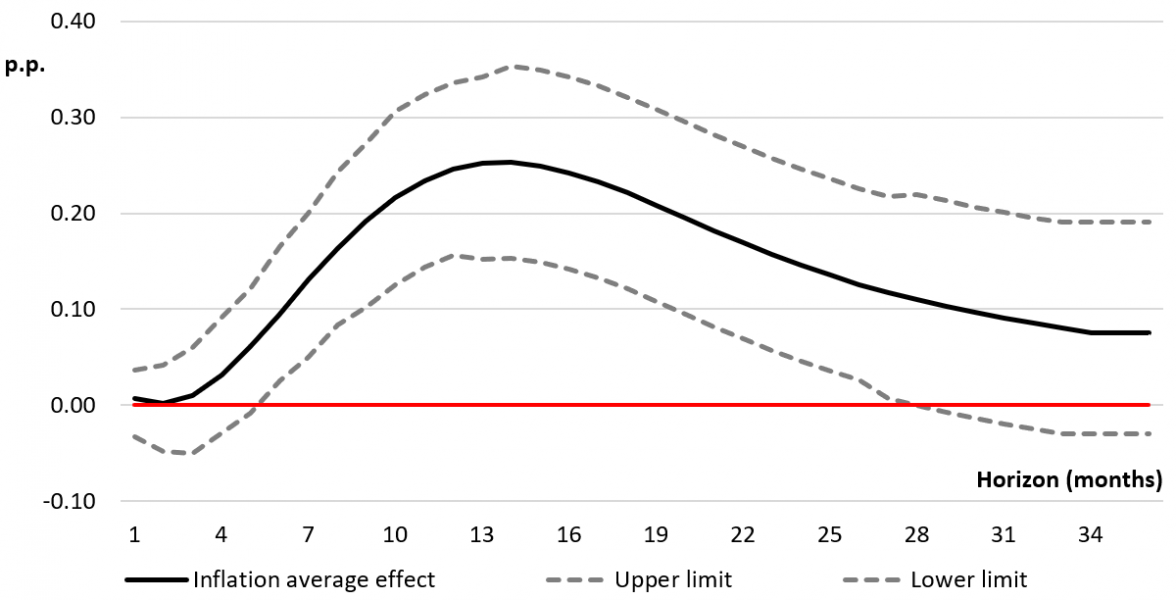

Figure 1 depicts the reaction of inflation to a shock in the drought variable dynamics. The drought indicator shows above-average dry periods. It can be seen that the effect of above-average droughts on the dynamics of total prices in Croatia is present six months after the shock itself and lasts for almost two years.

Figure 1: Inflation response to a shock of one standard deviation in drought index

Source: author’s calculation.

The paper’s main findings also indicate that extreme weather has the most significant effect on inflation, with drought being the weather variable that has the greatest effect on the economy. This has certain consequences, in terms that monetary policy should consider such effects, mainly due to the increasingly frequent and larger scale of extreme weather conditions. This can represent a great problem for Croatia, where droughts have become more frequent in the last few years. Additionally, the World Bank projects (2021) an increase in the average temperature for Croatia in the future. Thus, weather shocks could have long-term consequences on the economy in addition to those found in this research. As climate and weather disasters increase financial risks in the banking sector, it is necessary to increase the role of central banks in the “greening” of bank portfolios. Of course, these findings also provide information to the insurance industry due to changes in the strength and frequency of weather changes. However, considering that the paper looks at a simple macro model from a “bird’s eye” perspective, the analysis should be completed with more granular data and suitable analyses that could examine in more detail the transmission mechanisms of effects on certain aspects and sectors of the economy.

World Bank Group (2021): Climate risk country profile Croatia (link).

Škrinjarić, T. (2023), What are the short-to-medium-term effects of extreme weather on the Croatian economy?, CNB Working Papers, W-70, Croatian National Bank, https://www.hnb.hr/en/-/what-are-the-short-to-medium-term-effects-of-extreme-weather-on-the-croatian-economy.

International Foundation Big Data and Artificial Intelligence for Human Development (IFAB) (2022) data, available at: https://www.ifabfoundation.org/e3ci/.