The report contains findings from an annual EIB survey of Sub-Saharan African banks, conducted between April and June 2022. This means the war had already begun to shape banks’ perceptions but the financial tightening in global markets has continued to intensity since the survey. The report also incorporates data covering microfinance, private equity and venture capital, provide insights into how Africa’s financial sector is integrated with the rest of the world. The survey shows that following the outbreak of war, banks are concerned about funding costs in 2022. However, pre-existing issues, such as concerns about asset quality persist and are more pronounced for small and medium enterprises. This is leading banks to tighten credit standards for a third consecutive year and the flow of credit to the private sector might be further reduced by increased lending to the public sector. Despite the challenges, banks continue to make progress on increasing access to finance for women and in improving the screening of climate risk in their portfolios. There is a large gap between the share of banks that see opportunities in green lending and those that have green lending products. A lack of technical knowledge is a barrier for banks in this area and they see increased technical assistance from IFIs as a way to bridge the gap.

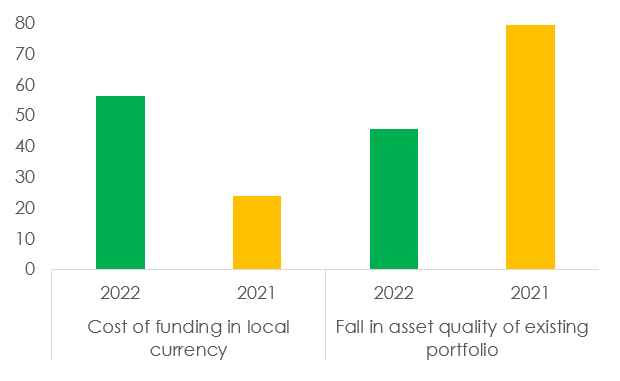

African financial institutions weathered the pandemic relatively well, thanks to pre-crisis capital buffers and targeted policy support but the war in Ukraine is leading to fresh concerns. Many central banks have raised interest rates to reduce inflation and tighter global financial conditions have increased bond yields. As a result, more than half of the banks in the EIB survey reported that the cost of funding in local currency was a concern in 2022. This barely featured in the survey in 2021, when concerns about asset quality dominated. Normally, a high interest rate environment supports bank profitability but banks in the region face difficult questions in terms of asset pricing. High inflation and rising input costs for businesses mean that both households and firms are suffering an income squeeze. If banks pass on higher interest rates to borrowers, they may force some borrowers into default.

Figure 1: Factors affecting banks’ business

(% of responding banks ranking each factor in the top three)

Source: EIB Banking in Africa survey, 2022 and 2021

Asset quality remains a concern for banks, particularly for loans to small and medium enterprises (SMEs). Approximately four-in-ten banks say that more than 10% of the loan book to SMEs is non-performing. Moreover, headline non-performing loan figures do not tell the whole story — there are significant shares of loans under moratoria or restructuring. Banks’ concerns about asset quality suggest that the size of the problem may be bigger than official data suggest and, correspondingly, that non-performing loan ratios are likely to increase in some countries, as policy support measures are wound down and tough global economic conditions persist.

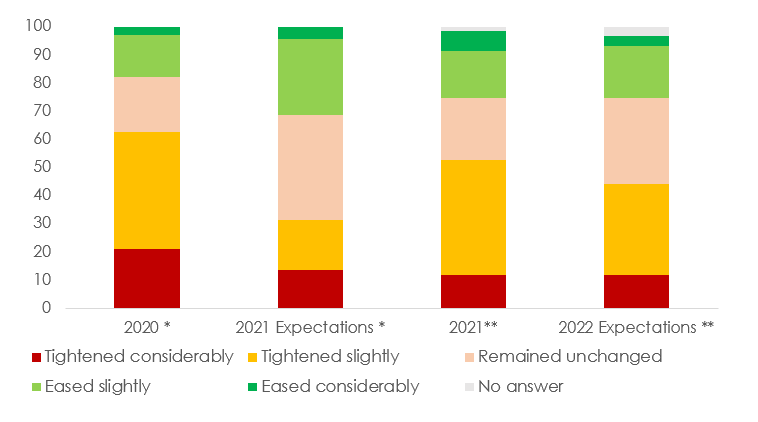

Given the difficult operating environment and asset quality concerns, banks expect to implement tighter lending standards on loans for a third consecutive year in 2022. Accordingly, cyclical factors have increased the difficulty for firms in accessing credit. Moreover, firms also face some structural barriers: lack of collateral and poor credit history are problems, especially for small and medium firms. The World Bank’s Enterprise Surveys offer a complementary perspective on firms’ access to finance, revealing that almost 74% of firms in countries in Sub-Saharan Africa that need a loan are credit constrained. The vast majority of credit-constrained firms are discouraged from applying for a loan for reasons such as high interest rates, stringent collateral requirements and complex application procedures. Compared to other developing regions, Sub-Saharan Africa stands out for its comparatively high share of firms that are discouraged by stringent collateral requirements, which appears to at least partly result from a scarcity of business assets. At 38%, the share of respondents that pledge personal assets exceeds the lower middle-income benchmark by 10 percentage points.

Figure 2: How credit standards have changed/will change

(% of responding banks)

Source: EIB Banking in Africa survey, 2022** and 2021*

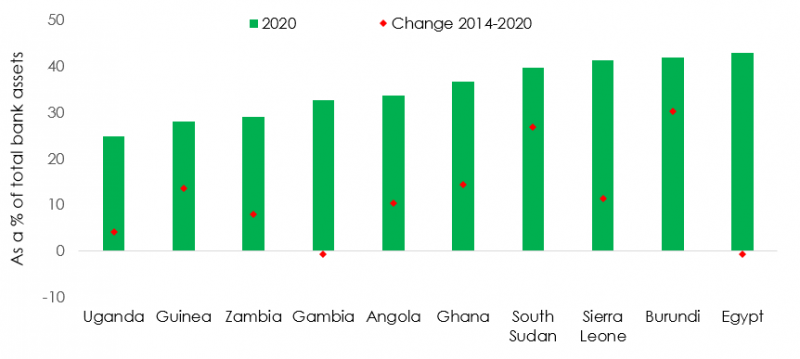

Banks have increased their exposure to risky sovereign debt. The banking systems with the highest public debt as a share of total bank assets tend to be in countries where sovereign creditworthiness is weakest. There are several countries where public debt accounts for more than 20% of bank assets. With the exception of Egypt, the sovereigns in the chart are either C-rated with a major credit rating agency or, if the country does not have market access and an associated credit rating, is assessed as at high risk of debt distress (or in debt distress) by IMF. However, with private sector borrowers coming under pressure due to squeezed incomes and being perceived as increasingly risky, banks may decide to further increase their exposure to the public sector. Therefore, in addition to the tighter lending standards being imposed by banks, a preference to lend to sovereigns over the private sector could also inhibit the flow of credit to the private sector.

Figure 3: Banks’ claims on central government

Source: IMF International Financial Statistics

Nonetheless, the share of banks planning to expand lending operations is somewhat higher in the survey for 2022 (89%) compared to 2021 (81%). However, last year only 60% of banks managed to expand operations so there was a shortfall relative to desired expansion plans. Also, as the full impact of the war in Ukraine was not yet apparent at the time of the survey, it may overstate banks’ current risk appetite. Banks also said that they expect to see increased credit demand, which will in turn require an expansion of their funding. Deposit funding will continue to be the primary source of funds. The share of banks planning to issue local currency bonds is falling while the share planning to access funding from IFIs is increasing.

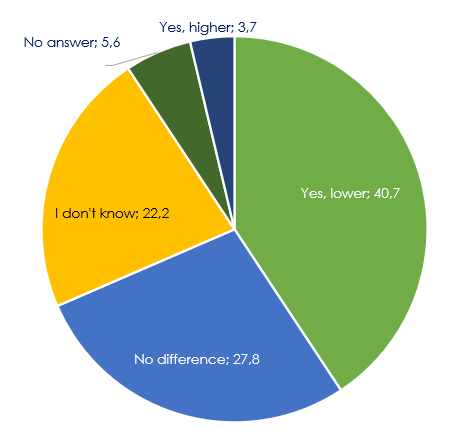

Banks are stepping up their efforts on gender lending: 70% of the banks surveyed have a gender strategy in place, an increase of 10 percentage points on the share in the survey in 2021. Almost 60% of banks also have products targeted specifically at female customers. The survey finds widespread evidence that asset quality is higher on female loans. Four in ten banks found that non-performing loan rates for women-led businesses are lower than those led by men. In some countries, the difference is even greater. For example, in Nigeria, 71% of banks observe lower non-performing loan ratios for women, as do 50% of banks in Kenya.

Figure 4: Does the NPL rate on female-led businesses differ to male-led?

(% of responding banks)

Source: EIB Banking in Africa Survey, 2022

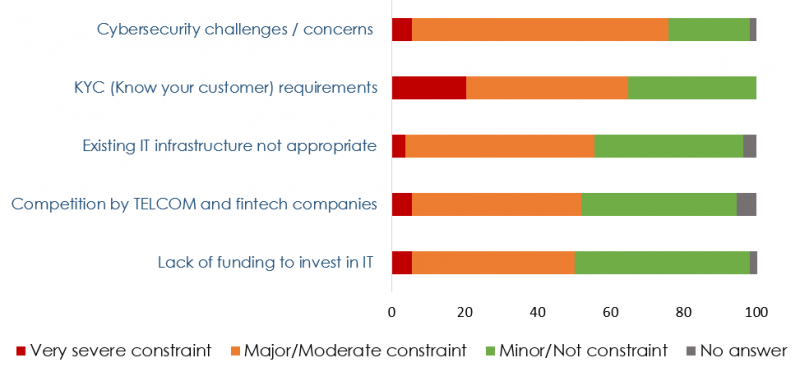

The pandemic led to an acceleration in the rate of digitisation of the banking sector, as banks were forced to use digital channels to reach customers. Ninety percent of banks agree that the pandemic has accelerated their internal digitisation transformation and 70% say that they increased the range of digital services available to customers. The rapid growth of the FinTech sector has been another catalyst for increased digitalisation for some banks although many banks also see it as a deterrent. The entire FinTech ecosystem in Africa has grown to more than 1 000 active companies in April 2022, up from 450 in 2020. Of these, 80% are homegrown and 20% come from outside Africa. Banks see several other constraints to increasing digitalisation too and three-quarters of banks rank cyber security risks as the biggest issue, followed by more difficulty implementing regulatory requirements. Another problem is the inadequacy of current IT infrastructure. The digital transformation also requires new skill sets and nine out of ten banks are investing in digital training for their staff. In this sense, greater use of digital channels creates significant investment needs, which can be supported by IFIs.

Figure 5: Obstacles to greater digitalisation (% of responding banks)

Source: EIB Banking in Africa Survey, 2022

Despite all the issues that banks need to contend with, they remain focused on climate. Four out of five banks could soon have formal climate strategies. The motivation is to reduce the risk, mainly financial risk, associated with climate change and to try to increase activities in areas such as green lending and green funding. Banks are doing more to assess the climate risks that they face. Almost 42% of banks were assessing the climate exposure of their portfolio in 2021. In 2022, this has climbed to 46% but with an additional 26% now planning to do so – none were planning this in 2021. Nearly 70% of banks see climate lending as an opportunity to fight climate change but, to date, only one-fifth of banks have introduced green lending products, meaning there is significant scope to expand green lending. However, banks will need support. About 60% cite lack of expertise, data and tools for climate risk as a barrier to doing more on identifying climate risks and opportunities. In addition, two-thirds of banks think that IFIs can help them expand green lending by providing training and technical assistance. This sets out a clear policy objective for IFIs in terms of growing green lending.