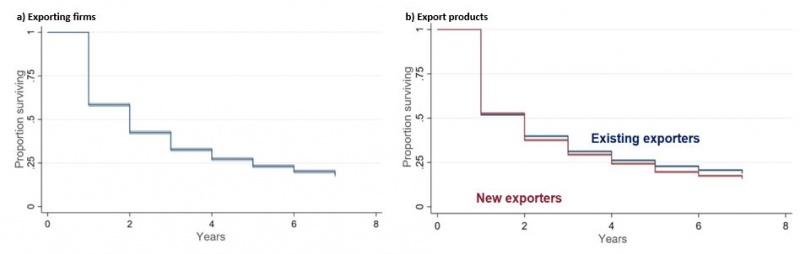

Previous studies have found an extremely short average duration of an export relationship, i.e. export companies generally fall out of international markets quite rapidly. For example, in Latvia two out of five new exporters withdraw within the first two years following their entry (Figure 1a). The pace of product failure is even faster (Figure 1b). The weak resilience of exporting companies and exported goods has fueled our interest in potential economic policy measures that would contribute to a longer duration of exports.

Figure 1: The survival curve for new export relationships (2007 – 2017)

Source: Statistical Office, Authors’ calculations

Using a large dataset of Latvian firms Benkovskis et al (2022) explores factors defining the survival of export relationships, with a special focus on product characteristics such as complexity. We examine the difference in the impact between absolute and relative complexity of a new export product, the former representing the complexity of the product per se, while the latter is its complexity compared to the firm’s existing export bundle.

As to firm-level export survival, the study confirms some of the findings in the existing literature. There is evidence of higher survival rates for firms that:

The main contribution of the paper is its focus on the effect of product characteristics on export survival both at the firm and at the product level. At the firm level we find that the absolute complexity of a product exported by a newly exporting firm does not affect the survival of the exporting relationship. Although complex products are likely to be highly differentiated and not easily replaced by competing products, such exports are likely to fail, if an exporting firm does not possess sufficient technological capabilities to ensure that the quality of the product is high. As the result, the overall effect on survival is neutral. An exporting firm’s survival would therefore hinge on the complexity of its exports relative to its capabilities.

While we do not have information on the product basket of Latvia’s firms that would allow us to infer their technological capabilities, we are able to leverage the information contained in their overall export basket. The paper explores this aspect in the context of product-level export survival.

The estimation results of our study indicate that the absolute complexity of a product tends to improve its survival. The positive effect of a product complexity could reflect both demand factors (complex products face more stable demand) and supply factors (complex products require better firm-level technology and competencies). In any case, these results suggest that shifting the composition of exports towards more complex products may improve their survival, positively affecting both extensive and intensive margins of export growth. In other words, “aiming high” can be a useful strategy for enterprises.

At the same time, the study reports a negative relationship between product complexity relative to the existing export product basket and the survival of new products. Such a finding is in line with a view that firms face higher marginal costs for products that are further away from their core capabilities. Moreover, the results also indicate that moving further away from the existing export bundle in terms of product similarity and proximity reduces the survival of a new export product.

Our findings both contribute to the theoretical international trade literature and provide policy-relevant implications.

As to the former, our findings suggest that theoretical models of international trade can be extended to incorporate product complexity and proximity to an exporting firm’s existing capabilities as product attributes. Such an extension may add an extra dimension to the relationship between international trade, reallocation of resources and aggregate productivity.

Regarding the implications for trade policies, we provide empirical evidence of the importance of core capabilities in export duration. Our findings provide useful insights for policy makers seeking to boost their countries’ export performance. We highlight the importance of identifying and strengthening core capabilities of exporting firms to improve export performance through longer product survival in export markets. Furthermore, a country should aim to upgrade its export content toward more complex products in an incremental manner rather than trying to leapfrog to products that are much more sophisticated than its current export content.

To sum up, these findings indicate the risk of “aiming too high” by exporting complex products that go beyond firms’ technological and non-technological capabilities. They point to an “aim high, but shoot low” strategy where firms increase complexity of their export basket gradually within their capabilities, so that the survival of complex exports is not endangered.

Benkovskis, K., Jarrett, P., Krill, Z., Tkacevs, O., and N. Yashiro (2022). The Survival of Latvian Products and Firms in Export Markets. OECD Economics Department Working Paper No. 1712; Latvijas Banka Working Paper No. 2/2022

Bernard, A., Redding, S., and P. Schott (2011). Multiproduct Firms and Trade Liberalization. The Quarterly Journal of Economics, vol. 126/3, pp. 1271-1318