We empirically investigate the impact of local house price booms on capital misallocation within manufacturing industries. Using the geographic variation provided by the salient Spanish housing boom (2003-2007), we show that manufacturing firms exposed to positive local house price shocks received more credit from banks and their investment grew more intensively when they had a larger proportion of collateralizable real-estate assets. The interaction of geographical conditions, that led to heterogeneous housing booms, with the collateral channel on investment resulted in an increasing dispersion of the capital-labor ratio within industries. A simple counterfactual calculation suggests that the misallocation generated by the collateral channel on investment could account for between one-quarter and half of the fall in TFP experienced in the Spanish manufacturing sector over the housing boom.

Housing is throughout history the most important asset class in the economy (Jordà et al., 2019). It is not only a determinant of wealth. The evolution of house prices affects consumption (Mian et al, 2013), investment (Chaney et al, 2013) and borrowing (Mian and Sufi, 2011) Given that house prices affect different components of aggregate output, it is natural to ask whether they also influence aggregate productivity. In addition, housing booms and busts are recurrent over time (Basco, 2018), which underscores the need to understand the link between house prices and aggregate productivity. In Basco et al. (2021), we use the prominent housing boom in Spain (2003-2007) to provide a first answer to this question.

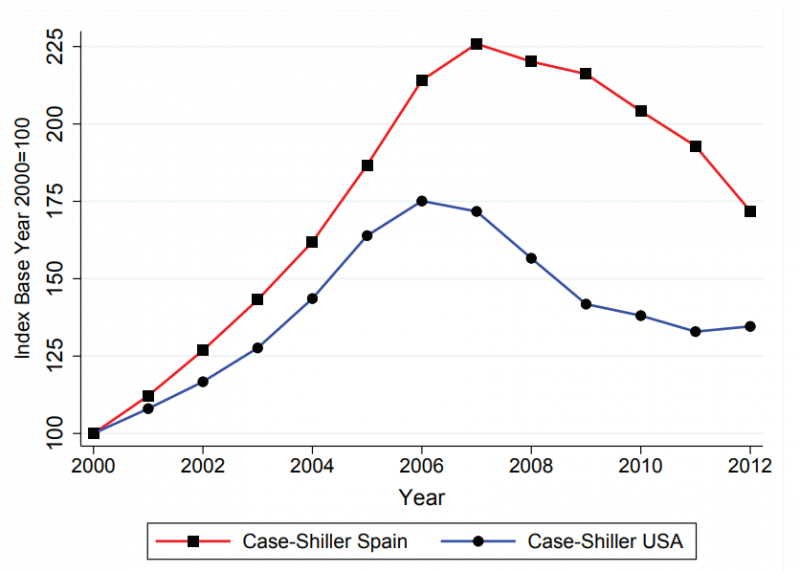

To put the Spanish housing boom into perspective, Figure 1 reproduces the evolution of real house prices in Spain and the United States. In Spain, the average annual growth rate between 2000 and 2007 (the peak) was 12.3 percent. In contrast, in the United States, the average annual growth rate between 2000 and 2006 (the peak) was “only” 9.8 percent. Thus, the housing boom in Spain was remarkable by international standards. In Basco et al. (2021), we show that this housing boom also coincided with a substantial increase in non-residential investment and leverage (compared to their Eurozone peers, where it was much muted). In addition, during this period, especially from 2003 onwards, there was a large increase in collateralized credit, which was related to the value of real estate assets. These aggregate macroeconomic facts make Spain the perfect country to empirically investigate the effect of housing booms on productivity.

Figure 1: Evolution of House Prices in Spain and the United States

Note: The figure plots the seasonally adjusted Case-Shiller home price index in nominal terms for Spain and the U.S. from 2000 to 2012, using 2000 as base year. Data for Spain come from the Spanish Ownership Registry, and data for the U.S. come from the Federal Reserve Bank of St. Louis.

How can housing booms affect aggregate productivity? We develop of simple theoretical framework to relate housing booms with (potential) misallocation of capital. The model relies on two plausible assumptions. First, the external funding of firms (banking credit) depends on the value of their collateral (real estate assets). This is a standard assumption in the related literature (see, e.g., Chaney et al., 2013). Second, the extent of the housing boom depends on the geographical characteristics of the municipality. In particular, the housing supply elasticity of the municipality pre-boom shapes the housing appreciation. This assumption is consistent with the urban economics literature (see, for example, Glaeser et al., 2008). The intuition is that, given an increase in housing demand (housing boom), the effect on house prices is lower in municipalities with higher housing supply elasticity. Given these assumptions, the model delivers two main results. First, given the distribution of real estate assets across firms, a housing boom disproportionately raises investment (and borrowing) among firms located in municipalities with low housing elasticity. Second, given the distribution of firms across municipalities, a housing boom disproportionately raises investment (and borrowing) of firms with a larger share of real estate assets. Note that these results imply that housing booms generate misallocation of capital, thereby decreasing aggregate productivity. The reason is that compared to a situation without the housing boom, firms located in relatively housing supply inelastic municipalities and with a larger share of real estate assets accumulate, ceteris paribus, more capital. That is, the source of misallocation is that housing booms reward, through the collateral channel, firms that experience a larger appreciation of their real estate assets, regardless of their own productivity.

We empirically test these predictions for Spanish manufacturing firms during the salient housing boom (2003-07). To perform this exercise, we put together firm-level data along with housing data at the municipality level. Firm-level data is obtained combining two datasets. First, firm-level investment and asset variables are computed using the reported financial statements from the Commercial Registry, which contains information for about 85% of all Spanish firms. Second, the borrowing measures are computed using loan-level data from the Central Credit Register. These data are collected by the Bank of Spain and include all loans over 6,000 euros granted to non-financial firms by banks operating in Spain. For housing, house prices are obtained from all census transactions recorded in the Spanish Ownership Registry. The proxy of housing supply elasticity was originally computed in Basco et al. (2020). In a nutshell, along the lines of the measure computed in Saiz (2010) for the United States, they proxy housing supply elasticity with the share of land available to build before the housing boom in each municipality.

Using standard econometric techniques, we find strong evidence supporting the predictions of the model for both investment and credit. Following the related literature, housing supply elasticity is used as an instrument for house price growth. We refer the reader to the paper for a thorough discussion on the endogeneity concerns and the validity of the instrument. For investment, we obtain an average house price elasticity of 13%. As a reference, Chaney et al. (2013) document, for the United States, an average elasticity of 6%. The higher elasticity for Spain can be explained by the reliance of Spanish firms to bank credit (compared to the higher use of equity in the US). More importantly, we find that, given the same local house price shock, manufacturing firms located in the 75th percentile of the distribution of the share of tangible fixed assets (proxy of real estate assets) would invest 98 pp more than firms in the bottom 25th percentile of this distribution. This latter result speaks to the misallocation of capital generated by the housing boom. Indeed, ceteris paribus, within the same manufacturing industry, capital was being diverted towards firms with a larger share of real estate assets. We find the same qualitative results when analyzing the effect of the housing boom on firm credit. Overall, the firm-level evidence is consistent with the existence of a collateral channel which distorts the allocation of both capital and credit when there is a housing boom.

Finally, we use the empirical estimates to illustrate the potential effect of housing booms on aggregate productivity. Intuitively, along the lines of Mian and Sufi (2011), we compare the evolution in the variance of investment (an indicator of misallocation in the model) between housing supply elastic and inelastic municipalities. Quantitatively, we find that the housing boom could explain between one-quarter and half of the actual fall in productivity in the manufacturing sector. We want to emphasize that we focus on the manufacturing sector. That is, we deliberately ignore the role of house prices diverting resources from the manufacturing sector towards construction and real estate activities, which would contribute to exacerbate the overall fall in productivity caused by housing booms (Basco, 2016 or Garcia-Santana et al., 2020).

To conclude, we find that housing booms can have negative aggregate productivity effects because they change the value of the collateral of firms, thereby distorting the allocation of capital and credit in the manufacturing sector. A policy implication is that housing booms not only affect average investment but also their composition, which can lead to lower aggregate productivity and potential output. Thus, policymakers should consider this additional cost of housing booms when drafting legislation to regulate housing and banking markets.

Basco, S. 2016. Switching Bubbles. European Economic Review, 87: 236265.

Basco, S. 2018. Housing Bubbles: Origins and Consequences. Palgrave Macmillan.

Basco, S., D. Lopez-Rodriguez, and F. Elias. 2020. Credit Supply, Education and Mortgage Debt: The BNP Securitization Shock in Spain. mimeo, Banco de España.

Basco, S., D. Lopez-Rodriguez, and E. Moral-Benito. 2021. House Prices and Misallocation: The Impact of the Collateral Channel on Productivity, Banco de España working paper No. 2135

Chaney, T., D. Sraer, and D. Thesmar. 2012. The Collateral Channel: How Real Estate Shocks Affect Corporate Investment. American Economic Review, 102(6): 2381-2409.

Garcia-Santana, M., J. Pijoan-Mas, E. Moral-Benito, and R, Ramos. 2020. Growing Like Spain: 1995-2007. International Economic Review, 61(1): 383-416.

Glaeser, E. L., J. Gyourko, and A. Saiz. 2008. Housing Supply and Housing Bubbles. Journal of Urban Economics, 64(2): 198217.

Jordà, Ò., K. Knoll, D. Kushinov, M. Schularick and A.M. Taylor. 2019. The Rate of Return on Everything, 1870–2015. The Quarterly Journal of Economics, 134, 1225–1298.

Mian, A., & Sufi, A. 2011. House Prices, Home Equity-Based Borrowing, and the US Household Leverage Crisis. American Economic Review, 101(5), 2132–2156.

Mian, A., Rao, K., & Sufi, M. 2013. Household Balance Sheets, Consumption, and the Economic Slump. Quarterly Journal of Economics, 128(4),1687–1726.

Saiz, A. 2010. The Geographic Determinants of Housing Supply. The Quarterly Journal of Economics, 25(3): 12531296.

The views expressed herein are those of the authors and should not necessarily be interpreted as reflecting those of the Banco de España or the Eurosystem.